In the past a gold rush was measured by the number of people or prospectors it attracted. The California Gold Rush of 1848 to 1857 was the biggest, attracting over 300,000.

I would surmise that the Yukon Gold Rush of 1896 to 1903 was the most famous because of its uniqueness and hardship of the journey. California was relatively easy to get to and had a nice, moderate climate. The Yukon Gold Rush in comparison attracted around 100,000 prospectors but when you consider it was almost a year's journey to get there, it was an amazing feat by the approximate 1/3 that completed the journey.

Prospectors would travel up the West Coast by ship to Alaska. They would then cross the mountain range by foot through the fall/winter and build boats at the headwaters of the Yukon River and boat down to Dawson City in the spring/summer. Canadian authorities implemented rules that one year's food supply was required to enter the Yukon, which was around 1,100 pounds and with other gear would add up to around a ton, so several trips up and down the Chilkoot Pass were required by each prospector.

One notorious photo of Chilkoot Pass, Alaska

Prospectors leaving San Francisco

Every gold rush has its players, leaders and discoverers. In the Yukon of 1896 it was America prospector George Carmack and wife, her brother Skookum Jim and nephew Dawson Charlie.

The discoverers always do well, as do many who follow. The discovery was made at Bonanza Creek and a year later an even richer discovery was found at Eldorado Creek.

However, in the end it is only a very small percentage that makes it rich and that is the same today as very few junior exploration companies make a discovery.

The modern gold rush of today is best measured by the flow of exploration dollars, not the number of prospectors, but you will see a rises in the number of junior mining companies, perhaps in dozens, not by 100,000s.

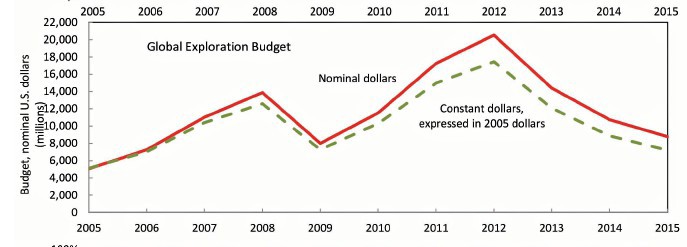

The chart below from U.S. Geological Survey is the global exploration budget for all metals. We can see there was quite a bull run from $5 billion in 2005 to $20 billion end of 2011. There was a pause because of the 2008 crash and gold exploration has followed the same path, down more than half since the 2011 peak.

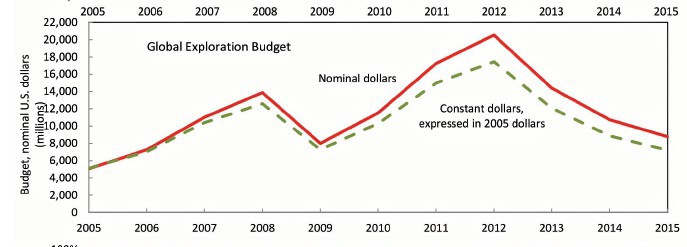

This next chart from Katusa Research shows money spent on mine development (CAPEX) by the gold mining companies, and it shows similar drop as above at -58%. Also, notice that 2017 shows the first up tick and I believe this is a start of a new bull run.

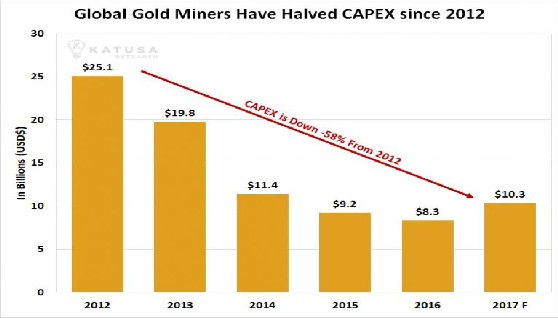

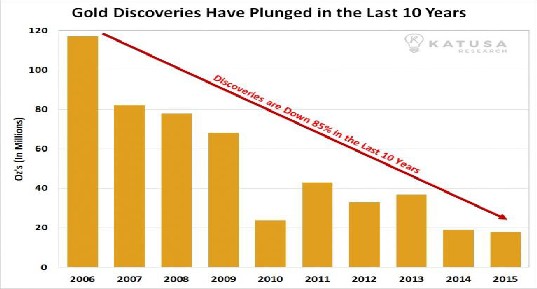

What is more from Katusa is the next chart that shows an alarming drop in gold discoveries, despite the large increase in dollars spent up to 2011.

