Royal Helium Ltd. (RHC:TSX.V; RHCCF:OTCQB), on the verge of becoming one of the largest diversified helium companies listed on a Canadian stock exchange, announced Tuesday that it is set to spud the initial well at its Val Marie project in Saskatchewan in on July 10.

Royal Helium Ltd. (RHC:TSX.V; RHCCF:OTCQB), on the verge of becoming one of the largest diversified helium companies listed on a Canadian stock exchange, announced Tuesday that it is set to spud the initial well at its Val Marie project in Saskatchewan in on July 10.

The company is acquiring Imperial Helium Corp. (IHC:TSX.V; IMPHF:OTCQB) at a time when the market for this increasingly important gas used in everything from semiconductors to health care is set to expand at least 8.3% over the next four years.

The transaction should provide diversification and boost the investment profile of the new company, Auctus Advisors founding partner Stephane Foucaud told Streetwise Reports.

"The new entity will benefit from a better balance sheet than Imperial’s," Foucaud said. "This cash position combined with the larger scale of the company should allow better access to capital at a lower cost."

Both Royal and Imperial have plants being built at Climax and Steveville, respectively. The consolidation enables Royal to have increased production and sooner.

“Imperial Helium has more near-term helium production, they’re going to be in production in November/December of this year, whereas Royal is going to be in production probably Q1 of next year,” Campbell Becher, a director of both companies. “It’s just added production, (and to) diversify the asset base a bit.”

Royal on Tuesday said it had received the final results of its seismic program at its 13,000-hectare Val Marie project, which is at the heart of the Bowdoin Dome feature, which has hosted current and historic helium production.

Using 35 kilometers of newly acquired and purchased trade data, Royal said it has identified a series of large structural features at the site and selected an initial drill target and five more high-priority targets.

Helium Shortage 4.0

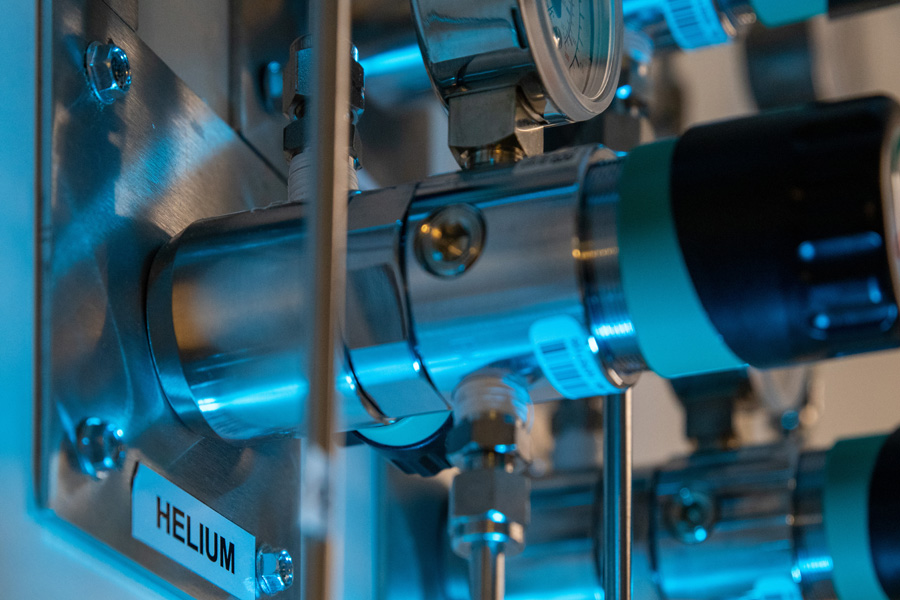

Helium, often a byproduct of natural gas production, is the second most abundant element in the universe. It’s also the second lightest and has the lowest boiling point. Because of that, it’s perfect for cryogenic applications like the cooling of superconducting magnets in MRIs. It’s also used in nuclear reactors, semiconductors, superconductivity, instrumentation, lasers, medical applications, light bulbs, and more.

Only a few countries produce the world's helium, including the United States, Qatar, Algeria, and Russia. Canada currently produces only about 1 percent but has the world’s fifth-largest helium resource. Saskatchewan hopes to increase the province’s output to 10% of the world’s supply by 2030 and has unveiled new incentives and tax credits to companies.

“There’s going to be an abundance of helium coming from Canada.”

—Campbell Becher, director of Royal Helium Ltd., Imperial Helium Corp.

ResearchandMarkets.com forecasts that the global helium market will grow from $4.45 billion this year to $6.14 billion in 2026 at a compound annual growth rate of 8.3%.

But it’s a finite resource on Earth, and the industry is in the midst of its fourth shortage since 2006, which some are calling Helium Shortage 4.0. The U.S. National Weather Service is cutting back on weather balloon observations, and the shortage is even affecting the birthday party balloon industry.

Helium is also difficult to store, so North American industries are seeking not only geopolitically stable sources, but local suppliers. One promising source is Canada.

“There’s going to be an abundance of helium coming from Canada,” Becher said. “We’ll just be feeding that U.S. market.”

Consolidation of Helium Industry ‘a Must’

The new company will have a robust portfolio of helium wells, including ones ready to produce, along with many exploration opportunities. It will also help to consolidate the industry, Imperial Executive Co-Chairman and Director Kyler Hardy said.

“Consolidation in the helium industry is a must,” Hardy said. “If there is going to be larger value creation in the sector, there must be a natural consolidator. This merger is the start of that consolidation process, where larger enterprises can then acquire multi-asset (exploration, development, and production) operators.”

The company will be better positioned to access capital and expedite offtake discussions and other ways to monetize assets. It also will allow Royal to generate cashflow sooner and benefit from general and administrative cost synergies.

"This acquisition would allow Royal to initiate production and significant cashflow from multiple fields near term, accelerate its production profile and enhance future growth for all shareholders," Royal President and Chief Executive Officer Andrew Davidson said in the release.

With Royal acquiring all of Imperial's issued and outstanding shares, Imperial shareholders will receive 0.614 of a Royal common share for each Imperial common share they hold. Based on both companies' closing prices on April 29, 2022, this represents a 10.01% premium to Imperial shareholders.

Also with the transaction, Imperial shareholders will get to own shares of a larger, more liquid, publicly traded entity and may participate in growth upside, given Royal has 1 million acres of helium land into which more than $20 million has been invested.

The deal is expected to close shortly after a special meeting of Imperial shareholders scheduled for July 12 in Vancouver, assuming they approve it. Upon acquisition closing, Royal will have 203,843,231 shares outstanding versus its current 142,741,726.

| Want to be the first to know about interesting Helium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC.. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Imperial Helium Corp. and Royal Helium Ltd., companies mentioned in this article.