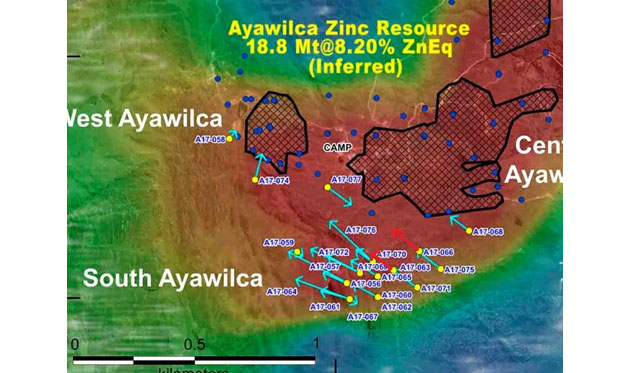

The latest set of drill results recently released by Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) seems to further solidify Ayawilca's reputation as a Tier I zinc asset in the making. Not only confirmed hole A17-063 the thick South Ayawilca mineralization with one of the best intersections of zinc mineralization at Ayawilca to date, a world-class 47.7 meters grading 11.3% zinc. Just as important was hole A17-066, which extended the strike of South Ayawilca in eastern direction, and delivered first proof of the idea that South Ayawilca and Central Ayawilca might be connected. The hole reported 3.5 meters at 7.4 % zinc and another 5.0 metres at 11.3 % zinc at a slightly greater depth. I have colored these holes in red:

A17-063 is obviously excellent and confirms a very thick, high grade central mineralized zone in South Ayawilca, which until now seems centered around monster hole A17-056 (63.9m @ 5.6%Zn AND 52m @ 10.1% Zn). Compared to these holes the intercepts of A17-066 pale in comparison, but are still very economic and mineable. I didn't expect anything big per my last article on this, but was still hoping for mineralization to remain a bit thicker, and more gradually declining towards Central Ayawilca as it would increase tonnage faster of course, but I will show later on that Tinka has nothing to complain about in this regard.

Here is the full set of drill results from the news release again:

Key Highlights

Hole A17-059:

∑ 0.8 meters at 37.5 % zinc, 0.5 % lead & 69 g/t silver from 50.3 meters depth (vein).

Hole A17-063:

∑ 47.7 meters at 11.3 % zinc, 18 g/t silver & 313 g/t indium from 302.2 meters depth, including

∑ 9.8 meters at 17.4 % zinc, 28 g/t silver & 587 g/t indium from 303.3 meters depth; and

∑ 12.2 meters at 17.1 % zinc, 26 g/t silver & 495 g/t indium from 327.4 meters depth.

Hole A17-064:

∑ 0.5 metres at 15.6 % zinc, 11 g/t silver & 304 g/t indium from 269.9 metres depth; and

∑ 0.4 metres at 14.5 % zinc, 17 g/t silver & 39 g/t indium from 277.2 metres depth.

Hole A17-065:

∑ 19.3 metres at 4.7 % zinc, 7 g/t silver & 93 g/t indium from 219.5 metres depth, including

∑ 2.6 metres at 20.6 % zinc, 23 g/t silver & 529 g/t indium from 236.2 metres depth; and

∑ 26.6 metres at 3.6 % zinc, 4 g/t silver & 46 g/t indium from 266.4 metres depth; and

∑ 24.7 metres at 3.8% zinc, 5 g/t silver & 51 g/t indium from 307.3 metres depth.

Hole A17-066:

∑ 3.5 metres at 7.4 % zinc, 24 g/t silver & 111 g/t indium from 330.9 metres depth, and

∑ 5.0 metres at 11.3 % zinc & 37 g/t silver & 270 g/t indium from 345.0 metres depth;

CEO Graham Carman had a few interesting things to say; I start with this quote from the news release:

"We are finding that the zinc mineralization is zoned around iron sulphides (mostly pyrrhotite with lesser pyrite) which may also host tin mineralization (note: tin assays are pending)."

Management didn't disclose results for tin yet, and after asking Carman it appeared that this was for two reasons: first it takes several weeks longer to do tin assays, and second they prefer to release current and possibly upcoming tin assays together, as soon as they have a solid understanding of an eventual mineralized tin zone. My assumptions on this are twofold: they might only want to release those results when they actually imply an economic tin orebody at South Ayawilca, and it's simply too early for this at the moment, besides this these tin assays could point towards another connection: the Tin Zone below Central Ayawilca, and management wants to investigate this completely.

This was even more interesting:

"We have also encountered an important northeast-trending fault, and can confirm that post-mineral movement has displaced mineralization laterally which opens additional exploration opportunities."

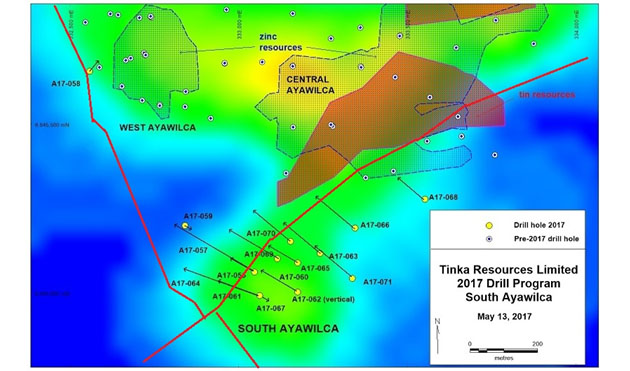

The existing South-West/North East trending fault is meant here, see the semi-horizontal line in this slightly outdated map:

Instead of this being a normal ((semi-)vertically displaced) fault, management now believes this is a slip-strike (horizontally displaced) fault and that the movement took place post-mineralization. This in turn could indicate that entire South Ayawilca has been part of Central Ayawilca in the past, and was displaced horizontally to the South west along this SW/NE slip-strike fault. Then why would Tinka bother drilling north of this fault?

