York Harbour Metals (YORK:TSXV) is one of those companies that has been around for 10 years but until recently seemed to show any real direction. Just over a year ago that all changed when the company did an incredible deal in Newfoundland on a former mine dating back to an 1893 mining of a VMS deposit of copper, zinc, and cobalt.

The company executed an option a year ago on the York Harbour mine consisting of five mineral licenses and 156 mineral claims with a total land position of 3,900 ha. The deal called for them to pay $95,000 in cash and to issue 1,485,566 shares and to spend $3 million in exploration over a two year period to earn 100% ownership of the project subject to a 2% NSR.

Some bright spark in the company realized that VMS deposits (also known as black smokers) tend to occur in clusters. Prior operators had conducted slightly over 19,000 meters of drilling and had 2,134 meters of underground drifts. The historical results revealed eleven different lenses of sulphide mineralization.

Starting in July York Harbour conducted a short 1,222 metre phase 1 drill program and released acceptable results in January. A week later the company announced an additional phase of drilling consisting of 22 drill holes with a total of 4,000 metres of diamond drilling.

Assays from this last drill program began to show up a month ago with some outstanding results such as 25 metres of 2.7% copper, 9.0% zinc, 17.78 g/t Ag and 164 g/t cobalt. The company just released the real bonanza grade holes on March 28. The market loved the numbers.

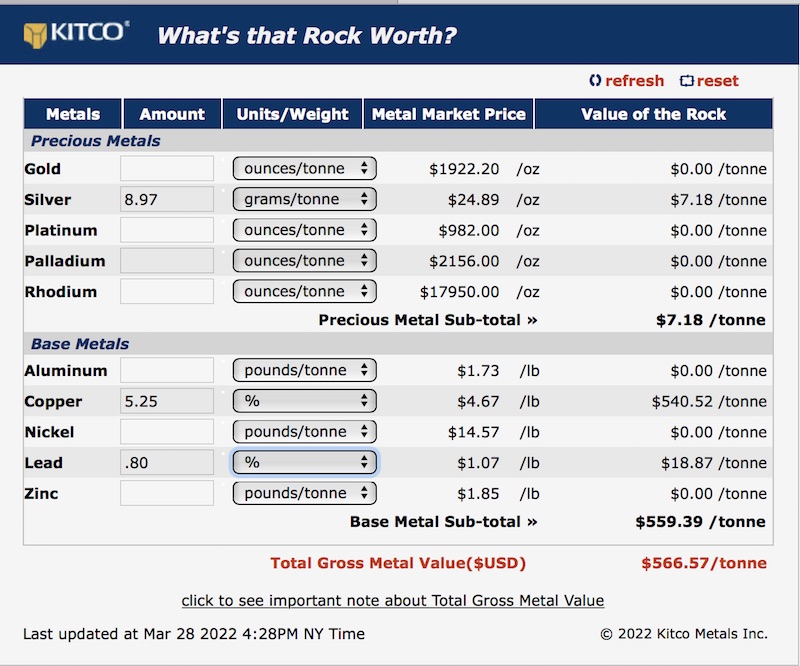

Hole YH21-24 showed 5.25% copper, incredible 436.5 g/t cobalt and 8.97 g/t Ag with 0.801% zinc. While the chart above reflects an in the ground value of $566 USD to the tonne, it does not reflect the additional $36 USD for twelve ounces of cobalt.

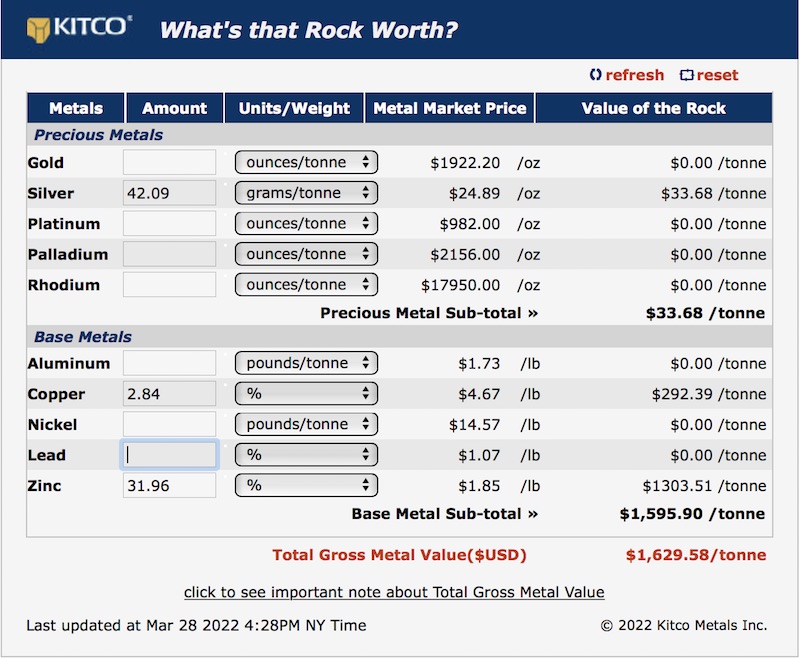

Hole 21-22 showed an even more incredible 5.26 metre intercept of 2.84% copper, 31.96% zinc and 42.09 g/t Ag worth $1630 USD to the tonne.

The company has just over 10 million warrants outstanding with prices varying from $.40 to a high of $.75 per warrant. When those are fully subscribed they will bring in an additional $7.2 million. With the price of the shares at $1.29 there will be a lot of investors exercising their warrants so I don’t see money for drilling as being any problem for YORK.

While York Harbour is an advertiser, I must confess I totally missed this one until management reminded me to look at the drill results they put out on Monday. They were outstanding and I got caught out at the airport when my ship finally arrived at the port. I own no shares, alas. So I’m a little biased but not a lot biased. Do your own due diligence but the company certainly seems to be on to something good.

York Harbour

York-C $1.29 (Mar 28, 2022)

YORKF OTCBB 48.8 million shares

York Harbour website

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosures

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. The articles mentioned are advertisers on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.