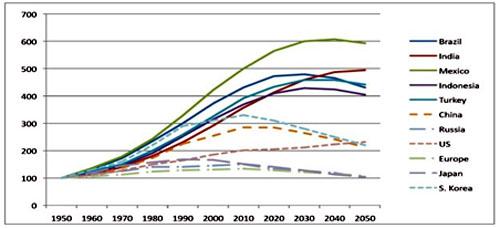

Chris Berry: About 10 years ago, Jim O'Neill from Goldman Sachs coined the term BRICs: Brazil, Russia, India and China, referring to major emerging markets that will drive above-trend global growth. Since then, other acronyms have emerged as investors hunt for other countries offering higher returns. Not long ago, HSBC coined the phrase "CIVETS" to refer to Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. Recently, the magazine Foreign Policy created an acronym for Turkey, India, Mexico, Brazil and Indonesia, now referred to as the TIMBIs. Clearly, investors are looking for additional avenues of growth aside from the BRICs and many believe these countries are the answer.

What makes these countries unique and has put them on the radar screen of investors is that they're characterized by several consistent factors: a young population, a growing population, relative political stability and a diversified economy.

China has been the linchpin of global economic growth for some time now, but there are troubling signs on the horizon: Wages in China have risen by at least 15% for eight straight years. In 2000, the average hourly wage in China was $0.50/hour, and today it's $3.50/hour. We met with investors in southern China in December and had an opportunity to talk about some of these data points and confirm some of our suspicions. We know that inflation is indeed a problem on the mainland.

A bigger, silent problem with China is whether or not the country will grow rich before it grows old. The country is facing a serious demographic crisis. Census data tells us that more than 50% of China's population is urbanized. That's about 691 million (M) people. By way of comparison, the U.S. reached this milestone of 50% of the population being urbanized in 1920, and the United Kingdom reached it in 1851. So that gives you an idea of how long it takes societies to urbanize and what happens with respect to growth rates once they do. I think that China will continue to grow for some time at above-trend GDP growth rates, but it's clearly unsustainable and it's going to slow down. A young and growing population can sustain economic growth and based on current demographic trends, China is in trouble.

Source: Foreign Policy

So, coming back to CIVETS and TIMBIs, we think that a focus on second-tier or additional emerging markets for growth is prudent going forward. It's what we use in screening for discovery investment companies.

China's population is at 1.33 billion (B), and the collective population of the TIMBIs is about 1.79B. I know India is included in that number, but it tells you that should China slow, either marginally or dramatically, there is a ready, willing and able group of consumers out there that could potentially sop up any fall in demand from China.

TER: China's GDP, though declining, is expected to remain well above 7% in 2012 compared with about 2–2.5% for the U.S. this year. Do you expect China's GDP to dip below 6% before 2017?

CB: It's hard to know for sure. China's 2011 GDP was $5.87 trillion (T). The combined GDP of the TIMBIs in 2011 was $6.29T, so we can see that sufficient demand exists in these other countries as the collective TIMBI GDP is growing, and it's already larger than China's. I think that paints an optimistic picture should China slow down. If we assume that the TIMBI GDP collectively grows at 6.5%/year out to 2020 and China grows at an average rate of 7.2% over the same timeframe, then the collective TIMBI GDP will be $11.12T and China's GDP will be $11.06T. This is only back-of-the-envelope math, but it shows us that the potential exists for other countries to absorb a lack of commodity demand from China. This is dependent on the GDP growth rates in the TIMBI countries remaining static with China slowing. In truth, this is only one of any number of scenarios.

Taking that one step further, when I conducted this analysis, I chose to ignore GDP growth in other parts of the world like the U.S., EU and Japan. It's clear that these three regions face some serious structural headwinds, but if substantial growth ever returns, you're looking at additional commodity demand.

TER: You've said the electrification of developing countries can be interpreted as a new form of cold war. Could you elaborate on that concept?

CB: One of the core tenets of our investment philosophy is that innovation will drive commodity demand. By this I mean innovation in materials science will spur demand for commodities, specifically for metals. As tens of millions of people join the middle class, that puts upward pressure on commodities and leads to an infinite demand for finite resources. The only way I can see to remedy this, short of lowering our overall consumption, is to innovate and essentially do more with less. So with respect to a higher quality of life, the genie is out of the bottle in the emerging world and can't be put back in.

