Before I set out on my usual magna parabolum, I want to set the record straight in light of the magnitude and frequency of market commentary that would have us all believe that we are soon approaching a market bottom, all based on set after set of “rules-based investment principles” that “have stood the test of time.” To that, I would say “Hogwash.”

Firstly, in countering the adage that says that “history may not repeat but it does rhyme,” in order for it to rhyme, there must be a reference point that allows one to seek out the rhyming partner.

“Don’t lose sight of the big picture.”

— John D. Rockefeller

As it would pertain to today’s market backdrop, there is no single point in history that even vaguely compares to 2022. Literally, nothing rhymes with gargantuan sovereign debt levels, egregious supply chain shortages, and rising social unrest leading to disorder. In other words, there is simply no reference point from which to draw comparisons.

As much as I am a stock market historian and gold market enthusiast, I do not see myself as a soothsayer. However, many of the popular bloggers and podcasters would have us believe that they have the “secret sauce,” paving the way for outsized investment success but what is so important to remember is that there are few investors alive that were in the trenches in the 1970s or the 1940s or even the Roaring ’20s.

I entered the investment industry in 1977 but was spared the horror of the 1973-1974 bear market. The closest I got to that wealth-destroying period of high inflation and contracting economic activity was by listening to stories from veteran brokers that survived it and from the looks in their eyes and tremolo in their voices, it was a very nasty time for all of them.

So, when I read the pomposity with which this new generation of “influencers” offer breathless, table-pounding “analysis” on the outlook for stocks, when one pulls back the curtain and peers into the control room, the objective of the narrative is to increase market share (“followers”) rather than delivering accuracy.

My point is this: Do not follow any given narrative in managing your investments; all investors, no matter how good, experience drawdowns but the experts that will take you down are the ones that are never wrong.

I sent subscribers an email alert this week that pointed out the danger of getting “too bearish” but after the Thursday-Friday rout in everything except gold, it sets up the potential for a particularly interesting triple-witching event next week and underscores the title of last weeks missive “Career Suicide: Never try to Second-Guess the Fed.”

Everybody is trying to leap-frog their competition in identifying another March 2009 or March 2020 bottom but why that is a flawed strategy is that both of those bottoms were engineered by a “friendly” Fed. There is no “friendly Fed” here in 2022 and until “official” inflation rates as reported by the U.S. government hit their target of 2%, there is no impetus for anything resembling a Fed pivot.

The current “wink-wink-nudge-nudge” narrative that says, the Fed will continue tightening until “something breaks,” fails to include the possibility that the member banks (‘the club”) like JPM and GS that own the Fed may decide to cover their shorts far earlier than the “something breaks” event.

As the late George Carlin would tell us, “It is one big club and you and I ain’t in it!”

The “club” covers shorts early and then goes long into the “something breaks” event. If you doubt this, remember Election Night 2016 when the market was down massively into the Trump victory?

Carl Icahn came on CNBC the next day chortling smugly how he and his “boys” bought the S&P futures in staggering size during the wee hours of the morning and summarily launched the next major upleg of the 2009-2022 bull market.

That was “the club” at its privileged best exercising their divine right of market manipulation with absolute dexterity and unabashed aplomb.

I started the June 10th missive on Thursday evening before the dreaded CPI number hit the tape and was almost forced to scrap what I had written over the past two days.

What I found absolutely staggering was the action in the Crimex gold pit. The very second the number hit the tape at 8:30 a.m., the algobots sprang into action and trashed the price down to $1,826.50 because the highest consumer price index reading since 1981 is obviously bearish for an inflation hedge metal, right?

Then, to add insult to injury (for everyone that got stopped out of their long positions), over the next two hours, gold put on a $50 reversal closing out the week at $1,875.

I was speaking to a fellow newsletter writer on Friday afternoon that absolutely hates gold and silver right now. He was lecturing me as to the myriad of reasons why Millennials (he is one) and GenExers (he is soon to be one) are avoiding the precious metals.

