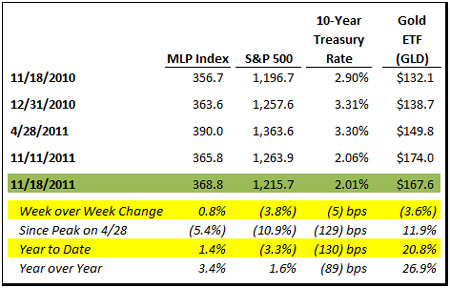

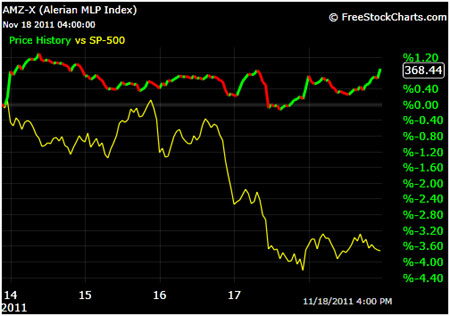

The chart below highlights the extent to which MLPs moved in the opposite direction of stocks this week. With a short (and likely limited volume) week upcoming, I expect MLPs to join the correlation party again, and track stocks closely this week, again bouncing around at the whim of the European sovereign debt market and whatever news comes out of Washington DC and the Super Committee.

Seaway Goes the Other Way

The biggest news items of the week in the energy space were the two announcements made by Enbridge, Inc. on Wednesday. The first: that ENB will purchase 50% interest in Seaway crude pipeline system from ConocoPhillips for $1.15 billion (press release). The second: that ENB and Enterprise Products Partners, which owns the other 50% of Seaway, would reverse the direction of the crude flowing through Seaway and start transporting up to 150k barrels/day in the second quarter of 2012 (press release), at a cost of $300 million. EPD went on to announce on Wednesday that EPD and ENB would discontinue their joint effort to develop the Wrangler pipeline, which was going to have 800k barrels/day of capacity and looked to be ahead in the race to de-bottleneck Cushing's crude supplies. Smart, cheap moves by ENB and EPD.

The spread between Brent crude and WTI crude spot prices, which had blown out to more almost $30 in late September, closed the week at $10.50. Ongoing concerns in Europe and stabilizing economic data in the U.S. have contributed to the tightening of this spread, but this sooner than expected Cushing bottleneck solution will bring that spread down further. Bad news for U.S. refinery companies, good news for producers and pipeline companies.

It seems like pipelines are in the news more than they ever have been. Last week's Keystone XL drama captured plenty of headlines, and sparked reams of editorial opinion about what was clearly a political move by President Obama to delay the decision until after next November. Just last month, KMI's purchase of El Paso garnered mass market attention, as did KMI's massive IPO earlier in the year and the ETE/WPZ bidding war for Southern Union. Living in an MLP bubble, it's hard to tell sometimes, but I get the feeling the general public is hearing more about pipelines than ever. CNBC viewers and Barron's readers are certainly getting inundated with MLP ETF advertisements.

The pipeline and MLP story is a good one, so the more people that hear about it the better for now, until other yield alternatives and secular growth stories emerge. Welcome newbies, maybe this is the long dreamed-of push that sends MLP yields down (and MLP valuations up) to REIT levels. I won't be holding my breath waiting for that, but I guess it could happen.

RBC Conference

There was an MLP conference in Dallas Thursday and Friday sponsored by RBC Capital. This conference is different from most of the others in that there are panel discussions involving MLP management teams, as opposed to the traditional conference that includes individual MLP management presentations one after another. Getting different executives on the same stage to discuss MLP topics is much more interesting.

The big takeaway in listening to the webcasts was how much opportunity exists for upstream and gathering and processing MLPs given current conditions for natural gas liquids in the Permian Basin, Granite Wash and shale plays. The need for more fractionation at Mont Belview, more processing in the Permian, and debottlenecking in general is very high. EROC, CMLP, CHKM, WES, ETP, LINE, LGCY and OKS all seem well positioned in those areas.

Winners and Losers

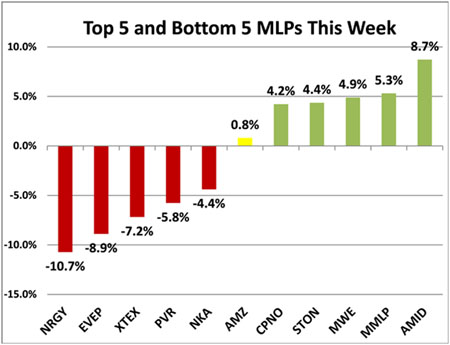

Big winner this week was AMID, which announced a $38 million debt financed acquisition and $0.02 per unit (+4.8%) likely distribution increase (press release). That's a big deal for an MLP with a market cap of around $200mm.

NRGY reported earnings this week, and disappointed again. NRGY (-32.1% total return) and NKA (-48.9%) are the two worst performing MLPs so far this year. While NRGY still has fans out there, its likely both NKA and NRGY will finish the year in the bottom two spots in the sector. NKA had been the worst MLP performer for the last two weeks, but this week gets out of the cellar and manages to be the 5th worst performer this week.

Other News

APL Expansion: Atlas Pipeline Partners (APL) announced $200 million expansion to processing facility in West Texas from 255 mmcf/d to 455 mmcf/d (press release). APL also priced $150 million of senior notes due 2018 at 8.75%.

Plains All American/Semgroup

- PAA reiterated bid for Semgroup Corporation at $24.00 per share, and reiterated that IPO of Rose Rock Midstream should not happen right now (press release).

- PAA gets rejected publicly by Semgroup (trading at $27.80)…again (press release).

PVR Equity Deal: Penn Virginia Resource Partners priced an offering of 7.0 million units at $24.55 for gross proceeds of $171.4 million (press release).

New MLP ETF Planned: Given the success of AMLP (from issuers perspective), of course others would follow, see article here.

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only. Long EPD, MMLP, KMI, ETP, WES.

Hinds Howard

MLP HINDSight