Another important factor is major gold miners' reserves have plunged below 2004 levels. They are hungry to find new gold deposits and discoveries and where do you think they have turned to?

The Yukon

Kinross Gold was the first of the major gold miners to make a move into the Yukon when it grabbed up White Gold. The major Yukon gold rush, however, started with Goldcorp Inc.’s C$520 million buyout of Kaminak Gold Corp. in 2016. Since then, Agnico Eagle Mines Ltd., Newmont Mining Corp. and Barrick Gold Corp. have all picked up gold properties in the territory.

Peter Tallman of Klondike Gold probably said it best: in the Yukon, 20 million ounces of gold has come from gravels but zero from the bed rock. Yukon is the largest unexplained geochemical gold anomaly on the planet.

This all is resulting in the Yukon is seeing its busiest year since 2011. Scott Casselman, head of mineral services with the Yukon Geological Survey (YGS), says:

"What we've seen this year is a noticeable uptick in the amount of investment in mineral exploration in the territory," he said.

"We're probably looking at about double what it was last year. We're looking at almost $100 million in exploration expenditures and I think the number was about $20 million in development expenditures, for a total of $120 million this year.

"That compares to $57 million in 2016."

Just last week the Canadian government announced $360 million in road infrastructure to access the Yukon's minerals, called the Yukon Resource Gateway project.

The Yukon is seeing a modern day gold rush with five major miners jumping in and several junior exploration companies with decent budgets.

I would say the most influential players in recent years to help trigger this rush would be Shawn Ryan who is credited with finding and developing the White Gold district, among others. Ryan has dealt most of his Yukon holdings and in 2016 moved to NFLD for gold prospecting. Next could be Rob McLeod of the famous McLeod mining family. His Underworld Resources was the Yukon project that was sold to Kinross Gold, and again Shawn Ryan was involved here.

There has been many other great prospectors in the Yukon, but I might as well mention John McConnell who has led Victoria Gold since 2011. Victoria's Eagle deposit has been advanced to 4 million ounces Measured and Indicated, has gone to feasibility and is fully permitted. It is likely to be the Yukon's first and largest hard rock gold mine.

There is not much leverage on a Yukon gold discovery owning the major miners that are now involved there, but there are a number of juniors to look at, advancing projects and in some cases with help from a major.

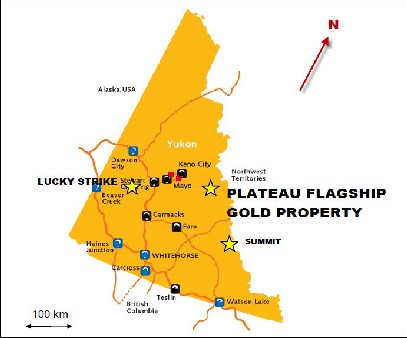

Goldstrike Resources Ltd. (GSR TSX.V) C$0.37, Shares out 184 million, Market Cap C$68 million

Goldstrike has done a deal with Newmont that will provide C$53 million investment to advance its Plateau project, Yukon. Newmont can earn a 51% interest in the first phase and up to a 75% interest. A drill program at Plateau was announced on July 5th.

Drilling in 2016 in 11 holes saw a couple of very good intersects:

PSGS-16-01 returned 6.05 g/t gold over 45.5 meters including 21.13 g/t gold over 12.25 meters, including 34.35 g/t gold over 6.75 meters. PSGS-16-08 returned 2.2 g/t gold over 13 m, including 8.5 m grading 3.21 g/t gold.

The Lucky Strike project is 100% owned, in the heart of the White Gold Camp and has multiple drill targets to test a 10 km gold trend. Lucky Strike consists of 751 contiguous claims covering more than 150 square kilometers, is contiguous with Kinross’ Golden Saddle property and is 100% owned by Goldstrike.

July 10th GSR announced a program of mechanized trenching, ground geophysics, geochemistry and diamond drilling at Lucky Strike.

