Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) is the oldest, largest and best of the gold royalty and streaming companies: top management, solid balance sheet, and well diversified. Risks: valuation is high (though always has been), particularly as it builds non-gold assets which trade at lower multiples. Franco is a core holding, though we are not buying now.

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) invented the streaming model and also has strong management and balance sheet, though it is less diversified than Franco. Risks: as with Franco, valuation is high. After Franco comes Wheaton; buy on pullback.

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) has lowest valuation of the “big three” and strong growth ahead for next year. Risk: less diversified, and there are still potential water problems at largest asset, Mt. Milligan. Buy.

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) has lowest valuation of the “big four,” and also has strong growth profile over the next 12-18 months, plus a built-in pipeline from its interests in Osisko Development and other sponsored companies. Risk: Less well known outside of Canada (though that also provides potential); it needs to sell down interest in OD. Buy.

Major gold producers mostly buys

Newmont Corp. (NEM:NYSE) is the largest gold mining company in the world, with no strong warts. When gold moves, it will also move, and move first given its strong name recognition. Risks: Management and balance sheet not as strong as Barrick or Agnico (among the large three miners). Hold.

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) completed turn around following merger with Randgold and appointment of Mark Bristow as CEO, with improved operations and balance sheet, lower costs. Bristow is top CEO in the space for his energy and insight. Risks: company seems more dependent on its CEO than other large miners; diversified portfolio also has higher political risk. Buy.

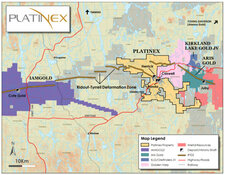

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) conservative management, strong balance sheet and consistent performer. The pending merger with Kirkland leapfrogs it to one of the largest gold mining companies in the world, but with stronger political-risk profile than others. Risks: Near-term, there will be ongoing stock pressure following the merger. Buy.

Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) one of cheapest of large gold miners, and in midst of turnaround (balance sheet, project rationalization) after new CEO. Risks: further to go, and the company has stumbled before. Hold.

Two silver stocks among best buys now

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) is one of largest silver miners in the world, with diverse operations, and upside from two very large but currently stalled silver projects. Risks: has experienced problems at very mines in recent years, producing lackluster quarterly results. Buy.

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) is undervalued relative to peers; recent acquisition of Roxgold gives it political diversification and growth upside. Risks: ongoing issues in Argentina as well as need to perform well with new assets in West Africa. Buy.

Diversified resource companies limit risks

Altius Minerals Corp. (ALS:TSX.V) has built a diversified portfolio of royalties in resources outside of gold and silver. Contrarian and imaginative management. Risks: downturn in China and resource sector leading to lower revenues. Hold.

Lara Exploration Ltd. (LRA:TSX.V) is building portfolio of royalties on properties it generates in Brazil and Peru. Several could be company makers. Conservative management with low G&A. Risks: as a small company, it is not always in a strong position in negotiating with partners on whom it depends of exploration expenditures. Strong buy.

Reservoir Capital Corp. (REO:TSX.V) holds cash-flowing assets with value well in excess of market cap of company. Risks: small company has experienced ongoing delays in filing financials. Whether or when value can be unlocked is risk. Hold.

Several juniors, with different game plans, are good buys

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) owns one of the largest undeveloped gold mines in the world, and in a safe jurisdiction. Stock significant discount to NAV. Updated feasibility will provide great clarity. Risks: seeking too much from a partner and delaying transaction, leading to ongoing dilution to keep company going. Buy.

Midland Exploration Inc. (MD:TSX.V) broad portfolio in mining-friendly Quebec, with several alliances and joint ventures, including with some of world’s leading mining companies. Business model minimizes its own spending. Risks: company is partly dependent on partners so progress can be slow in downturn; repeated, if small, “flow- through” financings create ongoing stock supply. Buy.

Orogen Royalties Inc. (OGN:TSX.V) plans to build a royalty portfolio through generation and has two large royalties, one to start cash-flowing next year and another on a potentially large Nevada project that could start in five or six year. Well financed, strong management, and actively partnering on its broad portfolio. Risks: need to continue to do transactions; first royalty could have start-up issues. Buy.

Azucar Minerals Ltd. (AMZ:TSX.V; AXDDF:OTXQX) is developing a large copper property in Mexico, backed by Newcrest, the major Australian company. The stock is selling at a fraction of the value of the property. Risks: progress is slow; and there is always the risk that Newcrest backs away.

Almadex Minerals Ltd. (DEX:TSX.V), spun out from Azucar (and thence from Almaden) has a low-risk business model with royalties (including on Almaden and Azucar), several joint ventures; and exploration properties. It is selling barely above cash and liquid assets. Risks: the business model means the company is reliant on others. It has executed a gold loan with Almaden, which has no revenue at present.

Cartier Resources Inc. (ECR:TSX.V): we are holding for economic assessment study leading to potential sale on its leading project; if successful, should be at a multiple of stock price. Risks: no sale may result, or there may be further delays; ongoing dilution hurts stock. Hold.

High yields are available from business lenders

Ares Capital Corp. (ARCC:NASDAQ) largest and one of most conservative of Business Development Companies, with high yield fully covered by earnings. Risks: economic downturn hurting ability of some portfolio companies to service their loans. Buy on dips.

Gladstone Investment Corp. (GAIN: NASDAQ) another conservative BDC, with approximately 25% of revenue coming from capital sales. Risks: its size puts it at relative risk in downturn, and trading near high end of some valuation metrics, including premium to NAV. Hold.

Global companies mixed

Nestle SA (NESN:VX; NSRGY:OTC) globally diversified with long record of increasing earnings and its dividend. Solid balance sheet. Risks: Relatively low margins; stock valuations near high end of its historical range. Hold.

Hutchison Port Holdings Trust (HPHT:Singapore) sports a high yield after a period of high capital expenditures. Risks: A decline in global traffic, only recently recovered from covid shutdowns, would hurt port revenues. Buy on weakness.

Kingsmen Creatives Ltd. (KMEN:SI) designs and builds stores, exhibits and other items, in a low capital, high margin business. Risks: COVID continues to hurt the business. Hold.

THE VANCOUVER CONFERENCE scheduled for next month has been postponed. Rick Rule’s conference scheduled for July will also not take place in Vancouver. All these new rules—and ever-changing rules—are to blame.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Franco-Nevada Corp., Royal Gold Inc., Fortuna Silver Mines Inc., Altius Minerals Corp., Lara Exploration Ltd., Vista Gold Corp., Midland Exploration Inc., Orogen Royalties Inc., Ares Capital Corp., Gladstone Investment Corp., Nestle SA, Hutchison Port Holdings Trust, and Kingsmen Creatives Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, Royal Gold, Osisko Gold, Fortuna Silver, Altius, Lara Exploration, Reservoir Capital, Vista, Midland Exploration, Orogen, Azucar, Almadex, Agnico Eagle Mines Ltd, Pan American Silver Corp. and Wheaton Precious Metals Corp., companies mentioned in this article.

Adrian Day's Disclosures: Adrian Day's Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor's opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2021. Adrian Day's Global Analyst. Information and advice herein are intended purely for the subscriber's own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.