Do as I do, not what I say! We had a prime example of this on Wednesday from President Biden, as he told oil and gas companies that they should not buy back shares or pay dividends but instead spend the money on exploration.

But what did he do?

U.S. Oil and Gas

He canceled the Keystone XL Pipeline on his first day of office, and then he halted all leasing and permits for oil and gas exploration on federal lands. In May of this year, he canceled three offshore oil and gas leases, and as of now, they have not leased one acre of land to drill.

J.t this past July, Biden proposed a policy to end all tax incentives to oil and gas companies. Would you think this gives no confidence for oil and gas companies to explore?

Of course, they have curtailed exploration, and most are focused on shareholder returns, and oil and gas production has declined, and all the inventories of oil, gas, gasoline, diesel and heating fuel, etc., are at multi-year lows.

Electricity prices along the Atlantic coast of the United States are set to increase 50-60% year-on-year as gas supplies become squeezed to meet winter heating and generation needs. New England on-peak power prices have averaged slightly below US$80/MWh in September, forward electricity prices for December 2022 have been trending well above US$200/MWh recently.

The operator of New England’s power grid has already warned of potential blackouts in the winter in case of a severe cold spell. Before Biden took office, the U.S. was producing more oil than it was using and more than the Russians or the Middle East. oil and gas companies are the favorite whipping boys of politicians anytime prices rise.

Meanwhile, today we hear the Biden administration is granting US$2.8 billion to companies to expand electric-vehicle battery production. This will do nothing to ease the current energy crisis.

Gas Shortage

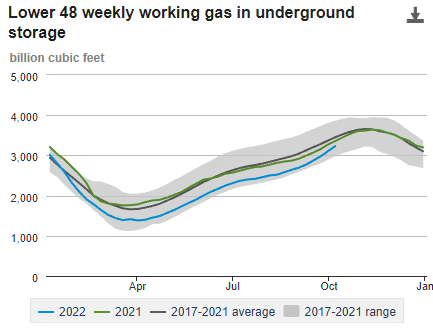

Last week we saw the first decent increase in gas storage that lifted the level off the bottom of the five-year average.

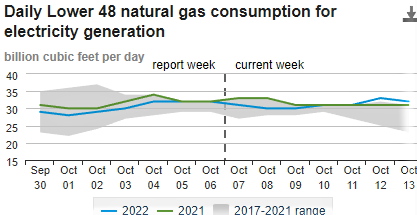

This will not help curtail high prices this winter, as the next two charts show rising demand.

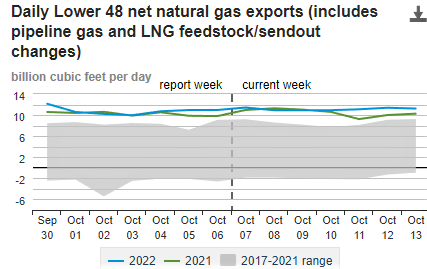

You can see from these charts that gas for electrical production is above the five-year average, and exports of LNG are at record levels, taking advantage of the higher European prices.

More and more gas will be diverted to higher prices leading to higher prices and possible shortages in North America. Getting data in Canada is very hard, and what is there is out of date. Ontario provides quarterly reports, but these have not even published the Q4 2021 report yet.

The U.S. has now become the largest exporter of LNG and is now importing about 15% of gas production as LNG, mostly to Europe. What is important is that approved LNG projects will ramp this up to over 50% of U.S. production.

I do know Ontario is scrambling for more natural gas for electrical generation.

Alberta recently had pipeline problems that should have increased storage. The only decent report is from Stats Canada, but they are months behind.

They have just reported July storage numbers, and it is not looking good — well below 2020 and 2021 levels.

• July 2022 15,840,398 cubic meters (15,840,398cm)

• July 2021 18,610,093cm

• July 2020 21,075,478cm

• July 2019 17,514,295cm

We have the most incompetent leadership in Canada, the U.S., and Europe like never before. Turfing the PMs in the UK is becoming a habit, as Truss resigned today. You can count on governments to make this energy crisis far worse.

You often see in the news about Canada's potential or capacity to export LNG. This is just nonsense or fake news; Canada has zero export capacity for LNG.

The first to come on line will be TC Energy Corp.'s (TRP:NYSE) pipeline, as shown in my report on them, and that will not be until 2025.