This follows up on a successful trenching program in 2016 that returned 0.42 g/t gold over 154 meters. The stock jumped on the Newmont news and has been sideways since. This gave the company credibility and beefed up the treasury. Its projects are seeing some good results, but on the negative side there are a lot of shares outstanding and projects are remote with little infrastructure and no road access.

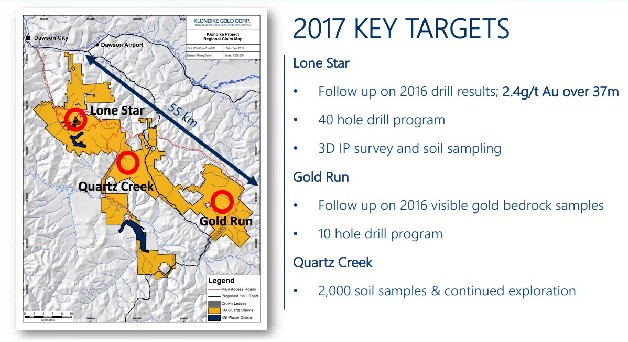

Klondike Gold Corp. (KG:TSX.V) $0.54, shares out 83.5 million, Market cap $45 million.

KG is run by Peter Tallman who highlighted the 20 million ounces mined from alluvial sources in the Yukon. However he got a hand slap from IROC and the company issued a press release August 22, retracting many statements. It came across to me as quite a negative press release, but the stock moved up anyway.

The most advanced project is Eldorado, 13,545 hectares and has road access.

The current focus is the Lone Star target and it recently added a second drill rig that will initially drill up to 40 holes along the Lone Star target/Bonanza Fault trend to rapidly test along the 4,000-meter soil anomaly, double the length of the target as presently understood.

• Plans to drill test two additional gold-bearing structural zones, the Nugget and Eldorado fault trends, which run parallel to the Bonanza fault/Lone Star target, have been prepared and will be initiated depending on seasonal conditions.

• Plans to drill test the Gold Run target, 50 kilometers southeast of the current drilling, are prepared and will be initiated depending on seasonal conditions.

The first two holes announced July 11th intersected 2.4 g/t over 40.9 meters and the other hole 2.1 g/t over 41.1 meters.

On August 1st two more holes were released with best at 1.6 g/t over 30.7 meters.

The company is well funded as it just raised $5 million at $0.29 per share with the majority with flow through at $0.34 per share. The company does not have a deal with a major at this point but Frank Giustra owns about 20% of the stock.

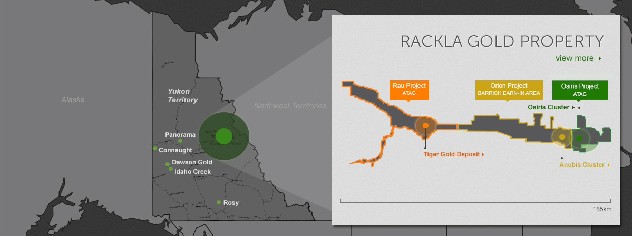

ATAC Resources Ltd. (ATC:TSX.V) C$0.85. Shares out: 140 million, Market cap $119 million.

ATAC has some advanced properties and a partnership with Barrick of approximately $63.3 million, which includes a private placement of $8.3 million (completed), and a two-staged, $55 million exploration earn-in option to acquire 70% of the Orion project, shown as the middle portion in the map below.

The project is a bit north of Keno where Victoria Gold is, so closer to infrastructure than some, but a 65km road is planned in the PEA, not sure if the recent government announcement will help with this. The company has drilled ~79,000 meters and outlined six zones of significant, high-grade, Carlin-type gold mineralization at Conrad, Osiris, Sunrise, Ibis, Anubis and Orion between 2010 and 2016

May 3, 2017: initial regulatory approval to proceed with constructing a 65 km tote road to the Tiger Gold Deposit that has an M&I resource of 485,7000 ounces gold at 2.66 g/t. The 2016 PEA for Tiger envisions a conventional year-round operation and has improved upon all aspects of the 2014 PEA. Key improvements include:

• Increased the pre-tax NPV(5%) by $54.4 million;

• 36% increase in total recovered ounces;

• Project life extended by two years;

• Pre-tax payback period reduced to 1.85 years;

