It has been about three months since I started talking about the uranium squeeze that I believe has just started, and told you about my favorite uranium explorer, Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), and since then we have seen the price of uranium go from $48 to over $60 per pound.

If you want a full recap of why I believe uranium will squeeze, read my last post when you are done with this article, but here are the important bits.

If you want a full recap of why I believe uranium will squeeze, read my last post when you are done with this article, but here are the important bits.

- There are 445 working nuclear reactors with another 450 proposed, planned or being built.

- The 2021 shortage of uranium was 23.6 million pounds or 13% of global demand.

- Uranium swings hard, going from $7 per pound in 2001 to $137 per pound in 2007.

- Russia and Kazakhstan are major suppliers, Kazakhstan has been experiencing tensions and Russia is being sanctioned for their unprovoked attacks on Ukraine.

- Uranium is more widely being accepted as a safe and clean fuel.

The Sprott Physical Uranium Trust has been buying up physical supplies, smoothing "cheap paper" issues.

Uranium is a cyclical commodity, but unlike most commodities, it is more of a feast or famine situation. Well, the table is set, and I can smell the food my friends. Some uranium bulls are now calling for a $200 spot price for uranium.

"In the past six months, I have reviewed dozens of uranium producers. They are all priced reasonably, except for one: Western Uranium & Vanadium Corp. It is a motorcycle priced like a tricycle."

I like to diversify within my already diverse portfolio. My personal strategy for commodities is to buy in small, medium, and large market caps. This isn’t a one size fits all scenario.

For the small market caps (and usual price per share), I look to explorers which usually have a trading range that they are bound to until they hit paydirt, maybe up or down 20% either way, with a little help from the spot price of the commodity. This makes them somewhat of a safe lotto ticket. In the case of uranium, they go out and drill over the winter using geology and historical data as a guide. If they don’t make a discovery in that season, their price is largely unaffected; if they do make a discovery, their price can soar to many multiples.

When it comes to medium market caps, I am looking for a producer that is overlooked and undervalued. Usually, you can find a producer in any commodity that is trading a little unfairly, sometimes it is the complexity of their operations, a discount for poor management, repricing that hasn’t trickled down or even a lack of buyer awareness. These discounts tend to be up to 20%, which in fairness is a huge find if you are among the first there.

In the past six months, I have reviewed dozens of uranium producers. They are all priced reasonably, except for one: Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX). It is a motorcycle priced like a tricycle.