Shell Plc. (SHEL:NYSE) leads a consortium actually building the LNG plant processing TC Energy gas.

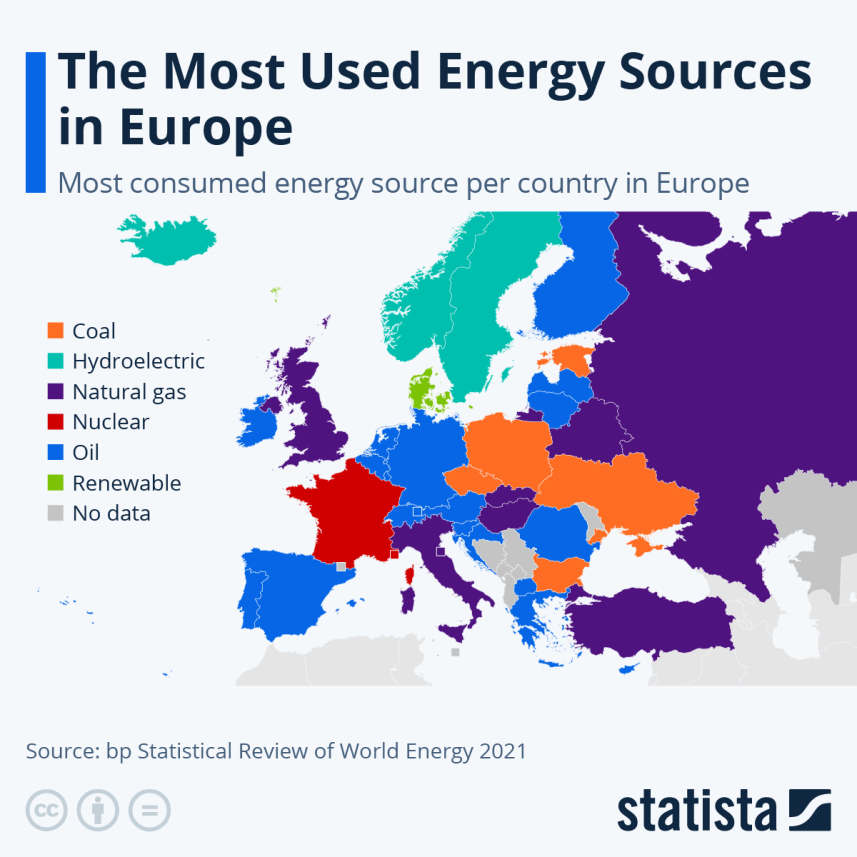

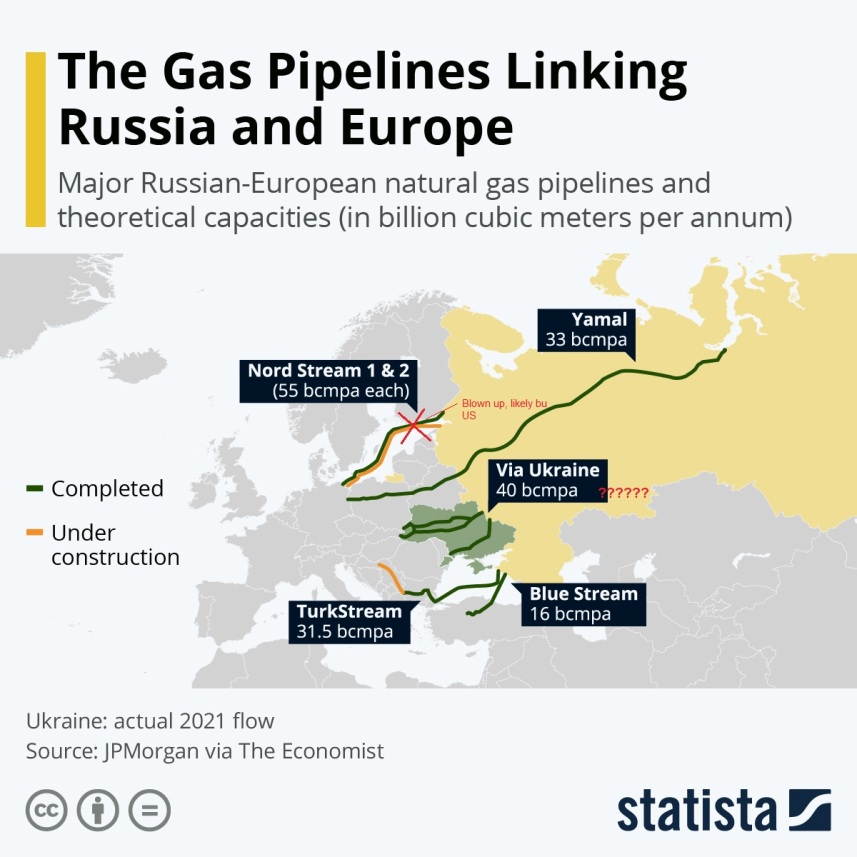

Statista has provided some excellent graphics that will help you understand the dire straits that Europe is in this winter.

Almost all these countries are dependent on fossil fuels.

The Nord Stream

The Nord Stream 2 was completed since this 2021 graphic but does not matter anyway, as it was blown up along with Nord Stream 1. What is coming from Ukraine is questionable, as the Russian invasion has started to target energy infrastructure.

I expect this is part of a plan before a Russian offensive this winter. There is no solution for this winter; Europe won't have enough energy. Germany will probably have to shut down industry and plunge into a deep recession and deep freeze, along with some other European countries.

The U.S. has now become the largest exporter of LNG and is now importing about 15% of gas production as LNG, mostly to Europe. What is important is that approved LNG projects will ramp this up to over 50% of U.S. production.

The gas will go to the highest bidder, so as time passes, the U.S. and Canada will compete with Europe for natural gas. Nobody knows how long this war will last and what damage to energy infrastructure will result.

Remember that most troops killed in war are either transporting energy or guarding it. This war will be no different other than there being a lot more gas and nuclear energy facilities compared to past wars.

And most likely, politicians will screw things up with their plans for the transition to green energy. In another desperate move ahead of the U.S. mid-term elections, Biden is releasing another 15 million barrels from the SPR.

