As a backdrop to providing all subscribers with a glimpse into how and why I select investments, it is important to first have an understanding of the asset class before wasting one’s time and energy on an idea that is either before its time or is beyond its buy-sell date.

In January of 2022, I elected to diverge from my longstanding adherence to the premise that errant global fiscal and monetary policies had created “the perfect storm” for precious metals (PM) investments.

While I continue to favor PMs as portfolio anchors, I determined that since the last two years of supply chain shocks and over-reliance upon traditional sources of electrical power, the world would wake up one morning shivering in the dark with the sudden realization that we were going to need a great deal more copper to facilitate the “electrification movement” — and that the cleanest source of energy on the planet was nuclear power, whose primary fuel, uranium, was in structural deficit.

In both cases, I felt that an explosive move in demand accompanied with non-existent CAPEX planning for both uranium and copper would propel them to superior performance in the world of resource investing.

On top of the generational advance seen in spot commodity prices since the arrival of the pandemic, uranium and copper are about to surpass the 2002-2008 period — the massive infrastructure buildout in China and for reasons more closely aligned with shortage conditions rather than unprecedented Asian demand seen during the prior advance.

For this discussion, I focus on the “red metal,” or Dr. Copper, where reputation and folklore would describe it as the “the metal with a PhD in Economics.” One of the reasons that copper showed up on my investment radar screen was that, historically, the junior exploration and development world avoided copper due largely to the boring nature of its applications.

Whereas gold is “the investment of kings” and diamonds are “a girl’s best friend,” copper has lacked the nobility and sex appeal of other commodities, and as such, has been largely ignored by the speculation crowd that instead dove into cannabis and crypto and egregiously overpriced tech stocks and renewables as a means of veering off the beaten track of investment conformity.

Alas, after a two-year sojourn into bureaucratic ineptitude verging upon tyranny, the global pandemic has been the beacon in a vast tunnel of darkness and ignorance that has finally highlighted the systemic and structural shortage conditions facing us as we burrow forward into the 2020s.

Simplified, if the new generations of global citizens insist upon a replacement for reliance upon fossil fuels and the elimination of all vestiges of the carbon footprint, they had better first take a course in ECON-101 and understand the strains that will accompany the transition from the internal combustion engine and (coal-fired electrical power plants) to solar and wind sources and electric vehicles on the highways.

Embracing that transition is the emergence of a massive increase in the usage of copper and since replacements are difficult to source and even more so to implement, the rapid depletion of historical sources in terms of both quantity (tonnes) and quality (grade) has multinational miners the world over scrambling for projects carrying scale and geopolitical sanctuary.

So, when I am presented with a “story” (because all investments are framed in a “story”), I want to know that before I take exploration risk, I can expect to be free from the dangers of political interference and — god forbid — confiscation. It is because of this that I view jurisdictional security as first and foremost in the hierarchy of preconditions followed by secondary considerations, such as infrastructure, geology, and management.

This constitutes a primer of sorts for those wishing to get a glimpse of my personal checklist comprising the preconditions for investment; there are many more subtleties far too numerous clog the pipeline in today’s missive so I now present an idea that has been assigned A+ ratings in all categories with special mention of one shining attribute in the ownership of this company — leverage.

Since I first joined the investment industry in 1977, I have been either directly or indirectly involved in a number of major discoveries where I speculated on a junior exploration company trading for pennies that ended up trading for many tens of dollars per share.

Since I first joined the investment industry in 1977, I have been either directly or indirectly involved in a number of major discoveries where I speculated on a junior exploration company trading for pennies that ended up trading for many tens of dollars per share.

They are indeed rare and while the “win ratio” is low, when Mother Nature and Lady Luck smile upon you in the mineral exploration field, the elasticity of return can be truly mind-boggling.

I cite as an example the Eskay Creek discovery in the Golden Triangle region of B.C. where a little junior called Consolidated Stikine owned a 50% interest in the play and went from CA$0.50 to over CA$40 in a little over a year.

A few years later, a discovery of a single pyrope garnet in Canada’s Northwest Territories set off what became the largest staking rush in world history as junior explorers scrambled to secure land positions in Canada’s Arctic.

Not only did the legendary DiaMet Minerals diamond discovery take the share price from pennies to over CA$70 per share, but it also launched an entirely new industry in North America with diamond cutting and polishing centres popping up in Yellowknife and other Canadian cities to facilitate the processing of gem-quality stones of extremely high value.

