Rising electrification in America's auto industry is likely to boost the prices of key metals needed to make the electric and battery-powered transformation a reality. Copper and lithium are already some of the hottest commodities on the market these days, but several catalysts for surging demand are visible throughout the next decade.

When it comes to the supply side, though, each of those metals face potential shortfalls if they cannot adequately ramp up output. The supply of copper is already expected to fall into a global deficit this year, while producers in the lithium market look like they may be initiating a wave of consolidation to improve their scaling and profitability.

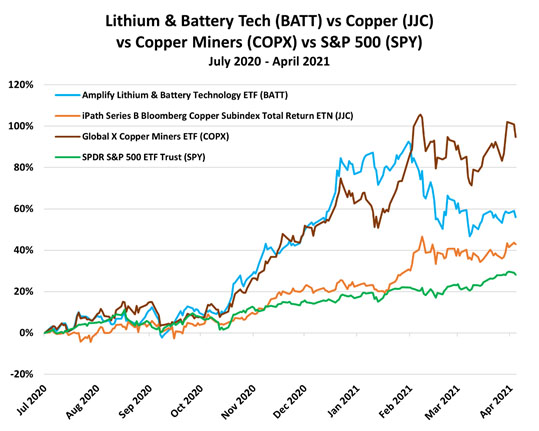

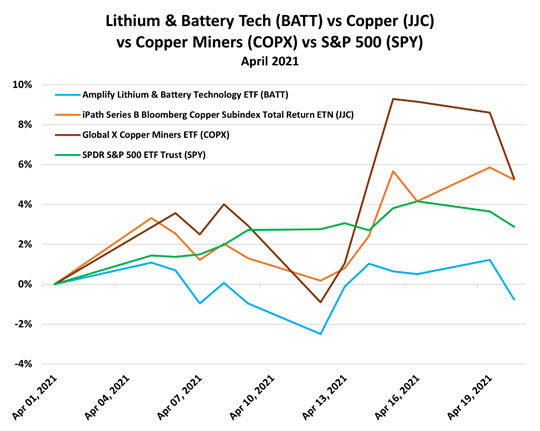

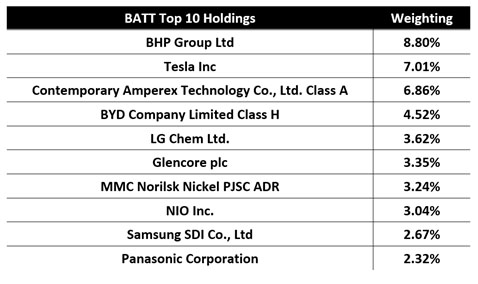

Related ETFs: Amplify Lithium & Battery Technology ETF (BATT), iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC), Global X Copper Miners ETF (COPX)

Strong U.S. EV Market Spurs Demand for Key Metals

The electric vehicle (EV) market in the U.S. may be set to spin into overdrive.

Last month, President Biden proposed spending $174 billion to promote EVs and install 500,000 charging stations across the U.S. as part of a sweeping infrastructure announcement, a plan MRP highlighted months prior to this official announcement. Bloomberg writes that the charging infrastructure would cover 57% of the charging that U.S. vehicles will need by 2030 and could spark the sale of some 25 million electric cars and trucks.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on April 13.

$100 billion of that spending will go toward consumer rebates. That program would replace the $7,500 rebates General Motors and Tesla Inc. no longer qualify for after they sold more than 200,000 zero-emission models. Per Reuters, the plan lays out $20 billion for electric school buses, $25 billion for zero emission transit vehicles and $14 billion in other tax incentives.

New data from Cox Automotive and Kelley Blue Book found sales of battery-powered EVs grew 44.8% YoY during the first quarter of 2021, with 98,832 units sold, as compared to 68,247 electric vehicles sold in the first quarter of the 2020 calendar year. Tesla was the dominant electric vehicle brand in Q1 2021, with 69,300 vehicles sold, or 71% of total EV sales in the U.S. during the time period.

These trends bode especially well for metals that are critical in the production of electrification and battery technologies. In particular, copper and lithium.

Copper—"The New Oil"?

Copper stockpiles in LME-approved warehouses recently hit their highest since November at 172,025 tonnes, but that hasn't stopped the ongoing rally in copper futures from touching a 2-month high at $4.245/lb—up more than 80% from a year ago.

In a new Goldman Sachs report, published Tuesday, the investment bank referred to copper as "the new oil", also noting that the market is facing a supply crunch that could boost the price by more than 65% in four years. By 2025, global demand for copper is expected to soar to nearly $15,000 per tonne, up from current prices of around $9,000 per tonne, per the bank's estimates.

