Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB) may want to consider changing its name to Norseman Copper. The company has a 100% option on its Taquetren silver project in southern Argentina, but rock chip samples from there are showing off-the-charts amounts of copper.

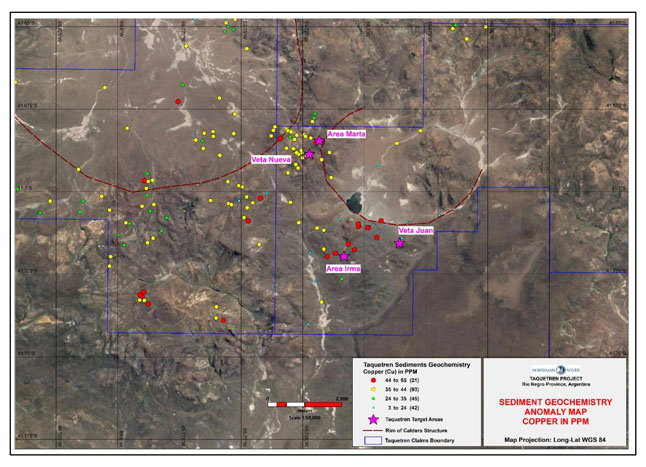

In April, the company reported that analysis of seven rock chip samples from the Veta Juan vein at Taquetren revealed an average of 7.73% copper — bonanza grade — with the individual samples ranging from 2.46% to 9.63%.

Now the company has made new discoveries at Veta Nueva and Veta Mirasol, located about 5km from Veta Juan. Two rock samples from Veta Nueva returned average values of 4.11% copper and 67 parts per million (ppm) silver, while at nearby Veta Mirasol, one sample returned 4.20% copper and 54 ppm silver.

Read Michael Ballanger's assessment of the new discoveries here.

The company acquired the option on the project in 2021 and has been conducting sampling to prepare for more advanced exploration. “These latest field findings strongly suggest the possible existence of significantly wider veins and the potential of finding other vein zones along the 5km NW–SE trending mineralized corridor,” the company noted.

Sean Hurd, Norseman’s president & CEO, stated, “Considering the project’s proximity to significant discoveries and the sheer size of the project, this represents an exciting opportunity for Norseman. The results to date, in particular the copper grades, are very encouraging.”

Industry Experts Paying Attention

The rock samples’ high numbers have caught the attention of industry observers. Michael Ballanger noted on September 21, 2022, “The initial results at Taquetren were quite impressive, and were this a showing in the Abitibi Greenstones or Nevada, the market would certainly have reacted last April when they reported 8% copper values in outcrops over a 300-meter-long section.”

“The initial results at Taquetren were quite impressive." — Michael Ballanger

He noted that the Norseman team has “been busy conducting field sampling analysis — basic geology — to attempt to formulate a 2023 work plan that will involve geophysics and diamond drilling once they have identified targets deemed suitable for further investigation.”

“As we move further out from the Patagonia winter,” Ballanger stated, “site accessibility and working conditions will allow for an acceleration of the program such that by the time the metals market corrections have run their course, Taquetren will have sufficient field momentum to attract the attention of investors willing to speculate on a Navidad-type result — and I cannot emphasize the degree of enrichment that a world-class copper-silver discovery would create, be that in any type of market environment.”

Ballanger has a Buy on Norseman Silver up to CA$0.20, “subject to revision on news.”

When hearing the latest sampling results, Ballanger noted, "The discovery that really caught my eye was Irma, where elevated gold values were found approximately 2km northwest of the Veta Juan area. This is significant because of the proximity of Taquetren to the Calcatreu deposit, a 400,000-ounce gold-equivalent discovery owned by Patagonia Gold."

"Given that Norseman’s field crew is headed by the geologist-prospector that actually discovered Navidad, Daniel Bussandri, Taquetren is off to a great start in the hunt for a game-changing deposit. The company has now identified four distinct target areas for additional geochemical and geophysical refinement as well as a maiden drill program in early 2023," he added.

"When you consider that Pan American took out Navidad by acquiring Aquiline for US$626 million in 2009, the stakes at Taquetren are high and rising as more and more evidence arrives indicating the potential for world-class scale and value," Ballanger concluded.

Clive Maund, president of clivemaund.com, concurs. In April, Maund noted that the “Taqueren Project in western Argentina has been described as a “world-class exploration play” and, in recent days, this claim has acquired serious credibility with news of the company receiving assays of bonanza grade copper at the site.”

“There are two big factors making Norseman stock attractive here for investors,” Maund stated. “One is the bonanza grade copper assays just mentioned, which should obviously have a beneficial effect on the stock price going forward, and the other is the fact that at its present price, the stock looks cheap after a quite severe bear market has lopped two-thirds off its price.” He rated the stock an “immediate speculative Buy.”

When Maund wrote this in April, Norseman stock was trading at CA$0.20; it is now trading at CA$0.11.

The Macro for Copper

Although the price of copper has come off its highs of nearly $5/lb earlier this year and is now trading in the $3.40/lb range, copper remains in demand. The move to electrification goes hand in hand with the increased use of copper. Research firm Wood Mackenzie noted that electric vehicles use up to three and a half times the amount of copper as an internal combustion engine car, and a “fully electric vehicle can use up to a mile of copper wiring.”

MacAlinden Research noted in 2021 that “solar panels and wind farms need as much as five times the copper needed for fossil fuel power generation, according to industry estimates. Per the Financial Times, analysts predict a supply crunch unless new mines are discovered and developed quickly.”

The research firm Fitch Solutions “expects a small surplus on the copper market for this year, but from 2023 expects growing deficits peaking at some 9 million tonnes by the end of the decade as demand accelerates “mainly driven by consumption related to the green transition.”

Multiple Options

In addition to Taquetren, Norseman holds the Cariboo, Silver Vista, Silver Switchback, and New Moon projects, located in a prolific region in central British Columbia, Canada.

Share Structure and Shareholders

Norseman trades on the TSX Venture Exchange under the symbol NOC and on the OTCQB under the symbol NOCSF. As of May 2022, there were approximately 57 million Norseman shares issued and outstanding, with approximately 80 million shares fully diluted. In the last year, shares have traded in a range of CA$0.11 to CA$0.39.

CloudBreak Discovery Corp. is the largest shareholder, holding approximately 11% of the shares, while company insiders own around 18%.

| Want to be the first to know about interesting Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Patrice Fusillo wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver, a company mentioned in this article.

Additional disclosures:

Clive Maund does not own shares of Norseman Silver and is not paid by the company.

Michael Ballanger owns shares of Norseman Silver. HIs company, Bonaventure Explorations Limited, has a consulting agreement with Norseman Silver.