Again the mainstream economists had their heads handed to them in a basket. Their consensus estimate on U.S. job numbers (Friday) was a cooling off to 250,000 new jobs, but instead, the number soared to 528,000.

Furthermore, the June increase was updated to 398,000 payrolls from 372,000. As I have been saying for about a year, it is 1970s deja vu.

When I came out of college in 1974, there were jobs galore as I had a choice between five job offers. I believe what is happened this go around with the Covid-19 government fiasco, a lot of baby boomers said enough is enough and left the workforce. I expect this job shortage scenario could last some time.

The unemployment rate fell to a further 3.5%, marking its lowest level since 1969 (deja vu), while average hourly earnings grew at 5.2% Y/Y. That data doesn't look too consistent with the last two-quarters of economic contraction.

Hello folks, it is called 'stagflation, 'slow growth and high inflation. The U.S. is gaining jobs like gangbusters and Canada is losing jobs, -31,000 in July and -43,000 in June.

The Bank of Canada was bewildered that the loony did not rise with oil prices that were normal in the past. That is because our government has destroyed our economy and the energy investment dollar flow into Canada will not be back for a long time. In fact investment in this country is out the window.

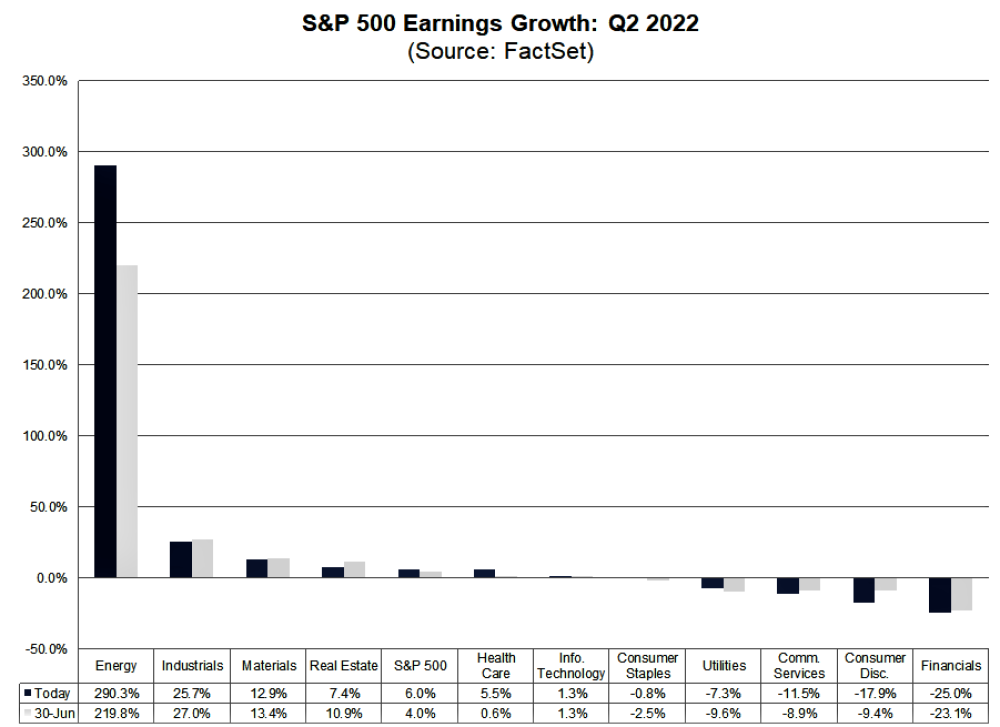

The talking heads have also been harping about Q2 earnings that have been decent. However, take out the earnings from the energy sector and things are getting bad.

The next two best sectors are Industrials and materials because many of these companies have positive influence from rising commodity prices. Note that financials are the worse and that is where we have concentrated short positions with put options.

Just a week after Walmart slashed its quarterly and full-year guidance, cuts are coming to the company payroll. The firm is laying off hundreds of corporate employees at divisions related to merchandising, global technology, and real estate.

Walmart has to reorganize itself as it marks down apparel and other items that have piled up in its stores.

With high inflation, consumers have changed their buying habits.

So where to now? The mainstream is of the believe that the Fed will soon have to lower rates because a slowing economy so buy stocks, despite the said stocks already suffering earnings decline because of a weak and changed economy plus their margins be squeezed by inflation.

Don't be fooled, this is just a bear market rally.

On the S&P 500 chart, you can see that we are pretty much at the 4200 area which was my minimum target for this bear rally. We could go a bit higher, up to around 4300, which would also be home to the 200-day MA resistance by the time markets got there.

The 200-day MA turned down in May, another long-term bearish signal.

Short term the market is overbought but I am not ruling out a little more to the upside. Support is around 3900 and if markets breach that, most likely we are headed to new lows.

This is a chance to lighten up long positions if you did not heed my warnings early in the year.

I am still on the fence about whether the bottom is in for oil and gas and their stocks and the same for gold and gold stocks.

As I mentioned, July and August are often inflection points for bottoms and tops.

If you bought the gold stock call options I suggested on July 21, that has been very good timing. I went in depth on the gold market in that issue.

I am expecting September to be a bad month for the main equity markets and then we are into scary October, historically the worse month of the year for the main equity indexes.

I am expecting that gold will diverge from the next equity downturn and be stronger. I will be keeping a watchful eye for clues.

Greenbriar Capital Corp. recent price was -$1.35.

I did an interview with CEO of Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC) Jeff Ciachursky this past Friday that you can find that on my YouTube channel here.

On Monday, GRB announced they are in the final stages of a formal binding offer to purchase an entire regional real estate franchise network (agency).

The purchase will have the sales, revenues, and net profits consolidated into a Greenbriar subsidiary.

The revenues Greenbriar proposes to buy consist of the franchise ownership of more than 2,000 agents, comprising $7.1-billion of real estate sales and about $104 million f consolidated commission income.

This would have a major impact on the valuation of Greenbriar Capital.

Benefits to the real estate agency would be the merging into a public company, where the value of the merged company assets is far greater than the current share value, making this an accretive acquisition for both parties.

There was no detail on the transaction price or how it would be financed, shares, debt, or a combination.

This could work well for GRB, they could gain on the sale of units at Sage Ranch and perhaps make money on the commissions too, assuming that this purchased agency would make the Sage Ranch sales.

I really like the chart set up too at this time. The down trend (green lines) were broken. The stock popped but has now backfilled the gap from $1.20 are to the $1.50 area. The stock has also bounced off support around the $1.20 area. It looks like a test of recent highs around $1.50 is in order and then see if it breaks through that.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Struthers Stock Report Disclaimers

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Disclosures

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Greenbriar Capital Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company release. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Greenbriar Capital Corp., a company mentioned in this article.