What we're seeing now in countries such as China and the U.S. is the spending of enormous sums of R&D dollars to innovate and patent next-generation discoveries focused on energy generation or energy storage. I liken this loosely to the Cold War in that during that era, the Soviet Union and the U.S. were trying to outspend each other militarily to ensure global supremacy of land, sea and air. The main difference between then and now is that the endgame in the Cold War was mutually ensured destruction and the endgame today, in terms of R&D spending on cleantech and greentech, is ownership of cutting-edge intellectual property and patents. That is what can sustain and foment a higher quality of life and also create jobs. Survival is still at stake; it's just in a different context.

TER: Is there a lack of consistent supply right now that's keeping innovation from driving demand? Or is it just a matter of needing more mines with more time for that to occur?

CB: I don't think there's a lack of supply just yet. Again, it's hard to use a broad brush to paint a picture when you're talking about so many different metals and materials. However, I think that we're looking at a supply crunch for select metals in the near term. This is dependent on above-trend growth in the CIVETS and TIMBIs as well as growth emanating from China. The rise of this new middle class has created a new paradigm for investors. So despite the fact that certain energy metals, like lithium, are a little out of favor, I think that it's an interesting time to be looking at the energy metals because if innovation will truly drive demand, as I think it will, we're going to need many more mines onstream and we're going to need them on soon.

TER: What are some energy-related commodities that you expect to benefit from additional demand from the TIMBIs and CIVETS as this electrification theory takes hold?

CB: Many commodities will benefit, but lately I've been spending most of my time on lithium, graphite and uranium. Those are the three that immediately come to mind.

TER: What are some ideas in the lithium space that you're following?

CB: Lithium is unloved right now, to say the least, and I think that investors probably took their focus off of lithium when the run-up in the rare earth elements (REE) stocks began. That said, lithium is still squarely in the crosshairs of research scientists looking for the next breakthroughs in battery technology. The lithium market today is an oligopoly in the sense that you have four primary producers. As such, there really only is room for the most promising juniors. Companies that I'm following in the lithium space include Talison Lithium Ltd. (TLH:TSX), Lithium One Inc. (LI:TSX.V), Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX) and Rock Tech Lithium Inc. (RCK:TSX.V; RCKTF:OTCPK; RJIA:FSE).

Lithium One impresses me with solid management. This is a proven team of mine builders and they know how to raise money—two skills any junior must possess. The company also has a beautiful brine deposit in Argentina called Sal de Vida, which is adjacent to FMC Lithium Corporation's (FMC:NYSE) Fenix property. A preliminary economic assessment (PEA) was completed on Sal De Vida in 2011 and confirms solid economics, which I think will allow Lithium One to ultimately compete with the established producers. The PEA demonstrated an operational expenditure of about $1,537/ton (t) lithium carbonate and $184/t potassium chloride. One of the main keys to success in the lithium space is the ability to produce byproducts because it lowers the overall cost of production. That is how an advanced exploration play such as Lithium One can compete. The company has also released an updated NI 43-101 resource estimate that increased tonnage by 30% and also increased the grade of the deposit by 10%. This was already a beautiful resource, and it continues to get better. As Lithium One will be producing potash as a byproduct, it has a ready customer in next-door neighbor Brazil—a country with a voracious appetite for fertilizer.

A final strength of Lithium One is its ability to strike strategic partnerships. The company has partnered with a Korean consortium to carry it to feasibility on Sal De Vida. Lithium One also has a hard-rock pegmatite project in James Bay, for which it has partnered with Galaxy Resources Ltd. (GXY:ASX). Given the expertise that Korean companies have demonstrated in lithium battery technology and many of the synergies that the Galaxy Lithium deal offers Lithium One, I am very confident that these partnerships will pay off for shareholders in the future. One final note, in the PEA the company produced on Sal De Vida, the annual revenue from potash sales is planned to exceed the operating expenses. This means the company will essentially produce lithium for free.

TER: Talison, which is the other company you mentioned, is already producing and is a big supplier to China.