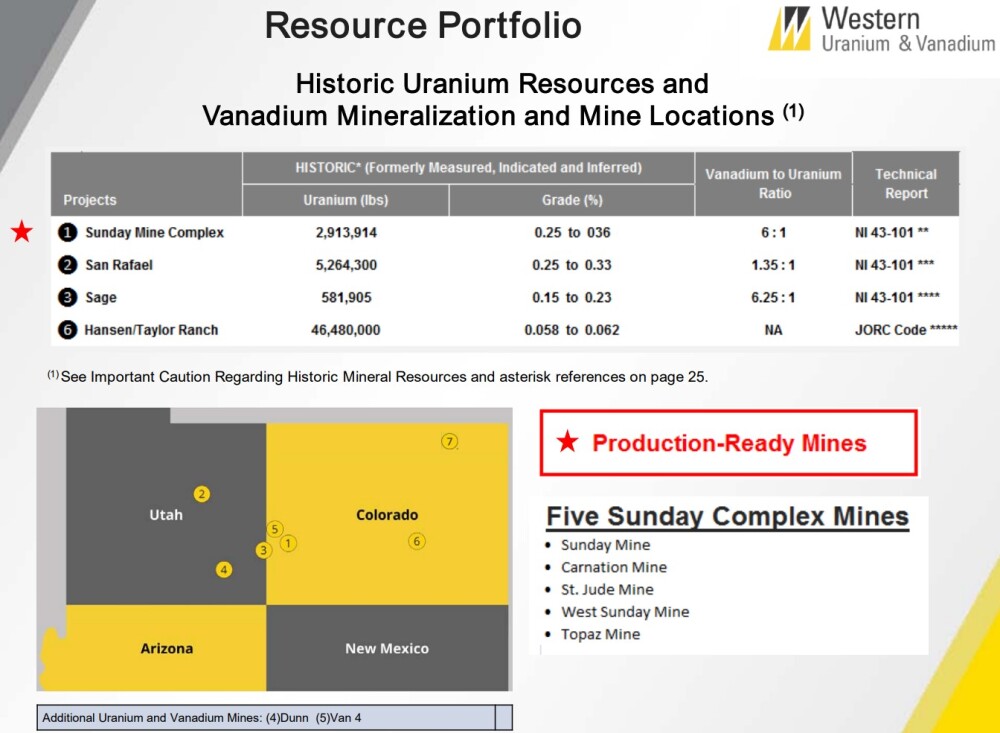

Western Uranium & Vanadium is sitting on 55.24 million pounds of known in-situ uranium and 28.2 million pounds of vanadium. At today’s uranium spot price of $60.00 per pound, that equates to $3.31 billion in resource value. Add in $346 million in in-situ vanadium, and we end up with a resource value of $3.65 billion. Where is Western Uranium & Vanadium trading today? At $89.4 million fully diluted, only 2.45% of the in-situ resource value.

This is all before adding in the simple fact that some of the properties have not been entirely explored and drilled to determine the reserves.

Let’s cover their assets and financial situation and then we can go over the likely scenarios.

Western Uranium & Vanadium owns seven projects. They are currently underground mining and stockpiling uranium at the Sunday mine complex. This ore is ready to be loaded and transported for processing. This site is not far from Energy Fuels’ processing mill.

In expectation of the run up in price, they purchased 125,000 pounds of uranium for $32 a pound in 2021 and will be delivering this to a utility at whatever the spot price is at the end of March. As of today, that is equal to a profit of about $4 million.

Western also has a royalty interest in an oil and gas operation in Colorado, this generates a monthly royalty check. There is a lag on the payments, but their last check was for $45,000 and that was with oil at $81 a barrel.

Western also has a royalty interest in an oil and gas operation in Colorado, this generates a monthly royalty check. There is a lag on the payments, but their last check was for $45,000 and that was with oil at $81 a barrel.

The simple scenario for shareholders is the continued operation in a favorable environment. The Sunday mine is currently being mined underground with ore being stockpiled. Each ton of material is about 1% uranium and 5% vanadium. Underground mining costs about $100 to $110 per ton. Hauling material should be anywhere from $20 to $40 per ton and mill processing is around $150 per ton. Using the more expensive range, we get a cost of $300 per ton raw materials to produce $1,200 in uranium and $1,100 in vanadium. So we get a margin of $2,000 per ton, or 87%.

The most likely situation in my mind is that Western Uranium & Vanadium gets acquired by one of the larger uranium players. Uranium boom cycles cause a lot of merger and acquisition activity. Typical M&A activity in the uranium space takes place at 5% to 15% of in-situ resource value. For this math, I will only include the historical uranium resource and remind you that they are trading 2.45% of in-situ resource value. This gives a buyout price of between $182 million and $547.5 million. In simpler terms, a buyout should result in a price of two to six times the current adjusted price of uranium.

We are sitting at uranium just under $60. Remember that uranium went to $137 in 2007 on the last bull run. Uranium is insulated from inflation and unemployment. I see Western Uranium & Vanadium as having the same asymmetric trade qualities as other uranium plays, where your potential for loss is considerably smaller than your gain potential. But unlike other uranium plays, this one has a valuation error multiplier.

This is not investment advice, and I am not an investment advisor. I am a mom and a professional firefighter, and I am passionate about clean and disruptive technology. I own shares in Western Uranium & Vanadium and am not compensated by anyone for my due diligence reports.

Disclosures

1) Statements and opinions expressed are the opinions of the Penny Queen and not of Streetwise Reports or its officers. The Penny Queen is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. The Penny Queen was not paid by Streetwise Reports LLC for this report. Streetwise Reports was not paid by the author to publish or syndicate this report. Additional Penny Queen disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This report is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles, reports, and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy Corp. and Western Uranium & Vanadium Corp., companies mentioned in this article.