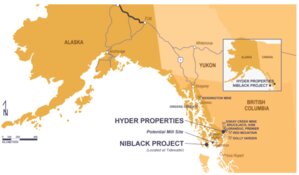

Amidst rising inflation levels not seen since the 1970s, a Russia-Ukraïne conflict that causes commodity market disruptions, and a Fed not sure what to do with interest rates, Vior Inc. (VIO:TSXV; VL51:FRA) remains focused on gold exploration.

The junior recently received the long-awaited results from the Phase I drill program at its flagship Belleterre gold project in Québec, situated about 100 kilometers south of Rouyn-Noranda. Management was happy with the results, highlighted by one bonanza-grade intercept of 0.5 meter grading 55.2 grams per tonne gold (55.2 g/t Au).

In addition, the company completed the first holes of a 4,000-meter Phase II drill campaign targeting the validation of high-grade feeder structures surrounding the past-producing Belleterre gold mine. The core looks encouraging to management.

Vior's Phase I drill program consisted of five holes for a total of 3,857 meters.

Phase I was designed to test the continuity of multiple gold-bearing veins at depth and better define the geological framework of the historic Belleterre mine trend, which has seen limited historical drilling below the 200-meter level.

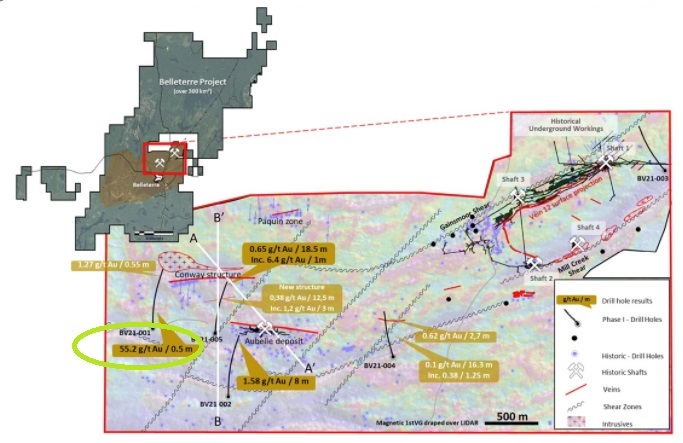

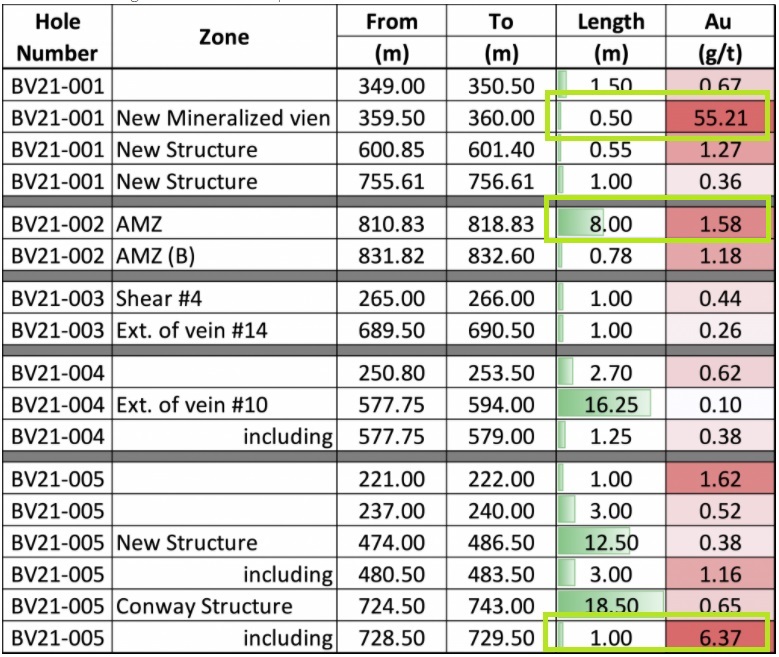

Drilling successfully intersected the down-dip projections of multiple historically mineralized vein structures and other previously unrecognized gold-bearing quartz veins and structures. The full drill results can be observed in the table below:

The highlight — and also the only economic drill result — is hole BV21-001, with 0.5 meter at 55.21 g/t Au. Although the 8 meters at 1.58 g/t Au intercept didn’t look economic, Vice-President of Exploration Laurent Eustache said it (combined with historical data) not only indicates width at depth, but could possibly vector in on nearby mineralization with width at much higher grades.

