Assays on grab samples taken by Blackwolf Copper & Gold Ltd. (BWCG:TSX) at its Cantoo property, near Hyder, on the Alaskan side of the “Golden Triangle” returned up to 30.4 grams per tonne gold, 2,860 grams per tonne silver and 5.8% copper (30.4 g/t Au, 2,860 g/t Ag and 5.8% Cu) from material eroding from stacked veins as much as 30 meters wide.

Denver-based Crescat Capital owns slightly less than 10% of Blackwolf and the firm’s Geologic and Technical Director, Quinton Hennigh, is effusive about the assay results.

“I like the Cantoo project a lot. The relatively flat vein that they've found there looks fantastic,” Hennigh told Streetwise Reports. “Reminds me of Goliath Resources Ltd.'s (GOT:TSX.V; GOTRF:OTCQB; B4IF;FSE) Surebet Discovery southwest of Hyder on the Canadian side of the border.”

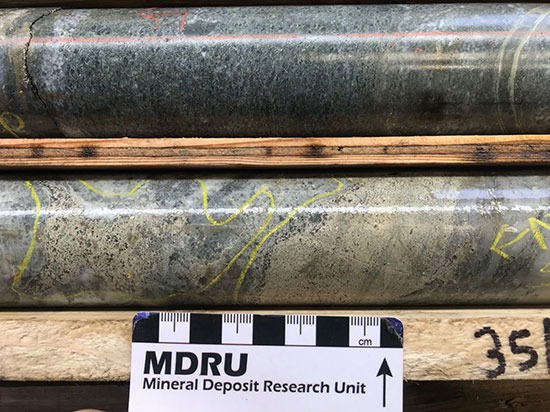

The veins at Cantoo have been traced more than 500 meters along strike and Blackwolf considers them high-priority drill targets.

At the Solo property, not far from Cantoo, grab samples assayed up to 10 g/t Au and 7,910 g/t Ag from a zone of quartz veining and alteration over a strike length of 535 meters. It remains partially exposed under snow and ice.

“Cantoo is one of the best projects I've seen in the Golden Triangle. I can't believe it's still there. It's never been drilled tested, it's got big, wide veins and it is adjacent to the Premier gold project that's currently in development by Ascot Resources Ltd. (AOT:TSX.V), literally right across the border (in Canada),” Blackwolf President and Chief Executive Officer Rob McLeod told Streetwise Reports. “We intend on drilling it this year.”

Indeed. Blackwolf is currently permitting drill pad locations to test the stacked vein structures.

Similar grades were found in samples from Blackwolf’s Doghole property, one of several showings on the Texas Creek claim block. The most promising one assayed 11.3 g/t Au and 530 g/t Ag. The claim was named after a creek that flows from the nearby Texas Glacier.

Blackwolf describes the high-grade veins at Cantoo and Solo as sharing geological similarities with the high-grade structures at the Brucejack gold mine on the Canadian side of the Golden Triangle.

Brucejack, and the considerable land package surrounding the high-grade mine, was bought late last year by Australian mining giant Newcrest Mining Ltd. (NCM:ASX) when it acquired Pretium Gold for $2.8 billion or $18.50 per share — a 23% premium to the closing price the day before the takeover offer.

Newcrest also owns 70% of the Red Chris copper-gold mine, a few hundred kilometers northeast on the Canadian side. Imperial Metals Corp. (III:TSX) owns the other 30%.

Blackwolf geologists spent three weeks at a fly-in camp in 2021 to gather the Cantoo samples and complete reconnaissance mapping. Many of the targets were generated from proprietary, historic maps owned by CEO Rob McLeod, who grew up in the area. The lack of personnel at assay labs kept Blackwolf from the releasing the results until early this year.

About 240 rock samples and 100 soil samples were collected across the Texas Creek and Cantoo properties. Surface sampling was centered on the Cantoo, Solo, Silver King, Double Anchor, Blasher, Iron Cap and Doghole showings, all of which have seen virtually zero modern-day exploration.

Yet Cantoo and Solo will continue to play second fiddle to Niblack, Blackwolf’s flagship volcanogenic massive sulphide (VMS) copper-gold-silver-zinc project on Prince of Wales Island off the coast of southeastern Alaska.

Resource expansion drilling last summer in the Lookout zone — the biggest deposit at Niblack — intersected much wider intervals than previous modelling would suggest, while exploration drilling down-dip of the deposit encountered encouraging base and precious metals intervals.

Two highlights from resource expansion drilling at the Lookout zone include:

- 27 meters averaging 1.06% Cu, 1.87 g/t Au, 32.83 g/t Ag, 1.04% Zn or 3.08% copper-equivalent (CuEq) in hole 226. A higher-grade 4-meter interval inside the 27-meter intercept averaged 2.61% Cu, 4.93 g/t Au, 76.58 g/t Ag, 2.34% Zn or 7.69% CuEq.