This will be the last because, after the mid-term elections, there will be a gridlocked government. The Republicans will win the House and maybe the Senate too, but even if they win both, Biden can veto any legislation, and it goes back to the House and Senate but must get a 2/3 majority vote.

That will not happen. However, markets love a government that can do nothing, and this may be a reason that extends this bear rally if and when one starts.

I believe it is a perfect time with the politically driven correction in oil and gas and the producers to buy one of the blue-chip integrated oil companies that will benefit from tighter energy markets and more LNG exports. Shell Plc. (SHEL:NYSE) has been in my Millennium Index before.

We sold it in 2014 for an 81% profit plus dividends because I believed oil was heading down significantly, and indeed it dropped from the $100 area to $50 and lower.

Now is a good time to add Shell to the Millennium Index.

Shell Plc.

Shell Plc. (SHEL:NYSE) is probably the best-known brand in the world, serving 32 million customers per day and 84 million loyal members. They have about 46,000 locations (more than Mcdonald's) in 80 markets.

Their goal by 2025 is to have 40 million customers and 55,000 locations. They currently have over 105,000 EV charge points and plan to grow this to over 500,000 in 2025. I expect the Shell brand will remain at the top for a long time.

Shell pays dividends in U.S. dollars, and the last quarterly dividend was US$0.25 per share, and since each ADR represents two ordinary shares, the quarterly dividend on the ADR was US$0.50. Based on a US$2.00 dividend per year and the current ADR share price, that is a yield of 3.8%.

I like Shell at this time because of its superior and well-known brand, and at current prices, the stock is valued better than its peers like Exxon, Chevron, and BP, for example.

Before Covid-19 hit, they were paying a US$0.47 dividend, and it dropped to the US$0.17 level in 2020 and early 2021.

