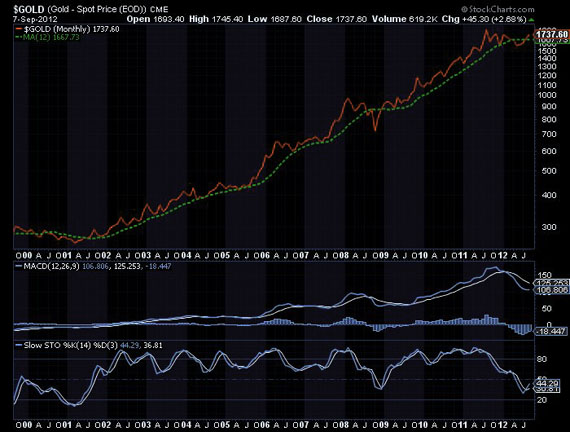

By the time Casey Research Managing Director David Galland took the stage to welcome 300 investors to the "Navigating the Politicized Economy" summit in Carlsbad on Friday morning, word had already spread around the room that gold had jumped out of the previous $1,671/ounce (oz) high and was at $1,740/oz.

The 3% increase for the week (13% on the positive side since the low of $1,526/oz in May) was attributed at least in part to a lackluster U.S. jobs report that could lead to another round of monetary easing next week when the Federal Reserve meets again, something that tends to bode well for the price of gold as increased money supply can devalue the dollar. The news that the European Central Bank would use its own bond-buying program to alleviate the Eurozone debt problems also turned attention to gold, which becomes more attractive in an inflationary environment that could result from increased liquidity.

Friday's rally was the second time in as many weeks that gold jumped 2%, an upward trend dating back to August 21 when it broke the $1,636/oz six-week top. Spot gold was up 2.13%, closing at $1,737/oz, the highest since February. Silver closed at $33.66/oz., a 3.1% increase and the highest price since March.

The question for these precious metals investors was whether the jump was part of a new trend or a one-day reaction to headlines that could drop down as fast as it bounced up.

Indicators

Mark Leibovit, chief market strategist at The Gold Letter, said he was not surprised. He watches indicators as varied as 30-day moving averages and lunar cycles to determine where commodities prices are going and why. "Part of it is seasonality," he said. "Investors are now stepping up to the plate after testing the lows and are establishing a new, higher bottom." Leibovit suggested the future could look like a mountain range with a couple of progressively higher peaks in September and October based on news events, possibly around large fall conferences, followed by pull backs. By February, he predicted the metal could shoot up with little resistance.

Dominick Graziano, technical analyst and co-founder of the Jelly Donut Brotherhood, a group of investors in attendance at the conference, said he is waiting for gold to exceed $1,800/oz. before he is convinced the jump was more than a blip. He watches daily, weekly and monthly charts and is looking for higher highs and higher lows on all three fronts once the market shakes out all the people who bought at $1,900/oz. "We had a classic double bottom, but I am not convinced yet that this is a new low," Graziano said. A key indicator he is watching is the global currency market. "The dollar and gold will compete and gold will eventually win," he said. He described the relationship between the two as a transition phase shown by the snake up and down pattern. "How it breaks will be critical," he said. Until it does, gold and the dollar could go up together even though they normally have an inverse relationship.

Casey Research Chief Metals Investment Strategist Louis James also was not ready to call it a new bottom after one day. He called the pressure on the Fed to increase liquidity "bullish for commodities and particularly bullish for precious metals." He cautioned investors to not assume the upward movement indicates a new reality right away. "What the beard giveth, the beard can taketh away," he said, referring to Fed Chairman Ben Bernanke's facial hair. "If the Fed doesn't do what's expected, those gains could be reversed very quickly." James preferred taking a long-term view, rather than reacting to daily headlines and chart jumps. "Ultimately, we think inflation wins. I think we are coming out of a correction and we probably have seen the bottom. We probably will see it eventually go up. I don't know that I would take all my chips and push them to the center of the table, but I would certainly not want to be out of the market at this time."