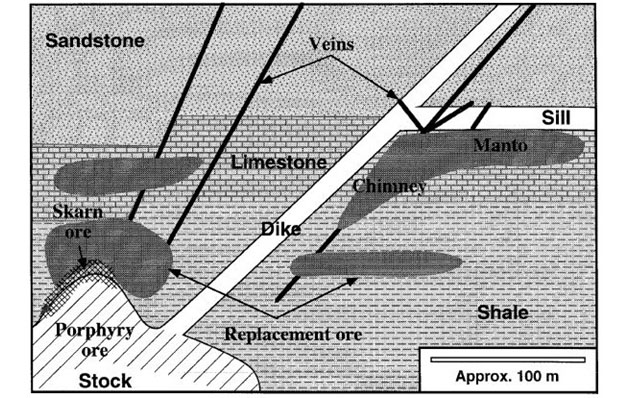

Management believes there could be another geological phenomenon at play. According to recent and earlier drilling (A15-046 (directly west of Central Ayawilca) intercepted 2.1m @ 37.3% zinc from 99.2m depth, and 6.3m @ 3.1% zinc at a depth of 185.7m, and A17-059 (see map above) intercepted 0.8m @37.5% Zn from 51m depth and 2m @6.3% Zn from 60m depth), there appear to be relatively thin zinc veins, hosted in sandstone, on top of limestone north of South Ayawilca and west of Central Ayawilca. This could, according to management, resemble the following diagram (USGS, provided by Tinka):

So the geologists of Tinka are basically planning on finding the feeder structure of those veins now, and possibly even connecting all zones together at depth. If they actually manage to do this, then it will be clear that Ayawilca could be a "zinc elephant" (usually this term is reserved for large copper deposits). And this is even regardless of what Tinka will find at the other targets like the coveted Zone 3.

According to the news release, Tinka has now released results from eleven drill holes of an estimated total of 30 holes planned for 2017. Seventeen holes have been completed. There are currently two rigs drilling at South and Central Ayawilca focusing on resource expansion and connection of these areas. A third drill rig is currently testing the possible extensions of West Ayawilca. A fourth rig has started at Zone 3, drilling hole A17-073, and as this is more mountainous terrain, a smaller, portable rig is used, which also drills a bit slower than the other 3 rigs. The result of this hole is expected in 4 weeks from now, and I'm very curious what assays will be reported here, as all surveys were very promising so far.

After discussing drill results and exploration potential, I also want to look a bit further into the consequences for my earlier hypothetical resource estimate.

Current results could increase the mineralized envelope roughly to an estimated (l x w x h) 500m x 175m x 40m x 3.3t/m3 = 11.5Mt, assuming continuous mineralization, and a narrowing mineralized envelope towards the Central Ayawilca. I believe the mineralized envelope there to be a bit wider (100m) then my earlier estimated 50m which I considered really conservative, based on a bit too enthusiastic, much thicker estimated mineralization (30-35m). The current 10m thick intercept could in my view justify a less conservative approach when estimating the width of mineralized zones here, as even the sandstone across the fault returned vein type mineralization. As I estimated an average thickness of 50m for entire South Ayawilca in my last article (which was based on anticipating a 30-35m intercept at A17-066), total tonnage for South drops from an estimated12.3Mt to an estimated 11.5Mt. When mineralization would in fact be continuous between A17-066 and upcoming drill result A17-068, at a thickness of about 10m, another hypothetic 0.5Mt could be added, so this is not very significant. Total estimated tonnage could come in close to an estimated 30Mt anyway (18.8Mt + 11.5Mt = 30.3Mt), and this would be already excellent.

On top of exploration, management is also applying for a larger permitted area around Zone 3, to cover more of the gravity anomaly. The timeline on this isn't available yet.

I also discussed drilling costs with management; they provided me with an all-in quote of US$300/m. When taking a currently completed estimated 6800m of drilling @US$300/m, this could have cost US$2M, leaving about an estimated US$6M (cash position reported per Dec 31 2016: C$12M or US$8.8M, accounting for corporate G&A etc.) in the treasury at the moment which is substantial, and could easily accommodate much more drilling if needed.

So it looks like Tinka Resources is ticking all the right boxes so far, and I am looking forward to the next batch of drill results, which I expect to come in three to four weeks from now.

The author is not a registered investment advisor, and has a long position in this stock. Tinka Resources is a sponsoring company. The views, opinions, estimates or forecasts regarding Tinka's performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka's management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

All facts are to be checked by the reader. For more information go to www.tinkaresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long term commodity pricing/market sentiments, and often looking for long term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor: The author, or members of the immediate household or family, own shares of the following companies mentioned in this article: Tinka Resources. The author's company has a financial relationship with the following companies mentioned in this article: Tinka Resources.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by author