It would be easy to point at the latest news on Portofino Resources Inc. (POR:TSX.V; PFFOF:OTCQB) and say, "look, a gold junior moving into the red hot lithium space!" But, of course Portofino never left lithium, it expanded into precious metals just before the gold price soared from $1,500 to over $2,000/oz (more about that later).

Portofino knows lithium and management knows Argentina

While Portofino is not new to lithium, what I said about lithium being hot is perfectly clear. The top-10 performing lithium companies (all but one pre-production) are up an average of +1,320% from their 52-week lows. These players span hard rock, brine and sedimentary (including clay-hosted lithium projects).

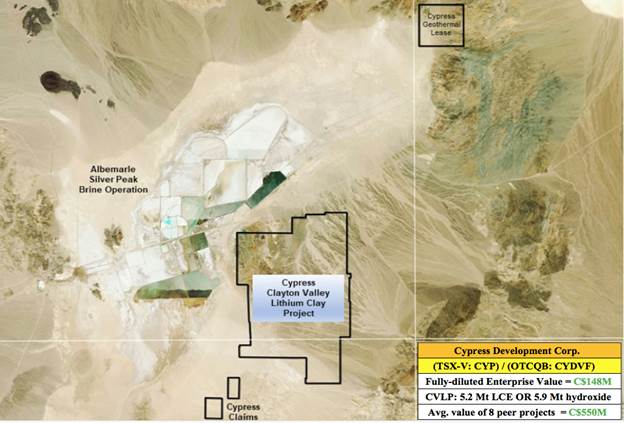

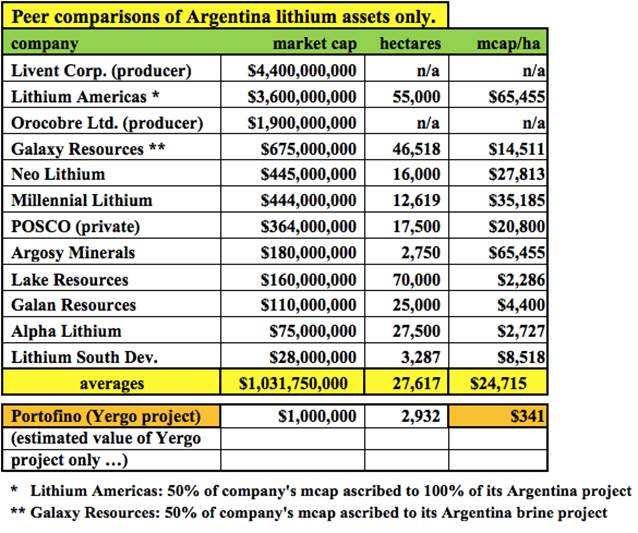

Portofino controls a 2,932 hectare brine project in Catamarca province, Argentina, 15 km southeast of Neo Lithium's very high-grade/very low-impurities project. Admittedly, 2,932 ha is not a giant footprint, but it's not tiny either.

Portofino's property is about the same size, or larger, than land packages held by Argosy Minerals and Lithium South Development Corp., who have market caps of $180 million and $30 million, respectively.

Not only is the lithium sector extremely strong, shares of companies with projects in Argentina are among the leaders of the pack, {Neo Lithium, Lithium Americas, Millennial Lithium, Argosy Minerals and Lake Resources are among the top-12 performers}.

Make no mistake, Yergo is not that valuable today, but it could be after it's drilled later this year. Lithium Americas is up 870% (even after announcing and closing a $350 million private placement) from its March 2020 COVID-19 low. It has a $3.7 billion market cap, Neo Lithium is up 818%.

