In an April 12 research note, Noble Capital Markets Inc. senior research analyst Mark Reichman stated that junior mining exploration company Aurania Resources Ltd. (ARU:TSX.V; AUIAF:OTCQB; 20Q:FSE) is fully funded for the remainder of 2021 after recently completing two separate financings.

The analyst advised that Aurania Resources raised gross proceeds of CA$7,771,700 from a brokered equity issuance of 2,507,000 common shares along with additional gross proceeds of CA$1,250,000 from a private placement. Noble Capital Markets estimated that following the close of these transactions Aurania had a total of 46,843,388 shares outstanding.

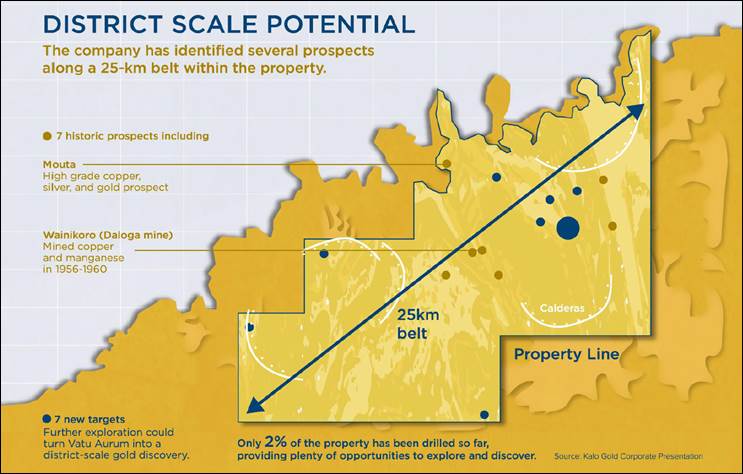

The report mentioned that Aurania Resources is focused primarily on identifying, evaluating, acquiring and exploring precious metals and copper property interests. The firm's flagship asset is The Lost Cities - Cutucu Project in Ecuador comprised of 42 mineral exploration concessions covering around 2,080 square kilometers.

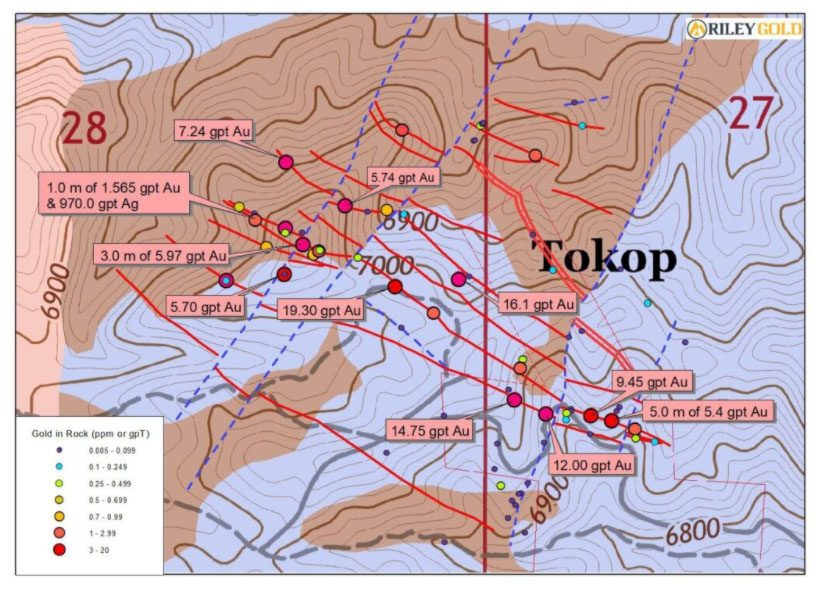

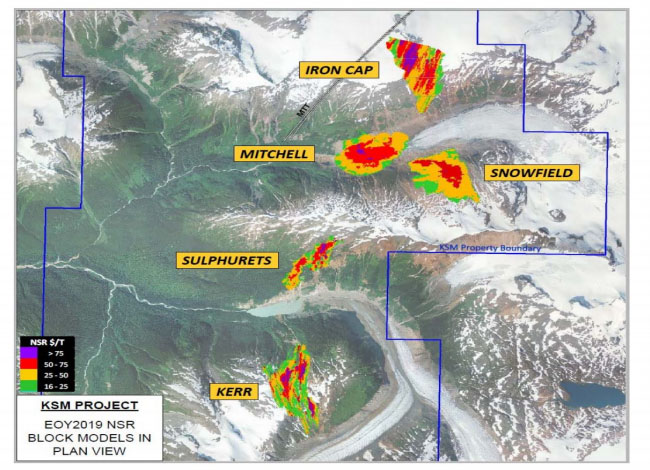

The analyst noted that diamond drilling work is currently being conducted at the Kuri-Yawi target with the objective of testing an epithermal target and a deeper porphyry target down to depths of as much as 1,000 meters. "Porphyry deposits, while low in grade, are the largest source of copper ore and can be important sources of gold," the analyst added.

Noble Capital's expects that Aurania's drilling activity will accelerate though it believes it could achieve even greater progress if an additional drill were to be deployed. So far, the company has drilled three targets and is presently working on the Tsenken N1 copper-silver target and the Kuri-Yawi epithermal gold-silver and copper porphyry target. The company's next plans are to carryout drill work at the Tsenken West copper-silver and Tiria-Shimpia silver-zinc targets.

Sr. Research Analyst Reichman commented, "Aurania's exploration program has yielded a plethora of drilling targets for a variety of metals and the potential to make multiple discoveries in its large concession package."

"In our view, the company has reached a stage where the outcomes of its efforts may start to become more readily apparent to the market," Reichman added.

Noble Capital commented that "Aurania Resources Ltd. represents a potentially high-risk, high-reward investment opportunity that hinges, in part, on management's ability to discover economically-recoverable mineral resources within the Lost Cities-Cutucu project area."

Noble Capital expressed its confidence in Aurania's shareholder friendly corporate governance practices and its strong management team. Noble advised; however, that the company will require external financing to fund its growth as it is not generating revenues or cash flow from operations and is operating in Ecuador, which it considers to be a comparatively higher-risk mining jurisdiction compared areas such as the U.S. or Mexico.

Noble Capital Markets listed that it currently has an "Outperform" rating for Aurania Resources with a target price of US$3.50/share. The company's shares trade under the ticker symbol AUIAF on the US-OTCB market and closed for trading at US$1.90/share on April 12, 2021.

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.