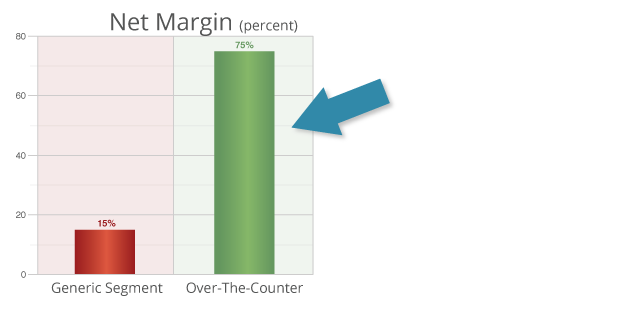

The generic segment typically has gross margins in the 70% range, but after rebates to retailers, the net margin falls to a range of high single digits to 15%.

There are no rebates with over-the-counter products, so 80% gross margins translate into 70–75% net margins on those products. That's almost all profit.

Hema-Fer falls into the high-margin OTC category.

In the supplement world, iron supplements are a top-selling product. They can be prescribed by a doctor or purchased without a prescription by an individual.

80% gross margins on OTC products translate into 70–75% net margins, almost all profit. Hema-Fer falls into the high-margin OTC category.

But not all iron supplements are equal.

The iron in a supplement can either be natural or synthetic. Natural iron is called "heme"—that's what is used in VANC's Hema-Fer.

Many other supplements use synthetic—or "non-heme"—iron because it's cheaper. But non-heme iron causes gastric complications in many people, and is not absorbed into the body as well.

Some of the leading iron supplements on the market are non-heme, yet they enjoy immense success because of their marketing campaigns.

One of the leading iron supplements in North America is called FeraMAX® and made by BioSyent Inc. (RX:TSX.V). BioSyent has built a CA$100 million-market cap company on the back of FeraMAX®. As BioSyent's most recent annual report will tell you:

"Shipments of FeraMAX® 150 commenced in April 2007. FeraMAX® 150 has been a strong driver of growth in the Company’s Pharmaceutical business."

FeraMAX is non-heme. Again, it has enjoyed such large success because of intense and focused marketing.

VANC plans on doing the exact same intense and focused marketing. . .but focusing on the fact that Hema-Fer is natural. I think that will be well received in the market.

VANC plans to, and is, in fact, already marketing this product to doctors with great results. The company can walk into a doctor's office with a natural product, explain why it's better than a synthetic one for patients, and let the facts sell themselves.

This approach is already proving successful in British Columbia in the short time since the product has launched.

Now, VANC is going to roll out Hema-Fer across the entire country, and it will prove especially popular on the east coast, where FeraMAX already enjoys robust sales.

Investors should look toward release of VANC's 2015 annual results, which may be surprising and could focus attention on the stock in a hurry.

Ultimately, the aim is to get Hema-Fer on the shelves of regional and national pharmacy chains, while touting the benefits of natural iron supplements to consumers.

The Canadian market for iron supplements is estimated to be CA$45 million (CA$45M) annually. For iron and other combinations, the market is ~CA$74M annually.

I think it's easily within reach for VANC to secure ~5% of that market in the near term, and much more than that as the consumer is educated.

In addition to Hema-Fer, investors will be looking towards VANC's 2015 annual financial results, which are due out in late April. These will show sales numbers from VANC's initial rollout of projects in 2015.

The numbers may be surprising for this new entrant into the space, and that could put some attention on the stock in a hurry.

Nick Hodge is founder and president of the Outsider Club, and investment director of Early Advantage. He is the author of Energy Investing For Dummies, appears regularly at investment conferences and is frequently interviewed by major media outlets. He is a graduate of Loyola University, Maryland.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Image provided by Nick Hodge.

Disclosure:

1) Nick Hodge: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for this article. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included based on my research. I am responsible for the content of the article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.