Global Resource Investments Founder Rick Rule also saw the recent movement as part of an upward trend. "I think today's response in the gold price has something to do with the fact that some of the market has figured out that the government is trying to solve a solvency issue with liquidity, and they're different questions. Adding to our debt on a short-term basis doesn't solve the solvency issue. I think today's response had something to do with that."

Rule also said that the recent upward trend was linked to the weakness of the U.S. dollar. "As weak as the U.S. dollar is, there is no obvious competitor for it in terms of the world's reserve currency with the exception, of course, of that form of money that's historically been a store of value as well as a transfer mechanism, which is gold. Gold and silver have done well during periods of instability, periods of turmoil and periods of fear. I suspect that the political debate in the U.S. for the last three weeks has provoked in others, as it has in me, some measure of fear."

Finally, Rule pointed out that the opportunity cost associated with holding gold is at all-time lows. "The government, in its war on savers, is driving down the interest rates. This has lowered the costs for people to hold gold on a leveraged basis and has also lowered their disincentive to holding gold. It used to be the disincentive to holding gold was it didn't pay you any interest. Well, nothing else does either. "The opportunity cost just disappeared."

Trickle Down to Equities

Investors were also anxious to see the higher gold commodity price be incorporated in valuations of gold equities. Market Vectors Gold Miners ETF (GDX), a measure of the senior gold companies, went from $49.15 to $50.04 between Thursday and Friday. Market Vectors Junior Gold Miners ETF (GDXJ) was up 34% on Friday to $23.55, a big increase from the 52-week low of $17.37.

Casey's James pointed to the emotional impact of topping that $1,700/oz line. "Markets are emotional. Momentum shouldn't play a role, but it does. There is money on the sidelines that is ready to come back into this sector." James pointed out that the precious metals market is small. "A little bit of hope goes a long way."

Rule pointed to a functional disconnect between higher commodity prices and junior share prices. "Most juniors don't have gold; they're looking for it. And if the price of something we don't have any of goes up, it shouldn't have any real impact on the share price," he said.

Rule also noted that the sector is undergoing a money shift. The shift has been driven for 10 years by institutional demand. That drove the type of stock that was popular in the market. Fund managers were looking for leverage to gold. So one of the things that they drove to was high up-front capital costs, low-margin, high-leverage gold deposits. "The industry has managed to lose a fortune on those deposits in the last 10 years," he said. Now that institutions don't have much money left to invest, the drivers that existed in the market for the last decade are gone.

In the future Rule believes the gains will be more company specific rather than marketwide. "What I suspect will drive the markets going-forward is financially accretive transactions rather than leverage to gold." He sees some 30 properties that could be acquired with healthy premiums paid because they are financially accretive and because the market is in a discovery cycle with some great news coming out. "The market rewards discoveries."

Casey Research Chief Energy Investment Strategist Marin Katusa looked at the fundamentals and wasn't ready to call a bottom in resource equities. "I personally don't think we're seeing the lows yet. In the last few days, the stocks have gained, but the volumes and the dollar amounts are nowhere near where they were 18 months ago or in mid- to late 2010." With so many funds out of money, he advises caution until new dollars come to the sector. "I believe we're in a pick right, sit tight market but not a sector-wide market. Tax law season is looming. Tax gain selling is looming. I still think we're going to see lower prices and we're not at the lows yet."

At the end of the day, Eric Sprott, CEO of Sprott Asset Management, put it in terms most at the conference could understand. "I made 15% today on the gold I bought at $260/oz," he said.

For the insights from 28 experts who spoke at "Navigating the Politicized Economy Summit," including Casey's Top Pick's and Doug Casey's parting words that it will be even worse that he thinks it will be so diversify geographically, download the audio collection here.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise. Interviews are edited for clarity. No one was paid by Streetwise Reports for participating in this interview.