After drilling a surprising 5.5 grams gold per tonne (5.5 g/t gold) over 50.15 meters in September and collecting an eye-popping grab sample grading 371 g/t gold, Puma Exploration Inc. (PUMA:TSX; PUXPF:OTC PINK) has launched its 2022 drill program with an initial 10,000 meters to get a handle on the quartz vein gold system at its Williams Brook Gold Project in New Brunswick’s prolific Bathurst mining camp.

"These guys are on to a bona fide discovery of some sort that will likely yield an economic discovery. This is just getting bigger and better."

—Quinton Hennigh, Geologic and Technical Director, Crescat Capital

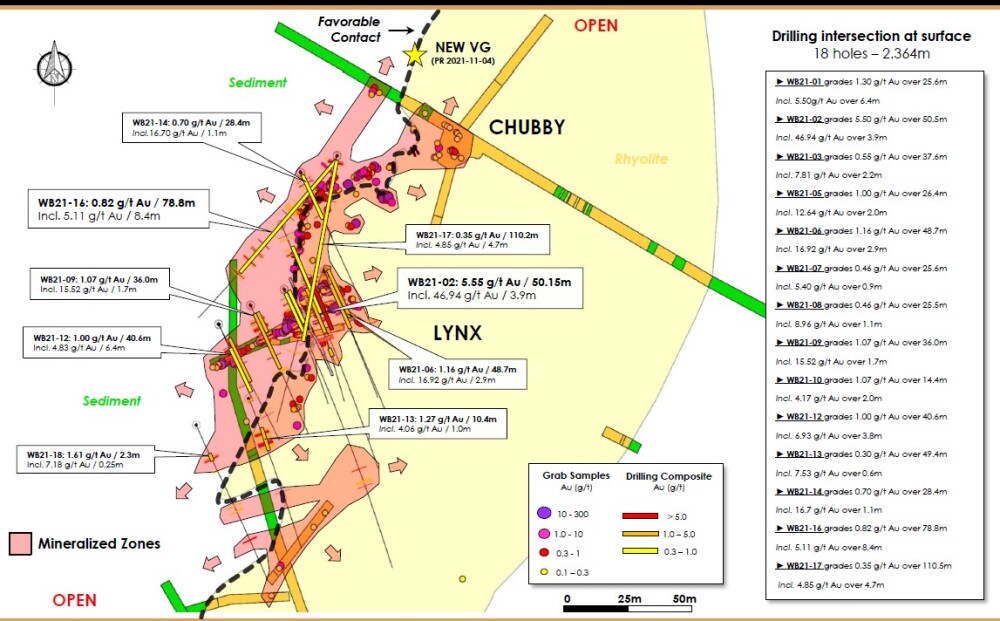

What makes that September drill intercept even more remarkable is that it occurred in the maiden 18-hole, 2,360-meter drill program on the 700-meter-long O’Neil Gold Trend at Williams Brook. The drill target was outlined with an airborne magnetic survey done earlier in 2021.

“That discovery hole was one of the best in Canada. It basically started from surface and showed the big potential of the entire length of the William Brooks property and perhaps a good opportunity to have two kinds of mines,” says Puma Exploration President Marcel Robillard, who spent about 10 years in the Bathurst camp working for other companies.

He adds: “We could think about a big open pit because of that five grams over 50 meters, basically from surface. But also in that (same) intercept there's about 44 grams (gold) over four meters, at about 45 meters depth, so that opens the potential to have a higher-grade underground mine.”

In addition, Puma recently announced an increase of its Williams Brook landholdings, adding 662 hectares to the property.

In December, the junior completed a marketed private placement with Quebec-based Desjardins Capital Markets for 10 million flow-through shares at CA$0.50 each. The $5M raised is funding the current 10,000-meter drill program.

Puma plans to drill another 10,000 meters in the fall, once it has the results from the first 10,000 meters.

“Lynx so far is one of the best high-grade zones that we've drilled. It seems like every time we bend down and pick up a sample, there's gold in it.”

—Marcel Robillard, Puma Exploration President

Last fall Puma’s team collected 750 samples (basically randomly selected rocks on the ground and in trenches) at surface along the O’Neil Gold Trend. So far, Puma has received assay results from 50 of those. Aside from that remarkable 371 g/t gold sample, other rock samples returned 51.7 g/t gold, 28.7 g/t, 27.2 g/t, 23.1 g/t, and 18.5 g/t.

The gold grades seem to show that gold mineralization is both significant and continuous along trend. The first target of the 2022 drill program is an area northeast of the Lynx gold zone, where Puma geologists found the 51.7-gram sample.

Lynx is one of four gold zones outlined along the O’Neil Gold Trend by Puma. The others are Pepito, Moose, and Chubby (a tongue-in-cheek reference to the body shape of Puma Executive Chairman Réjean Gosselin).

“Lynx so far is one of the best high-grade zones that we've drilled. But if we compare the grab samples that we’ve just started to release from Chubby to Moose, it seems to be more quartz veins and higher grade (the farther they go along trend). We will know more once we drill but it seems like every time we bend down and pick up a sample, there's gold in it,” Robillard tells Streetwise.

