In a StreetSmart Live! Broadcast on Feb. 4, 2021, Greg McCoach, publisher of The Mining Speculator; Jorge Ramiro Monroy, CEO of Reyna Silver Corp. (RSLV:TSX.V; RSNVF:OTCMKTS); and Peter Megaw, precious metals expert and chief technical adviser to Reyna discuss silver—current and future prices, the market, demand for the metal—and Reyna Silver—its strategy, assets, work in progress in Mexico and Nevada and upside.

Host Cyndi Edwards began the broadcast by stating that earlier in the week, on Monday, the spot silver price hit $30 an ounce, its peak since 2013. After the recent high, the price leveled out at about $26 an ounce.

The cause of this week's volatility, Greg McCoach, publisher of The Mining Speculator, said was the derivative silver position of an entity in London that is short 100 million ounces of the metal. Those holding the short must come up with the physical silver, which is not available in any of the usual inventories, or default, a serious situation, McCoach said. That bodes well for silver prices, as does the current tenuous status of the U.S. dollar.

"I wouldn't be surprised to see silver make an all-time high," he added. "When it does, it's probably going to do so like a hot knife through butter."

More and more people are coming into the precious metals space, McCoach said, motivated by the fear they will lose money in their current investments. Gold and silver have always proven their worth during hard financial times. However, the shift to precious metals is slow going as investors are still realizing profits in other sectors.

"As time goes on and markets get more volatile and bubble markets get pierced, watch what happens," McCoach said. "They are going to come flocking to the precious metals space."

Investors looking to preserve their wealth by investing in silver in part drives demand for the metal, said Peter Megaw, chief technical adviser to Canada-based Reyna Silver Corp. (RSLV:TSX.V; RSNVF:OTCMKTS) and chief exploration officer of MAG Silver Corp. (MAG:TSX; MAG:NYSE A). The second driver is the need for the metal for industrial applications, including electric cars, solar panels, various other green energy technologies, and for medical uses. Silver is the best conductor of electricity and a passive germ killer.

With demand for silver high and growing and silver prices on the upswing, companies in the space will benefit, McCoach pointed out.

A viewer asked which is preferable, investing in an exchange-traded fund or in individual company stocks. McCoach recommended the latter but advised she and others first determine the level of risk they are willing to take and then buy companies that offer it. He explained that production stories carry low risk and can yield double or triple returns in a precious metals bull market. Development companies carry more risk and can deliver good returns. Exploration plays are higher risk but also higher reward.

He pointed out that there are only about 12 silver explorers for people to invest in, unlike with gold, which has about 600 to 700. Of that dozen, few have the kind of projects Reyna has, and thus, Reyna is McCoach's Top Pick in that space.

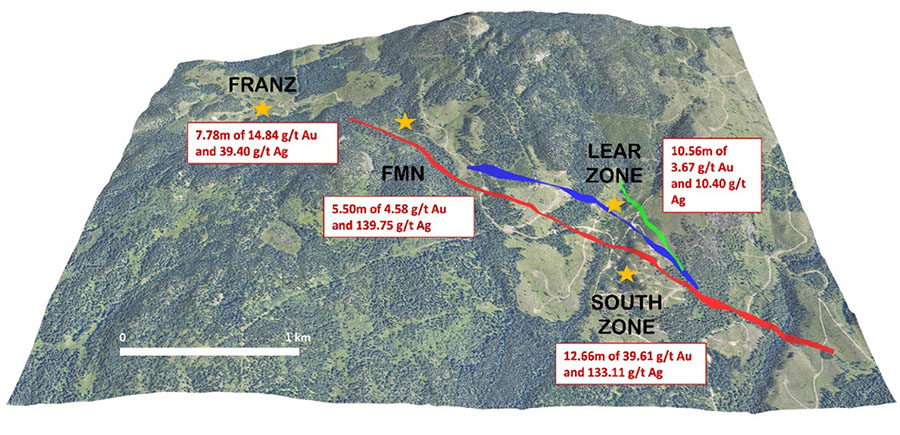

The broadcast then turned to Reyna Silver. CEO Jorge Ramiro Monroy noted it is currently advancing four projects, all of which he is excited about. Guigui, Batopilas and La Reyna are in Chihuahua, Mexico; Medicine Springs is in Nevada.

Drilling is underway at Guigui, its flagship property, where 10,000 meters are planned and 1,500 meters have been completed.

As for Batopilas, news from the project came out the morning of this StreetSmart Live! Broadcast.

Trenching and sampling yielded very high grade silver, "like Brillo pads of native silver with an average grade better than 2%," Megaw described. "Geologists were picking pieces of native silver crystals out of the ground."

Also discovered at Batopilas was gold, which may help Reyna determine the source of the mineralized system. Monroy noted a lot of work and interpretation still need to be done at the project, but Reyna is advancing toward identifying targets for near future drilling.

"The initial results this morning get us excited about the possibility of future success on this first project," McCoach said.

Megaw explained that MAG Silver initially owned Batopilas and Guigui but because the company knew it was not giving them the attention they deserved, they agreed to let Reyna take them off their hands. MAG took a position in Reyna and allowed Megaw to work with Reyna to help it become successful.

