With the uranium spot prices reaching multi-year highs at the moment, probably with the help of the Sprott Physical Uranium Trust which keeps on buying at the spot market in order to kickstart utility buying, Blue Sky Uranium Corp. (BSK:TSX; BKUCF:OTC; MAL2:FSE) is finding new mineralization at Ivana targets at their flagship Amarillo Grande uranium project in Argentina.

Although most uranium stocks haven’t really reacted to the latest jump of the underlying commodity, as general sentiment is somewhat overshadowed by skyhigh inflation, war sentiment and fear of Fed interventions, as soon as the markets regain their confidence, uranium stocks should be among the ones with explosive potential, as at current uranium spot prices at least most uranium projects and mines become economic.

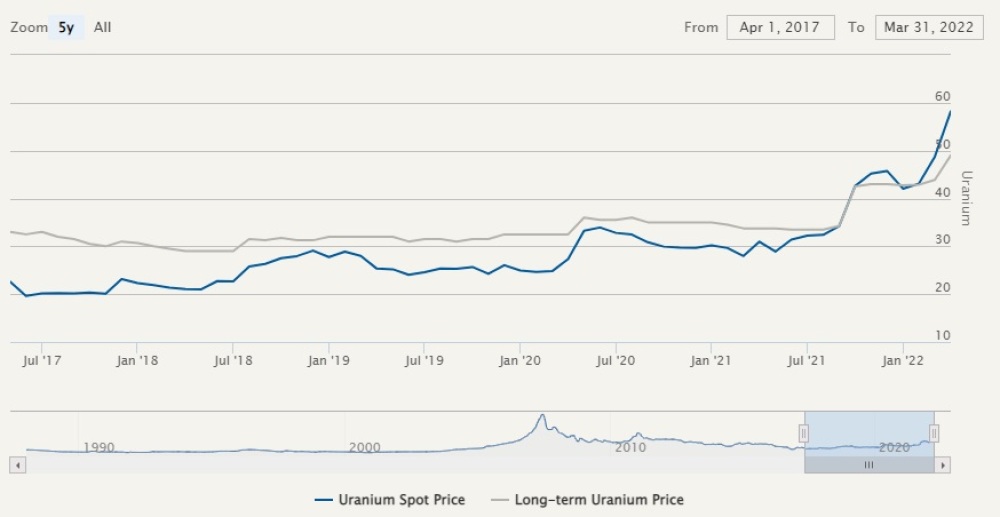

All moves of the uranium oxide spot price are represented nicely on this up-to-date chart provided by Tradingview, taken from my website.

Of course, the price that really matters for projects and mines is the long-term contract price, which somewhat deviates from the spot price. At the moment, this long term price is standing at US$49/lb O3U8, as per this Cameco chart:

A US$50/lb U3O8 price point for the long-term contract price is a very important threshold for many projects and mines, more specifically the better ones. The second league needs a US$60/lb U3O8 long-term contract price, so the entire business isn’t safe yet. Fortunately for Blue Sky Uranium, their project PEA is based on a base case US$50/lb U3O8 scenario, rendering it economic today.

In anticipation of the upcoming uranium bull market, Blue Sky Uranium is working hard to expand their Ivana deposit, and the most recent drill results appear to confirm they have found another high-grade hot spot, 1.5km away from the Ivana Central zone.

Please note: the views, opinions, estimates, forecasts or predictions regarding Blue Sky’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Blue Sky or Blue Sky’s management. Blue Sky Uranium has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