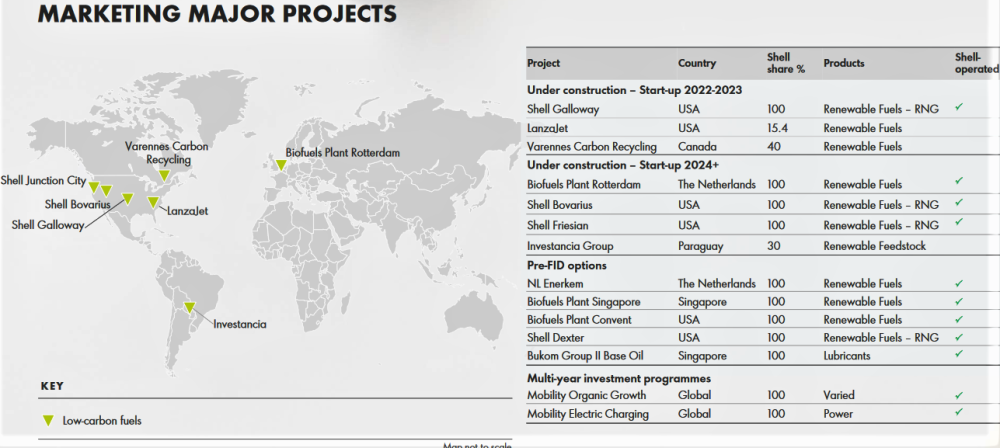

I expect Shell will get back to the US$0.47 level in the next couple of years. Shell has a growing portfolio in LNG as well as renewable projects coming on stream from now to 2024.

Production in the North Sea

They are bringing their Jackdaw Field into production in the North Sea, which can produce more than 6% of the UK's gas production in the coming years. Shell is also going ahead with the Crux Field in Australia, which will provide gas for their floating LNG facility.

Pursuing LNG Canada, Shell has a 40% leading interest in building out the facility in Kitimat, B.C. Kitimat was chosen as the ideal location for the facility due to the easy access to abundant, low-cost natural gas from Alberta/British Columbia’s vast resources.

The location also benefits from a relatively short shipping distance to north Asia, one of the fastest-growing gas markets in the world. The shipping route is approximately 50% shorter than from the US Gulf of Mexico and avoids the Panama Canal. =

The project has strong support from the local community, including indigenous First Nations, as well as from the local government. TC Energy will supply the gas.

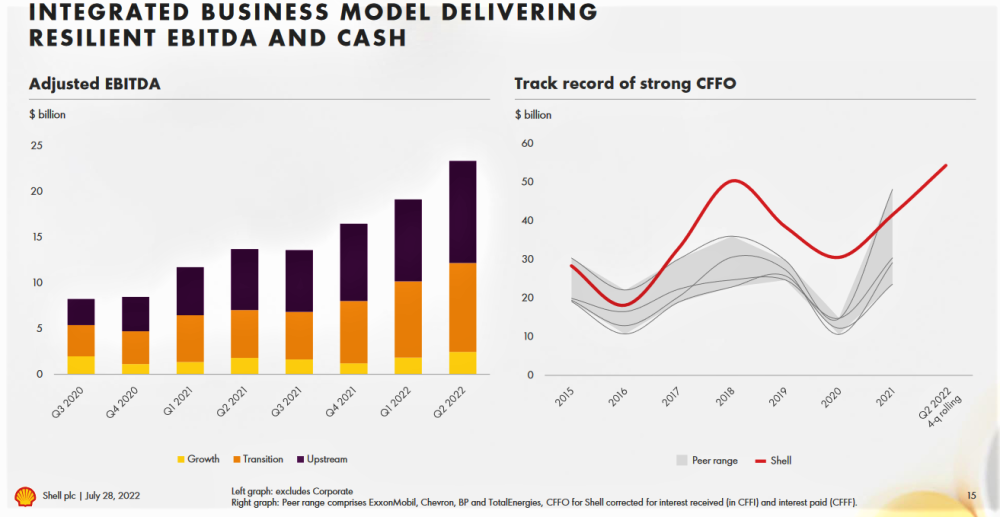

Recent performance has been strong, as shown below, and Shell is delivering stronger cash flow from operations than its peers. Shell should have a higher valuation, not a lower one.

A large part of Shell's LNG is a traded portfolio using other's assets. Their renewable segment is doing well, with the input cost to electrical price spread quite large at this time. This looks to continue for some time, and we will probably see the spread widen with even higher electricity prices.

