Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE) reports that it hit 14.3 meters of massive sulphides, typically associated with high-grade base metals deposits, in hole LR 002 at the Romanera deposit, one of three targets on the company’s wholly-owned Iberia Belt West project in Spain.

Assays on the core are pending, and Emerita CEO David Gower says the results will likely be published in July.

Three more holes will be completed soon, and two more drill rigs have been added to bring the total number of drills turning at Romanera to six. Two other rigs are testing other deposits at Iberia Belt West. It’s all part of a 70,000-meter — 43.5 miles — drill campaign designed to quickly prove up the resource.

“It's telegraphing that there'll be strong news flow coming from (Iberia Belt West) right through to the end of the year from the amount of drilling that we've laid out,” Gower told Streetwise Reports. “We're moving the project as quickly as possible to a development decision.”

The massive drilling campaign prompted Research Capital Corp. to reiterate its “speculative buy” rating and a $4 per share target price, while Toronto-based Clarus Securities has the same rating and a $5 target price.

Research Capital Analyst Adam Schatzker wrote in a May 17 note: “With drill permits in hand, EMO is making a significant shift in its exploration efforts with the focus moving from Infanta to Romanera. Romanera is the largest known target on the IBW project.”

Tight Drill Spacings

In a release, Emerita President Joaquin Merino-Marquez called the new drills “highly mechanized, high-performance machines that will have an important impact on the drill productivity.”

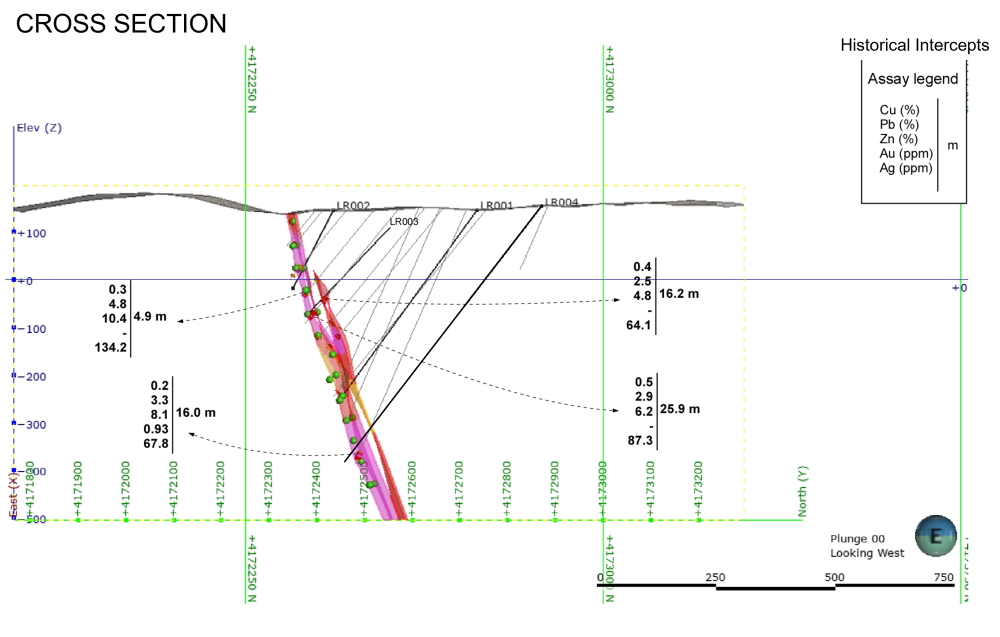

In the core of the deposit, the drill holes are being spaced 50 meters apart or close enough to bring the resource in the core of the Romanera deposit into the measured and indicated category, which is one step below reserves and sufficient for an economic study.

At the outer margins of Romanera, the step-out holes are 100 meters apart, which is designed to increase resource tonnage. However, Gower notes that if a hole hits high-grade mineralization, another hole will be drilled between that hole and the previous one.

A historical resource at Romanera was previously calculated based on holes drilled by Phelps Dodge and Rio Tinto long before National Instrument 43-101 – Standards of Disclosure for Mineral Projects were developed and put into practice.

The current drill program will twin and offset previous holes to essentially make the old resource the new resource, with some added tonnage. It will also provide material required for metallurgical testing.

The historical resource at Romanera (which is not National Instrument 43-101 compliant) tallies 34 million tonnes (34 Mt) grading 0.42% copper, 2.2% lead, 2.3% zinc, 44.4 gram per tonne silver, and 0.8 g/t gold with a higher-grade historical resource of 11.21 Mt grading 0.4% copper, 2.47% lead, 5.5% zinc, 64 g/t silver, and 1 g/t gold.

The massive sulphides start at surface and the recent intersection hit the mineralization about 134 meters downhole and it was comprised of sphalerite, galena, and chalcopyrite in a pyrite gangue.

Aznalcóllar a Game-Changer?

In addition to the IBW project, Emerita may be awarded the public tender for the Aznalcóllar project, a past-producing mine. Currently, criminal proceedings are continuing against certain government officials who originally awarded another company the public tender for the project.

Five judges in the Spanish criminal court have already declared that the other bid was illegal for Aznalcóllar. A final ruling should come down by the end of the year. If those proceedings are successful, as the only qualified bidder, Emerita would be awarded the tender.

“The biggest catalyst, of course, will remain a resolution to the Aznalcóllar lawsuit, because that's just a different scale of asset,” Gower told Streetwise Reports.

Emerita notes the business development environment has never been better, given pushes from government and even the European Union.

Supply chain issues across the globe have prompted the government of Andalusia to declare underground mining to be the preferred economic activity for the region and, as such, will be permitted on a priority basis. And the European Union has declared the Iberian Pyrite Belt “strategically important” and has put together a five-year €3.2-billion fund to support mining and metallurgy projects.

Gower says Emerita would have to complete an economic study on its Iberia Belt West project before it could get access to those funds. He’s also looking at different ways to use technology to make the project more efficient and environmentally friendly.

“We're always looking to upgrade the ESG component,” Gower said.

Sprott Asset Management, Merk Investments, and BMO Asset Management Inc. are among Emerita’s shareholders. Gower himself owns 2.46 million shares or 1.25%, and Merino-Marquez owns 1.59 million shares or 0.80%.

The company has about 195 million shares outstanding and trades in a 52-week range between CA$4.14 and CA$1.40.

| Want to be the first to know about interesting Gold, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Emerita Resources Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.