Maurice Jackson:

Joining us for a conversation are two of the most prolific names in the natural resource space, both legends in their own right, as we are joined today with Rick Rule of Rule Investment Media and David Cole of EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American).

I must say it's an absolute delight to be speaking with you both today, as I hold you both in the highest regard personally and professionally, as we plan to discover why mineral royalties are powerful financial instruments. We have a lot of ground to cover today, gentlemen, so let's get to it.

Mr. Rule, you have a proven track record of nearly 50 years as a wealth builder for you and your clients through resource stocks. What are you seeing right now that gives you the courage and conviction that resource stocks may present a once-in-a-lifetime opportunity?

Rick Rule:

First of all, you're always not wise to contradict your host, but I've had a couple of these opportunities in my lifetime. So I don't think it is a once-in-a-lifetime opportunity. But I, as you point out, have been lucky enough to see the opportunity before that's in front of me now. And it was extremely pleasant to participate in. Natural resource bull markets are wonderful financial events if you participate in them early enough.

My own belief is that right now we are in the latter stage of the beginning of a precious metals bull market. And we're probably in an earlier stage in a broader natural resource bull market. And the idea to participate in two real bull markets where the outcome is a probability, not a possibility, is extraordinary.

It is seldom before in my life to have the fundamental factors that are in front of me come together simultaneously that have given me the courage of my convictions with regards to the probabilities of the outcome, is what I'm talking about. And that's what feels good to me now.

Maurice Jackson:

Given the reasons you just conveyed to us, investors and speculators alike are seeking prudent ways to preserve their capital, and if possible, sweeten the deal with the delivery of some nice returns. About a decade ago, you introduced me to a business model that offers investors both of these virtues, and I'm referring to the concept of mineral royalties. For someone new to the conversation, would you please share what are mineral royalties and why are mineral royalty companies a strategic part of your portfolio?

Rick Rule:

What I've learned over time is that having an economic interest in a revenue stream where my gross is my net is a very good thing. What a royalty is, is a part of the revenue stream of a mine or an oil well or something else. But you don't bear any establishing capital risk, any sustaining capital risk, or any operating cost risk.

So to the extent, as an example, if you disagree with a management team over some of their expenses, it doesn't matter. You just get the check. Your gross is your net. A mineral royalty too is a timeless interest pretty much. And that means that most of the surprises that may occur are pleasant surprises.

If you are lucky enough to own a royalty on a tier-one mineral discovery, my experience has always been that big discoveries yield surprises and small deposits yield surprises too. But big discoveries yield pleasant surprises, and small discoveries yield unpleasant surprises.

So a mineral royalty, which is established on a, let's say, a 1 to 1.5 million ounce gold deposit, which feels attractive over 30 years, might end up producing two, two, and a half million dollars. The additional exploration expense that goes into establishing the lengthening of your royalty, the operating costs, the sustaining capital costs, the taxes, all that stuff doesn't matter. Remember with a royalty, for the most part, your gross is your net, which is very pleasant.

David Cole:

With regards to mineral royalties, what also comes to mind is the concept of optionality. Mineral royalties are phenomenal financial instruments, particularly in an inflationary environment, for the very reasons that you laid out and that discovery optionality and advancement of engineering techniques, all of which are multiplicative, make royalties fantastic instruments to hold.

Maurice Jackson:

And David, if you would expand on that word optionality, that may be a new term for readers.

David Cole:

Sure. So that's the chance that things might go super well or super bad. And a couple of guys, Black Scholes got a Nobel prize for defining a formula, how to calculate what optionality is worth and options trade in the marketplace. And with respect to royalties, what we're talking about is the chance that things can go well.

And as Rick pointed out, the cost that goes into the exploration and discovery work, development work, production work et cetera, et cetera, is born by the counterparty, not by the royalty holders. So we're exposed to all that upside optionality. And that's one of the things that makes a portfolio of royalty so powerful.

Maurice Jackson:

Mr. Cole, you're the CEO of the royalty generator and I'm referring to EMX Royalty. Please introduce us to the value proposition that EMX Royalty presents for investors along with your current share price.