- Hole 227 hit 32.6 meters averaging 1.03% Cu, 1.49 g/t Au, 26.54 g/t Ag, 0.92% Zn or 2.67% CuEq. It included a 3-meter interval averaging 2.37% Cu, 3.29 g/t Au, 58.97 g/t Ag, 1.42% Zn or 5.78% CuEq.

BlackWolf used metal prices of US$3.25/lb Cu, US$1,600/oz Au, US$1.15/lb Zn and US$20.75/oz Ag to make its copper-equivalent calculations.

The Lookout Zone, situated near the top of a mountain, hosts a large trough of polymetallic semi-massive to massive sulphide mineralization. It hosts consistent widths of copper-gold-silver-zinc mineralization that is more than 120 meters thick at its widest point.

That consistency leads company management to believe Lookout could be mined by bulk-tonnage underground methods — the closest one gets to an underground open pit.

The current National Instrument 43-101 resource at Lookout is 5.6 million indicated tonnes averaging 0.95% Cu, 1.75 g/t Au, 29.52 g/t Ag and 1.73% Zn, with an additional 2.4 million inferred tonnes of 0.73% Cu, 1.42 g/t Ag, 21.63 g/t Ag and 1.17% Zn.

Blackwolf is updating the resource estimate to include multiple rounds of drilling on different zones, expected to be released in the coming weeks.

A higher-grade core hosts 1.2 million indicated tonnes averaging 1.7% Cu, 3.2 g/t Au, 62.6 g/t Ag and 3.8% Zn.

Drill holes 225 and 228 at Lookout were exploration holes drilled up and down-dip, respectively, as step-outs from a massive sulphide interval in historical hole U-074, which had previously intersected 1.5 meters averaging 2% Cu, 3.3 g/t Au, 90 g/t Ag and 23% Zn.

Hole 225 intersected 2.66 meters averaging 0.11% Cu, 0.36 g/t Au, 13.47 g/t Ag and 1.34% Zn, while hole 228, which went a bit deeper, intersected a broader interval of 12 meters averaging 0.13% Cu, 0.45 g/t Au 5 g/t Ag and 0.25% Zn, including 2 meters averaging 0.62% Cu, 1.07 g/t Au, 11.4 g/t Ag and 0.52% Zn.

These holes are between 75 and 100 meters below the current mineral resource.

Lookout is one of six major massive sulphide showings at Niblack, all of which have seen some manner of exploration over the years.

Copper ore — at grades as high as 5% — was mined at Niblack in the early 1900s and loaded onto barges for processing at an on-shore mill. Declining metal prices shuttered the operation in 1908.

Since then some legendary miners have taken shots at it: Anaconda Mining Inc. (ANX:TSX), Cominco (before it was Teck-Cominco and then just Teck Resources Ltd. (TECK:TSX; TECK:NYSE)); Canadian base metals stalwart Noranda (now Xstrata Plc (XTA:LSE)) and Lac Minerals (a former subsidiary of Barrick Gold Corp. (ABX:TSX; GOLD:NYSE)) even formed a joint venture to co-develop Niblack.

In 1995, Canadian miner Abacus Minerals acquired the Niblack interests from both Lac and Noranda and drilled more than 100 holes there. It published a resource in 1997 but again metals prices stalled momentum.

Abacus spun out Niblack Mining in 2005 and in 2008 the spinout was acquired by Committee Bay Resources (now Auryn Resources Inc. (AUG:TSX; AUG:NYSE)). The global economic downturn later forced Committee Bay to option the project to Heatherdale Resources Ltd., which has since become — you guessed it — Blackwolf.

“Many of the great mines and deposits, certainly in North America, have had numerous owners that advance things to a certain stage and then economic conditions change. Like, say, Canadian Malartic, it used to be an underground mine but then they decided to go with an open pit,” McLeod said.

The plan is to eventually mine ore at Niblack and ship it by barge it to a mill either in Alaska or across the border in Canada. Whose mill? That’s the question.

“As far as developing a mine, (Blackwolf) needs a path to process it. The big challenge in developing a mine would be putting in a mill. It would take an extraordinary effort to permit in a mill these days, at least in that area. What does it mean? Well, it means that somebody needs to build a mill, somewhere in that region, maybe even on the Canadian side. And then there's a case for a centralized hub and spoke mining operation there,” Hennigh said.

Getting the project to that stage will require capital.

Other than Crescat, Blackwolf is backed by some noteworthy institutions, including mining financier Frank Giustra’s Giustra Trust with 4.3% and Vancouver-based Delbrook Capital with just less than 10%. Insiders and close advisors also have significant skin in the game, holding slightly more than 20% of the company.

Vancouver-based Couloir Capital recently started covering Blackwolf with an initial "buy" rating and a fair value per share estimate of CA$1.28 apiece.

Fully diluted, Blackwolf has 37.2 million shares outstanding and trades in a 52-week range of $1.51 and $0.50.

Sign up for our FREE newsletter

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Blackwolf Copper & Gold Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.