CB: It's a huge supplier. Talison is, in my opinion, a misunderstood stock. When you look at the overwhelmingly powerful position that this company has in the lithium space and then you look at its share price performance, there's clearly a disconnect. Talison provides China with 75% of all of that country's lithium needs, and it continues quarter after quarter to post strong financial results. It has huge pricing power and was able to negotiate a 15% price increase beginning in January 2012 with its customer base. Its production increased year over year by 7%. Included in this is a 10% decline in cash operating costs/ton, so Talison is raising prices and it's lowering its costs. So what do you think that means going forward for cash flow? It's going to continue to get better and better. Company management has told me they view chemical- and technical-grade lithium demand as firm and only getting stronger. Finally, the company is in the early stages of planning a facility to produce lithium carbonate. This will help it capture additional margin across the value chain. The real catalyst for Talison is that this pricing power should translate into increased cash flow and continued dominance in the lithium markets.

TER: We'll get to those other two companies that you mentioned, but I want to ask this question. As you suggest, the lithium space is a bit cool right now. Other than Talison's recent merger with Salares Lithium Inc., in Chile, the consolidation that industry experts were expecting hasn't occurred. What do you believe is the path to shareholder value now?

CB: Many juniors in the lithium space have been able to sustain themselves through joint ventures or having a strategy of cash conservation while exploring and defining a resource. A lack of consolidation in this space speaks to how the lithium space is structured. A small number of producers with large resources are expanding. Talison is planning on doubling its production capacity, and FMC has committed to increasing its capacity by 30% in coming years. Rockwood has announced plans to increase production capacity to 50,000 tons by the end of 2013. This has really deferred consolidation as many aren't sure if there is room for numerous additional players in the lithium space. Clearly there is a lack of willingness to risk the capital necessary. If there's an up-tick in electric vehicle or e-bike demand, lithium will come back to the front pages, and then we might start to see some consolidation. But right now, because these producers own the market, it's really tough for anybody but the best to break in. I don't believe that Talison, FMC, Rockwood and Sociedad Química y Minera de Chile S.A. (SQM:NYSE; SQM-B:SSX; SQM-A:SSX) need to be in an acquisitive mode just yet, as they are clearly focused on organic growth through expanding current capacity.

TER: Tell us about those other two names you're watching.

CB: Western Lithium has a clay deposit in northern Nevada called Kings Valley. It recently completed a prefeasibility study, which shows very strong economic potential. Western Lithium will have the ability to produce up to 27 thousand tons (Kt)/year of lithium carbonate several years down the road after commercial production commences. One of the keys to Western Lithium is its potential operating costs, which are sub-$1,000/t when byproduct credits are included. This is what would allow a company like Western Lithium to compete with the big boys. I talked earlier about research innovation, and Western Lithium is working with the U.S. Department of Energy's Argonne National Laboratory to develop lithium carbonate for various battery applications. That tells an investor that the company can successfully partner with research labs and produce battery-grade material, which is what end users like LG Chem and Samsung need. You can't just dig these resources out of the ground and then hand them off. Lithium carbonate is highly specific to the end user. When a lithium play has proven that it can produce a high-purity form of lithium carbonate, it has a huge feather in its cap.

TER: Western Lithium also brought some properties and royalties in Nevada from Western Uranium Corp. (now Concordia Resource Corp. (CCN:TSX.V)). What do you make of that deal?

CB: In the junior space, you're on a treadmill and what you try to do is defray dilution during the march to commercial production or a take out. Junior resource companies take their dilution in the stock through equity offerings or take their dilution in the ground through joint ventures. Any royalties that a company can pick up are going to be beneficial to long-term shareholders as they effectively allow the company to side-step shareholder dilution and strengthen the balance sheet.

TER: What's your view of Rock Tech and its Georgia Lake project in Ontario?

CB: This is one of the smaller companies that I follow in the lithium space. I have been up to visit the Georgia Lake property, and have seen the pegmatite outcroppings here. Rock Tech recently completed a drill program and these results should add to the NI 43-101 resource estimate it currently has at Georgia Lake. In Discovery Investing parlance, we refer to Rock Tech as an incubator company. It is in the early stages of exploring its properties and there is a chance for upside because of the "mystery" surrounding what the drill results may tell us. Rock Tech has also demonstrated the ability to produce battery-grade lithium carbonate and will need to add to the size of this resource, continue to define it and then I'd like to see it look for some sort of a partner in the same way that Lithium One has done with its James Bay property.

TER: On to graphite.

CB: The share prices of almost all of these graphite juniors in the last couple of months have gone parabolic. Graphite is likely to be the story of 2012 and we're fielding a lot of questions from our subscribers on how to interpret this space and how to invest accordingly. It is exciting, and there's a lot to learn about it and a lot of potential for growth, but there also is apparent excess capacity in China, which we think argues for extreme prudence when choosing where to invest. That's one caveat that I would offer in terms of thinking about investing in this space: the potential that China could ramp up production, including high-purity, large-flake graphite production.

