Inhibikase Therapeutics Inc. (IKT:NASDAQ) is currently trading well below its cash value on the eve of a potential major catalyst. More news is certain to follow, which makes this stock a compelling investment opportunity with limited downside risk.

The company, a clinical-stage pharmaceutical company developing therapeutics for Parkinson's disease (PD) and related disorders, is trading well off its IPO price of $10.00 in December 2020. In June of 2021, IKT saw a substantial drop in value after it completed a $45 million follow-on offering at just $3.00/share. The company continues to trade at reduced value and is currently sitting at a market cap of just $35 million, well below its cash value of $45 million.

Despite the drop in value, IKT has continued on its development path and is on the cusp of a potentially significant catalyst. Inhibikase President and Chief Executive Officer Dr. Milton Werner will give an oral presentation at this week’s Alzheimer's and Parkinson's Diseases Conference in Barcelona, Spain, being held March 15 to March 20. Werner’s presentation is set for Friday, March 18, after the market close. As part of his presentation, Werner is expected to review IKT’s Phase 1a/b trial results of its lead candidate IkT-148009, which the company believes is transformational to the treatment of neurodegeneration. If the trial results prove positive, it could represent a serious value inflection point and set the stage for a Phase 2 study in Parkinson’s.

Getting to The Root Cause

PD is a treatable disease, but the root cause behind it is still not known. It is possible to control the symptoms of the disease especially in the early stage. In the spirit of keeping the science simple, the substantia nigra is responsible for controlling motor functions, and this region of the brain contains specialized neurons that create the brain chemical dopamine that ensures neurons fire quickly and efficiently. If dopamine levels fall, then loss of motor control typically follows and eventually shows up as a tremor in the hands or a shuffling of the feet. When dopamine levels drop, it’s a result of degeneration of neurons located in the substantia nigra.

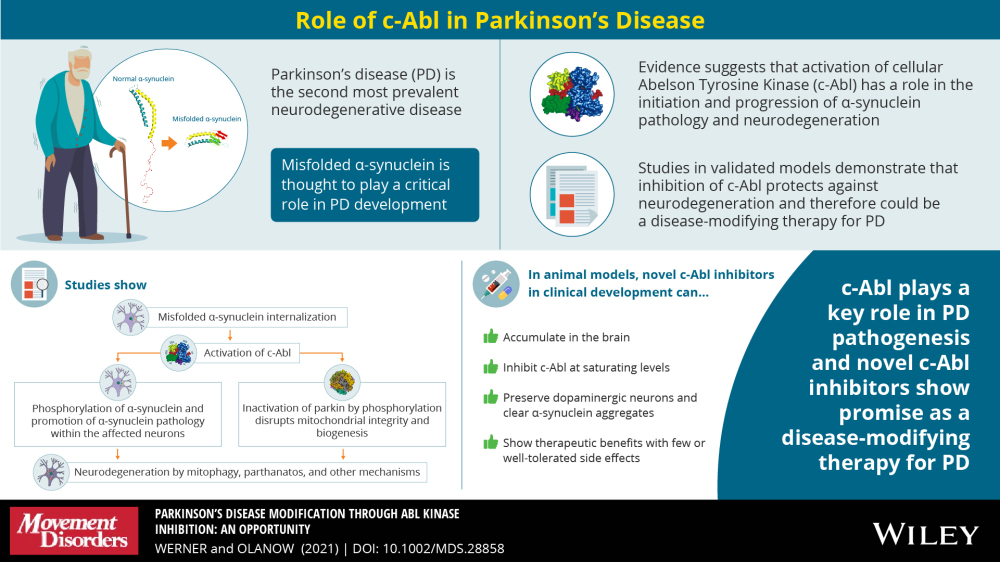

This infographic shows how cellular Abelson Tyrosine Kinase (c-Abl) is responsible for the production of the toxic form of alpha-synuclein which is theorized to be a possible cause of PD. Blocking c-Abl is expected to restore balance within these neurons and stop the degeneration along with the disease.

The global anti-parkinsons market is expect to reach $9.56 billion by the end of the year and grow to $12.25 billion by 2026. The primary drug used to treat PD is ledopa/carbidopa followed by dopamine agonists. It's important to highlight that these drugs treat the symptoms of the disease, and don’t address the root cause. IkT-148009, on the other hand, is a small molecule designed as a once-daily oral medication that targets the underlying mechanism—a possible root cause—of PD by blocking the activation of the Abl Kinase.