David Cole:

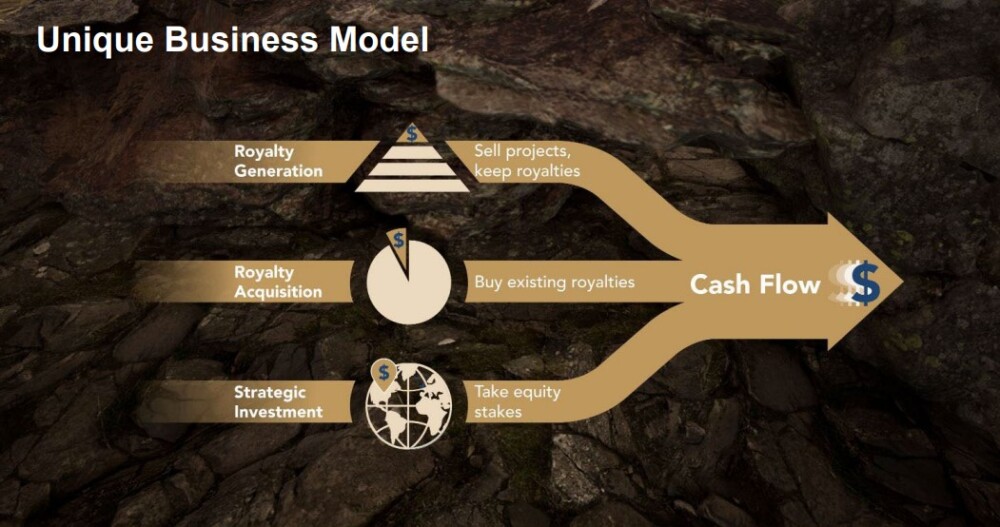

Well, I'm more than happy to talk about that. And first of all, it all revolves around the concept that royalties are fantastic instruments, and different royalty companies accumulate royalties in different ways. There are royalty financings to advance mine projects. There's purchasing of existing royalties. And then there's royalty generation.

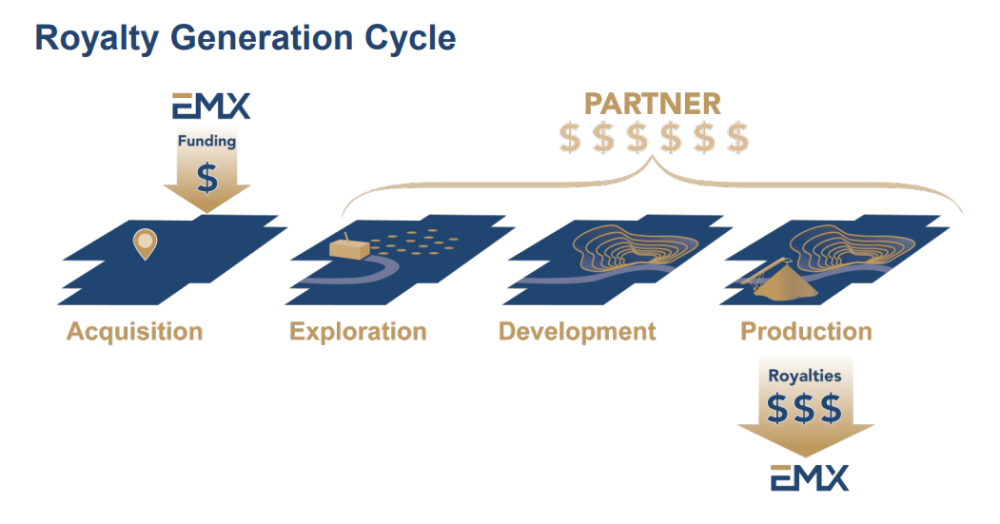

We love to generate royalties through the prospect generation business model, acquiring prospected mineral rights around the world, adding value by doing good geology and coalescing data, and selling that to an industry, hungry for discovery opportunities. And as Rick said, I've never seen an industry more hungry for discovery opportunities than we have today across the periodic table.

And we love doing that. We love selling them on for cash shares and of course, royalties. We also buy royalties to augment that portfolio, create that portfolio effect, and to further advance the optionality.

Maurice Jackson:

And you do that organically. That's what I find very intriguing about your business model.

David Cole:

That is our defining factor. That's our hedgehog, and we've sold by example, Maurice, 83 projects in the last four years. We have a track record of just selling projects right and left. And when I'm talking about selling projects, what I mean is we stake mining claims, or we acquire mining licenses from governments, add value, and then move them onto a counterparty, junior companies, and major companies.