TER: We're also starting to hear about spherical graphite. Does this form have any advantages, for example, through use in specific applications?

CB: The key to manufacturing an efficient lithium-ion battery is to try and achieve the highest energy density for a given surface area. Producers essentially shape flake graphite into a sphere to realize the maximum energy density for the battery in the annode. As this is a highly specialized product, it commands a higher price on world markets. Access to spherical graphite isn't the most important issue. More important is the ability to access the large-flake, high-purity graphite in a stable geopolitical jurisdiction at the lowest cost. Large-flake natural graphite is currently one-third the price of synthetic graphite, which is predominantly what's used in batteries. A real challenge to vehicle electrification is the cost of the car and the bulk of this cost is associated with the battery. If you can lower the cost of the battery either through breakthroughs in electro-chemistry or by using lower-cost raw materials, mass adoption of electric vehicles may be here sooner than we think.

TER: What are some plays that you're following?

CB: Northern Graphite Corporation (NGC:TSX; NGPHF:OTCQX) is a company that we've followed from before its initial public offering and still really like. It has extremely strong management that has experience in graphite mining. The metallurgy of its Bissett Creek property right off of the Trans-Canada Highway is very well understood, thanks to recent findings by the company as well as a great deal of historical work. Northern Graphite is well on its way to producing a bankable feasibility study in Q112 or Q212. It's a highly scalable resource that appears open in multiple directions and is likely to grow the overall tonnage. Bisset Creek demonstrates a low capital expenditure of CAD$70-80M and competitive cash costs of $1,000/t. Finally, Northern Graphite released successful pilot plant test results earlier this year, where results showed that more than 50% of the concentrate produced will be jumbo-size +48 mesh flake, averaging 97.7% graphitic carbon. All of this adds up to what I think will be a very high-margin business.

We also have been following Standard Graphite Corp. (SGH:TSX.V). Again, when we look at these types of companies, the first thing we look for is management. We would characterize this an incubator company and the CEO, Chris Bogart, has experience in the energy metals space. He ran Magnum Uranium Ltd., which was taken out by Energy Fuels Inc. (EFR:TSX). The vice president of exploration for Standard is Antoine Fournier, who was on the team that discovered the Lac Knife deposit, which is now the primary asset of Focus Metals Inc. (FMS:TSX.V). It has 100% ownership of 12 properties in Ontario and Quebec, all of which are early stage. There is no resource estimate on any of these properties, but several of its properties surround Bissett Creek and the Lac Knife deposit, so you can very loosely use what we know about those properties as a proxy for what the Standard Graphite properties might resemble with respect to grades and tonnage. Standard also owns properties near the Lac des Illes graphite mine currently owned by Timcal.

One of Standard's properties is also near a past-producing graphite mine in Ontario called Black Donald. This was a prolific producer of high-grade, large-flake graphite for many years. Having 12 wholly owned properties is a good thing. I view it as de-risking—in other words, you can conduct exploration on these properties and find the best resource(s) and move forward on it as opposed to putting all your chips in one basket and hoping that your single project is a world beater, when it might not be. The company is going to spend $5M this year on an exploration budget. It's conducting electromagnetic (EM) surveys right now on the properties and should have drill targets prioritized by this summer. The stock has moved upwards in tandem with other graphite plays this year, but I think it holds additional potential for upside pending results from its exploration program.

TER: Tell us briefly your thesis in the uranium space.

CB: That's a timely question because, of course, of the recent one-year anniversary of the Fukushima disaster. Uranium will be in a supply deficit soon. The Megatons to Megawatts Program between the U.S. and Russia is coming to an end in 2013. There is a real question as to whether or not that will be renewed under the same terms. Numerous countries, like Saudi Arabia, China, and Russia are moving ahead full steam with a nuclear reactor buildout. Nuclear power is one of the only sources, if not the only source, that can provide reliable baseload electricity going forward. So I see significant demand for uranium in the future and it doesn't appear that supply will maintain the same growth rate. This will put upward pressure on the price of uranium soon.

TER: Other than perhaps geothermal, but that's a ways off.

CB: Yes. Nuclear is here and now. It's proven, and we know it works. Advances are being made every year in nuclear technology in terms of making it more reliable and safer through improved pebble bed reactors or different reactor designs. So the technology today is much different than it was 30 or 40 years ago. The demand for cheap, affordable and reliable electricity paints a very bright picture for uranium going forward.