Then, a few years later, mining entrepreneur Robert Friedland’s Diamondfields Resources made a big nickel discovery in northeastern Labrador that wound up in a $4.3 billion takeover by Inco in 1997.

The points of commonality in all of these discoveries include rarity, scale, and grade. When I am speculating on a junior explorer trading for pennies per share, knowing how long the odds are of finding anything economic, I have to weigh those odds against the elasticity of return if there is a discovery.

If I am listening to a pitch from a geologist that talks about the potential for a 500,000-ounce (500 Koz) gold discovery, I am usually left unimpressed not at the geological model or the methodology of the search but more so because there is limited upside. I do not like to invest in a junior explorer unless there exists a reasonable chance for a discovery but it must be coupled with expandable scale and grade because if only one out of ten juniors experiences success, then it had better appreciate at least tenfold in order to make up for the nine other “bowsers” that drew blanks.

By example, I took great interest in the Canadian diamond play in 1991 because there had never been evidence of the existence of gem-quality diamonds of economic scale in Canada prior to DiaMet’s discovery.

That led to my focus on the Mountain Province story and its 60% interest in the Kennady Lake discovery of 1995 and the ascendancy of the share price to nearly CA$10 from pennies in less than 12 months. The rarity of diamonds created a scarcity factor that attracted massive investment capital thus providing the elasticity of return and subsequent windfall for those brave enough to take positions.

This brings me to a unique opportunity called MAX Resource Corp. (MAX:TSX.V; MXROF:OTCBB), a new position of which I only recently learned by way of a discussion with a colleague, a trained geologist who has been managing money for over 35 years. He took the time to walk me through a geological model but not before suggesting that I do some background work on an extensive and remarkable sedimentary unit located in central Europe known as the Kupferschiefer (German for “copper shale”) that has been the primary source for copper for the entire European continent since as early as 1499.

It covers an area of approximately 600,000 square kilometers with the Polish mining operations producing over 212,894 tonnes of copper and 756.7 tonnes of silver mined as of 2012 (from the North-Sudetic trough) and 20,000,000 tonnes of copper and more than 14,085 tonnes of silver mined since 1949 (from the Fore-Sudetic monocline).

There are various characteristics that set apart these very rare sedimentary units from other types of copper-silver mineralization but suffice it to say that Max Resources has acquired a large land package in northeastern Colombia in an area home to existing mining infrastructure where Glencore International Plc (GLNCY:OTCMKTS) currently operates the Cerrejόn coal mine.

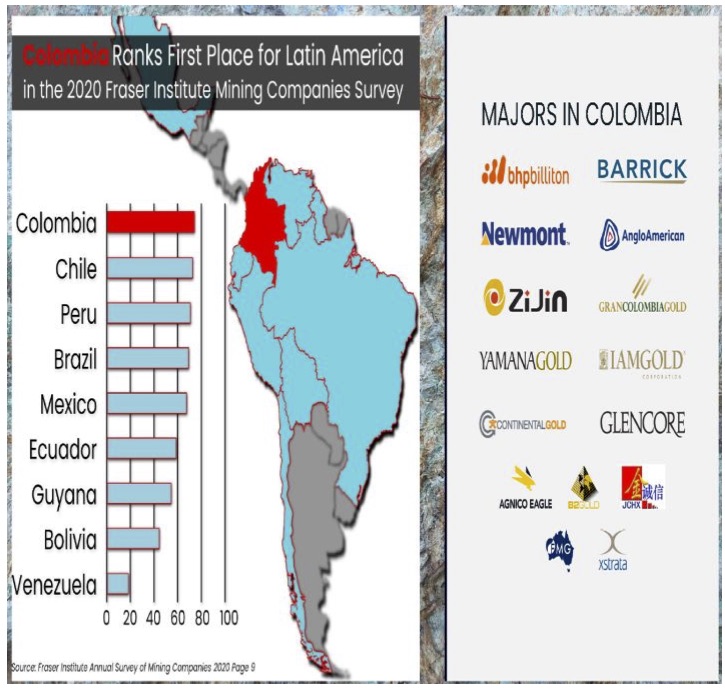

Surprisingly, Colombia currently enjoys a premier mining industry ranking from the Fraser Institute with many major and intermediate mining companies active so as far as country risk is concerned, it is of minor consideration.

Surprisingly, Colombia currently enjoys a premier mining industry ranking from the Fraser Institute with many major and intermediate mining companies active so as far as country risk is concerned, it is of minor consideration.

