Astra Exploration Inc. (ASTR:TSX.V), with its recent, now closed, nonbrokered private placement, generated CA$2.4 million (CA$2.4M) and garnered some highly accomplished investors, a news release noted.

"The demand for this offering and the quality of investor attracted has been incredible, especially in these challenging markets," Astra CEO Brian Miller said in the release. "Their collective vote of confidence sends a very positive message regarding Astra's potential as an investment opportunity."

"Pampa Panciencia is similar in many ways to Yamana's El Peñón, one of the largest gold mines in the world."

—Peter Marrone, founder and executive chairman of Yamana Gold Inc.

For the financing, Astra issued 12 million (12M) units at $0.20 apiece. Participants included Michael Gentile, an investor who owns significant positions in about 20 junior mining companies. He invested the most, subscribing for 5M units of Astra's offering, and now owns 23.75% percent of the Canadian exploration company.

Why Investors Are Casting Their Votes for Astra Exploration

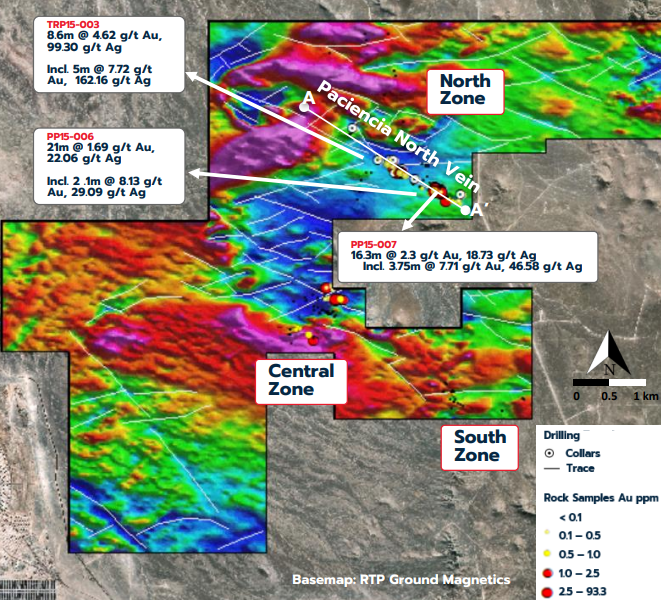

What Gentile likes about Astra and its Pampa Panciencia project in Chile, in particular, is its potential for multiple discoveries, scale, and improved grade at depth, he said in the release. Also favorable is its location in a jurisdiction with a rich mining history and excellent existing infrastructure, including nearby mills and producing assets.

"The company has done an excellent job with very little funds so far, building up their geological model that has led to consistent intersections of wide mineralized structures of 20–30 meters punctuated by higher-grade substructures as they moved deeper in the system," Gentile added.

His approach to choosing mining companies in which to invest involves identifying, early on, assets with the attributes to potentially become mines, he said. He likes to invest as early and as cheaply as possible. He prefers to be one of a company's Top 5 shareholders, long term, and contribute value via support on financings, acquisitions, or capital markets strategy.

"When I invest in a company like Astra, if my thesis is correct, I’m looking to make 10–40 times my money," Gentile said. "I hope to realize that value in my portfolio over the long term through eventual acquisitions or mergers of the companies."

New Venture Equities Fund Limited Partnership, a private, equity-style investment fund managed by Goodman & Co., subscribed for 2M units of Astra's offering. With these and its previously acquired shares, the fund now owns a 14.5% interest in Astra.

Peter Marrone, founder and executive chairman of Yamana Gold Inc., subscribed for 1.65M units, earning him an 8.5% stake in Astra. Marrone, too, finds Astra's exploration work to date and discovery of low sulphidation epithermal systems compelling and noted these types of systems tend to be immense.

"I am very impressed by how management has been able to define structure and grade with such a limited amount of exploration expenditure, and near to surface, which portends very well for the project as drilling now turns to deeper areas," he said in the release. "This has impressive upside."

He added that Pampa Panciencia is similar in many ways to Yamana's El Peñón, one of the largest gold mines in the world.

Share Structure More Tightly Held After Financing

In addition to Gentile, Marrone, and New Venture Equities, Astra management and insiders subscribed to the offering, for a combined 1M units. Now, the management team owns 20.4% of Astra, compared to 26% before this financing.

"With a market cap of only $5M prefinancing and a tightly held share structure with management and the three strategic investors announced today owning about 67% of the company on a partially diluted basis, Astra is set up for success," Gentile said.

The company will use the proceeds of the recent financing to fund its phase two drill program at Pampa Panciencia, slated to start later in the season. Astra has already defined and derisked drill targets for it, which, Gentile noted, "could be very successful for the company."

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Astra Exploration Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.