Reasons for Optimism

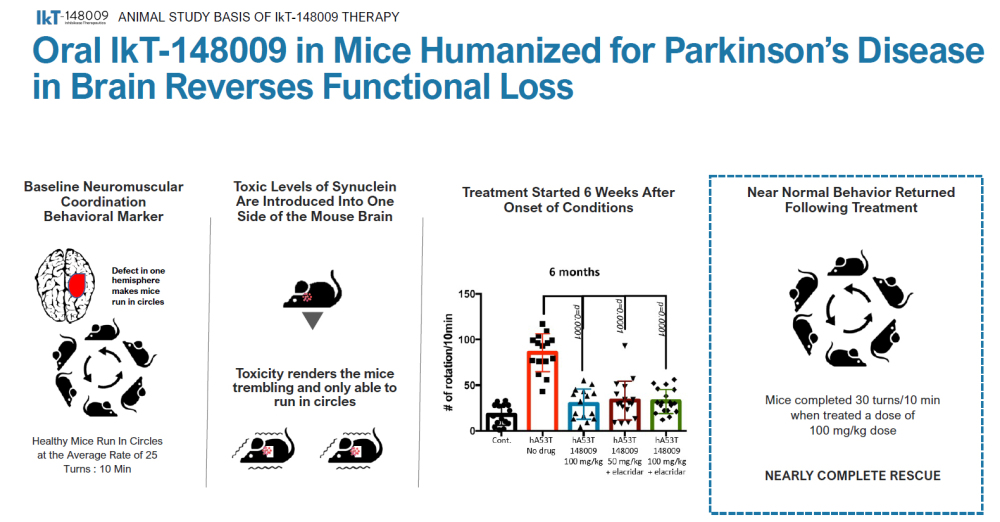

Besides the obvious concept that failed or even marginal studies don’t typically take center stage at a major conference, there is sound basis for optimism that Werner’s Friday phase 1a/b trial readout will be positive. IKT is confident that targeting c-Abl is transformational to treatment of neurodegeneration and early results showed extreme promise. The preclinical mouse models showed the neurodegeneration could be accomplished if c-Abl was activated. Mice incapable of producing c-Abl don’t develop any neurodegeneration in animal models of progressive Parkinson’s disease. In the phase 1 study, IkT-148009 showed no clinically significant adverse events up to the 175 mg level. At the conference Werner should discuss if they reached the Maximum Tolerated Dose. Assuming they didn’t reach a MTD, then Ihibikase is in a position to explore many other paths forward.

The phase 1b trial was randomized 3:1 and was set to do three-dose escalations of seven-day dosing. The treatment group contained three cohorts of eight patients with mild to moderate Parkinson’s Disease. Beyond the safety and tolerability endpoint that they are likely to meet, the clinical trial is also looking to assess motor and non-motor function, gut motility, and measures of alpha-synuclein aggregate clearance as exploratory endpoints. Early positive surprises with these exploratory endpoints could yield very exciting possibilities for patients and investors alike.

Investment Summary

For Inhibikase current and potential investors, there is a lot to like and even more to look forward to. The upcoming trial results are expected to show an excellent safety profile of the drug and likely biomarkers that translate into efficacy. In addition, this opens the door to label expansion in other indications, including multiple System Atrophy (MSA). That expansion not only broadens their markets, but further enhances IKTs attractiveness to investors and possible partnerships. Larger pharmaceuticals have shown an eagerness to partner or outright acquire similar clinical stage companies on the hunt for Parkinson’s related breakthroughs as evidence in recent deals between Denali/Biogen, Roche’s acquisition of Inflamazone for $449 million, and Eli Lilly’s 2020 $1.0 billion acquisition of Prevail, among others. With a rapid increase in the phase 2 pipeline expected this year Inhibikase is extremely undervalued relative to its peers IKT stock is trading at a discount to cash so it makes no sense for them to raise money now. The biotech index is also in a tailspin and they are well funded into the future so the risk of dilution is minimal and behind them. What really isn’t getting the attention it deserves is the fast track potential. Their meeting with the FDA for Fast Track was scheduled for this quarter. Investors who have stuck around recognize this is indeed a good, promising company and are simply looking for more proof and positive momentum, both of which should come this week with other catalysts on the horizon. For savvy biotech investors that understand this is a validated target, at current value, there isn’t much downside risk to entry and a lot of potential going into an announcement this week that is likely to be extremely positive.

Michael Sheikh is the founder of Falcon Strategic Research, which focuses on small-cap and micro-cap companies that are not covered by traditional analysts on Wall Street. Sheikh is an Air Force Academy graduate with a degree in economics; he was a KC-135 pilot. He was a stock broker for Dean Witter and was a research analyst for National Securities, covering the aerospace sector. He is a contract CFO for various public companies.

Disclosures:

1) Michael Sheikh: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: None. Funds controlled by Name of Company hold shares of the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.