Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE, US$7.26) provided additional insights to its last quarter and last year results in a conference call. For the year, silver production was down 19%, due to lower grades and temporary COVID-shutdowns at both silver mines, Caylloma and San Jose. (Our earlier report, Bulletin 766, implied the silver reduction was for the quarter; it was for the year.) Higher prices offset lower production and that, together with the onset of the new gold mine in Argentina, saw revenue up around 9%, but because of lower capital spending, free cash flow doubled for the year to almost $79 million.

Following a weak fourth quarter overall, Fortuna has pointed to improvements, particularly at the new Argentina mine, Lindero; this year is "materially better." There are still some technical difficulties with specialized equipment. Because of COVID travel restrictions, they are unable to get the vendor technicians on site, which is delaying fixing the problem. The company now expects to be at 85% capacity by the end of this month or early next.

Back to exploration

The company also said it was going to spend more on exploration, which had been "short-changed" for three years as the company focused on the development and construction of Lindero. This will include "aggressive" near-mine exploration at San Jose, as well as drilling the nearby El Blanco project it has optioned from Minaurum. Similarly, at Callyoma, it will be drilling extensions as well as new areas. And at Lindero, it will be drilling a second gold porphyry, near the main ore, which is looking to be a small, higher-grade deposit, suitable as a satellite deposit. It will also be drilling new projects in both Mexico and Argentina.

As of the end of last quarter, the company has $34 million in cash. With good metals prices, the famously conservative company is looking to strengthen its balance sheet, aiming for "a fortress." With strong management, a solid balance sheet and a full year ahead at the new mine, Fortuna, which remains fundamentally undervalued relative to other comparable silver miners, is a buy.

Franco Looks to Higher Revenue Ahead

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE, US$124.33), following its record quarter and year, has increased its dividend by 30%, a larger-than-normal amount. The company felt comfortable doing that with more than $1 billion revenue, and its largest asset, Cobre Panama, with its first full year of operation behind it.

The company expects another record year ahead, particularly with Cobre continuing to ramp up production, another cornerstone asset, Candelaria, back up and running, and a third, Antamina, expecting an increase in silver deliveries. The oil and gas unit had a good 2020 and is expecting another strong year this. Overall, it is expecting 10% in gold-equivalent ounces (GEOs).

Franco has no debt, $530 million in cash and $1.4 billion available on its credit facility for any new acquisitions. It sees most likely areas for opportunities in acquisition or mine development financing.

The company is well diversified, more so than other large royalty companies, with no single asset or single operator contributing more than 13% of its revenue (Cobre Panama). It has top management and balance sheet. Although it has rebounded of its low at $106/share at the end of February, Franco remains a buy, particularly for those who do not already own it.

Altius Is On Track for More Growth Ahead

Altius Minerals Corp. (ALS:TSX.V, 15.90), on its call, provided guidance for the year ahead. It no longer provides revenue guidance due to the volatility in commodity prices, but rather volume guidance for its assets. Other than the coal assets, which continue to wind down, Altius is expecting similar or increased production at most mines. It has been using its cash flow for scheduled debt repayments, dividends, and continues to repurchase shares, $6 million last year. It continues to buy back shares this year—another 400,000 shares, compared with 644,000 for all of 2020.

The large land build-up during the weak commodity years of 2013–2015 is mostly vended now, with far less land available for deals. But there will, of course, be rewards from the work now being undertaken by others on these projects. The project generation business contributed $6.7 million, net of reinvestments.

Following the lead up to, and the successful IPO (initial public offering) of Altius Renewable Resources, Altius' stock has been strong, barely above $11/share at the end of November. We are holding, but looking for opportunities to buy more.

