TICKERS: CRH, GSK, IMRS, MDA.TO, RIM; RIMM, TMD, VPT, VRS, ZMS; W1I; ZMSPF

Looking at Small Medtech and Biotech in Canada: Nick Waddell

Interview

Source: George S. Mack, The Life Sciences Report (5/3/12)

Is there a developing Silicon Valley model in Canada? Not quite yet, but Publisher and Founding Editor Nick Waddell of the Vancouver-based Cantech Letter would like to see that happen. Meanwhile, he's looking for—and finding—exciting small- and micro-cap ideas as potential big returners. In this exclusive interview with The Life Sciences Report, Waddell discusses current favorite healthcare names that will surely surprise people who have not been looking North.

Is there a developing Silicon Valley model in Canada? Not quite yet, but Publisher and Founding Editor Nick Waddell of the Vancouver-based Cantech Letter would like to see that happen. Meanwhile, he's looking for—and finding—exciting small- and micro-cap ideas as potential big returners. In this exclusive interview with The Life Sciences Report, Waddell discusses current favorite healthcare names that will surely surprise people who have not been looking North.

Nick Waddell: I would describe it as an invest-in-what-you-know approach. I think many investors, especially newer ones, can be overwhelmed by the sheer size of the equities market, and people end up being intimidated by the sheer amount of data out there. My approach is to divide the market into small sections, whether by geographic region or by sector, and to find value there. That way, instead of examining thousands of different investment vehicles I can narrow the market down and know it like the back of my hand.

TLSR: You are an online publisher. In April two online publications won Pulitzer Prizes. Where does the online format go from here?

NW: It's an interesting question. I've been involved with publishing on the Internet since the early days. I was part of a site called The Canadian Stock Market Reporter back in 1994, which was one of the very first profitable sites on the Internet. I've remained involved and watched it evolve. Now it has become a part of the fabric of our everyday lives. I've written for both print and Internet, and there are advantages to each. But ultimately I think the advantages of the Internet lend themselves well to niche interests and niche sites, and that's how it will continue to evolve. However, that makes me worry a little about general interest publications and where they're going, because I think they're extremely important.

TLSR: You hosted a roundtable on the topic of the Canadian government's role in fostering technology. My impression is that you have a generally negative view of your government's management—or lack of management—of incentives. What are the issues and what might the solutions be?

NW: I wouldn't characterize my view as entirely negative about the government. But I don't want the government's hand in everything. The dangers of large government can be seen in Greece, where the government is triple the size of the Canadian government.

I do believe government should find ways to foster and encourage private industry and technology. Specifically we should be learning from the U.S., where technology, more than any other industry, is being developed in physical clusters. The biggest example is, of course, Silicon Valley. In Canada we don't have a Silicon Valley equivalent, but we've had two tries at it. The first was in Ottawa, where the entire thing blew up with the demise of Nortel Networks Corp. (NRTLQ:OTCPK). We have gotten a second chance with Research In Motion, which has fostered a Silicon Valley-style culture around the Kitchener/Waterloo area in Ontario, especially now with the arrival of Google Inc. (GOOG:NASDAQ) and Microsoft Corporation (MSFT:NASDAQ).

TLSR: What should government be doing?

NW: The Canadian government is overly focused on oil, gas, minerals, grain and wood, because these industries contribute to the tax base at the present time. I think it should be more concerned with moving Canada up the technology value chain and in leveling the playing field. We have some incentives, like the flow-through shares (FTS) program, which allows startup companies not currently earning taxable income to convey deductable expenses to shareholders. The program is available to mining and other resource industries in Canada, but we don't have it for technology.

Recently, at the World Economic Forum in Davos, Switzerland, there were some encouraging signs when Prime Minister Stephen Harper talked about lagging research and development in Canada and about implementing some of the recommendations from a report called "The Review of Federal Support to Research and Development," which was produced by a group led by Open Text Corp. (OTC:TSX; OTEX:NASDAQ) Chairman Thomas Jenkins. The report concluded that government spending in Canada was outdated, needlessly complex and should be changed to more of a U.S.-style system in which there is direct investment into technology rather than through tax incentives.

TLSR: The U.S. National Institutes of Health (NIH) makes grants to academia and companies. Is that the kind of program you'd suggest?

NW: Yes. More is needed. In the U.S. there is 5–10 times the amount of direct investment per capita into technology than in Canada. We are really lagging in terms of simple direct investment.

TLSR: What about the Canadian government's deep interest and investment in healthcare? Has that translated into innovation in healthcare?

NW: I think it has. But, again, I don't think that has been led by government. The real center for innovation in healthcare in Canada is Québec. It is one of three or four North American centers for healthcare, life sciences and biotech. Every major biotech company in the world has a presence in Québec. I believe the government's role there is to support what private industry has already built, and to find ways to communicate with the industry about what its needs are. Often it comes back to direct investment, rather than tax credits.

