Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB) is an exciting pure-play copper (“Cu”) story with a growing portfolio of properties and projects in the mining-friendly western U.S. It has a high-quality management team and board, especially for a company with C$5M in cash and an enterprise value (market cap + debt – cash) of ~C$4M.

Allied Copper is all cashed-up, in the right place, at the right time with the right team.

Companies with large cash war chests relative to their enterprise values have tremendous blue-sky potential to make things happen. Allied’s team is actively pursuing acquisitions. They expect to have a lot to talk about this year as they pursue long-life, scalable projects in safe jurisdictions and advance existing projects.

Security of Cu supply is top of mind as serious concerns mount across South America. Chile, Perú, and Ecuador are in the midst of political challenges that threaten to raise royalty and/or tax rates, the cancellation of key permits, or expropriation of assets.

Why is copper such a great investment theme?

In addition to copper’s growing use in new high-tech applications like electric vehicles, telecom / 5G wireless, grid-scale energy storage systems, and renewable power plants, it remains one of the most important components (along with steel and cement) of new and replacement infrastructure (roads, bridges, buildings, etc.) and electrical grid build-outs.

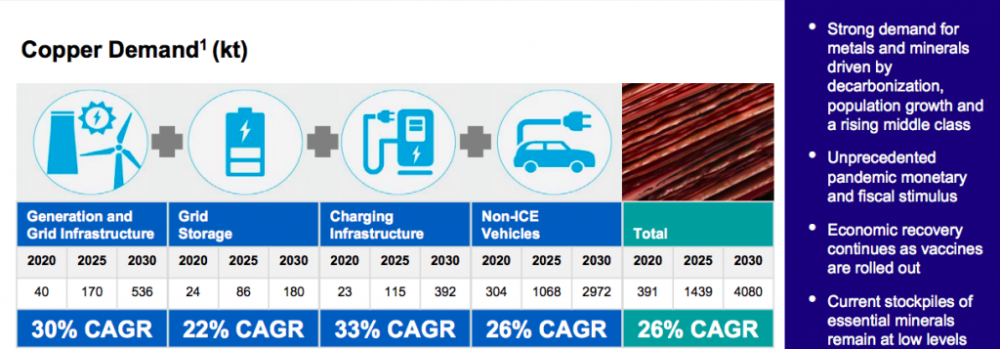

In the chart above from a recent Teck Resources presentation, expected demand growth from 2020 to 2030 in new uses of Cu is estimated at 26%/yr. By 2030 an additional 4M tonnes/yr. will be needed for the four categories shown in the chart. That’s ~16% of the ~25M tonnes consumed in 2020.

Later this decade as tens of millions of EVs per year plug into the grid, substantially more Cu will be needed to build and connect new power plants. At the same time, the world is undergoing a paradigm shift to renewable energy platforms, which are copper-intensive.

Wind and solar farms use a staggering amount of Cu in wires, cables, motors, and transformers. Bottom line, anything plugged into a wall or connected to the Internet leads to more copper-dependent power generation.

