The Gold Report: Many believe that the price of gold represents a market referendum on the value of paper money and the health of the world economy. Do you agree?

Jay Taylor: Yes, I do. Gold rose from the mid-$200s/ounce (mid-$200/oz) in 2002 to as high as $1,900/oz. That clearly suggests that things are not all right in the global economy. Politicians like to create the illusion that they can create something out of nothing and give it to people in exchange for votes. Gold gets in the way of that falsehood politicians wish to use to deceive voters for their own gain and the gain of those who fund their election campaigns.

TGR: Gold has fallen from $1,900/oz to below $1,400/oz. Some people say this proves the bubble has burst.

JT: I wish that were the case because that would mean that the policymakers—the people in charge of the Federal Reserve, the Treasury and of other countries and banks around the world—had fixed everything, but I don't believe that for a minute. If anything, their policies are making things worse.

I wish there was a reason to be optimistic about the global economy. Keynesian economic policies didn't work in the 1930s, and they're not working now. Franklin Roosevelt's Treasury secretary and a personal friend of the president said after the second term, "We have just as much unemployment as we had at the start of the downturn, and we have a huge amount of debt to boot." And the same thing can be said now if we use the same measure of unemployment as we did in the 1930s.

As David Stockman said recently, Fed Chairman Ben Bernanke is in the process of destroying capitalism. Pushing interest rates to zero destroys savings and creates malinvestment. That works very well for the people who control the supply of money and credit, but it doesn't work very well for the people who are actually contributing to the economy: miners, manufacturers, farmers. The middle class is being destroyed. That's why, if you are not on Wall Street or in government, you have to own gold and silver because the currency is being used to reallocate wealth from most of us to those who rule us from Washington and Wall Street.

TGR: But we keep hearing that the recovery is just around the corner.

JT: Well, that's what they said in the 1930s, too.

TGR: You've talked about gold "being increasingly a bipolar market." Do you think we're going to see a divorce between the paper and physical gold markets?

JT: I think that, ultimately, physical will win, especially as those in the futures markets demand delivery, only to find the gold doesn't exist. ABN Amro has already defaulted on its delivery obligations and required settlement in paper. As long as people think they can take paper money and still go out and buy the gold or whatever else they want, this fraudulent system can hold together. But ultimately, as trillions upon trillions of new money is created, it will fail. I don't know how long that will take. The paper markets are controlled and dominated by Wall Street, which joins Washington in this con game. But the real markets for gold are not only the Chinese but also average Americans and average citizens everywhere who have their eyes open and their ears shut to mainstream propaganda. They know the ruling elite are the parasites eating away at their wealth.

TGR: If there were a divorce between the physical and paper gold markets, wouldn't this be a severe blow to financial instruments generally?

JT: Yes, ultimately it should be. But we have had all manner of immoral behavior on Wall Street with the housing bubble, yet nobody has gone to jail. The fox is in charge of the chicken coop. If the markets force some sort of honesty on these evildoers, it would be a good thing. But it wouldn't necessarily be pleasant for anyone. A fair amount of circumstantial evidence from the Gold Anit-Trust Action Committee (GATA) and other sources supports the contention that the big bullion banks are manipulating the precious metals markets. That's supposed to be against the law. But as Dr. Karen Hudes, former chief counsel at the World Bank, pointed out on my radio show on June 11, there is a powerful group of corporations that rule America and that are above the law. That would include the bullion banks, the mainstream media and the governments of the Western world.

TGR: Why do you think the big run-up in the equities markets has not buoyed the prices of precious metals stocks?

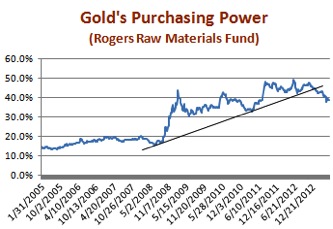

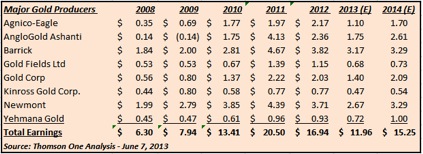

JT: Mining stocks have not performed well relative to the price of gold even before the price of gold fell. Part of the reason is that the cost of production has gone up faster than metals prices. Mining profits started to erode as Quantitative Easing 2 (QE2), QE3 and QE infinity started pumping up the prices of other commodities such as energy and materials. In addition, the gold mining companies were scaling up and became fairly reckless. I watch very closely the "real" price of gold, which I define in terms of the Rogers Raw Materials Index. After Lehman Brothers, the "real" price of gold rose dramatically and with that so did the earnings of major gold producers.