TLSR: Do you find Canadian CEOs to be risk averse to development of new business?

NW: That's an interesting question. I would have to defer to the people who've done the studies and surveys. A number of different firms have looked at this. Maybe Canadians are a little bit more risk averse than Americans, and this always comes up in comparisons. There may be a grain of truth in that.

TLSR: A Canadian guest visiting in my home in the U.S. told me that one reason for the business development lag in Canada is the weather. People don't want to go there because of the cold. Does that assertion hold water?

NW: I've heard that. Certainly no one is going to be attracted to Ottawa for the weather. If a similar salary or incentive is being dangled for a job in Menlo Park versus Moose Jaw, that becomes a pretty easy decision if you have no previous links to either place. These are challenges that we have to overcome in Canada. It is what it is.

TLSR: You've written about some interesting Canadian healthcare companies. I would like to hear your thoughts.

NW: I've been made aware of a group of medical device companies nearing commercialization of their products. They are intriguing to people who have an interest in biotech or life sciences but aren't prepared to sit around and wait for clinical trials or U.S. Food and Drug Administration (FDA) clearance.

TLSR: In other words, opportunities where you don't have to wait 10–15 years to get to market.

NW: Exactly. There are three companies in particular that I've met with recently, and three others as well.

I recently met with the management of CRH Medical Corp (CVE:CRM.V). This company is comprised of many of the same people who were part of a very large local success story here in Vancouver called ID Biomedical, which was bought by GlaxoSmithKline (GSK:NYSE) for $1.7 billion (B). ID Biomedical was very successful in developing influenza vaccines. Management took that company through from beginning to end, and nobody is going to have a problem with a $1.7B payday for 10–12 years of work.

In this next effort as a team, the people at CRH Medical specifically looked for something that was ready to go to market, and they acquired the O'Regan System, which is the first patented single-use, 100%-disposable product for hemorrhoids. It is a banding technology invented by laparoscopic surgeon Patrick J. O’Regan. It only takes a minute or less of the physician's time to band a hemorrhoid, and it does not require any advance preparation for the patient. CRH is out of the gate with this, and the company has posted three consecutive profitable quarters already. This is a management team with a history of success and a product that is already in the market and profitable.

TLSR: Single use means recurring revenues. It's interesting from that perspective.

NW: Exactly.

TLSR: What about another company?

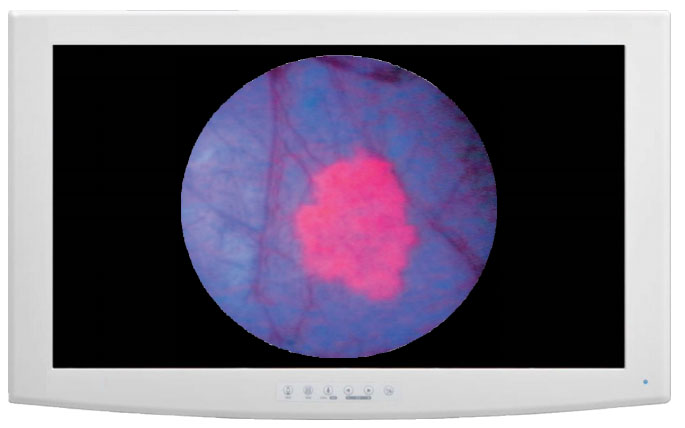

NW: I recently met with Verisante Technology (VRS:TSX.V), which has developed a skin cancer detection device called the Aura. It uses Raman spectroscopy to biochemically analyze the skin to detect melanoma, and basal cell or squamous cell carcinomas. This is all done non-invasively, and the results are immediate. It is already approved in Australia, Europe and here in Canada. The company has deep ties to the Department of Dermatology at the University of British Columbia, which is a world leader in skin cancer research. Verisante is rolling the product out in Canada within the next six weeks, and we are right on the cusp of Aura's entrance into this market. The device sells for $60,000 (60K), and revenue could come quite quickly.

TLSR: What's the value proposition for the dermatologist?

NW: The big market for Verisante is Australia, where the incidence of skin cancer is much higher, and the value proposition for dermatologists is very compelling because they can charge $200–500 for a screening. It doesn't take very long to recoup their investments when they're seeing as many as 50 patients a day.

TLSR: That's the way dermatologists like to work, seeing each patient for just a few minutes?

NW: Exactly. This device works in seconds, literally.

TLSR: And a positive screen means an immediate biopsy.

NW: Yes. Of course, the only way to determine with precision that the cells are cancerous is through a biopsy, but if you have 100 moles on your back this will point you to the ones that should be biopsied.