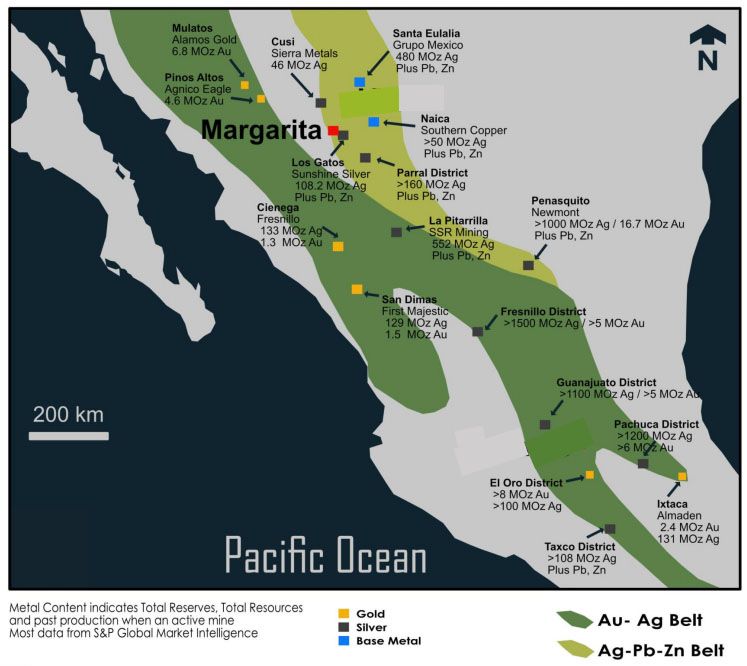

Most investors are familiar with mining juniors touting nearby mines as examples of possible outcomes of their exploration activities. Sometimes analog mines are past producers, sometimes they're 50-150 km away, and sometimes they're mediocre assets.

By contrast, Portofino's Yergo project is 15 km from Neo Lithium's PFS-stage 3Q project, possibly the single best lithium brine project in the world.

In the chart above I show most of the lithium players with all, or substantially all, of their lithium properties in Argentina, (POSCO, Lithium Americas and Galaxy Resources also have projects in other countries). By no means do I mean to suggest that any of the larger companies would care about the Yergo project.

However, there are a handful of names that might benefit from acquiring a new brine project, especially one with demonstrated low Mg levels and one that does not share its salar with others.

If drilling hits Li concentrations anywhere near that of Neo Lithium's project, Yergo could become something fairly significant. Could it be worth $100 million? Probably not! But, $5–$10 million? Perhaps, especially in the hands of a larger lithium player. Remember, the company's market cap is just $8 million.

Although Portofino's lithium assets (including a ~650k share position in lithium junior Galan Resources) hold significant promise, the company's primary objectives in 2021 remain in the gold sector.

Readers are reminded that management has boots on the ground in Argentina, valuable business relationships dating back nearly a decade, with people in Catamarca province. These relationships are being leveraged not just for lithium, but now for precious metal opportunities as well.

2 gold properties, Gold Creek and South of Otter, to be drilled this year

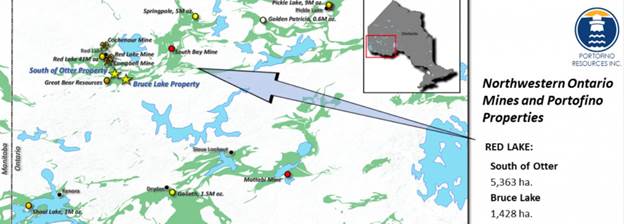

Near Red Lake, Portofino has the South of Otter ("SOT") and Bruce Lake properties. In Atikokan, Portofino has three more, Gold Creek, Sapawe West and Melema West. All five properties, totaling 12,843 hectares, are in northwestern Ontario and are controlled via very low-cost, multi-year options to acquire 100% interests. Gold Creek and SOT are the two flagship projects.

Gold Creek comprises 15 mining claims containing ~4,036 contiguous hectares in the Atikokan area, near Red Lake. Gold Creek is Portofino's most advanced gold project. Management is planning for a 1,000 m (5–6 hole) drill program in the spring.

Historical data, mostly from the eastern portion of the property, includes multi-ounce gold grab samples and drill intercepts of 4.3 g/t gold over 41 m and 4.36 g/t gold over 20.4 m completed in 1995, and a 1 tonne bulk sample in 2008 that returned an average grade of 9.9 g/t gold.

Although there's been limited drilling, substantial exploration over the decades at Gold Creek included prospecting, mechanical stripping and trenching, geological mapping, airborne magnetic and electromagnetic survey, ground magnetic and electromagnetic surveys, selective radiometric and gravity surveys, and geochemical sampling.

Management negotiated the Gold Creek property option at the height of the global pandemic in March–April 2020. I believe it got a very good deal. How many pre-maiden resource properties have had a 1 tonne bulk sample taken?

A tonne at 9.9 g/t gold—that's US$600/tonne rock! Significant gold mineralization has been traced along a 1.5 km strike length with grab samples as high as 759 g/t (~24.4 troy oz/ ton).

In the summer and fall, two prospecting programs were carried out which included 211 grab samples. Historical zones of mineralization were sampled, confirming anomalous and high-grade gold in multiple zones—samples returned up to 45.6 g/t gold.

A Mag Survey was flown over the entire property in late summer, followed by a property-wide compilation and structural interpretation. This critical work greatly enhanced the geological and structural understanding of the property.