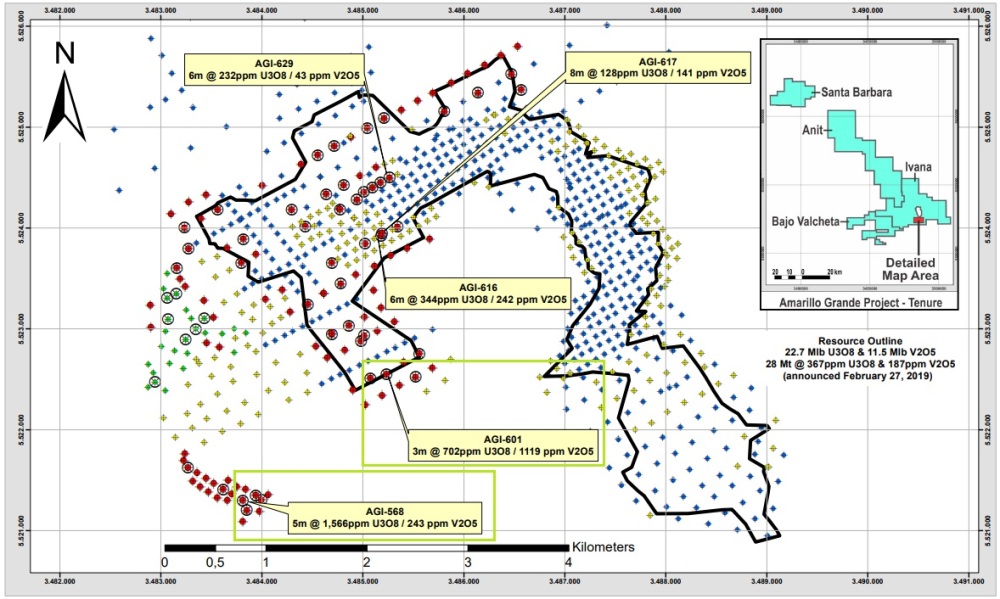

On March 23, 2022, Blue Sky Uranium announced the completion of their 3,255m RC drill program for 350 holes at Ivana Main, bringing the total amount of drilling at 10,877m for 838 holes at this target. Drilling at Ivana North and Central is continuing as permitting was granted in March of this year. The company still has 1,200m of RC drilling to go in order to complete their 4,500m program.

The latest news release discusses the second batch of RC drill results for Ivana Main, more specific 115 holes for 978m drilled. Of these 115 holes, most had convincing vanadium grades, but only a small portion (13 holes surpassing the cut-off grade) was economic for uranium grades, as the average grade of the Ivana deposit is 367ppm U3O8, and the cut-off grade 100ppm U3O8. There were a few noticable outliers though, with the highest grade intercept located at an area 1.5km from the Ivana deposit:

- 5m averaging 1,566ppm U3O8 and 243ppm V2O5 in hole AGI-568, located more than 1.5kilometres from the southwest margin of the current mineral resource

- including 7,027ppm U3O8 and 236ppm V2O5 over 1m

- 3m averaging 702ppm U3O8 and 1,119 ppm V2O5

- including 1,774ppm U3O8 and 1,981ppm V2O5 over 1 m in AGI-601

- 6m averaging 344ppm U3O8 and 242ppm V2O5

- including 933ppm U3O8 and 109ppm V2O5 over 1m in AGI-616

- 8m averaging 128ppm U3O8 and 141ppm V2O5

- including 562ppm U3O8 and 30ppm V2O5 over 1m in AGI-617

- 6m averaging 232ppm U3O8 and 43ppm V2O5

- including 448ppm U3O8 and 16ppm V2O5 over 1m in AGI-629

These highlights can be seen on this map, including the 2 best intercepts marked in green:

Considering the southwest location of both highlights, it might be the case that a more high-grade trend could be present in this area, maybe even connecting both locations. CEO Cacos was enthusiastic about these higher-grade intercepts, as he commented the following:

“The western side of the deposit is mainly represented by superficial strongly oxidized lower grade mineralization, where the eastern portion of the deposit comprises deeper and higher grades and weakly oxidized material. This high grade intercepted at 1.5km to the southwest (in an area with other holes intercepting uranium) is the highest grade observed for this western sector, and it may represent high uranium grade patches within of oxidized material with lower grade, always in the first 5 to 10 meters in depth (superficial).

This sector is also showing vanadium grades above the deposit average, and based on the type of minerals including vanadium (for example carnotite, a uranium vanadate) it may represent a sector with higher processing recovery related to the average for the deposit (carnotite is leachable). Therefore, this entire western sector, comprising patches with higher grades of uranium and in general higher grade of vanadium, requires a specific review (or fine-tuning) of its economic potentiality if considering that uranium to vanadium price relation is actually 1 to 5 (U:V) and because it is superficial mineralization, potentially mined at very low cost.”