• Tote road access: supports year-round operations and simplifies project logistics;

• 100% CIP process: simplified and conventional process allows for year-round operations and reduces LOM sustaining capital costs;

The Osiris project on the right or east side of the Orion Barrick JV has seen some impressive results. The 2010 discovery drill hole at Osiris intersected 65.20 meters of 4.65 g/t gold (OS-10-001)

• Four zones make up the 12 sq/km Osiris cluster: Conrad, Osiris, Sunrise and Ibis

• Conrad is the most advanced zone and OS-12-114 intersected 42.93 m of 18.44 g/t gold

• Completed 74,201 meters in 231 holes within the cluster

No doubt if this project continues on the current path it will show enough size for Barrick to just take out ATAC. There are advantages to having a senior partner, but it can be a challenge for the junior, in this case ATAC, to get the best value for the project. Other majors are deterred from making an offer and the one with their foot in the door (Barrick) can wait it out for an opportune time because it has a good choke hold on the project.

In interest of full disclosure, I had a small position in the stock, but recently sold. There is nothing wrong with the company, it is just that the recent pop in price (see chart) provided an opportune profit.

Victoria Gold Corp. (VIT:TSX.V) C$0.53, Shares out: 504 million, Market cap C$267 million.

Victoria has no major for a partner but Kinross Gold owns 11% of the company.

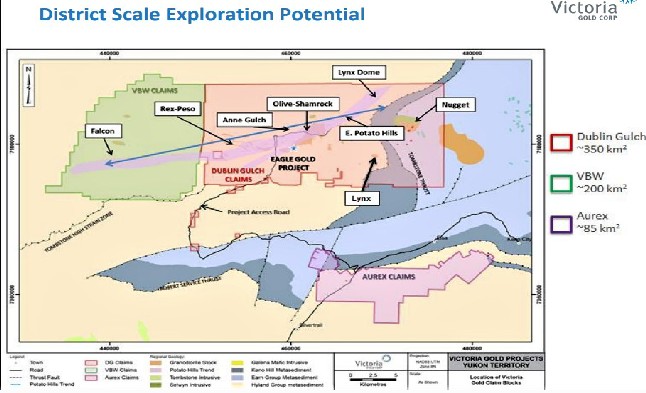

VIT's Eagle deposit at Dublin Gulch is advancing to the production phase. The PEA is complete, it is fully permitted and is in an area with good infrastructure, roads and power. It is next door to the historic Keno mine that seen many years of silver production (approx. 240 million ounces). The Aurex Claims are the old Keno mine and you can see the road to Keno City on the far right, although now it is just a very small town.

Yukon Energy is planning an $80 million power line upgrade to Keno City.

The current Eagle deposit grade is at 0.67 g/t part of a total Indicated resource of 6.3 million ounces.

Although individual veins grade from 10 to 30 g/t gold, a typical 1.5 meter sample interval, which includes both the vein and granodiorite host rock, ranges from 0.8 to 2.0 g/t gold in the ore zone. Silver values are generally lower than gold values.

The PEA is quite robust and is based on 2.66 million ounces at 0.67 g/t gold and a mine rate of 33,700 tons per day. The strip ratio is low at 0.95 to 1 and a low CAPEX of US$288 million. Cash costs at US$538/oz and AISC at US$639 and only 2.8 years payback.

It is one of few shovel ready projects with all permits in hand in a low geopolitical risk jurisdiction. The low-cost (operating & capital) and high-margin nature of Eagle Gold ensures that it should be built in most conceivable gold price scenarios.

The stock seems quite cheap with a value of just $65 per ounce based on the 2.66 million ounces in the mine plan and considering US$40 million in the treasury. Considering the total 6.3 million ounces the value is just US$27 per ounce.

I believe there is a couple reasons for this.

• The company is in that stage from discovery/development to production and typically stocks often trade sideways until production is near.

• There is also uncertainty that the company can raise project financing and is currently looking to negotiate US$220 million in debt financing. If it completes that, there is still about a US$40 million shortfall as total construction cost is estimated at US$300M.

That said, any progress on the finance front could move the stock back up.