Note from the charts above that the upward trend in the "real" price of gold has been broken and with that major gold mining company profits have also declined and are projected to decline further this year.

TGR: New Gold Inc.'s (NGD:TSX; NGD:NYSE.MKT) takeover of Rainy River Resources Ltd. (RR:TSX.V) and its Rainy River project in Ontario is not a big takeout. It's $310 million, but it's the first of any size that we've seen for some time. Do you think this is a one-off, or do you think that we can expect bigger companies taking advantage of the depressed share prices of the smaller ones?

JT: No, I think it's not a one-off. It's likely to become a trend. Something like 50% or more of the junior resource companies are on death's door; they don't have enough money to stay in business for another year. Many of those companies can now be had for a song. Shareholders will say, gee, at least I'm getting something out of it. They won't have a choice.

TGR: Which of the bigger companies are actively looking for acquisitions?

JT: Certainly Sandstorm Gold Ltd. (SSL:TSX), which employs a streaming model, is a company that's looking to pick up some assets. I suppose some of the really big miners that I don't follow as much, the household names like Newmont Mining Corp. (NEM:NYSE) and Goldcorp Inc. (G:TSX; GG:NYSE), will be in a position to pick up some of the smaller juniors.

But it's not so much mergers and acquisitions that I'm interested in. My target is mostly smaller juniors that are cash-flow positive, don't have to issue tremendous numbers of shares, have great exploration potential and can grow organically. For example, Dynacor Gold Mines Inc. (DNG:TSX) is one of my favorites. The company will produce about $0.30/share in cash flow this year. It is selling at around $1.15/share and will probably double its production to over 100,000 oz by 2014. Dynacor also has some wonderful exploration targets. The company has about 28 million shares outstanding, and it never issues more. It funds its needs internally from cash flow.

One of the biggest risks that shareholders have to be cognizant of in this industry, especially among the exploration companies, is dilution. Dynacor has been patient and has grown slowly but steadily over the past several years. It provides milling facilities in Peru to high-grade mom-and-pop operators. Peru has something like 75,000 small, licensed operators, so Dynacor has really carved out a niche business and its growth prospects are very substantial.

Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT) is another company with good cash flow and is certainly in a position to grow organically from its San Francisco mine in Mexico.

TGR: There has been a fair amount of protests against foreign mining companies in Peru. Do you think that Peru is solid from a mining viewpoint?

JT: I do, though you have to look at companies in Peru on a case-by-case basis. Dynacor has been there for a long time, and it has done an extremely good job of working with the government and the people. Dynacor has not been arrogant, like many of the majors. I'm not saying Peru is risk free. I don't think any place on earth is risk free, including the United States. But Jean Martineau, the president and CEO of Dynacor, has worked from the bottom up, and the company is viewed as almost a Peruvian company. The capital has come from outside, but it's really the Peruvian people that are the company and they are benefitting from Dynacor's business model. Rather than a Canadian company going into Peru and grabbing major tracts of land and putting smaller producers out of business, Dynacor enables small mining operations to continue producing gold and building the wealth of middle- to upper-class family wealth.

TGR: Could you comment on some other companies that you follow?

JT: I met with Golden Arrow Resources Corp. (GRG:TSX.V; GAC:FSE; GARWF:OTCPK) management a couple of weeks ago. The company is really on to something very significant with its Chinchillas silver project in Argentina. The project already has outlined some 110 million ounces (110 Moz) silver equivalent, and it has barely scratched the surface of its exploration targets. Joe Grosso, the chairman, has really done a remarkable job of forming relationships with the local people in Argentina.

San Gold Corp. (SGR:TSX.V) is a completely different story. The company's operating performance over the last number of years has been a big disappointment. But I believe we're going to see a turnaround. San's revised management team has a much better grasp of costs and is employing capital to make its mining operations in Manitoba much more efficient by linking high-grade zones together. San should be able to pull more high-grade ore out of the ground. That's why I placed a fairly heavy bet on it personally and in my newsletter. San's infrastructure is in place. I could be wrong, but if I'm right, we could be looking at a $1.80/share price instead of a $0.14/share stock.

