Summary: Copper futures recently touched a decade high as key investment banks openly declared a "supercycle," raising their price targets through 2022. Net positions in copper are their longest since December, copper miners' cash flows are climbing, and stockpiles continue to trend downward with little to no relief in sight—a particularly shocking development, considering the world is on the precipice of an electrification boom.

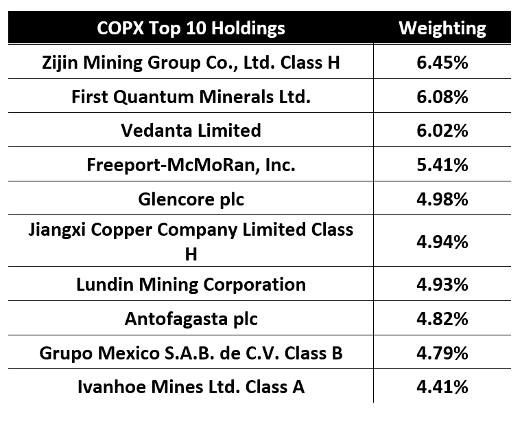

Related ETF & Stocks: iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC); Global X Copper Miners ETF (COPX); Freeport-McMoRan Inc. (FCX:NYSE); Glencore International Plc (GLEN:LSE); BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK)

On Feb. 24, copper prices hit their highest level in 10 years, smashing through $4.30 per pound (more than $9,000 per tonne). That surge helped copper close out its strongest month since 2016, as prices based on the most active copper futures contracts ended more than 15% higher for the month of February, according to Dow Jones Market Data.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on March 2.

Though the red metal lost some ground over the last week, amid the rout in equity and bond markets, futures held their ground above the $4 mark and closed at about $4.09 on Monday. The price spike has prompted analysts at Goldman Sachs, Citigroup and others to raise their bets on continually rising copper prices.

Jeff Currie, head of commodity research at Goldman Sachs, recently said that metals such as copper are already at "supercycle levels," noting that we are headed into a global boom in electrification with drained stockpiles. "We have no copper. . .and we have not even started the energy transition story of electrifying the world. . .Copper is the only thing we know that can conduct electricity at the rate needed," he said. Last week, Goldman Sachs raised its 12-month copper price target to $10,500 per tonne, along with $9,200 in three months, $9,800 in six.

Citigroup also alluded to an ongoing "supercycle" in the copper market, upping their call on copper prices for 2021 and 2022, forecasting $10,000 per metric ton, with a "bull case" for $12,000 per ton. Citi also upgraded shares of leading copper miner Freeport McMoRan to Buy from Neutral.

Miners like FCX have seen huge benefits flow to their balance sheets from buoyant copper prices. Per JP Morgan, Freeport, which has just reinstated its dividend and set out a new policy for shareholder returns, could generate $14bn of free cash flow from 2021 to 2023.

The Financial Times reported last month that BHP, the world's largest miner, would pay an interim dividend of $5.1 billion ($5.1B) as profits hit a seven-year high. Glencore said it would resume its payout with a $1.6 billion return after scrapping its annual dividend in August.

Natalie Scott-Gray, a senior metals analyst at StoneX, forecasts copper demand in 2021 will rise by about 5% year-on-year (yoy), outstripping supply, which she expects to grow by 2.3% yoy. If her predictions come true, Mining.com notes that the global copper supply will move from a small surplus in 2020 to a potential deficit of more than 200,000 tonnes of copper this year.

Overall, large base metals speculators have continued to steadily increase their net long positions in the copper futures markets over the last month, according to the latest Commodity Futures Trading Commission (CFTC) data. The non-commercial futures contracts of copper futures, traded by large speculators and hedge funds, totaled a net position of 75,404 net contracts in the data reported through Feb. 22, a weekly gain of 1,495 net contracts and the highest level since last December.

According to the Financial Post, inventories of copper in warehouses registered with the London Metal Exchange (LME) closed out last month at 74,200 tonnes, down by 31,600 tonnes since the start of January.

Some metrics show copper prices still have some catching up to do. As Barron's notes, the copper to gold ratio, which expresses the value investors assign to copper against that of the safe haven gold, is currently 0.13, meaning the price of unit of copper is just over one-tenth the price of a unit of gold, whereas the ratio's long-term average is almost 0.3, according to Pavilion Global Markets.

Though some have suggested that continuously rising copper prices may spur a rush for replacements, substitution with aluminum or plastics has experienced a marked downward trend in recent years. As Bloomberg writes, aluminum's poorer conductivity and larger volume could pose technical challenges that outweigh the commercial benefits in corners of the market that are set to grow the fastest, such as electric vehicles (EVs) and renewable energy. JPMorgan recently said copper demand from those sources would rise from 925,000 tonnes this year to 4.2 million tonnes by 2030.

MRP has noted that green technologies are likely to experience a new wave of federal assistance in the U.S. under the Biden administration.