And in the junior company deals, it's commonly cash payments and share payments. We've done exceedingly well with the share payments over our nearly 20-year history and always a production royalty at the end. With major companies, which we also love to do business with, we've done six deals with Rio Tinto, the largest mining company in the world in the last four years, as one example. And there, it's more focused on the inground expenditures, cash payments, and of course the royalty at the back end.

And we're just delighted to have the capital across our portfolio being expended by our counterparties, but also their expertise employed across that portfolio, which is enhancing this concept of discovery optionality, which is where the big win comes from. Of course, there's commodity price optionality as well, which is a hot topic in an inflationary environment.

Maurice Jackson:

Now, before we delve into specific projects, multi-pronged question. Mr. Cole, how many projects are in the EMX property bank, and how many of those projects are now in the harvest mode of generating royalties?

David Cole:

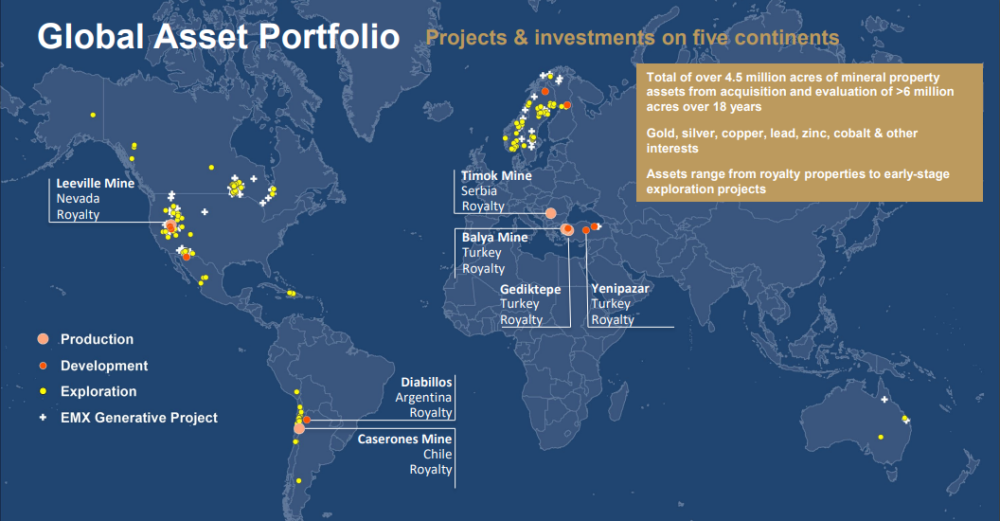

So when you use the word bank, that's probably a good word to use. So we have approximately 300 mineral property positions globally, in more than a dozen countries. We've always taken a broad approach. We've cast a broad net to find value, and that's a very strong base of a pyramid.

And then EMX does have half a dozen producing assets or assets that are just about to become produced at the top of the pyramid. And we're at the transitionary point where we're going from a junior company that's been building a portfolio of mineral property positions and royalties to one that has strong cash flow. And we're right at that tipping point this year.

Maurice Jackson:

And we're going to highlight five of those here in just a minute. Rick, in the resource space, precious metals seemed to dominate the conversation. But I'd like to get your thought on base metals and in particular, the outlook for copper.

Rick Rule:

I think the two easiest things to think about are that the driver for copper is the ascent of humankind to the extent that there are almost eight billion people on earth and more people every day. And to the extent that humankind has a responsibility, I believe, to take the poorest half of humanity and increase their wellbeing, that automatically comes to copper.

Many readers may not know that 1.2 billion people on earth have no access to electricity. And another 2 billion people on earth have access to intermittent or unaffordable electricity. We've done a great job as humankind over the last 30 years in increasing the material for a lot of the poorest of the poor. But we have a lot more to do, and an important transition from a subsistence lifestyle to a more fulfilling lifestyle, at least part of the material translation is electricity, and electricity is copper.

At the same time that we need to continue to increase access to electricity for the poorest half of humanity, the other half of humanity wants to increase their electrical consumption to electric vehicles, power, gadgets, all those types of things. All require copper. While this happens, in other words, while demand for copper is inexorably higher and where the rate of increase is probably increasing, we have under-invested as an industry in copper exploration production for 30 or 35 years.