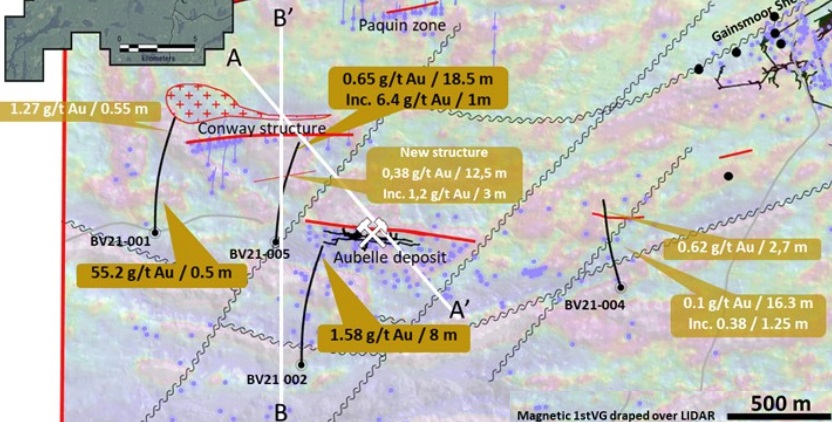

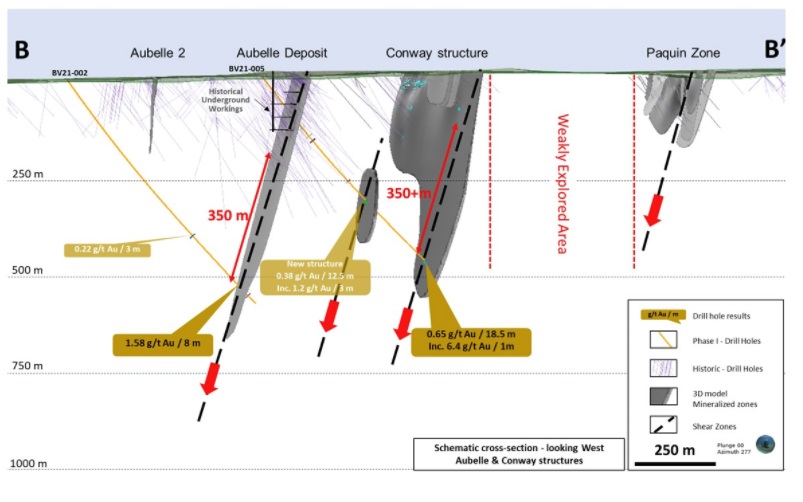

Please note that the holes were drilled under a 50-54 degree dip so the actual depth doesn’t surpass 500 meters. Three out of five holes were targeting the Conway structure and the Aubelle deposit, the trajectories of the sections A-A’ and B-B’ can be seen on this zoomed-in map:

The idea was to target extensions of both mineralized structures at depth, as can be seen below in the B-B’ section:

Although the intersections weren’t spectacular or economic (as a basic threshold, results for vein systems should have a cut-off grade of at least 4 g/t Au and a width of at least 2 meters in order to be economic at current gold prices. Calculation: grams multiplied by meters should equal at least 8 at US$1,950/oz Au), they implied continuity of mineralization, and seem to provide sufficient vectors for management to be encouraged by what they drilled, as CEO Mark Fedosiewich commented:

“Five core holes were drilled in Vior’s Phase I maiden drill program, four of them returned gold intercepts, including two narrow high-grade gold and three thick intercepts of lower-grade gold-bearing quartz veins. Our team is very encouraged by the strength of the gold system, which not only shows exceptional continuity over 350 meters down-dip of the historical Aubelle Mineralized Zone (AMZ) and the Conway vein, but also suggests these zones are increasing in thickness with depth. This initial drill program was a big step towards de-risking the Belleterre gold project, and the structural data obtained from this program will be critical in helping our team vector towards higher-grade vein shoots.”

I wondered what kind of structural data could lead to higher-grade vein shoots in this case.

“The results from the Phase I drill program demonstrated some strong and well distributed gold structures at depth in the continuity of the historical high-grade quartz veins at surface. We have observed wider gold intercepts and are very encouraged by the presence of new mineralized zones between Aubelle and Conway. Evidence of down-dip continuity over 350 meters, new structures in-between, wider gold intercepts and the validation that the high-grade mineralization continues at depth all provide for a strong opportunity for more aggressive exploration," Eustache explained.

He added: "It is an important milestone in the exploration de-risking process and now opens up the untapped exploration potential in the west part of the historical mining trend. These Archean gold deposits are not homogeneous over an entire structure and commonly develop high-grade gold shoots along structural lineaments, and this is exactly where our technical team is now concentrating.”

As most of the targeting seems to be at considerable depths, I asked if directional drilling could be helpful to limit the meters drilled and associated costs. Eustache said that there are still many targets close to the surface, but for targets at depth, there are various strategies that can be used to mitigate drilling costs, such as directional drilling and the use of wedges.