Biden has a plan to install 500,000 electric vehicle charging cords by 2030, roughly a fivefold increase in the nation's EV infrastructure that could cost more than $5 billion. Bloomberg writes that the infrastructure milestone would cover 57% of the charging that U.S. vehicles will need by 2030 and could spark the sale of some 25 million electric cars and trucks.

BloombergNEF forecasts by 2040 there will be a need for 12 million charging points, each requiring about 10 kg of copper.

The proliferation of electric vehicles that could result from a massive buildout of charging stations has the potential to push copper demand even higher, considering EVs take around 83 kilograms of copper on average.

Solar panels and wind farms need as much as five times the copper needed for fossil fuel power generation, according to industry estimates. Per the Financial Times, analysts predict a supply crunch unless new mines are discovered and developed quickly.

Ongoing investment in these same technologies throughout the European and Chinese markets will provide an even larger source of demand.

Another bearish argument has focused on a large amount of scrap copper being held off the market for now. Bloomberg reports that copper scrap prices headed for an unprecedented 11th monthly advance, as the premium people are willing to pay to secure refined metal remains elevated and signals the increasing appeal of scrap. However, while buyers are indeed becoming more desperate to secure immediate supplies of copper and turning to the scrap market for relief, scrap hordes are a lot smaller than they used to be.

Back in December, Michael Lion, a trader at Hong Kong-based Everwell Resources, told Fastmarkets: "These days, there are no longer people holding big. . .inventories in the scrap industry—like [they would have done] 20 to 30 years ago when the industry was dominated by family businesses. So, the increase in prices does not do that much in [terms of] drawing out much more material."

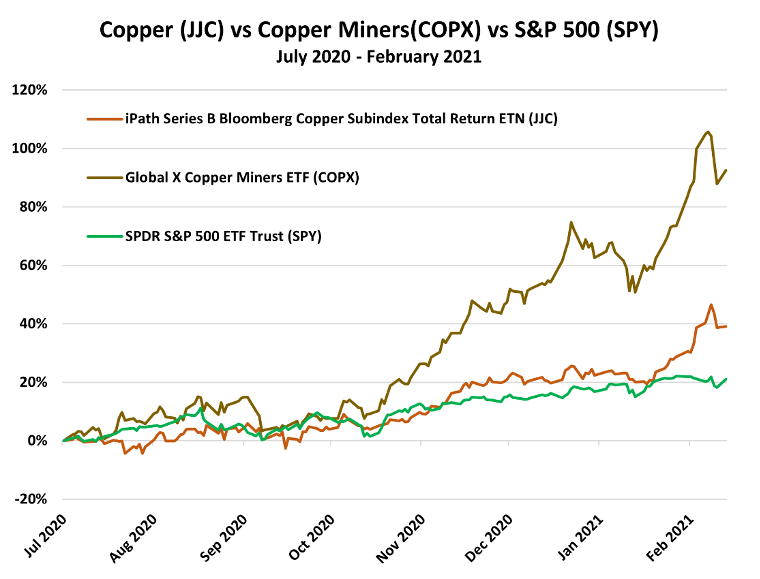

MRP added LONG Copper and Copper Miners to our list of themes on July 17, 2020.

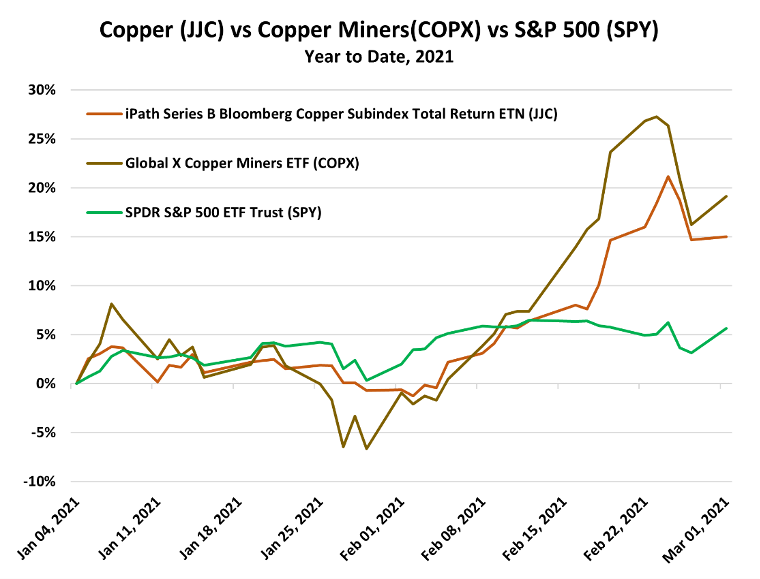

We've been tracking the theme with the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) and the Global X Copper Miners ETF (COPX), which have returned +39% and +92%, respectively, over the life of the theme. Each of those have outperformed the S&P 500's return of +21% over the same period.

Charts

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.