The truth is most of the world's great copper mines are a bit like me. They're old, they're past their prime. Bingham Canyon has been producing for 120 years. Chuquicamata has been producing for 105 years. Grasberg has been producing for my whole lifetime, which is to say 69 years. You don't stand at the top of a pit, throw in fertilizer and water and have it grow more copper. That's not the way it works.

So five years from now, what you see is that these old behemoths become longer and longer and longer of tooth. While as a consequence of three decades of underinvestment and exploration production, there's nothing to take their place. And if there is something to take their place, increasingly, there are political and economic roadblocks put in front of them. There's a wonderful copper deposit here in the United States called Resolution that the world's been talking about for 20 years. And it's probably 10 years away from permitting and production, not in time to make any difference in a supply outlook.

So, to the extent that one is able to make a copper discovery, the appetite among the major copper producers to buy these projects, to replace the old behemoths, which are long of tooth. And the incredible interest that governments and consumers have in increasing the material wellbeing of their citizens, which is a fancy way of saying increasing demand for copper, means that an intelligently constructed copper exploration royalty development program, I say intelligently crafted. Part of the problem in the last 30 years has been that not only haven't we invested enough money, we've invested most of the money that we've invested stupidly.

So we've been both unwitting and unscrupulous in the mining business with regards to copper. But the result of that is that successful efforts in the copper business pay absolutely tremendous rewards and will continue to, I think. Most people in the west when they think about copper, think about Tesla or something like that. And that's fine. That's wonderful.

I think there is going to be an increasing demand for electrification for well-to-do people. But the real opportunity is increasing the material living standards for the bottom half of humanity. We have an obligation to do it. We've done a good job of it over the last three decades, it's going to continue. And the driver is going to be copper.

David Cole:

I'll point out if you don't mind that Dr. Richard Schodde is our consulting and advisor on the mineral economic side out of Australia, MinEx Consulting. He believes that conservatively, the planet will consume as much copper in the forthcoming 20 to 25 years as has been consumed by humanity throughout all the history cumulatively.

And when you think about that with respect to the under-capitalized situation in the copper industry, it's a very, very dynamic situation. It's very difficult not to be extraordinarily bullish on copper. And Rick mentioned that Bingham Canyon Mine, one of the largest open-pit mines in the world is where open-pit mining was first invented. The globe currently consumes the entire endowment of that deposit annually. So it's an interesting situation for the copper business.

Maurice Jackson:

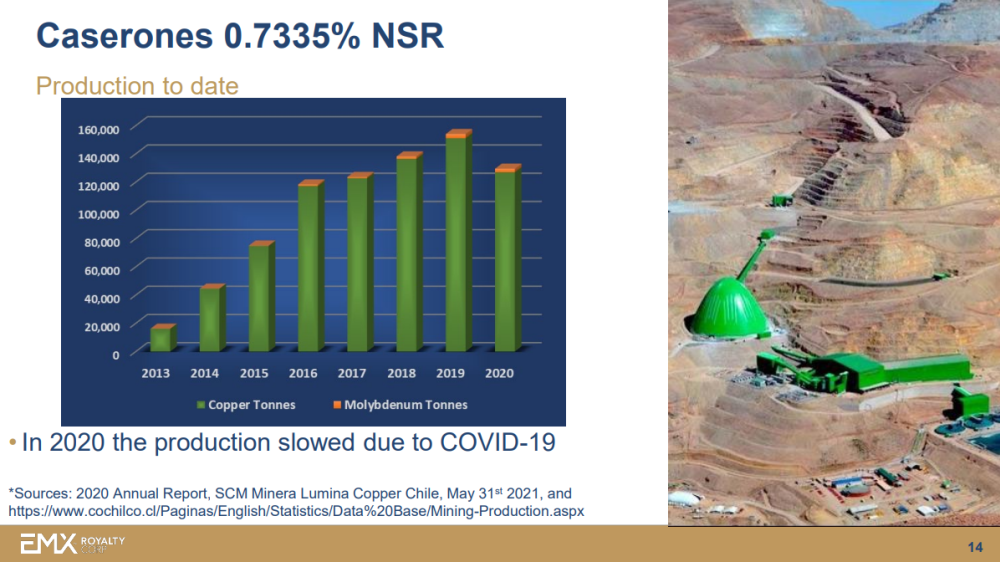

Sticking with copper, Mr. Cole, let's visit the EMX property banking, and get acquainted with some of your royalties beginning in Chile at the Caserones Mine where EMX recently increased its position there. Tell us about the royalty and why the increase.