Of utmost importance for junior explorers operating in foreign lands is to be able to demonstrate to local authorities solid financial strength by way of multinational joint-venture partners or internal balance sheet integrity.

This paves the way for expansion of concession rights in the event that exploration efforts are successful. The Feb. 28 announcement detailing a transaction with Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE) whereby Endeavour buys 5% of Max through the private placement of shares (total deal CA$7.76 million) satisfies the balance sheet requirement after which it is expected that all permits and concession rights will be approved in advance of an April drill program.

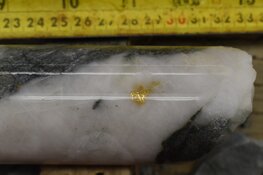

The project of interest is the Cesar project where three separate discoveries of copper and copper-silver bearing mineralization were made, with the most recent being the Uru (“African belt type”) and Conejo (copper-silver) discoveries. But the find made in 2020 known as the AM discovery carries Kupferschiefer-style mineralization and district-scale implications.

What leaps off the page for this author is the sheer scale of the land package which covers an area of approved concessions exceeding 70 square kilometres at Uru and an impressive 116 square kilometres at AM. It is estimated that the Cesar Basin extends for a 90-kilometer-long zone of interest hosting the three discoveries.

Excellent road access and proximity to deep-water ports (within 100 kilometers) are contributing features to the appeal and that Max has already done a great deal of the earlier, high-risk exploration — with success — is of huge benefit to shareholders entering the play now versus three years ago. The term “de-risked” comes to mind and while there is still an element of exploration risk, when measured against the potential reward of “African Belt” (Uru) or “Kupterschiefer-style” (AM) deposits, the opportunity is clearly evident and unmistakably compelling.

To be sure, the markets have not been kind to the junior explorers or developers relative to the move in metals and energy prices largely because the new wave of investors that are increasingly dominating markets have little (positive) history with the junior resource sector.

It has been a challenge for many of the younger institutional portfolio managers to embrace even a 5% allocation to the senior metals players after more than a decade of FAANG outperformance, let alone a “punt” into an intermediate or (gasp!) a junior.

For this reason, I believe we are in the early stages of a bull market in junior resource companies that will last for the next decade. This is primarily the reason I opted to pen this Special Situations Report.

If my forecast is correct, subscribers can expect geometric advances in all of the positions in both GGMA 2022 portfolios but not without the need for one word — patience.

If my forecast is correct, subscribers can expect geometric advances in all of the positions in both GGMA 2022 portfolios but not without the need for one word — patience.

Generational shifts in investment paradigms based on demographics can take years and I use as an example the example of the Internet, which was first constructed in the 1960s to allow American military computers to communicate with each other long before the public gained access in 1989 when Compuserve was first able to service 500,000 users.

The paradigm shift that enabled massive adoption of the new technology took 10 years to manifest itself into an investment mania peaking in 2001 with the collapse of the DotCom bubble but not before enriching a great many investors and entrepreneurs in the early stages.

Since 1982, the world has been led to believe that due to advances in productivity created by technological innovation and globalism, it had entered a period of perpetual disinflation. As a result, commodities (ex-energy) suffered from a low pricing regime that discouraged capital expenditures for exploration and development of new sources of supply.

That trend was interrupted in the early 2000s with the massive China infrastructure buildout but ended in 2011 when a decade of commodity price advances were punctuated by the 2008 Great Financial Bailout. That era has now ended and has been replaced by a world whose resources upon which we have relied heavily since the advent of the Industrial Revolution as now in dire shortage conditions with no cure seen on the immediate horizon.