As no holes are planned in this southwest area, I wondered if management had any plans to explore this area soon. CEO Cacos answered: “We are now focused on completing the drill program we had planned for Ivana Central. Following that campaign, we will review all results and design a new program to follow up on all deserving results.”

Despite only 13 out of 115 holes reaching the cut-off grade, CEO Cacos was pleased with the results:

“We are very pleased with these recent results, which indicate great success in all aspects of the program. New strong uranium and vanadium mineralization both within the deposit margins and in a large step-out hole confirm the potential to both expand and upgrade the Ivana deposit. We look forward to the final results of the program that will help us plan the next steps in the process for this remarkable deposit and project.”

I wondered why he was so pleased, as the step-out hole was clearly good news, but most of the infill didn’t make the cut-off grade. He answered that the grades observed within the deposit follow the type grade observed for those zones, with exception of the southern holes that may potentially expand the deposit in that direction. According to CEO Cacos, they were pleased to get good high grades as it is always indicative of the potential to make new discoveries. In this case, they need to properly review all the results and investigate the scale of the uranium occurrence in this region.

As a reminder, the current resource stands at 22.7M lbs U3O8 Inferred. The 2019 PEA, based on this resource, shows a decent post-tax NPV8 of US$135.2M, with a robust IRR of 29.3%, at US$50/lb U3O8. Keep in mind management aims at expanding the resource from 22.7M lbs to 75-100Mlbs, so lots of exploration drilling needs to be done first.

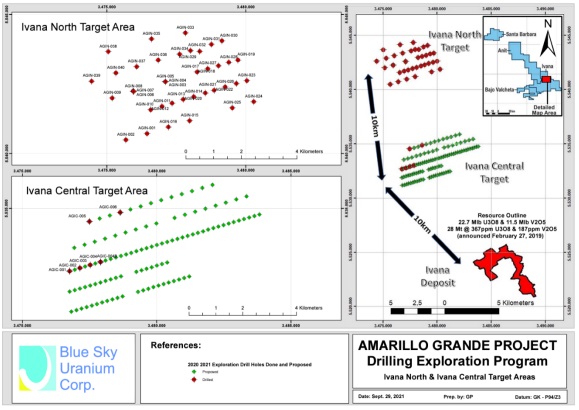

Besides the completed and reported results for the Ivana deposit, the 4,500m program at the Ivana North and Ivana Central targets plus two other nearby targets is the main focus for now to find more mineralization: (red indicates assays reported, blue represents the assays pending):

According to management, 209 holes were completed, and 2,300 samples were recently dispatched to the labs, with results expected back in a month. For this program, I was wondering if the program could go deeper if the results indicated potential for this, as discussed in my last article. CEO Cacos answered: “Yes, testing at depth is always an option, as we believe there is significant potential for uranium discovery below the current deposit.”

The treasury currently stands at an estimated C$0.6M, which should just be sufficient to complete the remaining drill program. The company expects to go back to the markets to raise approximately C$3M fairly soon, likely in April/May. These funds will allow further exploration and drilling, as well as pay for the baseline environmental studies that will be required for the upcoming Pre-Feasibility Study, which will commence in Q4 of this year.

Conclusion

With the second batch of Ivana Main drilling coming back from the labs, results were mixed, as lots of infill drilling showed intercepts with grades below the cut-off grade for the existing resource statement. However, Blue Sky Uranium also discovered a new high-grade area to the southwest of the Ivana deposit, and hopes to extend mineralization over there. Lots of assays are expected to come back from the labs soon, so let’s see if management succeeds in finding more mineralization at Ivana Main, but also Central and North. With the Sprott Physical Uranium Trust, the Russia-Ukraine conflict and sky-high inflation pushing uranium prices to multi-year highs at the moment, Blue Sky Uranium seems to be in a good position.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All currencies are in US Dollars, unless stated otherwise.

All pictures are company material, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Dolly Varden Silver's NPV and resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Dolly Varden Silver or Dolly Varden Silver's management. Dolly Varden Silver has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Blue Sky Uranium Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Sky Uranium Inc., a company mentioned in this article.