We are watching Strathmore Minerals Corp. (STM:TSX; STHJF:OTCQX). Management has a great deal of technical and practical experience in the uranium sector. The company has completed strategic partnerships on its two primary deposits in Wyoming and New Mexico, which are two of the most prolific uranium mining districts in the United States. In Wyoming, the area of focus is the Gas Hills district and Strathmore has executed a strategic agreement with KEPCO, which is the Korea Electric Power Corp. KEPCO now owns 14% of the company acquired through an $8M private placement. I like this because it can lead to an off-take agreement and provide Strathmore with a ready and willing customer for its product. There is additional opportunity for KEPCO to fund up to $32M worth of exploration at Gas Hills and earn-in to 40% ownership of the project. The property in New Mexico is called Roca Honda. This is a joint venture that Strathmore has entered into with Sumitomo Corp. (8053:TKY; SSUMF:OTCPK). It's a 60/40 joint venture in favor of Strathmore. This property could be one of the largest and highest-grade uranium mines in the United States we've seen in quite some time. Currently, the project is in the permitting stage with a feasibility study due later in 2012. I am hopeful for a mine permit decision sometime in 2013. This is a company that has high-quality assets in a solid jurisdiction, and it's done the right thing in terms of partnering with potential end users who also see the value in the company by spending so much time and money to help develop the assets.

Another uranium company I've just started following is European Uranium Resources Ltd. (EUU:TSX.V; TGP:Fkft). It used to be called Tournigan Energy Ltd. This company can be thought of as both a "pure" play and an "area" play. Its sole focus is on developing uranium assets in Europe (Slovakia, Sweden and Finland). With over 160 operating nuclear reactors in Europe today, this seems to me to be a sound strategy irrespective of what some European countries have said about a long-term move away from nuclear power. European Uranium has a sound technical team in place and a strategic investor in AREVA (AREVA:EPA), which provides a huge stamp of credibility for the company. It has recently released a prefeasibility study, which demonstrated that the company could potentially be one of the lowest-cost producers of uranium globally with a life-of-mine cost of $23/lb. Going forward, the catalysts are additional drilling on its centerpiece deposit in Slovakia, called Kuriskova, and a full feasibility study that will provide additional clarity on the economics of this property.

TER: You recently launched your scorecard. How does it help investors select these companies so they can reap rewards for them?

CB: The DIS, or Discovery Investing Scoreboard, uses a word score to rank each one of the 10 discovery factors. We use a word score as opposed to a simple number to take out the subjectivity surrounding the evaluation of these small cap companies. Rather than subjectively assuming that Bissett Creek is a 7 out of a 10, what you're able to do is say, "I think it's a very good asset." What we then do is take all of these word scores that the crowd provides us and combine them into a number. It's not a straight weighted average. We want to see that the crowd scores—in other words, the combined scores that you, I or anybody else who ranks Northern Graphite might come up with—serve as a leading indicator of share price performance. This can help investors make decisions. Your readers can sign up for free at www.discoveryboard.com.

TER: Thanks for talking with us, Chris.

Chris Berry, with a lifelong interest in geopolitics and the financial issues that emerge from these relationships, founded House Mountain Partners in 2010. The firm focuses on the evolving geopolitical relationship between emerging and developed economies, the commodity space and junior mining and resource stocks positioned to benefit from this phenomenon. Berry holds a Masters of Business Administration in finance with an international focus from Fordham University, and a Bachelor of Arts in international studies from The Virginia Military Institute. He co-authors a newsletter with his father, Dr. Michael Berry, called Morning Notes. You can subscribe for free at www.discoveryinvesting.com.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Brian Sylvester of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Energy Fuels Inc., Focus Metals Inc., Lithium One Inc., Northern Graphite Corporation, Rock Tech Lithium Inc., Standard Graphite Corp., Strathmore Minerals Corp., Talison Lithium Ltd. and Western Lithium USA Corp. Streetwise does not accept stock in exchange for services.

3) Chris Berry: I personally and/or my family own shares of the following companies mentioned in this interview: Talison Lithium Ltd., Northern Graphite Corporation and Standard Graphite Corp. I personally and/or my family am paid by the following companies mentioned in this interview: None. I was not paid by Streetwise for participating in this story.