David Cole:

So well, first of all, as said, we're very bullish copper and have always believed in having a diversified portfolio and copper has been a key component of that. Scott Close, who heads our investor relations team, likes to call Caserones, "Casherones." This is a very long live asset. Officially, it's a 17-year-mine life, but as geologists, we've looked at it. We see 25-plus years of production here just from the existing deposit as it is open-ended at depth, and copper cutoff grades have a long history of decreasing over time because of these various factors that we're pointing out.

So these are very long-lived assets. It's like having a 30-year bond that pays in pounds of copper. And we do see a little bit of upside with respect to production coming from that, but we're very bullish copper prices. And we did have the opportunity to buy at a fair valuation, a 0.4% royalty on that deposit. And then the opportunity came along for us to augment that as additional family members who owned this royalty wanted to sell and liquidate.

“We have under-invested as an industry in copper exploration production for 30 or 35 years.” ~ Rick Rule

David Cole:

And so we had the chance to increase that, and we did it as that next bite was larger than we could afford by ourselves. We brought in Franco-Nevada as a partner, and we have a huge amount of respect for Franco-Nevada. They're the leader in the mining royalty space. And if you would've asked me who's the best company to be a strategic investor in EMX, I would've said Franco-Nevada. Very happy to get them across the line and become a shareholder in EMX, part, and parcel to us taking that further bite and increasing our exposure to Caserones. And that's not our only copper exposure in the world. Of course, we have a royalty on the Timok Project, which is one of the largest ongoing copper-gold discoveries on the planet.

Maurice Jackson:

Why would Franco Nevada the biggest, most successful company in the mineral royalty sector want shares in EMX?

David Cole:

Yeah, everybody asks me this question and Maurice, please feel free to ask them. And the answer to the question, I know the answer. And it comes back to what we were talking about earlier, and that's our hedgehog and that's our organic growth strategy, so our royalty generation work. That's what separates us from the crowd. And that's why we're the only junior or mid-tier royalty company that Franco Nevada has ever bought stock in and hold stock in currently.

“I think there is going to be an increasing demand for electrification for well-to-do people. But the real opportunity is increasing the material living standards for the bottom half of humanity. We have an obligation to do it. We've done a good job of it over the last three decades, it's going to continue. And the driver is going to be copper.” ~ Rick Rule

David Cole:

And we're delighted to have them on board. They've been giving us accolades for the royalty generation's work for many years. We know these folks well from our history. I used to work with some of them at Newmont Mining Corporation, and they would come up to me. David Harquail once said, "Dave, we believe that your royalty generation work is topnotch, and hats off to you for doing that."

And ultimately, it was that that carried him across the line and got them to invest in the company. But ironically, it was associated with a royalty purchase. But Franco Nevada recognized the power and the integration of buying royalties as well as growing them organically to build your portfolio.

Maurice Jackson:

All right, I've thrown you some softballs here. Here's a tough one. EMX has recently deployed a substantial amount of capital lately acquiring cash flowing and/or soon-to-be cash flowing royalties and taking on debt to do so. Does this really make sense in the long-term health of the company? I mean, is this really in the best interest of the shareholders?

David Cole:

Absolutely, absolutely. So, our calculated risk-adjusted internal rate of return on the monies that we've invested into purchasing these portfolios of royalties vastly exceeds the cost of that capital. And speaking of the cost of capital, one of the important goals here is to populate the top of the pyramid, increasing our cash flow, and enabling us to move across that border from a junior company to a mid-tier company with strong cash flows, which will significantly reduce our cost of capital as we are able to form a relationship with major senior banks. And we're in those discussions now.

So this is all part of our strategy to prudently grow our portfolio. And particularly in an inflationary environment, paying a 7% coupon rate to borrow some money to buy things that have double-digit internal rates of return is smart business.

Maurice Jackson:

Rick, as a shareholder, how significant is it when you see Franco-Nevada paying a premium to own a 3.5% stake in EMX?

Rick Rule:

I like good partners. I've been a Franco-Nevada shareholder on and off because of course they disappeared for a while since 1982, and I hold them in very high regard. Dave has done a good job, I think, of attracting other sophisticated shareholders in EMX.

But certainly, I'm attracted to EMX as a shareholder. What price they paid is really a matter of their own concern, the fact that they paid a premium. I think if you look at the nature of the royalty transaction, the premium was explained.