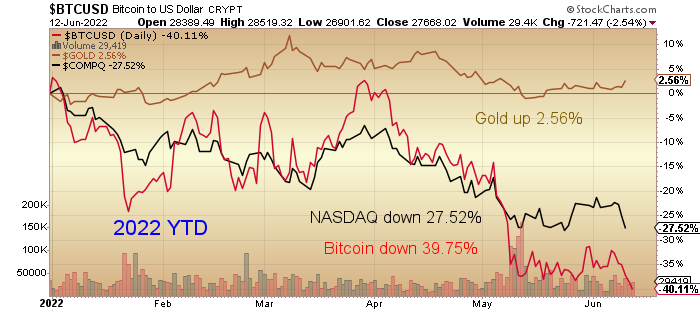

After we exchanged barbs a few times, his “knockout punch” was that gold cannot do well when the Fed is battling inflation to which I replied, “Then why is it up 2.56% year-to-date?”

Had the new wave of youthful investors been able to allocate as much as 10% in gold, the major benefit would be anything but financial but rather educational as they pounce upon the learning curve of bear market navigation in the manner of a drowning man lunging for a life preserver.

Instead, they are mired in recency bias, continually begging for a Fed pivot such as they received in March 2009 and March 2020, both of which fostered the now-famous “BTFD” trading mantra that worked beautifully as long as the Fed had their back.

The golden life preserver fulfilling its role as a financial rescue asset floats alone and unused by generations of investors that only know about bear market idiosyncrasies from old books and retired brokers and that, as they say, is a damn shame.

Gold bullion appears to be forging an important low here in the month of June with July being one of the top three months of the year for seasonality which sets up a reasonable chance of a tradable rally in both Senior and Junior Gold Miner ETF’s (GDX/GDXJ). I suspect that we are entering the phase of the cycle where the blue chips that dominate the Dow Jones Industrials and the S&P 500, currently in “correction mode” will join the NASDAQ and the crypto names in full-on “bear market mode.”

When this current outperformance by the blue chips crumbles (as we saw last week), we suspect the pre-programmed alogbots will begin gravitating to “that which is working” and because the oil trade has become a crowded theatre, they are going to accelerate their portfolio weightings to gold and other risk assets that should elude the clutches of the Fed’s anti-inflation claws which includes the mightily-asymmetric uranium trade at the forefront.

The difference between a truly tradable bottom and a bear trap lies not in the lip service of the CNBC talking heads but in the undisputable actions of a few million traders. Irrespective of the level of percentage decline, the 2008 and 2020 lows were “deep correction” lows, not the nature of the lows of 1969, 1974, or 1982, which were actual “bear market” lows, characterized not by CNBC trotting out shopping lists of “bargain buys” but rather daily list parades of “stocks to avoid.”

Since the 2009 lows, contrarian strategists have flaunted their avant-garde investing process such that every pullback was populated with the gaggle of highly vocal and colorfully visible cheerleaders using dour retail sentiment numbers as buy signals. That strategy only works in bull markets that are insulated by a friendly Fed.

In bear markets—and I mean real bear markets—buying the dip does not work because it is a de facto violation of a primary trading rule which is to “never average down by adding to a losing position.”

There is a final reason why the current softness in stocks has more legs and since a picture is worth a million keystrokes…

This discussion of “angst” carries different meanings for different people. The vast majority of investors are experiencing the feeling of abandonment now that the invisible hand of Fed intervention and interference supporting stock prices has gone invisible.

Gold investors like me are concerned that the most bullish set-up for any inflation-sensitive commodity in history failed to launch it into the collective embrace of a new generation of investors.

However, there is not enough angst out there to create the pervasive sense of impending doom which typifies market bottoms. We may be there in gold; we are nowhere close in stocks; we are light-years away from achieving Fed’s 2% inflation target.

I close the weekend missive with a comment on volatility. At the start of the year, I concluded that the most predictable event would be a sharp rise in volatility and used the UVXY:US as my proxy for volatility and as my portfolio hedge for 2022.

I exited the position with a 30% gain in April but given the magnitude of the decline, I was surprised that it failed to take out the 52-week highs near $39. The reason, as it would turn out, is that declines that are disorderly tend to cause a sharp spike in volatility but an orderly one such as the one in which we currently sit does not trigger spikes.

I am watching closely for an opportunity to replace the position and will advise subscribers in due course.

GGMA Portfolio Account

- Added 100,000 Aftermath Silver at CA $.20 /USD $.159

GGMA Trading Account

- Added 100,000 Aftermath Silver at CA $.20 / $.159

GGMA Model Portfolio

No changes but I am looking to replace the UVXY:US this week under $14.00.

No further commentary other than to reiterate my comments from Email Alert 2022-58. The major averages may have more downside but if it rhymes with the other bear markets I have endured, exploration success can create marvelous outliers.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.