A New Deal for Midland, But That's Not All

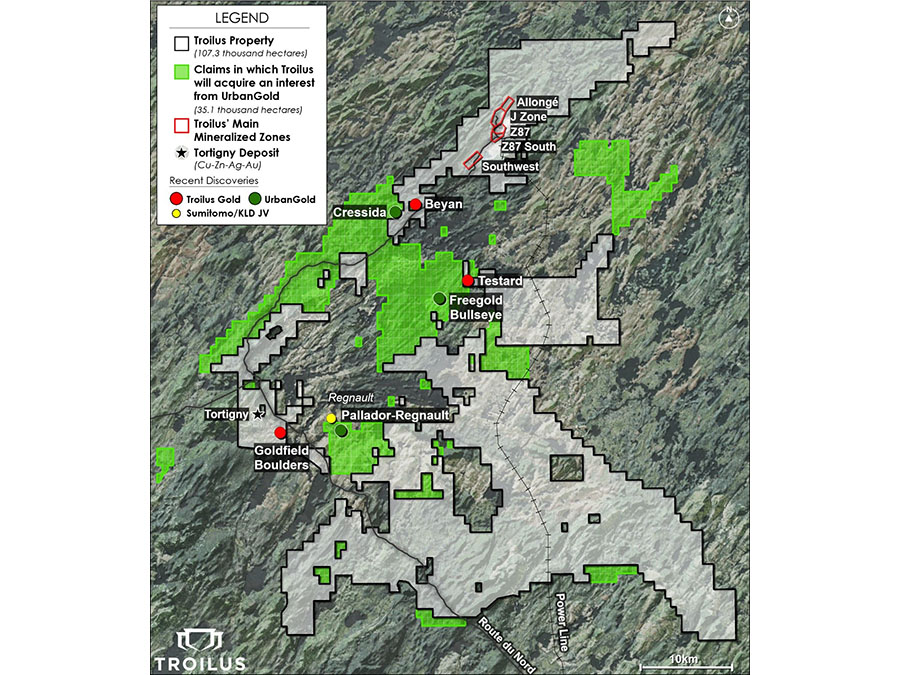

Midland Exploration Inc. (MD:TSX.V, 0.90) is not standing still. Since our last update earlier this month (Bulletin 769), Midland has signed a new deal with Soquem, an alliance looking for gold and strategic metals in Nunavik, in the underexplored Labrador Trough. The agreement calls for up to $5 million in exploration spending over four years.

Another significant development is that the world's largest mining company, BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), is moving its nickel and copper exploration headquarters to Toronto, from Santiago, Chile, following a partnership agreement with Midland last August. BHP's chief technical officer Laura Tyler in making the announcement, said she expected "a golden age of exploration" in the years ahead. With a large land package in the prospective areas of Quebec's north, and the first exploration alliance with BHP, Midland stands to benefit from this new emphasis. It continues to be a buy at current prices.

Wheaton Moves Forward Steadily

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE, US$39.26) met its 2020 guidance, with fourth-quarter production of 185,000 GEOs and 673,000 for the year. It is expecting production to be about 5% higher this coming year, a somewhat modest call given that 2020 production was hurt by covid-restrictions. Guidance for the next five years is somewhat improved; its largest revenue source, the Vale's Salobo mine, is in the midst of an expansion scheduled to commence in the first-half of next year. A new mine, Pampacancha, in Peru, is being delayed due to new COVID restrictions in that country, though Wheaton did receive its first shipment of cobalt from Voisey's Bay.

Wheaton increased its dividend again, by 30% over 2020, following its policy to pay about 30% of cash flow. At a tad over 1.3%, its yield is above that of peers Franco and Royal Gold, though less than that of Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE). After paying down almost $300 million on its credit facility, Wheaton is now net debt neutral, with about $2 billion still available for new transactions. Wheaton is a buy.

TOP BUYS for the coming week: In addition to those discussed above, top buys now include Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX, US$105.81); Orogen Royalties Inc. (OGN:TSX.V, 0.30); Barrick Gold Corp. (ABX:TSX; GOLD:NYSE, US$20.95); and Lara Exploration Ltd. (LRA:TSX.V, 0.71).

Upcoming Seminars

With the U.S. slowly re-opening, there are two in-person conferences scheduled in the months ahead. At The Money Show, Orlando, June 10–12, I shall be presenting a two-hour gold investing course, as well as be a panelist on top global picks. Speakers include Steve Forbes and Stephen Moore.

FreedomFest, Mark Skousen's ever-popular jamboree, this year to be held near Mount Rushmore, South Dakota, July 21–24. Speakers including popular returnees such as Whole Foods' John Mackey, and radio host Larry Elder, and new speakers including Ayaan Hirsi Ali, whose talks on women's rights, Islam and European immigration, has seen her come under attack. The special "mock trial" will put the government's covid response in the dock.

Two other upcoming conferences will be virtual, The Money Show Money, Metals and Mning conference, April 20–22; and the annual Sprott Natural Resources Symposium, July 15–17. More details are on our website.

Originally posted on March 20, 2021.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

[NLINSERT]Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Lara Exploration, Orogen Royalties, Franco-Nevada, Midland Exploration, Altius Minerals, Royal Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, Osisko Royalties, Lara Exploration, Wheaton Precious Metals, Altius Minerals, Midland Exploration, Fortuna Silver Mines and Orogen Royalties, companies mentioned in this article.

Adrian Day's Disclosures: Adrian Day's Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor's opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2020. Adrian Day's Global Analyst. Information and advice herein are intended purely for the subscriber's own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.