Copper demand to remain strong; supply increasingly uncertain

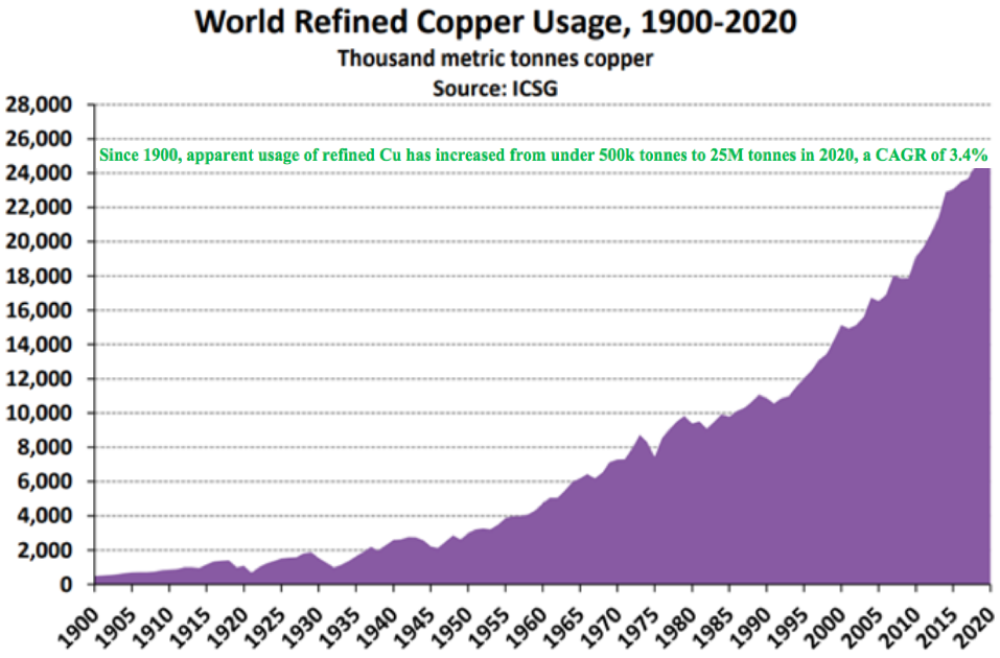

As a result of Cu’s use in so many new (and conventional) applications, its outlook appears bright for decades to come. Even a small increase above the 120-year CAGR of 3.4% (see chart below) makes a big difference.

Consider that in 2050 consumption would increase to 68.2M tonnes/yr. at a 3.4% CAGR, 81.1M tonnes/yr. at a 4.0% CAGR or 93.6M tonnes/yr. at a 4.5% CAGR. Copper is probably the most important industrial metal on the planet.

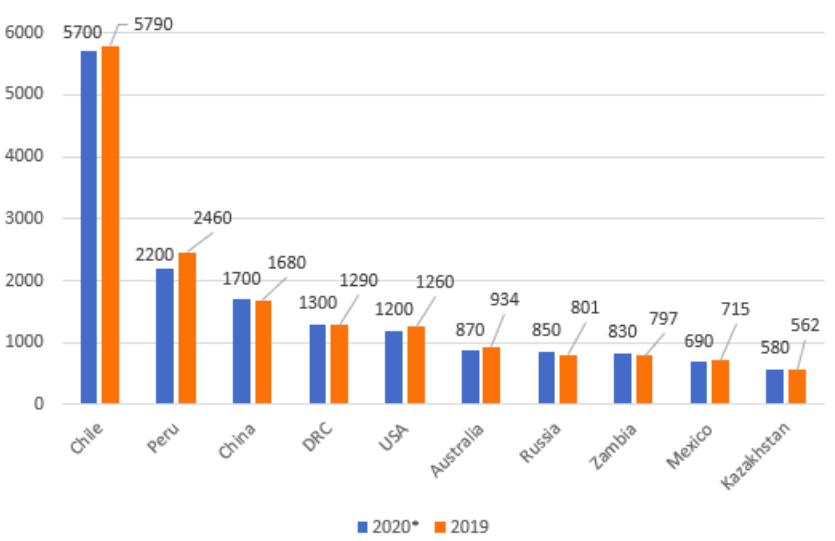

Among the top 10 Cu producing countries, the top four are; Chile, Peru, China, and the DRC. Of the remaining countries are Russia, Zambia, and Kazakhstan (Kazakhstan is closely tied to Russia). Combined, Chile and Peru account for nearly 40% of the world’s primary mine supply.

South America (Chile, Peru, Ecuador, Argentina, Colombia) hosts the majority of the largest Cu projects in the pipeline, but a combination of water scarcity, environmental challenges, high altitudes, left-leaning politics, and obtaining and maintaining local community support, are meaningful headwinds across the continent.

This makes projects in the U.S., Canada, and Australia incredibly important and highly sought after.

Allied Copper all cashed-up, in the right place, at the right time with the right team

Allied has three Cu properties so far, all in the western U.S. Make no mistake, these are early-stage opportunities. However, if the Cu price bull market continues, investors can achieve strong capital gains with juniors like Allied Copper, companies that have the potential to make impactful discoveries.

Perhaps the most exciting part of the Allied story is upcoming acquisitions (or options to acquire) of additional properties in the U.S. There are a number of highly-attractive properties that have been overlooked, under-explored or not advanced with modern techniques. The best opportunities have substantial exploration upside, yet can be picked up cheaply with modest upfront cash.

“With the recent change in governments in Chile and Peru, there’s uncertainty on royalty costs and other aspects of mining across S. America, home to nearly half the world’s copper production. Investors are now looking for secure, politically safe jurisdictions.

Allied Copper is well positioned to meet this need with its key asset in Nevada and the purchase of additional projects in the western U.S. We have an experienced management team prepared to take assets into production to support the world’s transition to battery electric cars.”

— Exec. Chairman Warner Uhl

The most recent addition to Allied’s portfolio is the sediment-hosted, Cu mineralized, road accessible 365.7-acre Stateline Property (“STL”) in the Paradox Copper Belt in San Miguel County, Colorado / San Juan County, Utah. STL is eight km southeast of the producing Lisbon Valley Mining Complex (“LVMC”).