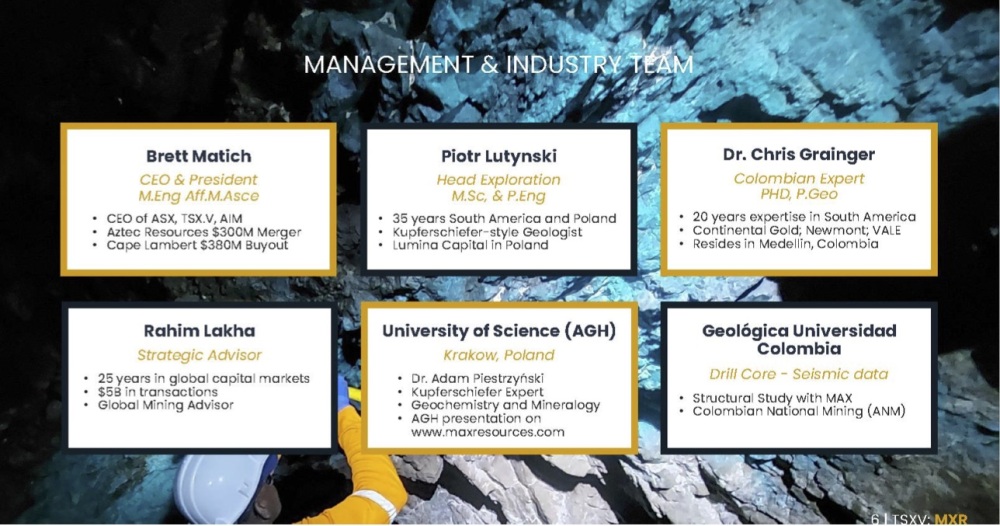

Lastly, if there is one facet of analysis that applies to the junior resource industry, it is that quality of management is of paramount significance in the delivery of above average performance. CEO and President Brett Matich was CEO of Aztec Resources, which rose from a A$1m market cap company to an A$300m merger with Mount Gibson Iron as well as his involvement with TSX.V-listed Cap-Ex Ventures where he oversaw the discovery and establishment of an 8-billion-tonne magnetite resource. In other words, Mr. Matich knows how to navigate the exploration field and, more importantly, how to turn a prospect into a profit-generating return for all shareholders.

Head of Exploration for Max is Piotr Lutynski, described as a “Kupferscheifer-syle” geologist who was quoted in a recent publication as stating that “The copper and silver are very classical elements likely to be in sedimentary deposits like Colombia,” said Lutynski, noting he has worked in similar mineralization in Peru. “It’s the same stratigraphy with the sandstone below the limestone on top and Kupferschiefer equivalent in the middle.”

Head of Exploration for Max is Piotr Lutynski, described as a “Kupferscheifer-syle” geologist who was quoted in a recent publication as stating that “The copper and silver are very classical elements likely to be in sedimentary deposits like Colombia,” said Lutynski, noting he has worked in similar mineralization in Peru. “It’s the same stratigraphy with the sandstone below the limestone on top and Kupferschiefer equivalent in the middle.”

Also utmost in importance is the “in-the-field” team whose knowledge of the local geological environment is surpassed only by familiarity with the political environment as it would relate to permits and land expansion. Consulting for the Cesar Basin team is Aussie Dr. Chris Grainger whose “creds” I investigated prior to formulating this report.

“Dr. Grainger resides in Medellin Colombia and has over 20 years of geological expertise with extensive experience in South America, including Colombia, specializing in grassroots and brownfields exploration, and resource definition and development within a number of different commodities and diverse geological environments.”

Dr. Grainger is well-known to a number of my Australian mining friends and in the words of one colleague, carried somewhat of a “rock star” reputation when it comes to both South American geology but also Colombian politics. Rounding out the team is the inclusion of an expert in the field of Kupferschiefer-style deposits, Dr. Adam Pietrzynski who hails from Krakow, Poland, which gives credence to the geological model being advanced at the AM discovery.

In sum, investors get a great deal of “torque” — upside leverage to a discovery — and with the initial April maiden drill program at Uru where highlights included values of up to 14.8% copper and 132 grams per tonne silver hosted in an “African Belt” style mineralized envelope followed by the delineation of drill targets at Conejo and AM, this largely unexplored region of Colombia could provide investors with a life-altering event.

For this investor, the most attractive part of owning Max is that it lies on the northern edge of the world-renowned Andean Copper Belt, which has been host to some of the largest and richest copper deposits in the world. Even more significant is the presence of copper and silver at roughly one part silver to ten parts copper which is another earmark of “Kupferschiefer-style” deposits.

Max is exploring in the right location for the right metals with the right management team and checks all of the boxes required to make it a “must-own” going into April. As of today, the market capitalization is approximately CA$50M, a number which significantly discounts the potential upside in the event of exploration success which validates the geological model being advanced by Messrs. Lutynski and Grainger.

As a reminder, Bob Friedland’s Diamondfields Resources held a CA$50M market cap shortly after they confirmed the ovoid zone at Voisey’s Bay only to be acquired by Inco in 1997 for $4.3 billion in cash and stock. That was an “80-bagger” in 1997 so expecting a “20-bagger” out of Max is not a stretch if they can prove out the model in upcoming weeks and months.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at [email protected] for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.