TLSR: Is there another company you could mention?

NW: The next two companies are in a very interesting space that is gaining a foothold right now—robotic surgery. The two companies are completely different. One is IMRIS Inc. (IMRS:NASDAQ) and the other is Titan Medical Inc. (TMD:TSX.V). The market estimates I have for robotic surgery total about $1B now, but it is set to grow by $1B every year for the next five years.

IMRIS is an already established company in the magnetic resonance imaging (MRI) department. The company has 43 patents around MRI systems. The technology is intraoperative fluoroscopy and magnetic resonance used together. IMRIS is just getting into the robotic surgery market, but it is in partnership with a well established Canadian tech company, Macdonald Dettwiler & Associates Ltd. (MDA.TO:TSX). You have IMRIS, a company with an established base market reduced risk and the upside of a market that is growing by leaps and bounds. You also have the comfort of having an established partner like MacDonald Dettwiler.

TLSR: These are operating room suites for intraoperative visualization, correct?

NW: Yes.

TLSR: Can you talk about robotics company Titan Medical?

NW: Titan just listed on the TSX Venture Exchange this year. The company has an exclusive license agreement with Columbia University for its technology. The real upside and benefit of Titan lies in its claim that its robotic surgery system is the world's smallest in terms of required diameter to enter the body, while still maintaining full manipulation capabilities. Its Amadeus Robotic Surgical System is Star Trek-type technology. Surgeons are able to perform surgery remotely and can seamlessly switch between local and long-distance operators.

TLSR: This is still development stage, correct?

NW: It is, yes.

TLSR: Another company?

NW: A lot of people think of Calgary and the rest of Alberta as an oil- and gas-only domain, but there is a lot of technology going on in Calgary. Ventripoint Diagnotics (VPT:TSX.V) is an example of this. It has a 3D diagnostic system for examining the heart, which is an alternative to traditional methods such as MRIs and can increase the speed of diagnosis by as much as 20 times. One of the real benefits of VentriPoint is that it can use existing 2D or 3D imaging equipment that's already found in most hospitals. The system can be added with software and a tracking sensor system. Anatomical information can be identified by connecting dots on the heart to form a more realistic and specific image than existing MRI systems can do.

TLSR: This is a noninvasive diagnostic for detection of pulmonary arterial hypertension. Is that right?

NW: Yes.

TLSR: Was there one more you wanted to mention?

NW: Yes. Zecotek Photonics Inc. (ZMS:TSX.V; W1I:FSE; ZMSPF:OTCPK) is a Vancouver company involved in the use of scintillation crystals. It's not a pure medical device play, but the company has developed applications for 3D TVs and creative applications for screening devices in airports. But it can also use these scintillation crystals in medical imaging and industrial applications because the micropixel photodiodes can replace the current vacuum tube-based phototubes in positron emission tomography (PET) scanners. It provides real-time anatomic and metabolic images using enhanced diagnostics. PET scanners, the last time I checked, cost about $1 million (M) per unit. As I said, it's not a pure play medical device story, but it could be very big. There are performance advantages that include making the scanners faster and getting higher resolution.

TLSR: One might think of the PET scan section of the business as a free call option, because you would only pay $34M to buy this company today. A $1M per installation price tag could really move shares.

NW: Steven Palmer of AlphaNorth Asset Management is a fund manager here in Canada. Your readers will be familiar with him from your last interview. Steve's a big proponent of Zecotek because he thinks that the multiple initiatives could each have a significantly positive impact. He believes that the company's 3D technology, which does not require 3D glasses, could be worth $100M, and he believes the laser division could be worth another $100M, but that the upside potential of this company could be much, much higher than the sum of its parts.

TLSR: Palmer is looking at Zecotek as a 10- or 20-bagger.

NW: Exactly. He also thinks the value of the current lawsuits that the company has filed, which defend its technology, could be more than $200M.

TLSR: Nick, I've enjoyed meeting you.

NW: Thank you very much.

Nick Waddell is Founding Editor of Cantech Letter. Founded in 2008, Cantech Letter is an online magazine focusing on Canadian-listed technology stocks. The site has grown into one of the most popular and respected financial sites in Canada, and was recently described by Canadian Business Magazine as "one of Canada's premier technology newsletters." Waddell, who is senior editor, is routinely called on by the mainstream media for perspective on Canadian tech stocks, and has been featured on BNN as well as the CBC program The Lang and O’Leary Exchange.

Want to read more exclusive Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George Mack of The Life Sciences Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Life Sciences Report: Zecotek Photonics Inc. Streetwise Reports does not accept stock in exchange for services.

3) Nick Waddell: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: Zecotek Photonics Inc. and Verisante Technology Inc. I was not paid by Streetwise Reports for participating in this story.