I doubt Kinross would want to see Victoria put this into production as it would buy it out first. The project must also be on the radar of Barrick Gold, because Barrick has the JV with ATAC that is only 20 or 30 km north of Victoria's Dublin Gulch. A takeover offer from Kinross or Barrick would not surprise me and it would be at a good premium to the current share price.

Zonte Metals TSXV:ZON OTC:EREPF C$0.36, shares out: 42 million, Market cap $15 million.

Zonte might be considered the ugly duckling because its valuation is so low. It is valued at 1/3 of the cheapest stock in the peer group. If you know the story of the ugly duckling, it turned into a beautiful swan and I hope that is the case here as it is my favorite and I own a decent position.

There is a couple reasons why it might have a lower valuation. Zonte is new to the Yukon, not well known and their McConnells Jest project is earlier stage and although had very promising exploration results, the first drill program has just been completed and waiting results.

Zonte is not a pure Yukon play but a point I like. The company mandate is to find projects with multi-million ounce potential in favorable mining jurisdictions, so has some diversification. It also means that when the Yukon goes to deep freeze and everything comes to a standstill, Zonte can progress elsewhere.

The company's Wings project in NFLD is drill ready and Zonte was one of the first in this belt. Interesting and Yukon related, this is where Shawn Ryan went and has staked ground up to the Wings boundary.

Zonte also has a claim dispute over the AngloGold/B2 Gold's 5 million ounce Gramalote deposit in Colombia. On June 26th, Special Court suspended AngloGold's claim application until court proceedings are concluded. These fractional claim disputes are not new in Colombia, Galway settled for $300 million in 2012 for fractional claims over the Ventana gold discovery.

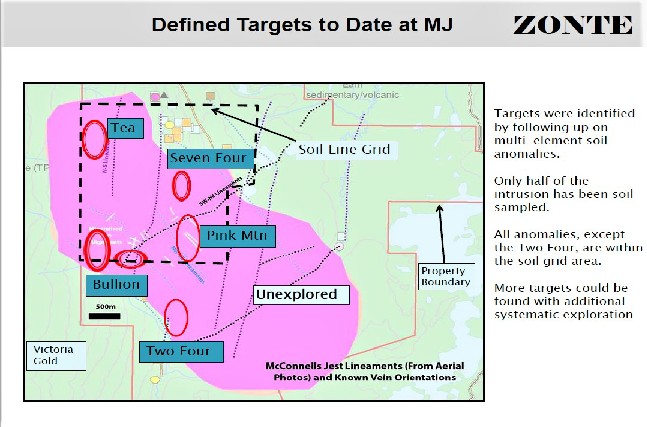

I want to focus on the Yukon here and if you go back to the property map for Victoria Gold you will notice a brown shape under the word "Nugget" and this represents an intrusion or Pluton that is about twice the size of the one at Victoria's Dublin Gulch. Zonte has 100% interest in these claims that border Victoria Gold and Aurex silver claims. It is named McConnells Jest because of a glacier event.

As one geologist put it, how could a property wedged between a large gold deposit and a silver mine be barren? Above is a closeup of the Pluton and between Bullion and Two Four a new zone was discovered called "Hill." Recent drilling was completed at Hill, Two Four and one of the other targets.

McConnells Jest is very comparable to Victoria Gold's Dublin Gulch and has the benefit of a known geological model like Dublin Gulch in this gold belt.

There has been a number of comparative observations from geologists who are familiar with Dublin Gulch and have even worked on it.

• McConnells Pluton is about twice the size, so maybe it will have more zones.

• The Carapace at McConnells is completely intact but eroded at Dublin. Originally it was thought the top was scrapped off at McConnells, but actually the McConnell glacier protected it while Dublin and Keno Hill were exposed to erosion. The Carapace is where the higher-grade gold is known to be found in these systems.

• The other feature of these intrusives (IRGS) is narrow Scorodite veins that typically run around 1 vein every 30 meters. At McConnells some areas run one vein every meter, like at the Two Four zone where this density was found across 50 meters, so about 50 veins.

The market appears to waiting on news and/or drill results. The $0.35 level on the chart has been resistance but it appears the stock is starting to crack through this with an underlying up trend of higher lows.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start ups and was a co-founder of Paramount Gold and Silver.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Victoria Gold, Zonte Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by the author.

Struther's Resource Stock Report Disclaimer:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.