"That's what separates us from the crowd. And that's why we're the only junior or mid-tier royalty company that Franco Nevada has ever bought stock in and hold stock in currently." ~ David Cole

Rick Rule:

But the truth is that in Franco-Nevada, EMX has a partner that should they have an opportunity that is time-sensitive and attractive, they have a partner that could stroke a $250 million check or a $350 million check overnight without blinking an eye.

And a partner that has the sophistication and the courage to be able to do that, that's what's important.

Maurice Jackson:

Rick, we just highlighted copper. What is your outlook on the opportunity before us in nickel?

Rick Rule:

Well, nickel, you could also say is also an electric metal. It's in tighter supply than copper. Most of the marginal nickel production that we've seen in the world in the last 30 years is lateritic nickel, which is nickel that occurs in tropical environments, often in Indonesia and the Philippines. And the production of lateritic nickel is extremely environmentally degrading and also extremely energy-intensive. So you need to break down nickel between lateritic nickel and primary sulfide deposits.

Primary nickel sulfide deposits are very rare and extraordinarily valuable. A primary nickel mine, even at today's nickel, makes an awful lot of money. In the very near term, the nickel price looks inexorably higher because the world's most important nickel producer is Russia. The political difficulties between Russia and the rest of the world, including the fact that because Russia has been kicked out of the SWIFT banking systems means that even if they sell nickel, they can't get paid for it in any currency that they can spend.

But looking beyond that, the uses of nickel in batteries, in stainless steel, in metallurgical applications, nickel is tied very, very directly like copper to the ascent of humankind. But primary nickel deposits are even rarer than high-quality primary copper deposits.

Maurice Jackson:

David, about two weeks ago, EMX announced that it had made a strategic investment in privately held Premium Nickel Resources, which holds a trio of defunct nickel, copper and cobalt mines in Botswana of all places. Now, this seems to be a big deviation from the EMX business model. What's going on there?

David Cole:

Well, it's actually a key part of our business model to make strategic investments. And so it's quite synergistic with our royalty generation work. We've got smart economic challenges around the world, identifying properties to acquire. And occasionally, they come across an opportunity to invest in a company where we cannot, not buy the stock.

And you may recall the investment that we had in Russia of all places, that we liquidated at a substantial profit. That was a strategic investment in an ongoing copper and gold development story. We did exceedingly well on and were happy to have our money out of Russia back in 2018 and have not gone back, I'll point out.

But that's an example of us making strategic investments. Our track record over a nearly 20-year pathway here has been quite good. We've netted out over 50 million USD from our strategic investments. And we've had a couple of bumps on the chin. We're comfortable with taking risks and the wins have far outweighed the losses.

This is our next major strategic investment, absolutely delighted for the very reasons that Rick pointed out to have that nickel exposure. And we think that the premium nickel asset in Botswana is going to be in the top five nickel sulfide systems on the planet. We're very bullish about that opportunity.

Maurice Jackson:

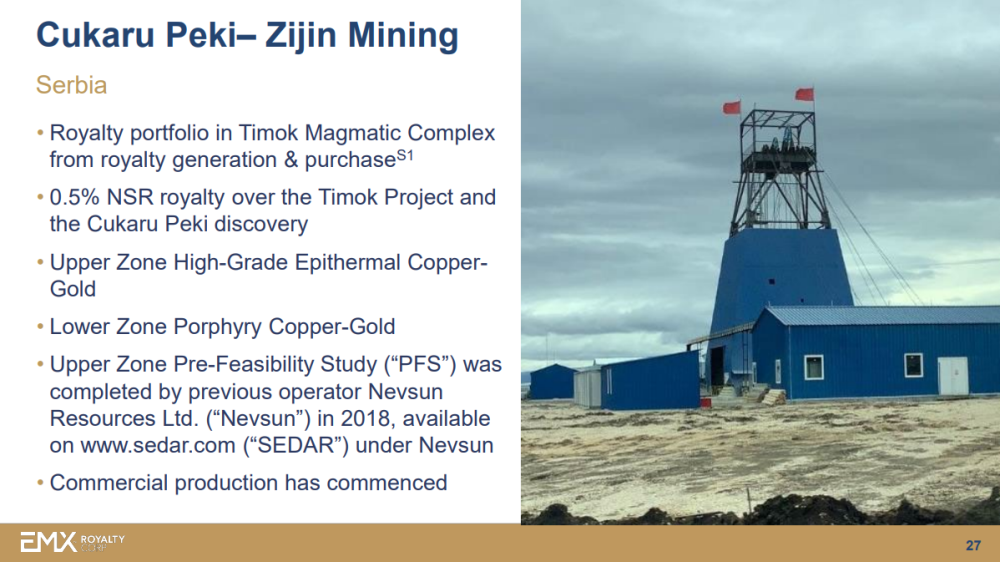

Multimillion-dollar question here, can you provide us with an update on the situation with Zijin Mining in Serbia at the giant Timok copper-gold mine?

David Cole:

Everybody wants to know the answer to that. Of course, I can selectively disclose information, but I can say that we are in negotiations with Zijin. They've been quite professional and communicative to work with, and I'm confident that we'll come to a mutual agreement.

Maurice Jackson:

All right. The Balya silver-lead-zinc mine in Turkey, it's been ramping up for a while now. What's the latest there?

David Cole:

So the exploration results have been phenomenal. The deposit continues to grow. They've decided that they will build a second mill, which we're delighted that will substantially enhance our cash flow long-term. And they are entering into commercial production now. I expect the first royalty check to come in within the next couple of months, actually. And I do expect production to ramp up from multiple underground headings over the course of the next five years. Five years from now, it's going to be a substantial annual royalty for us.

Maurice Jackson:

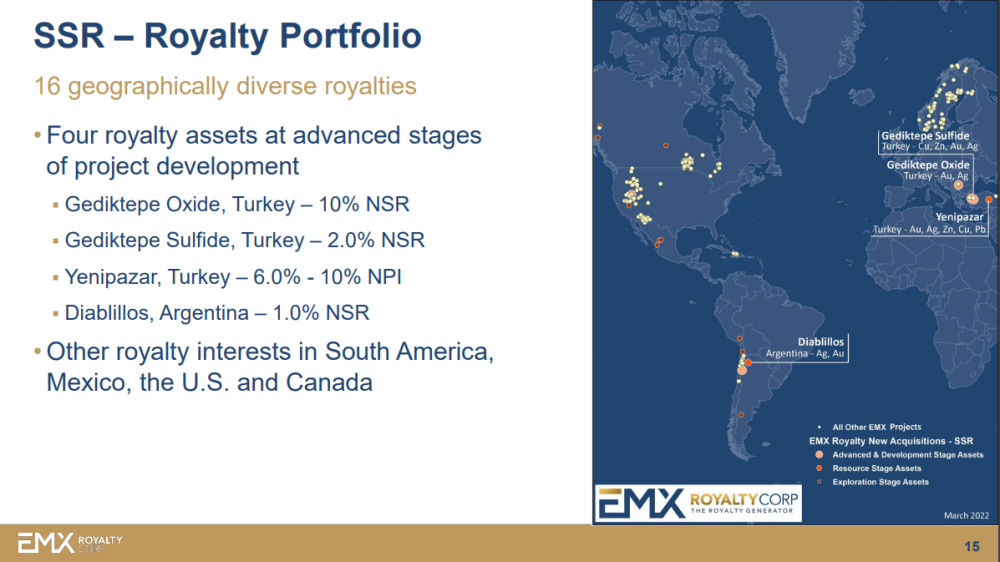

Can you give us an update on the Gediktepe gold oxide and polymetallic mine? And when will this royalty begin cash flowing?

David Cole:

That one's also just a couple of months away, Maurice. And so that's an interesting royalty in that the royalty on the upper oxide zone, which is gold and silver enriched, is 10%. That was part of the sales price when the predecessor to SSR sold that on to the current operator, Lidya, and that 10% kicks in after 10,000 ounces have been poured. And we're right at 4,000 ounces right now. They are in production, they're placing ore on the pad. They did have a tough winter season, so that slowed them down a little bit, but they're only a few weeks behind.

And we're seeing greater production as they head into summer. As soon as they cross the 10,000th ounce, which will be just a few months out, probably June or July, then we'll start to receive royalty payments on that, and that is a 10% royalty. And that's on the upper oxide zone, which we believe will have about a five-year mine life. And then it goes into the polymetallic sulfide zone, which is dominated by zinc and copper, two commodities we love. And that's a 2% royalty in perpetuity on that zone.