Due to mass adoption of green technologies like batteries and electrification, demand would significantly increase by up to 900% to 8.7 million tons by 2030, the bank estimates. Should this process be slower, demand will still surge to 5.4 million tons, or by almost 600%. By the start of the next decade, Goldman estimates "a long-term supply gap of 8.2 million tons by 2030, twice the size of the gap that triggered the bull market in copper in the early 2000s."

Electric vehicles take around 83 kilograms of copper on average, while charging points need 10 kilograms of copper per unit. A team of Jeffries analysts, led by Christopher LaFemina, expects copper demand in EVs will rise to 1.7 megatons in 2030 from 170 kilotons in 2020. Additionally, a shift from coal and gas power to wind and solar works in copper's favor because those systems require five times more copper than conventional ones.

Even in the here and now, the world is just about getting by with current copper supplies. Part of that can be chalked up to reduced output in 2020 from COVID-induced mine closures in South America, but a much larger component has been China's rampant demand. In March, the country's copper imports rose 25% from a year earlier, capping off a strong first quarter that saw overall imports of the orange metal at 1.44 million tonnes, up 11.9% YoY, and the highest first-quarter amount since at least 2008, according to Reuters data.

Citi expects global demand for the metal used widely in power and construction to grow 6.5% this year to 24.75 million tonnes, and sees a deficit of 521,000 tonnes.

Additionally, Citi analyst Max Layton notes that supplies of copper scrap will jump this year, but scrap is unlikely to come fast enough to meet robust demand, "given logistical constraints and an 8-month lag between price strength and copper scrap coming to market for processing."

As MRP has highlighted previously, scrap is a diminished threat these days with fewer large stockpiles left to materially shift the market. Michael Lion, a trader at Hong Kong-based Everwell Resources, told Fastmarkets: "These days, there are no longer people holding big… inventories in the scrap industry—like [they would have done] 20 to 30 years ago when the industry was dominated by family businesses. So, the increase in prices does not do that much in [terms of] drawing out much more material."

Lithium Powers up the Battery Boom

In a recent note, analysts at Macquarie Research predicted that demand for electric vehicles could trigger "material shortages" of the metal from 2025. Widely used lithium-ion batteries contain around 7% to 10% lithium regardless of the overall battery chemistry, Macquarie said.

Per the Financial Times, lithium carbonate prices have soared about 70% this year on strong demand for electric vehicles, and Macquarie forecasts further price increases of 30%–100% over the next four years.

Bloomberg New Energy Finance projects battery demand to surge tenfold by 2030.

General Motors (GM) shows automakers are finally taking the EV revolution seriously, going all-in on its own lithium ion (Li-ion) battery factories. TechCrunch reports that GM recently announced plans to build a second U.S. battery cell factory—a $2.3 billion facility in Spring Hill, Tennessee—with LG Chem as joint-venture partner. Once fully operational in 2023, the joint venture's two battery factories will have production capacity of more than 70 gigawatt hours, double the capacity of Tesla's Nevada Gigafactory.

The Wall Street Journal reports that the two companies' first battery plant in northeast Ohio is already under construction and expected to open next year. As we highlighted last year, there were over 100 battery megafactories being planned around the world.

As the industry continues to mature, major players in the lithium business may be looking toward consolidation to improve their operations and economies of scale.

Just last week, Australian lithium miner Orocobre Ltd. bought smaller domestic peer Galaxy Resources for $1.4 billion to create the world's fifth most valuable lithium producer. As Reuters reports, the all-stock deal for A$1.78 billion ($1.38 billion) will establish Australia's most valuable lithium miner with a A$4 billion ($3.1 billion) market capitalization. After years of Australian mine closures and drawdowns in an effort to drain a supply glut that consistently dampened prices, both companies have unveiled significant expansion plans, putting the merged company on track to produce more than 130,000 tonnes of lithium carbonate equivalent (LCE), up from around 40,000 tonnes now, according to analyst Reg Spencer of broker Canaccord Genuity.

Theme Alert

MRP added LONG Copper and Copper Miners to our list of themes on July 17, 2020. We've been tracking the theme with the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) and the Global X Copper Miners ETF (COPX), which have returned +43% and +95%, respectively, over the life of the theme. Each of those have significantly outperformed the S&P 500's return of just +28% over the same period.

We added LONG Battery Metals to our list of themes on August 14, 2020, tracking the theme with the Amplify Lithium & Battery Technology ETF (BATT). Since then, the BATT has returned +47%, more than doubling the S&P 500's +22% return over the same period.

Originally published April 21, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.