Since 2007, I have been actively involved in the resource sector. This year will mark a full decade, and I've been able to make a small fortune for myself, close friends and family.

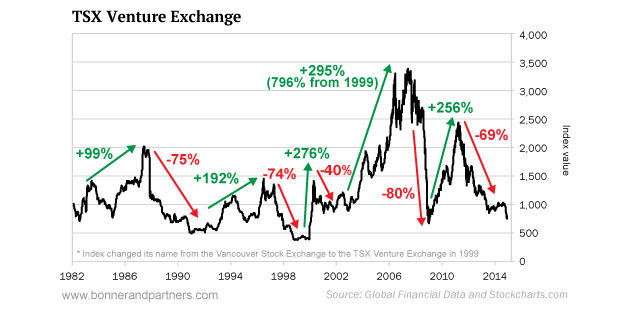

Between 2008 and 2011, I was invested in the bull market that saw companies go from virtually non-existent to CAD$400M in market cap, and between 2011 and 2015, I experienced the brutal bear market, which saw these same companies and their CEOs go from lavish vacations and $4 million homes to the bankruptcy courts.

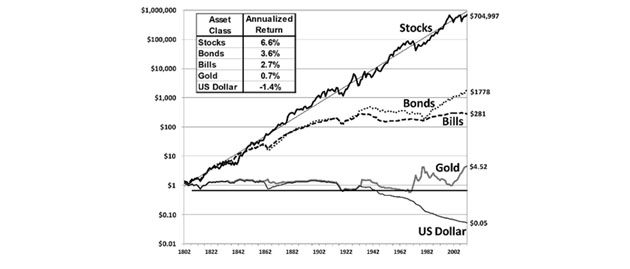

This is a highly cyclical business, and what most investors (who don't take the time to research) miserably fail to understand is that the gold and silver stocks are not long-term investments at all—they are leveraged wealth vehicles to trade the underlying commodity. When done right, these speculations of boom and bust cycles create fortunes.

I was shocked to learn that the shares of the miners themselves are not the best investment—not during the bear market, and not during the bull market, either.

It was Rick Rule, the 40-year veteran and hundred-millionaire investor and money manager that some of the richest people in mining have called "the most street smart analyst in resources," who laid out these cycles for me and explained exactly how to thrive by anticipating them.

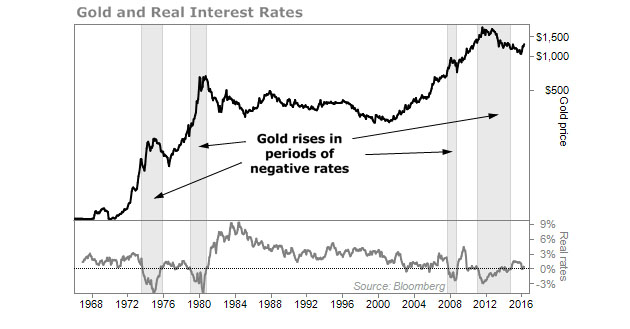

It was Rick who had explained to me that for thousands of years, gold had kept its purchasing power, and, therefore, it wasn't an investment vehicle at all. It was a means of storing and retaining wealth that one gained in his ventures, job and businesses.

There have always been, though, gold rushes, or periods of time when the companies mining the ore were swimming in profits, and there are other times when mountains of high-grade ore were left in the ground because mismanaged companies ran out of money.

The huge difference is today's monetary system does not judge gold bullion as money. In the eyes of the masses, it's not even a competing currency—it's just a relic of the past.

This creates gold and silver bull and bear markets, a phenomenon that has never been seen before, since currencies never floated in price vs. the precious metals.

"If you want to measure your gold holdings to something, compare it to fiat currencies," Mr. Rule told me, "and not to cash-producing assets, because gold is money.”

That sounded familiar, since Warren Buffett says exactly the same thing.

The difference is that Buffett doesn't even put his savings in gold, a strategy Ray Dalio has called "foolish, at best."

"Daniel, don't try to make a fortune owning precious metals in physical form," Rule looked straight at me and said, "Instead, speculate in the shares, and do it by sticking with what works and with the people who make it work."

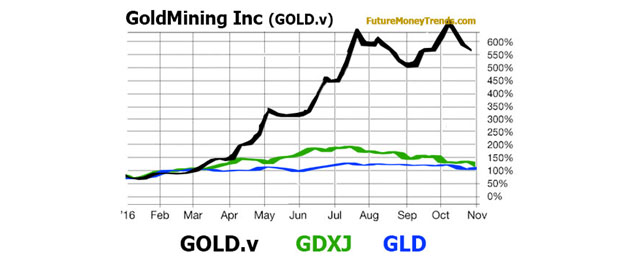

"When one compares the performance of the shares to bullion during times of rising valuations, one undoubtedly sees that gold optionality is one of the best business models. It's how Ross Beaty and others made a name for themselves and created fortunes.”

Since that meeting in 2011, I became obsessed with finding the ultimate gold optionality play to ride the next big bull market. My team and I have discovered a few core optionality plays, including one that Rick is a large shareholder of through his KCR Fund.

Right now, gold is breaking out big, and I want to make sure you fully capture the value of the "gold optionality" business model, so I've laid it out in an exclusive report HERE!

Daniel Ameduri is the editor of the Wealth Research Group and the cofounder of Future Money Trends Letter, FMT Advisory and Crush The Street. After warning family and friends in 2007 about the coming market and mortgage collapse, Ameduri started his own YouTube channel, VisionVictory, which has received 10 million video views. On March 18, 2008, Ameduri called for Dow 8,000, the collapse of Lehman Brothers, AIG, and Washington Mutual. During the mortgage crisis, he helped people buy Put Options on Countrywide Mortgage; these Puts saw a gain of 1,400%.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Daniel Ameduri: I, or members of my immediate household or family, own shares of the following companies referred to in this article: GoldMining Inc. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: None. My company has a financial relationship with the following companies referred to in this article: GoldMining Inc. has a marketing agreement with Gold Standard Media. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of the author.