In an April 15 research note, H.C. Wainwright & Co. analyst Heiko Ihle provided an update on Uranium Energy Corp.'s (UEC:NYSE AMERICAN) Burke Hollow project and the company's recent offering.

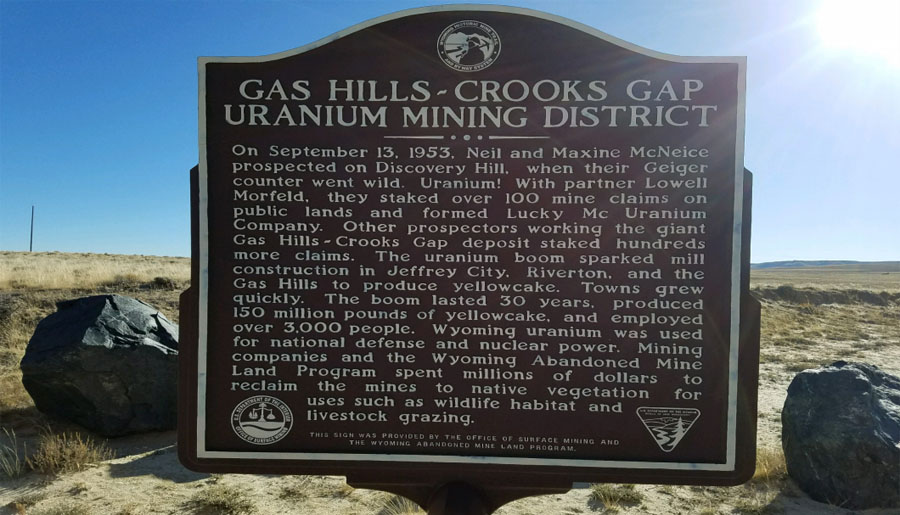

As for its Burke Hollow in situ uranium asset in Texas, the company has been working since April 9 to delineate the resource there, Ihle noted. Using two rigs, Uranium Energy completed 40 holes, the goal being to better understand the five Goliad Formation trends in production area PAA-1.

Of that set of holes, highlight hole 283.0-319 encountered an average uranium grade of 0.163% and a 4.483 grade thickness.

The energy company also placed 45 exterior monitoring wells there, adding to the existing 75, "to account for trend extensions," Ihle wrote.

Regarding Uranium Energy's recent financing, Ihle relayed that it closed, having generated $12 million. The company now has more than $110 million in cash, equity and inventory holdings. Its cash on hand is enough for Uranium Energy to completely fund its purchases of physical uranium for its stockpile.

Along with using the financing's proceeds to add to its uranium inventory, the company intends to use it as working capital.

Looking forward, Ihle reiterated H.C. Wainwright's view that macroeconomic developments eventually should boost uranium prices, thereby making production for Uranium Energy economically viable. At such time, the company is expected to commence production at one or more of its facilities.

"This is especially important given ongoing wellfield development and definition drilling that should support a meaningful production ramp-up at Burke Hollow," Ihle added.

Also as the prices of the metal rise, the company should realize value through its uranium inventory.

H.C. Wainwright has a Buy rating and a $5 per share price target on Uranium Energy, the stock of which is trading now at about $2.88 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.