He noted that when a drill intersects good-looking gold mineralization, the company can avoid re-drilling the beginning of a hole by deviating from the mother hole with another leg, in order to investigate potential mineralization continuity in the surroundings.

Besides these first results coming from the Phase I program, Vior completed several drill holes from its 4,000-meter Phase II program.

The program targets confirmation and step-out drilling along the projected extensions of multiple past-producing gold-bearing vein structures of the historic Belleterre gold mine.

After visual inspection of the core, several vein structures appear to be intersected. Apparently the visuals justified several samples being rushed to the assay labs, so it wouldn’t surprise me if some visual gold was observed. Visual gold often generates grades above 10 g/t Au so I’m curious what results will be reported.

Management anticipates having the first of these assays back in three or four weeks. I wondered if these assays were part of the four holes targeting the 12W vein extension at depth.

“We have increased the number of holes drilled in the 12W vein extension from 4 to 6 because of the very encouraging vein structures that we encountered, and have sent some rush samples from from three of these holes to date,” Fedosiewich said.

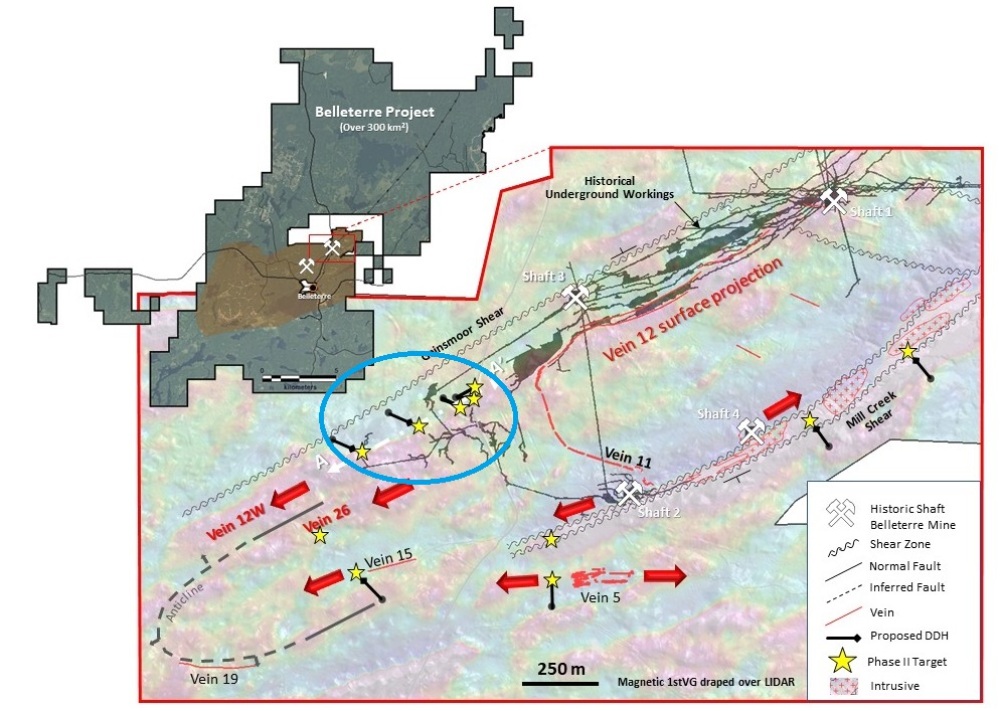

The Phase II drill program consists of 10 high-priority drill targets totalling over 4,000 meters and is focused on the former Belleterre mine concessions. These holes are outlined below:

- Six (from the previously planned four) holes are testing the southwest extension of the 12W vein (see Figure 2 and 3 below). This structure is interpreted to be the extension of the main historical high-grade mineralized horizon of the past-producing Belleterre mine, where the majority of gold production occurred. Vein 12W is also parallel to the regional Gainsmoor deformation shear zone, which is interpreted as a key structural control to mineralization for the greater Belleterre district.

- Three holes are testing the Mill Creek shear zone, which parallels the Gainsmoor deformation shear zone and hosts multiple historical high-grade veins accessed via two of the four shafts of the former Belleterre gold mine. Two of the three holes will test the northeast extension of the structure and will be located within 250 meters of shaft 4 and spaced 400 meters from each other along the structure where intrusives and associated gold mineralization have historically been recognized. The third hole, a greater than 300-meter step out from shaft 2, will test the southwest extension of the mineralized structure (see Figure 2 below).

- One final hole will test a 400-meter step out to the southwest extension of veins 15 and 26, where both zones have been historically under-explored (see Figure 2 below).

