If you take the time to read through all of the commentary on silver that is freely accessible via the myriad of social media outlets and popularized content providers, you come away totally bewildered by the vast array of opinions, arguments, and theories covering silver’s role in the world monetary kingdom as well as its applications in the electrification movement and technology in general. As a commentator, I am astounded at the lack of actual research applied by many of my colleagues to the actual economics of silver and while newcomers to the world of investing have gravitated to the (mis)use of the phrase “due diligence”, the evidence abounds that they have no real understanding of the phrase and what it actually entails.

"The same group that ramped AMC for $2 to $70 on gaseous vapors of hopium are now being hand-delivered on a silver platter the singular most promotable, ramp-able, moon-rocket-of-a-stock owned by mining legend and billionaire Eric Sprott..."

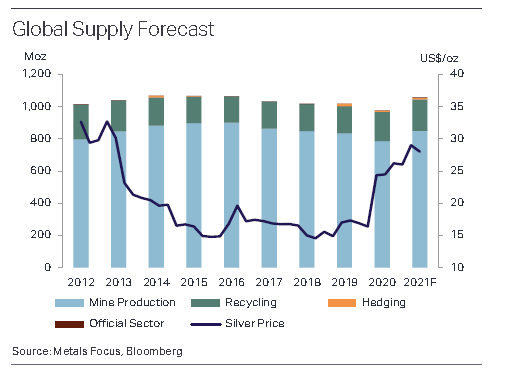

I read an article this week that had the author hyperventilating through an overheated keyboard over the assumption that all of this currency debasement was going to exacerbate the “current global shortage situation” (in silver). As I vainly attempted to avoid choking on the mouthful of Cabernet-Sauvignon I was “sipping,” I thought to myself “What publications could this chap be reading and in what decade were they penned?”

I had just finished reading a fascinating article on “Kupferschiefer-style” mineralization which occurs in the region near the Germany-Poland border which carries approximately ten parts copper for every one part silver, but based upon the sheer volume of this style of mineralization, it has been determined that it constitutes the largest historical silver resource on the planet. The significance of this lies in the fact that these deposits are primarily copper deposits carrying silver credits along with them so while we are commonly shown what are deemed to be “stand-alone” silver deposits as part of a junior’s marketing pitch, the silver supply is dominated by base metal operations.

I recall back in 2013 while attending the Prospector and Developers’ Convention in Toronto speaking to a Glencore executive about a 30-million-ounce silver deposit in Peru and just at the point where I was about to deliver my “knockout punch”, he held up both hands and proceeded to tell me that Glencore’s zinc operation in Peru had slag heaps (waste dumps) with ten times that amount of silver that were viewed as “unremarkable” at best. I skulked away to the Royal York Hotel’s famous “Library Bar” to drown my embarrassment immediately thereafter.

In the history of global mining, there has never been a “global silver shortage”. Unlike gold, where most of the metal ever mined now resides in vaults controlled by the central banks, silver enjoys no such controls so every ounce produced has to find either a monetary or industrial buyer.

So, when a new player to the world of silver starts tripping the light fantastic in a celebratory jig about the outlook for silver prices, I look for remarks about supply as a queue to proceed with the article. Furthermore, if the word “shortage” appears in the first two paragraphs, I move along.

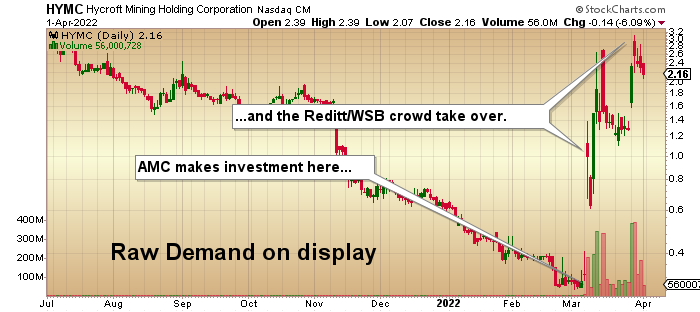

Now that I have cloud-seeded the first part of this missive with what might be construed as a “bearish” tilt toward the silver market, it is the other side of the equation that has my attention (and what prompted me to buy a few silver contracts this week) was the implications for pricing that could develop in upcoming weeks and months by the arrival of unanticipated demand. What steered me in the direction of the possible resurgence of such demand was a development that has left me totally aghast - the performance of a heretofore uninteresting junior gold developer called Hycroft Mining Holding Corp. (HYMC:NASDAQ).

For those unfamiliar with the details, a company historically involved in movie theatres, AMC Entertainment (AMC:US) caught the attention of the Reddit/WSB crowd and ramped the stock from under $2 in early 2021 to over $70/share for absolutely no fundamental reason but in doing so raised a mountain of fresh capital in its wake. I applaud the decision to use the pump as a funding conduit but that is where my adulation goes off a cliff.