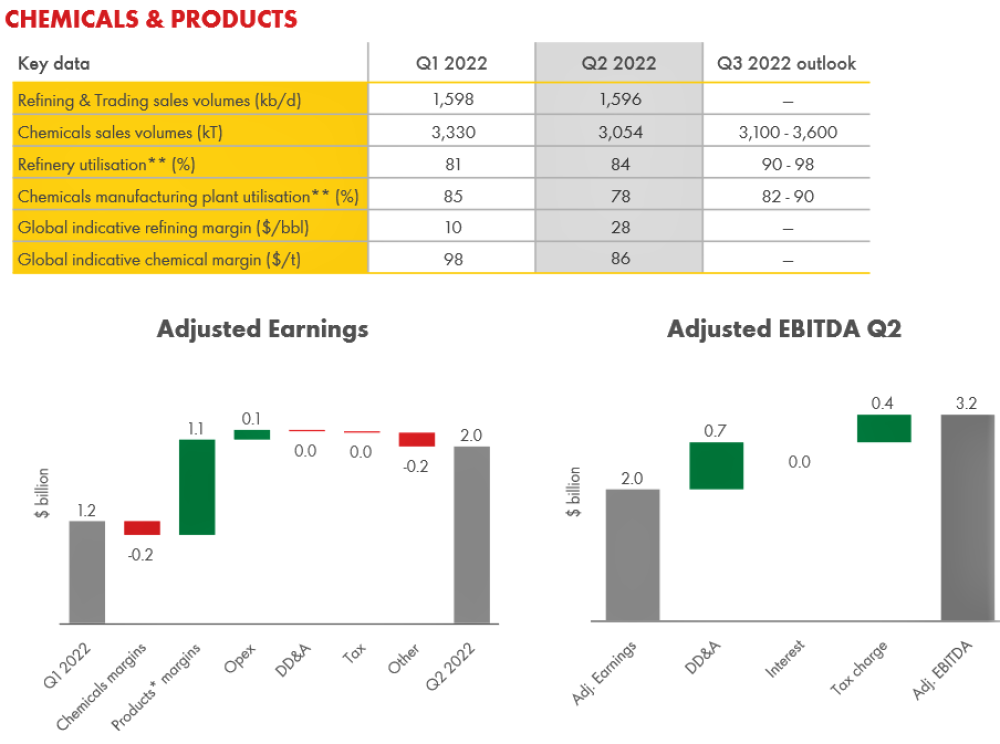

Shell's chemical division is significant, contributing almost 20% of the earnings in Q2. Chemicals are cyclical. and their division has seen a weaker performance. Shell says now at a bottom of the cycle based on the chemicals they are in.

More important is that their Pennsylvania plant starts production of polyethylene this year, which is currently a high-margin plastic product, so this will greatly improve their Chemical Division.

Shell's oil and gas production has declined some in the last several years, but the quality of their portfolio of assets has improved considerably, and they are now a lot more profitable on a little less production.

Comparing Q2 2022 to Q2 2013 in it's presentation, when oil prices were about the same, Shell produced +65% adjusted earnings in Q2 2022 compared to Q2 2013 and three times the cash flow and doubled shareholder distributions.

Recent performance has been strong, as shown below, and Shell is delivering stronger cash flow from operations than its peers. Shell should have a higher valuation, not a lower one.

Shell has a US$6 billion share buyback underway in Q3, something similar will continue in Q4.

Basically, Shell looks at the share valuation to determine the mix of dividends and stock buyback. The US$7.2 billion payout in Q2 to investors was a record. The dividend is very stable, and buybacks will help increase the dividend.

Conclusion

I like Shell at this time because of its superior and well-known brand, and at current prices, the stock is valued better than its peers like Exxon, Chevron, and BP, for example.

Marketwatch reports its PE ratio without extraordinary items at 8.6, and the stock is trading right around book value. They have a US$6 billion share buyback and are on a path of increasing cash flow and dividends.

P/E w/o extraordinary Book Value

Exxon 11.35 1.54

BP 12.1 1.16

Chevron 14.42 1.63

Shell 8.6 0.98

Shell is well positioned for a growing LNG market, and it is continuing to high-grade its portfolio by divesting in lower margin assets. While most of the major integrated oil and gas companies are trading at highs on the chart, you can buy Shell at a good price after a bit of a correction.

It looks like the stock could break to the upside out of wedge pattern. There is resistance between US$54 and US$56, so we need a clear break above US$56 to confirm a new bullish move.

Support is between US$48 and US$50.

We can buy the stock now and get almost a 4% and growing dividend while we wait for capital appreciation.

Speculators could try the Call Options. I like the January 2023 $45 Call for around US$8.30.

It is US$7 in the money, so the premium is only US$1.30. A US$10 move in the stock would give you more than a double, but you won't get the dividends with the options.

| Want to be the first to know about interesting Oil & Gas - Services and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Struthers Stock Report Disclaimers:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Disclosures:

Charts provided by the author.

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.