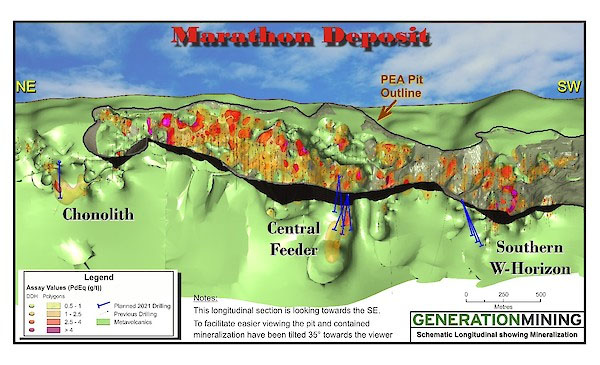

In a March 3 research report, Haywood Securities analyst Pierre Vaillancourt reported that Generation Mining Ltd. (GENM:TSX; GENMF:OTCQB; 9GN:FSE) is expected to release a feasibility study on its Marathon palladium-copper project in Montana within two weeks' time.

"We believe the upcoming feasibility study will demonstrate strong underlying value for the Marathon project and for Generation Mining, supported by a rising metals market," he added.

Vaillancourt noted the anticipated differences in this feasibility study from the 2020 preliminary economic assessment.

A significant and positive change, he wrote, is that the feasibility study will not include the two-phase mine outlined in the PEA, in which production was to start and be sustained for the first five years at 14,000 tons per day (14 Ktpd) then increase to 22 Ktpd in the sixth year. Rather, the feasibility study will have production commencing at a much higher rate, at about 25 Ktpd.

"This approach will result in higher production and will benefit from an enhanced mill flowsheet with higher recoveries and higher grade metal concentrates," Vaillancourt commented.

Because the mine outlined in the feasibility study will be larger, the analyst noted, capex will be higher than previously calculated, now around $600–700 million versus the PEA's $431 million. Operating costs also will be higher.

"However, we believe the economies of scale will favor stronger returns," Vaillancourt wrote.

He also highlighted that better metals prices mean better Marathon economics. Today's palladium and copper prices, US$2,345 per ounce and US$4.11 per pound, respectively, are much higher than those used in the PEA, US$1,275 per ounce for palladium and US$3 per pound of copper.

"At current prices, palladium revenues are 64% of total revenues, based on annual production of 122,000 ounces, and copper is 23% of total revenues, based on annual production of 29,000,000 pounds," Vaillancourt indicated.

Now that the feasibility study is complete, Sibanye-Stillwater has 90 days to decide whether or not it wants to exercise its option to increase its stake in the Marathon property from its current 20% up to 51%, noted Vaillancourt. Haywood, however, sees another option.

"[Sibanye-Stillwater] could acquire Generation Mining altogether in order to take full control of the operations and derive maximum benefit from Marathon cash flow," Vaillancourt wrote.

Haywood has a Buy rating and a CA$1.75 per share target price on Generation Mining, the current stock price of which is about CA$1.02 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.