On the giddiness of a fat treasury after years of “subsistence farming”, AMC decided to foray into the perilous halls of the junior mining menu but with all of the asset-rich, valuation-challenged junior miners all scrambling for attention, AMC opted to take a material chunk of Hycroft (formerly bankrupted disaster stock Allied Nevada Corporation).

Now, publications with far greater sway and influence than the GGM Advisory have already lined up the AMC/Hycroft deal in their crosshairs and have roasted the deal and the Hycroft Mine with total acidity and malice of intent. That mine is unquestionably “challenged” in terms of both metallurgy and optics – and – if we are to believe the armchair mining analysts that decided to assail the deal – it will undoubtedly crush anyone that takes a position.

That was all at around $1.30 per share and even I was tempted to inquire of the loan post at the firm I use if I could borrow a few hundred thousand shares in order to profit from the impending crash in the stock – and then it hit me. The same group that ramped AMC for $2 to $70 on gaseous vapors of hopium are now being hand-delivered on a silver platter the singular most promotable, ramp-able, moon-rocket-of-a-stock owned by mining legend and billionaire Eric Sprott in the form of HYMC and because they know nothing about mineral economics, they are free to trust only in the power of their investor community which, after the AMC ride, allows the court of investment judgement to be determined only by price and volume.

On March 27, HYMC traded at $3.10 and closed out the week at $2.16. That is up 138% or 66% from the price when the Doomberg group (amongst others) issued the death sentence.

What that tells me is that silver needs no supply-demand equilibrium in order to make money. Silver needs nothing in the form of “fundamentals” nor does it require investors to conduct anything that might come close to resembling “due diligence”. With all of the cash sloshing around the system from incredible market moves like AMC and Gamestop and Tesla, based purely on momentum and FOMO, all that is required are the steely nerves of the novice crap shooter, because silver’s future lies in the randomness of the riverboat casino or the back-alley dice game. Why should we not take a position in silver, where the key to performance lies in the sudden unexpected appearance of monstrous, unbridled demand?

Given that skyrocketing base metals prices are encouraging the mobilization of formerly sub-economic supply, will the arrival of this possible new supply also stimulate the accompaniment of the silver bi-product? Who cares? Fundamentals do not matter. I think not. If the old adage of “safety in numbers” can be applied to gang warfare, it is of even greater significance in the stock pump game and if there us one thing that HYMC and AMC have demonstrated to the investment world with the utmost of emphasis and strength of purpose, it is that size matters.

If your investor group decides that as a collective, they are going to revalue a worthless corporate issuer to a level considered borderline fraudulent, then let free market capitalism live on and reward the believers.

For this reason, I think silver is going to hit $50 per ounce in the next move because a bunch of video-game-trained Millennials figured out how to vanquish the “bosses” in the form of traditional Wall Street power brokers known as bullion banks. In late February of 2021, the SilverSqueeze movement went into a gunfight armed with machetes and got taken out behind the proverbial woodshed. However, they have recently regrouped and reinforced their ranks with profits taken in the rise to all-time highs in many if the “meme stocks”.

The ascendancy of Hycroft Mining to a market cap of absolute absurdity represents the sounding of the clarion call of the advancing armies being called to service and it is with great irony that that I declare that there is absolutely no reason from either an economic or event-driven perspective that this move will occur.

I cannot provide time frames or price objectives with any real clarity or certainty but at the end of the day, this is what happens when citizens the world over lose all respect for the integrity of their home currency. When the fear of losing money — i.e. the recognition of risk — vacates the marketplace, it is because money has lost its scarcity value. When central banks are allowed to create currency and credit with little or no controls or limitations, that scarcity value evaporates and bubbles — one after the other — come rushing in.

My greatest fear is the point in time when people lose all interest in earning a living because government eliminates the requirement for the “earning” part. What history has shown regarding all financial crises since the Crash of ’87 is that it is the responsibility of the government to protect investors from any and all risks, be they subprime banking fraud or health issues such as the 2020-2022 pandemic. Now, with inflation raging at nearly 8%, they are considering stimulus cheques designed to offset the impact of rampaging fuel and food prices proving once again that these legislators have never taken and certainly never passed any courses in economics.

I know that there are many gifted analysts out there that can provide relevant statistical reasons for owning silver and I recognize that my disillusionment with traditional fundamental analysis may come across as a blasphemy of sorts, but until the sanctity of money and respect for savings have been restored by a return to the principles of sound money and prudent fiscal behavior, I will no longer attempt to provide a logical rationale for ownership.

Instead, I will simply remember the immortal words of the croupier when the right number shows up in that wonderful carpet of green felt: “Winner, winner, chicken dinner!”

Originally published April 1, 2022.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at [email protected] for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with an emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosures

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.