TGR: You met with Prophecy Platinum Corp. (NKL:TSX.V; PNIKF:OTCPK; P94P:FSE) CEO and President Greg Johnson at the World Resource Investment Conference in Vancouver. Afterward, you said that this company's story "stood out head and shoulders above the rest." What is it about Prophecy's Wellgreen platinum group metals and nickel-copper project in the Yukon that so impresses you?

JT: A whole lot of factors. I visited the project a couple of years ago before Prophecy brought on Greg Johnson, and I've always believed that it was perhaps one of the greatest PGM projects in the world. I didn't feel at that time that the company had the management in place to really pull it off. A project of this scale is going to require a massive amount of technical talent. Greg was a co-founder of NOVAGOLD (NG:TSX; NG:NYSE.MKT) and also worked with South American Silver Corp. (SAC:TSX; SOHAF:OTCBB).

After Johnson came on, John Sagman was added to the team. He was with Xstrata Plc (XTA:LSE) and also with Vale S.A. (VALE:NYSE), handling the nickel and platinum group metals operations. I think Sagman and Johnson form a management team core that can actually get it done. Wellgreen's scale, size and dimensions of mineralization and the grades of the platinum group metals are remarkable. We're looking at widths and thicknesses that exceed anything that Ivanplats Ltd. (IVP:TSX) and the other companies in South Africa have. The big question here has to do with metallurgy. This is a deposit of 7 Moz platinum group metals plus gold, 2 billion pounds (2 Blb) nickel, 2 Blb copper and the exploration potential is absolutely enormous. But can Prophecy get enough of the metals out? Can it be optimized to the point where the deposit is economic? I think with Prophecy's new management team the answer to those questions is most likely yes.

TGR: Wellgreen's preliminary economic assessment shows a capital expenditure (capex) of $863 million. Is that going to be a problem considering the current economic conditions for raising money?

JT: Absolutely. That is certainly the other major concern here. Close to a $1 billion in capex is not very easy for a company selling at $0.65/share. But management is looking at the potential to develop high-grade starter pits, which would enable it to start out at a smaller scale with a much smaller capex.

TGR: Do you like the prospect-generator model?

JT: Yes, mainly because prospect generators use other people's money to derisk projects and avoid dilution. Prospect generators, at least the companies that I follow and respect, have very strong technical talents in exploration. They've identified projects that have a reasonable potential to host meaningful ore deposits. Most companies have a couple of projects and blow through huge amounts of money to drill them out. Prospect generators do some low-cost preliminary work to establish a geological thesis for exploration. Then they get other companies to come in and spend their money.

TGR: What companies do you like in this area?

JT: Eurasian Minerals Inc. (EMX:TSX.V) is my favorite. There are other companies that I would call hybrid prospect generators, companies like Aurvista Gold Corp. (AVA:TSX.V), Bravada Gold Corp. (BVA:TSX.V) and Paramount Gold and Silver Corp. (PZG:NYSE.MKT; PZG:TSX). But among pure project generators, Eurasian has the biggest projects and the most money, and it is allied with the biggest mining companies. I think it's just a matter of time before Eurasian comes up with at least one major economic deposit that sends the stock to much higher levels.

There are others I like, such as Riverside Resources Inc. (RRI:TSX). John-Mark Staude, the president and CEO, is doing a remarkable job. Riverside has projects in Mexico and in the United States and also now some base metals deposits that are being explored by major companies in British Columbia. The company just announced some excellent high-grade silver results from trench assays and drill core on its Jesus Maria mine on its Penoles project in Durango, Mexico. This could be the first discovery that catapults the company from a $0.35/share stock into the mining big leagues.

Millrock Resources Inc. (MRO:TSX.V) has copper and gold projects that major companies are spending some serious dough to explore. Miranda Gold Corp. (MAD:TSX.V) just hooked up with Agnico-Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) as a strategic partner in Colombia. Miranda has an ample amount of cash but is looking hard at picking up good projects from companies unable to stay alive in this difficult market.

