The Gold Report: What does the agreement you just announced to extend Freeport-McMoRan Nevada LLC's (Freeport Nevada's) option to acquire an interest in Quaterra Resources Inc.'s (QTA:TSX.V; QTRRF:OTCQX) Yerington Copper Project in Nevada really mean?

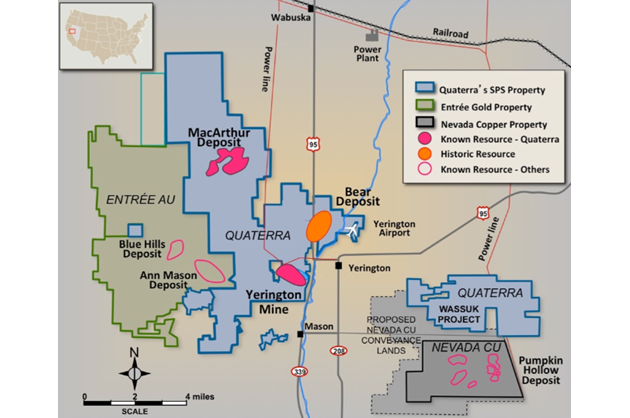

Gerald Prosalendis: It means the funding is available to secure the land position, maintain operations and, under the right circumstances, continue drilling at the Yerington Copper Project. To achieve this, Quaterra and Freeport Nevada are extending by two years a four-year option agreement that allows Freeport Nevada to earn an interest in Quaterra subsidiary Singatse Peak Services (SPS), which holds all the Yerington project assets. The extension requires Freeport Nevada to make option payments to SPS of $5.75 million over two years.

TGR: What are the precise terms of the extension?

"Quaterra and Freeport Nevada are extending by two years a four-year option agreement that allows Freeport Nevada to earn an interest in Quaterra subsidiary Singatse Peak Services."

GP: To extend the current stage of the option agreement, Freeport Nevada must make at least four option payments over two years totaling $5.75 million, one every six months starting this month. The first option payment received on June 13 was for $1.8 million. The second option payment, due in December 2016, is for $1.25 million. There are also third and fourth payments of $1.35 million each. Freeport Nevada has the right to terminate the agreement at any time with 60 days' notice. Freeport Nevada maintains its option to earn an initial 55% interest in SPS by making $40.7 million in option payments.

TGR: How will the option payments to SPS be used during the extension?

GP: Option payments received from Freeport Nevada will be used by Quaterra subsidiary SPS to finance property maintenance, running costs and environmental compliance at the Yerington Copper Project. The agreement also has provisions that can free up funds for drilling at Yerington, particular the Bear copper porphyry deposit.

TGR: How will drilling be financed at the Bear?

GP: Everyone involved at Yerington has an interest in ongoing exploration work, particularly through drilling. That is why we have all invested so much. The extended option agreement not only makes available the financial resources for property maintenance, running costs and environmental compliance, but also has built into it the ability to free up funds for exploration drilling. How will this be done? SPS has the ability to propose special exploration programs involving drilling that can be undertaken with Freeport Nevada's agreement and funded using accelerated option payments provided by Freeport Nevada in terms of its earn-in. This discretionary approach provides Quaterra and SPS with a strong incentive to identify compelling drill targets.

TGR: What happened to Stage 3 of the agreement? Wasn't this a three-stage deal?

GP: Nothing has changed in terms of the fundamentals of the original agreement with Freeport Nevada. Stage 2, the current stage, has merely been extended by up to two years. Otherwise the agreement stands at it was negotiated. Freeport Nevada has to make option payments totaling just over $40 million to earn an initial 55% in the project. It can earn a further 20%óincreasing its holding to 75%óby spending a total of $99.5 million or by funding a feasibility study, whichever comes first. Before then, Freeport Nevada can terminate the agreement at its discretion.

TGR: Has the extension of this stage of the agreement delayed the ongoing work program at Yerington?

"Option payments received from Freeport Nevada will be used by Quaterra subsidiary SPS to finance property maintenance, running costs and environmental compliance at the Yerington Copper Project."

GP: The agreement we announced has possibly extended the period for Freeport Nevada to earn its initial 55% in the project by up to two years. However, the project is moving forward and the work necessary to make decisions about development at Yerington is being done in a systematic fashion. SPS has recently completed a six-hole, 20,275-foot drill program at the Bear. It is now appropriate to digest and organize the information that was collected. We have funds available for this work. We need to understand precisely what the data are telling us about the potential size of the Bear, the orientation of the mineralization and the possible location of higher-grade zones of material within the mineralized zone. We also need to do follow-up deskwork, as well as additional geophysical work. All this takes time, but is key to selecting the most prospective targets for drilling. Once we have worked our way through the data and learned all that we can, we will be in a position to propose a work program that involves exploration drilling.

TGR: What did the results of the recent drilling program at the Bear tell you?