Stateline’s exposed Cu oxide mineralization at surface, hosted in sandstone units, bear strong similarities to Cu deposits along trend at the LVMC. Outcropping samples returned up to 1.6% Cu.

There are many historical occurrences that have been identified throughout the belt, but most have never been explored with modern exploration techniques.

Moving to Nevada, the Silver King (“SK”) Property is a Cu-Au porphyry asset at the intersection of the well-known Battle Mountain – Eureka (Cortez) trend and the Warm Springs Lineament. It’s comprised of 316 un-patented lode claims for a total area of 2,560 hectares.

SK is a promising exploration target in Lincoln County, Nevada (between Las Vegas & Ely). It’s in a geologic trend hosting multiple producing mines. Allied can earn into a 100% ownership of SK for a total of $420k over five years.

Management announced the start of a ground Induced Polarization (IP) & Resistivity survey. The 3D coverage will involve 400 m x 200 m grid spacing while the 2D array will have 100 m spacing along three lines. The coverage area is ~5 sq. km. The survey aims to capture images to a depth of 500 to 600 m.

Both survey coverages aim to define geophysical signatures of a possible porphyry system with associated polymetallic skarn and/or carbonate replacement mineralization at depth. The company expects to receive results in March and conduct a drill program in Q2 or Q3.

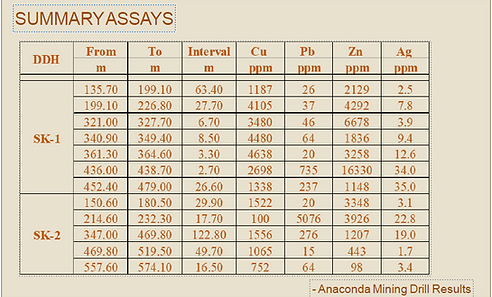

The highlighted assays below, from Anaconda Mining’s drilling, show two intervals of up to 2%+ Cu Eq. Five styles of mineralization have been observed to date providing multiple drill targets within a potential porphyry system.

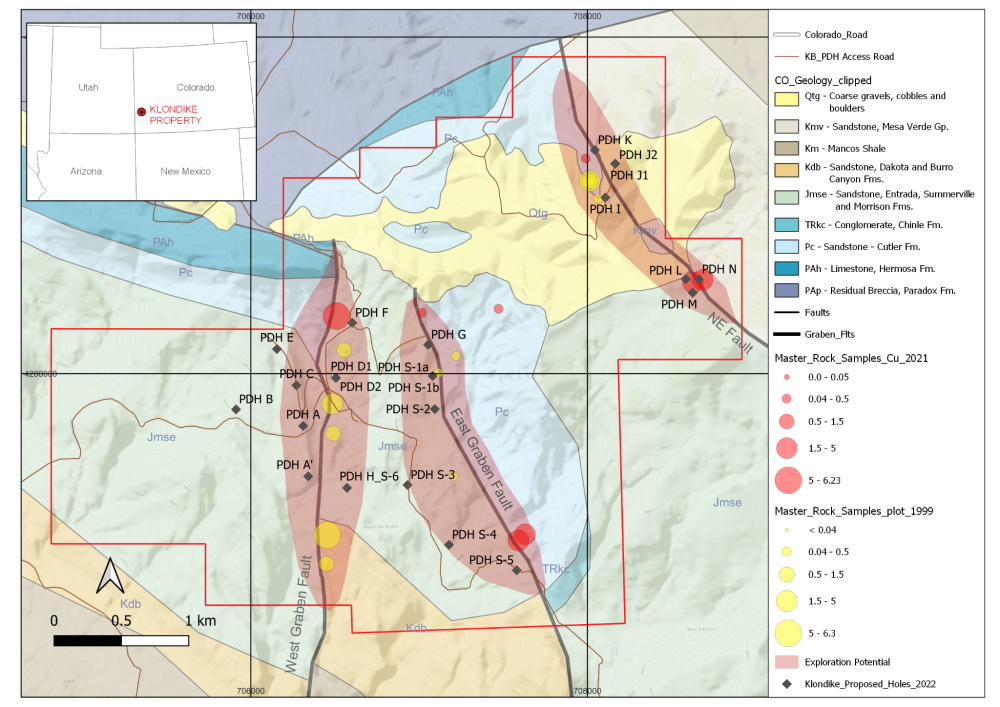

Allied’s third asset is an option on the Klondike Property in Colorado, located within the Paradox Copper Belt. The operating LVMC Mine is 50 km to the NW. Klondike consists of 76 unpatented lode claims totaling 843 hectares (2,083 acres). Klondike is expected to be accessible for exploration all year.