Apart from the 5.55 g/t gold over 50.15 meters intersected in hole WB21-02 in the initial drill 2,400-meter program, or what Robillard calls the “discovery hole,” there were other smaller hits in that first round of drilling. Hole WB21-01 returned 50 g/t gold over 0.5 meter; WB21-02 returned 59.68 g/t gold over 1.85 meters; WB21-03 intersected 23.1 gold over 0.65 meter; and WB21-05 drilled into 16.07 g/t gold over 1.1 meters.

And hole WB21-16 into the Chubby zone intersected 78.75 meters grading 0.82 g/t gold, including a higher-grade core of 5.11 g/t gold over 8.35 meters.

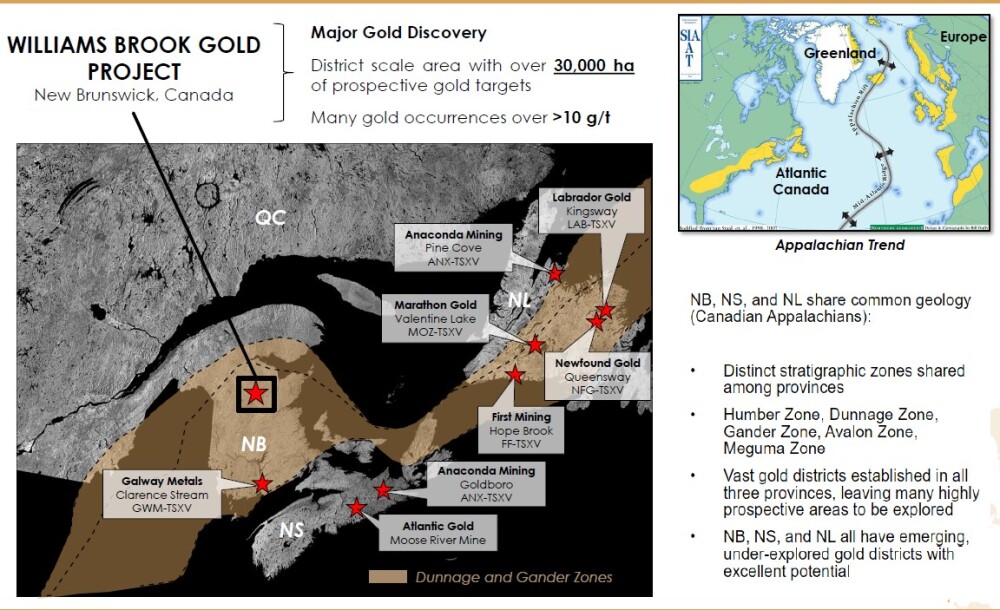

More than 12 mines have entered production in the Bathurst camp, the most prolific of which was Brunswick No. 12 mine — a volcanogenic massive sulphide copper-lead-zinc deposit that ran from 1963 until 2013 and remains one of the biggest base metals deposits ever found.

Williams Brook is among a group of promising gold discoveries in Canada’s maritime provinces.

South of Williams Brook, Galway Metals Ltd. (GWM:TSX.V) is drilling the Clarence Stream gold project in New Brunswick.

Next door, in Nova Scotia, Anaconda Mining Inc. (ANX:TSX) has filed a positive feasibility study for the Goldboro open-pit gold project.

And in Newfoundland, First Mining Gold Corp. (FF:TSX) has the Hope Brook project.

Labrador Gold Corp. (LAB:TSX; NKOSF:OTCQX) is working on the Kingsway property.

Finally, Marathon Gold Corp. (MOZ:TSX; MGDPF:OTCMKTS ), with a considerable market cap of $711M, is developing the 5-million-ounce Valentine Gold Project.

Robillard sees Williams Brook as analogous to Valentine, given their respective geology.

“My big brother is for sure Marathon. Why? Because we have the same kind of contact related to some major faulting. They are for sure a lot more advanced; they have done up to 250,000 meters of drilling. And we just have done, say, 2,400. So, you know, the objective is to find something similar,” Robillard says.

Quinton Hennigh, Geologic and Technical Director of Crescat Capital, recently wrote about Puma in a Streetwise commentary

"I would say that these guys are on to a bona fide discovery of some sort that will likely yield an economic discovery," Hennigh said. “Puma has only explored about 700m of what appears to be a significantly larger gold system and will expand its drill program. This is just getting bigger and better."

Puma has spent the last year or so putting pen to paper on property deals with different landowners.

These acquisitions ultimately give the junior greater control of the camp.

Puma recently acquired 30 claims known as the South-East Moose Brook property. To secure the claims, Puma paid 50,000 shares up front and $10,000 cash.

Another 50,000 shares will be due a year after the deal closes, and 100,000 shares due two years after that.

The vendor also gets increasingly larger cash bonuses for a preliminary economic assessment, a positive feasibility study and reaching commercial production.

The owner retains a 2% net royalty on any production, half of which can be bought out for $1 million.

Puma trades in a 52-week range of $0.64 and $0.15 and counts Denver-based Crescat Capital among its largest shareholders.

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Puma Exploration Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Puma Exploration Inc., a company mentioned in this article.