GP: SPS drilled six holes totaling 20,274 feet starting in August last year. The five holes drilled in the Bear porphyry copper deposit totaled 18,257 feet. Results of the first hole SPS drilled, Hole B-048, supported historic assays from Hole 23B drilled in 1966 by Anaconda. It has given us added confidence in the results we have from a 49-hole drill program conducted at the Bear in the 1960s. Obviously, more drilling will be necessary before we can draw any firm conclusions.

Drilling in the four stepout holes (Holes B-049 to B-052) was successful in extending the known mineralization at the Bear an additional 2,000 feet north-northeast by 3,000 feet northwest-southeast. Also important, the average thickness of the mineralized intercepts of these holes was about 1,000 feet. We believe the deposit remains open in three directions, and that it currently covers more than two square miles. We also drilled the last hole, GHH-001, 6,000 feet to the south of the first five holes in an area with no previous drilling. Sporadic zones of copper mineralization were present in this hole and could be interpreted as an extension of the Bear porphyry system. More work will have to be done to assess the significance of this hole in the south. There are more details on the recently completed drilling program available on the Quaterra website.

TGR: Is the Bear still a focus of your efforts?

GP: Yes, the Bear remains the focus of our efforts. We will use the next six months to look closely at all the data obtained from the recently completed drill program. This information, along with surface work including geophysical surveys, will help us better to understand the Bear deposit and assist in future drill site selection. We believe success at the Bear could open the way for development of the Yerington district. It could prove to be the catalyst for the phased development of our total package of Yerington assets. But we are quite a way off from that scenario. With that in mind we also intend to initiate and self-fund desktop studies to assess the overall development potential at Yerington.

"Everyone one involved at Yerington has an interest in ongoing exploration work, particularly through drilling."

TGR: Is Quaterra still the operator at Yerington?

GP: Yes. Quaterra, through its subsidiary SPS, is the operator at Yerington and will be until Freeport Nevada completes option payments of $40 million and agrees to accept the 55% interest in SPS to which it will be entitled. At that point, Freeport Nevada will become the operator of SPS's Yerington assets.

TGR: What happens if Freeport Nevada exercises its right to terminate the agreement?

GP: Well, considering we have both just agreed to extend the agreement, that way of thinking may be a bit premature. But let's remember, all the work being done and all the land and operating payments being made are necessary to consolidate and move the project forward, no matter who is involved. In six months from now, the Yerington project will be in better shape and farther down the line. If Freeport Nevada elects to leave, as is its right, none of the work will have been wasted. It will also have been completed without dilution to Quaterra shareholders either in the ground or in the market. Quaterra will still own 100% of a large, multi-deposit district, with infrastructure and water rights all located in a mining-friendly jurisdiction in Nevada with a history of copper production. These are powerful incentives to keep moving the project forward under any scenario.

TGR: Thank you for your insights.

Gerald Prosalendis is the president and COO of Quaterra Resources Inc. He has been an officer or director of a number of publicly traded mining exploration and development companies. He was the vice president corporate development of Western Silver Corporation and was involved in the successful sale of that company in 2006 to Glamis Gold Ltd. for $1.6 billion. He was also vice president corporate development of Dia Met Minerals, a member of the team that developed the Ekati diamond mine and was involved in the sale of Dia Met to BHP Billiton for $687 million in 2001. Prosalendis is currently enrolled in a Master's degree in environmental management at Royal Roads University, and has a Bachelor's degree from the University of Cape Town.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Some statements contained in this interview are forward-looking statements under Canadian securities laws and within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are identified by words such as "believes," "anticipates," "intends," "has the potential," "expects," and similar language, or convey estimates and statements that describe the Company's future plans, objectives, potential outcomes, expectations, or goals. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. In particular, forward-looking statements in this interview include that the Company will receive option payments over the next 24 months; that exploration drilling will be undertaken, particularly at the Bear deposit; that results will define further mineralization or high grade zones; that historical and new exploration will support a resource on the property; and that the Yerington assets have the potential to support mining operations. These statements are subject to risks and uncertainties that may cause results to differ materially from those expressed in the forward-looking statements. A summary of risk factors that apply to the Company's operations are included in our management discussion and analysis filings with securities regulatory authorities, and are publicly available on our website. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. The Company does not undertake to update any forward-looking statement that may be made from time to time except in accordance with applicable securities laws.

Disclosure:

1) Patrice Fusillo and Paul Guedes compiled this interview for Streetwise Reports LLC. Ms. Fusillo provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None. Mr. Guedes provides services to Streetwise Reports as a contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) Quaterra Resources Inc. paid Streetwise Reports to produce and distribute this interview. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Quaterra Resources Inc. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Gerald Prosalendis and not of Streetwise Reports or its officers.

4) Gerald Prosalendis: I was not paid by Streetwise Reports to participate in this interview. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. I or my family own shares of the following companies mentioned in this interview: Quaterra Resources Inc. My company has a financial relationship with the following companies mentioned in this interview: Freeport Nevada.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.