To earn a 100% interest over three years, Allied will have to issue 7M shares and make a total of C$400k in cash payments. In addition, Allied will have to incur a total of C$4.75M in exploration expenditures.

"We look forward to exploring our western U.S. copper projects: SK, Klondike, and Stateline, Allied Copper's initial building blocks. With C$5M in our Treasury, we’re excited to secure additional promising copper opportunities in 2022.”

— CEO Richard Tremblay

A recent reconnaissance program at Klondike conducted by Cloudbreak / Alianza consisting of mapping, stream sediment / rock sampling, was undertaken to help define drill targets.

Rock sampling and mapping successfully expanded the footprint of both targets and identified an additional target. Sampling returned an impressive 1.56% Cu over a 4.6 m chip sample.

Previous work reported high-grade surface showings of 6.3% Cu + 23.3 g/t Ag. In addition to high-grade potential, disseminated Cu-Ag mineralization has been observed, which may be amenable to modern open pit mining with Solvent Extraction Electro Winning processing — similar to the LVMC.

TSX-V listed metals / mining juniors have had a tough couple of months with tax loss selling, COVID-19, and inflation fears. However, now’s the time to look at high risk / high return exploration plays in the best metals, with properties in top jurisdictions. That’s Cu in the U.S. & Canada!

Look at the long-term Cu price graph above. Copper is only ~7% below its all-time high, yet many Cu juniors are trading as if the world is ending. With Omicron soon to be behind us, will Cu stocks rally? I for one think they will.

Allied Copper Corp. has a strong team and C$5M in the bank to explore three attractive properties and acquire more. With an enterprise value of just C$4M, it would not require that much drilling success for the valuation to soar.

Key management team and board members

Executive Chairman Mr. Warner Uhl specializes in taking projects from concept through to operating mines and delivering key process / operational improvements. He has 30+ years’ experience as a senior mining & engineering professional building & operating mines globally, incl. leading major projects with Procon, KGHM, Iamgold & Leighton Contractors.

Mr. Uhl consulted with Nevada Copper resulting in IRR & NPV improvements, and was formerly project director of the Mt. Milligan Mine construction. While with KGHM he was involved in the Robinson Mine near Ely, Nevada. Past President & CEO of BMEX GOLD and presently the Regional Director for Study Management in the Americas Worley Technology and Expert Solutions.

President, CEO, Director Richard Tremblay has 15+ years’ experience as a natural resource executive & entrepreneur. He has extensive experience managing explorers, raising public & private equity capital, developing investor relations programs & delivering value. His recent experience includes corporate development roles at Temas Resources, CEO of Golden Ears Consulting and the CEO of Pacific Potash.

Director Campbell Smyth has 25+ years’ experience financing, managing & investing in resource-focused businesses incl. 15 years of managed portfolio investing. He received a bachelor of commerce degree from the University of Western Australia and is an authorized securities representative in Australia. Mr. Smyth is currently the Chairman of Norseman Silver, a director of Nubian Resources and CEO of Clairiden Capital.

Director Kyle Hookey has 10+ years’ capital markets experience in N. America, the UK & Australia advising on M&A, financings, and corporate restructuring. Previously, Mr. Hookey was based in Australia working with Goldman Sachs, JBWere, and Euroz Securities. He’s a member of the CFA Institute, a Partner in Cronin Capital, CEO of Calidus Resources & VP Corporate Finance of Imperial Helium.

CFO Morgan Tiernan has 8 years’ tax & advisory experience for private & public entities. He has a Diploma of Business, is a Chartered Accountant and has a bachelor of law.

Director David Eaton has 40 years’ capital markets experience incl. as a floor trader at the Vancouver Stock Exchange, corporate finance, capital raising and advisory & merchant banking. Mr. Eaton’s experience includes real estate, mining, tourism, retail, manufacturing, marketing & distribution. His recent experience includes CEO of Jayden Resources, Director / Consultant Novo Resources, Confederation Minerals, Kariana Resources and Chairman of Baron Global Financial Canada since 2007.

Tech. Advisor Cam Bartsch P.Geo has over 20 years’ experience from grassroots through to production, focused on structural & econ. geology. Evaluated & completed structural assessments for Kinross, Newmont & Teck as a senior structural Geo with Terrane Geoscience. Worked at the BCSC and Equity Exploration Consultants. Helped expand the Back River Project with Dundee Precious Metals & Sabina Gold.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Allied Copper Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Allied Copper Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Allied Copper Corp. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Allied Copper Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Allied Copper Corp. Please click here for more information. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allied Copper Corp., a company mentioned in this article.