Paramount is definitely a takeover target. This is a company with a little less than 10 Moz gold equivalent in Mexico. Lots of exploration upside remains on both of its projects. Paramount has deep pockets. I like this one a lot.

And I like Aurvista quite a bit as well. I think that if we get a rise in the equity markets, the company is going to be fine. Aurvista's grades are around 1 gram/tonne, with lots of exploration potential. It could be a multimillion-ounce deposit. Aurvista could be a takeover target somewhere down the road.

Bravada is skating on thin ice right now. The company just lost its partner in the Wind Mountain gold-silver project in Nevada, Argonaut Gold Inc. (AR:TSX), but that project is very strong. Argonaut walked away not because it didn't like the project, but it just picked up Prodigy Gold Inc.'s projects, so it had to preserve its capital. The geologists loved the project. I think Bravada will get another partner in there and will do extremely well, if it survives.

TGR: John Kaiser expects a wholesale cull of mining juniors: 500 companies or more. What do you think?

JT: I think John's right. Some will disappear in acquisitions, and some will just stop doing what they're doing. As much as I love gold and silver, the mining sector is not immune to malinvestment. Some stocks rise in the good times but can't be sustained because there's no organic growth, no cash flow to sustain them. And thanks to the creation of money out of thin air, they were born as public companies but no doubt should never have been on the scene in the first place, thanks to dishonest fiat money, which funds the yachts for Vancouver stockbrokers, but ends up sending average people to the poor house.

TGR: A great many investors in mining stocks have moved from gloom to despair. Do you have any words that would cheer them up?

JT: We are still in the bull market of a lifetime in gold. I follow the work of Charles Nenner, who is a cycles analyst. Charles is calling for a mid-June turnaround in gold and silver. I'm 66 years old. I was around for the last gold bull market in the 1970s. This is going to make that one look like child's play. I think we can expect something comparable to what we saw in the 1970s, when gold went from $35 to $200 to $100 and then from $100 to $850/oz. It's not necessarily something to be happy about because it portends a lot of trouble geopolitically and in the global economy, and that's not something I want to see. I don't invest in gold because I'm cheering for the world to fall apart. I invest in gold and silver because I believe the policymakers are guaranteeing the world will fall apart.

TGR: If this big run-up starts this summer, how long before the benefits start accruing to mining companies?

JT: That's a very good question. I'm not absolutely sure they will. I hope so, but this will happen only if we see deflation rather than hyperinflation. If we have a hyperinflationary event, I think the only real thing to do is to own the metals itself. If we head into a deflationary depression, I think gold mining will do extremely well as it did in the 1930s. But mining is like any other business. Revenues need to be higher than expenses. In a hyperinflationary environment, costs tend to rise faster than the price of gold.

TGR: Gold producers did well during the Great Depression.

JT: Extremely well. Homestake rose by six or sevenfold, while the Dow went down 89%; gold producers did well because the real price of gold rose. While the price of gold was fixed at $35/oz, deflation caused wages and materials costs to decline and profits to surge.

TGR: Thanks, Jay.

JT: My pleasure.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor's interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career—including publication of his weekly Gold, Energy & Technology Stocks newsletter. He also has a radio program, "Turning Hard Times into Good Times."

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Goldcorp Inc., Timmins Gold Corp., Golden Arrow Resources Corp., Prophecy Platinum Corp., NOVAGOLD, Aurvista Gold Corp., Paramount Gold and Silver Corp. and Argonaut Gold Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Jay Taylor: I or my family own shares of the following companies mentioned in this interview: Aurvista Gold Corp., Bravada Gold Corp., Dynacor Gold Mines Inc., Eurasian Minerals Inc., Golden Arrow Resources Corp., Millrock Resources Inc., Miranda Gold Corp., Riverside Resources Inc., Paramount Gold and Silver Corp., Prophecy Platinum Corp., San Gold Corp., Sandstorm Gold Ltd. and Timmins Gold Corp. I have never been paid by any of the companies mentioned in this interview in exchange for their coverage in my newsletter. However, with the exception of Sandstorm Gold, the companies my family or I own as noted in 3), all of the other companies have at one time or another in the past been sponsors on my radio show, "Turning Hard Times into Good Times." I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.