Figure 2 can be seen here, showing the Phase II drill targets and their context:

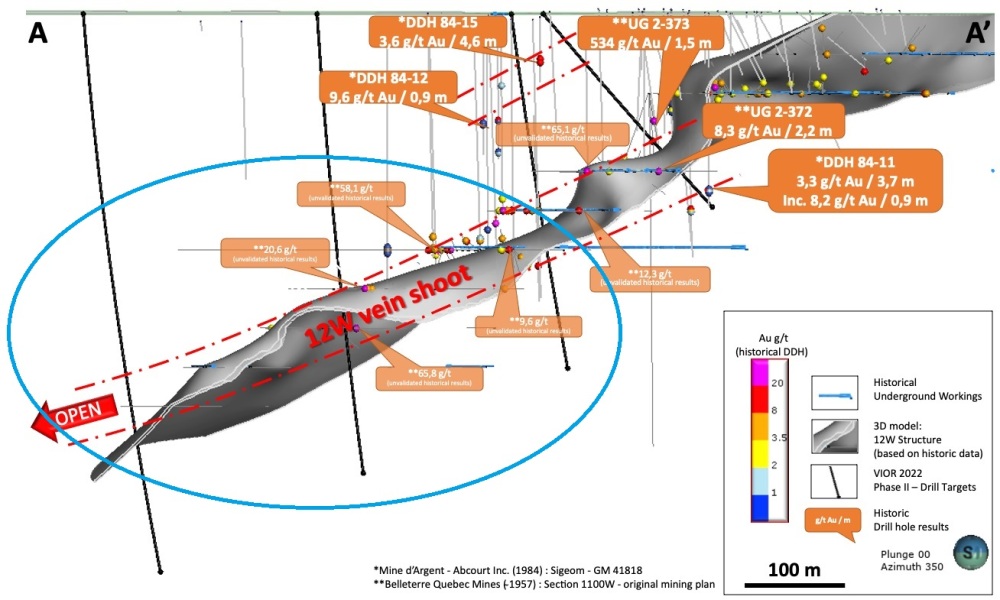

In my view, the six holes testing the Vein 12W strike to depth could be the most meaningful, as most of the mined out mineralization was produced from this very vein in the past, likely with gold left behind in the shoot.

Lots of historical drilling intercepted short, high-grade mineralization, with grades like 20.6 g/t Au, 58.1 g/t Au and 65.8 g/t Au, mostly 100 meters below the deepest mined out level, as shown in Figure 3 below (which shows historical high-grade mineralization in a three-dimensional model):

Previous drilling did not exceed 250 meters below surface — and as Belleterre has been mined to a depth of 750 meters and gold mineralization in the Greenstone Belt in Québec often continues to depths much deeper than that — management is excited by the low level of exploration at depth on the historic mine trend, as continuity of mineralization often provides a high chance at exploration success.

Therefore this could well be one of the most effective and least risky exploration strategies out there, which is exactly what you need being a cash-burning junior like Vior. I like this sound strategy very much. Let’s see what Belleterre has in store at depth.

Eustache also provided an update on Vior's lower-priority Skyfall project.

“We are still working on the geophysical data reprocessing and are not yet ready to elaborate on our advancements. We will return to the field late spring/summer in order to gradually advance it, and will update the market with our more detailed field strategy at that time. This has everything to do with our current focus, as we will be stretched with all of our personnel at Belleterre during the ongoing exploration program over there,” Eustache said.

The current cash position of Vior sits at around CA$2.8M, and the company is cashed up at the moment to complete the current Phase II 4,000-meter drill program, as well as a summer field program at Belleterre. A big advantage for Vior is the low all-in cost of diamond drilling in Québec's lower Abitibi region, coming in at about CA$160 per meter.

There are also significant tax incentives for flow-through capital raises dedicated to exploration in Québec. This enables the company to raise at a significant premium, thereby limiting dilution.

Management is already contemplating a Phase III drill program for Belleterre, which will need additional funding, somewhere in the near future.

Conclusion

The first batch of drill results wasn’t the most impressive, but it confirmed the validity of the strategy Vior management is pursuing: seeking gold mineralization at depth below an existing (in this case mined out) deposit, as is often the case with Greenstone Belt projects in the Abitibi in Québec. Even the lower-grade intercepts provided valuable vectoring information for Vior’s geologists to establish sufficient continuation of mineralization of veins at depth. The ongoing Phase II program, focusing on the area directly adjacent to the historic mine, predominantly producing from Vein 12W at the time, already provided the company with such visually interesting cores that it decided to rush the assays. With the results expected back from the labs within 3-4 weeks, it could be an interesting summer for Vior. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Vior's resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Vior or Vior’s management. Vior has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.