Regarding Medicine Springs, Reyna finished an initial exploration program in December and is now finalizing the work plan for it.

At La Reyna, the company is in the process of obtaining access permits. Once in hand, Reyna intends to carry out exploration work similar to what it did at Batopilas.

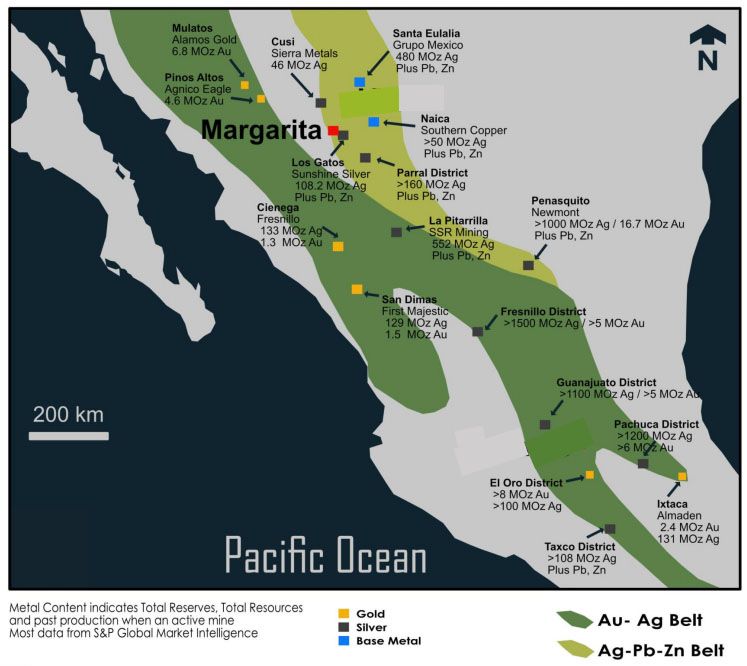

Reyna Silver's initial and ongoing strategy, Monroy said, is to look for and find deposits that attract the majors, and those are ones with high grade and district scale and are located in safe jurisdictions.

For companies to constantly produce and profit during the short good and long bad periods for which the silver market is known historically, they must have high grade and size, Megaw explained. The companies with those stand out among the others. District scale refers to an ore deposit that will produce and generate profit for a long time, whether via one big mine or numerous smaller ones.

"Grade lets you make money at the worst of times, and size gives you the ability to survive several market cycles," Megaw added. "So essentially, you're sleeping at night during worst part of the market and partying all night for the rest."

A viewer asked what the likelihood is that MAG or another company will buy out Reyna, and Monroy responded that it was too early to speculate. To generate interest, Reyna first must make more progress with drilling and get much closer to having a resource. Also, he pointed out, the company has only been public for about six or seven months. Monroy did say, though, that he remains in constant contact with prospective buyers, keeping them updated on the company and the advancement of its projects.

The CEO highlighted that Reyna has a strong balance sheet, strong projects, incredible intellectual capital and drill confirmation of the presence of high-grade silver. Looking forward, the silver explorer offers "tremendous upside," he said. "We're just getting started here."

He suggested viewers keep an eye on Reyna Silver, follow it on its website and subscribe to the company's newsletter.

Readers can view the broadcast here:

[NLINSERT]

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: MAG Silver. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Reyna Silver. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Reyna Silver, a company mentioned in this article.

StreetSmart Live Disclosures:

1. The following companies discussed in this broadcast have paid a fee to participate: Reyna Silver.

2. This broadcast does not constitute investment advice. Each viewer is encouraged to consult with his or her individual financial professional and any action a viewer takes as a result of information presented here is his or her own responsibility. This broadcast is not a solicitation for investment. StreetSmart Live does not render general or specific investment advice and the information should not be considered a recommendation to buy or sell any security. StreetSmart Live does not endorse or recommend the business, products, services or securities of any company mentioned here.

3. Statements and opinions expressed are the opinions of the presenters and not of StreetSmart Live or its officers. The presenters are wholly responsible for the validity of the statements. The presenter was not paid by StreetSmart Live for this broadcast. StreetSmart Live requires presenters to disclose any shareholdings in, or economic relationships with, companies that they write about. StreetSmart Live relies upon the authors to accurately provide this information and StreetSmart Live has no means of verifying its accuracy.

4. From time to time, StreetSmart Live and its directors, officers, employees or members of their families, as well as persons interviewed for broadcasts and interviews on the site, may have a long or short position in securities mentioned. As of the date of this broadcast, officers and/or employees of StreetSmart Live (including members of their household) own securities of the following companies discussed in this broadcast: Reyna Silver. Reyna Silver currently has a consulting relationship with StreetSmart (description available at https://www.streetwisereports.com/disclaimer/html#consulting).

5. Jorge Ramiro Monroy is CEO of Reyna Silver and Dr. Peter Megaw is chief technical advisor; both own securities of the company.

6. Disclosures for Greg McCoach, editor of Mining Speculator:

I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: Reyna Silver.

I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None

My company has a financial relationship with the following companies discussed in the broadcast: None

7. Disclosures for Cyndi Edwards:

I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: Reyna Silver

I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None

My company has a financial relationship with the following companies discussed in the broadcast: None