So that's another key asset within the portfolio that starts to cash flow in a few months.

Maurice Jackson:

Now that 10% is just remarkable. With all the new royalty cash flow and pending royalties poised to begin paying, what will the cash flow look like for EMX for the remainder of 2022?

David Cole:

Yep. So we will be coming out with guidance in two quarters, and we're diligently working on that. And our bankers are talking to us about that. And that's part of our shelf filing that we're also in the process of, and this is all part of our maturing from a junior company that's been building a portfolio to a mid-tier company with strong cash flows. And so, as soon as we provide that guidance, Maurice, you'll be one of the first to know.

Maurice Jackson:

Right, looking forward to it. Leaving the property bank, Rick, I know you have very stringent, selective criteria for companies that make the grade, if you will, before you will commit your capital. Now, we just heard Mr. Cole referenced that EMX has five attractive royalties and more on the way along with an attractive share price, in my opinion.

That all sounds compelling, but you taught me years ago that the competitive advantage for a shareholder is found in the board of directors, management, and technical team. Why are the people equally, if not more, important to you as a shareholder than the given project, and specifically the team that comprises EMX royalty?

Rick Rule:

Bad people can screw up good rocks. If the wrong team controls the cash flow, they get it and the shareholders don't, simple as that. The second thing, of course, is that luck favors the trained observer. And you need luck in exploration. Dave has done a great job over 20 years. He's a geologist himself, but I would say his true talent is hiring and motivating, and keeping very good geologists.

So, what has always attracted me to EMX has been the technical IQ per dollar of market cap. The fact that although the team has done a decent job of buying royalties, what I think is the real secret sauce is the fact that they have generated royalties by generating 300 exploration concepts that other people have bought into. It can take a decade for prospect generation to work for you. But prospect generation, in my own portfolio, has been by far the most capital-efficient exploration speculation that I have done. What the EMX team did is they figured out a better payment mechanism.

For most of my life, I invested in teams that had great intellectual capital that generated projects, and they ended up getting a carried interest in the project. The problem with that is that they sometimes didn't have the ability to carry the load as the project went into production. And well, they had a lot of exploration expertise, they maybe didn't have construction or development expertise.

What David did is he really simplified the way they got paid. Rather than get paid in the ability to own on a subsidized basis, a minority interested in operation that they may not know how to operate, he developed a circumstance where they got paid a carried interest by way of a royalty, which is ultimately a safer and probably a more valuable instrument.

The same intellectual capital that he has hired and deploys in the exploration business can be used to both sources and evaluate either merchant banking opportunities, which is to say those companies that he invests in strategically or royalties. So I think it's important that the exploration IQ that has been assembled within EMX turns out to be a strategic advantage in moving their asset base forward.

Maurice Jackson:

Now, Rick, we've heard you convey the merits of owning mineral royalties, and we've heard the virtues that EMX royalty presents to the market. Before we close, what did I forget to ask?

Rick Rule:

Well, I think, the important question to ask any company that's beginning to mature is how are the capital allocation decisions made. What would be as, an example, the capital cost assumptions around the debt that they took on, and what sort of pro forma delta would occur between the cost of capital to return on capital employed? How strategically will the decision be made internally as to whether to emphasize the merchant banking business, the royalty generation business, or the royalty acquisition business?

And then finally, I think, the royalty acquisition business is extremely competitive. I would ask Dave to describe the competitive advantage that he may feel against the 30-some-odd other players in the mineral royalty space.

Maurice Jackson:

All right, Mr. Cole. So, you know what's up for our next interview.

David Cole:

It boils down to our alpha, which is on the technical side. And we believe that astute business decisions are rooted in solid technical understanding. And we've always had a strong technical team here at EMX to drive those business decisions so that we can have that astute allocation of capital.

Buy the depths, yeah. As Rick likes to say, you want to use the cycles to your advantage rather than be used by the cycles.

Maurice Jackson:

Mr. Cole, for someone that wants to learn more about EMX royalty, please share the website address.

David Cole:

www.emxroyalty.com, Maurice.

Maurice Jackson:

Gentlemen, it's been a pleasure speaking with you today. Wishing you both the absolute best.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Proven and Probable LLC does accept stock options and cash as payment consolidation for sponsorship. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING, OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.”

All Rights Reserved.

Images provided by the author.

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.