Prospecting and mapping in the fall led to the discovery of the New Road Zone. Fourteen grab samples were collected, the two best showed 4.1 g/t gold and 720 ppm copper.

Management believes its understanding of the mineralization has significantly improved. For example, locations of historical work are much better known. Gold zones confirmed in 2020 will be drill-ready—following a detailed review of previous drilling and ongoing structural interpretations.

South of Otter is Portofino's premier Red Lake project

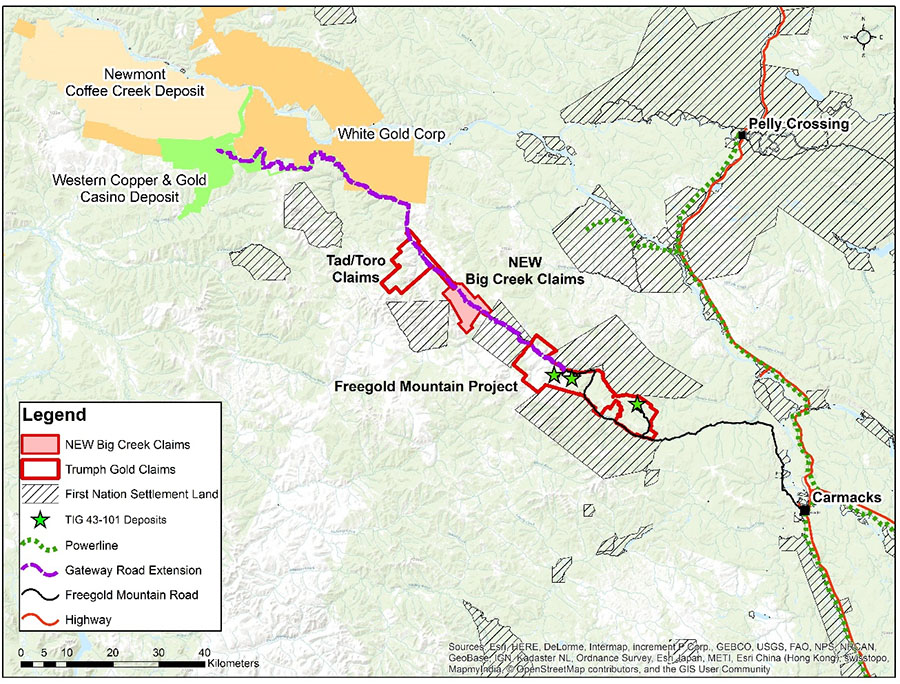

The 5,363 hectare South of Otter ("SOT") property is in the same greenstone belt hosting the world-class Red Lake District ("RLD"), including Great Bear Resources' high-grade Dixie project in northwestern Ontario. SOT is ~8 km east of Great Bear's prolific, ongoing gold discoveries.

The RLD is one of the highest-grade gold mining camps on the planet, and has produced >30 million ounces of gold. The regional geology has been compared to top-tier districts such as the Timmins and Kirkland Lake Camps in northeastern Ontario.

In August, 2020, management reported assays from grab samples that identified two gold-bearing quartz veins sampling 18.0 g/t and 8.19 g/t gold. Historical exploration at SOT includes prospecting, sampling, geophysical surveys and limited diamond drilling.

A few months ago, a ground VLF/EM survey was done to refine gold mineralization targets of merit and to identify areas for prospecting, trenching and drilling. Three substantial conductors were found over a 1.6 km strike length.

Three earlier-stage gold properties….

Portofino has an option on 100% of the 1,428 ha Bruce Lake property, also in the RLD, ~1.5 km northeast of Great Bear's Pakwash property, and ~11 km southeast of the above mentioned Dixie project. Bruce Lake hosts gold-in-soil anomalies discovered in 2010. Management believes regional magnetic highs coincident with the gold-in-soil anomalies are significant.

Melema West is a smaller (869 ha), early stage property ~28 km northeast of the town of Atikokan. There are some gold showings in the area and the property is on a structure that's parallel to Agnico Eagle's 32,070 ha, 4.5M oz., near-surface Hammond Reef deposit. Lately, Agnico has been staking ground around Melema West and Sapawe West.

CEO David Tafel recently commented,

"Gold-bearing northeast trending structures in this area are extensive, well documented and traceable for over 30 km. Recent claim staking by Agnico in the area, contiguous to Melema West, and around Sapawe West, supports our belief that these properties are strategically well located."

The Sapawe West property is quite close to Melema West, just north of the Quetico Fault and 2.5 km west and along strike of the past producing Sapawe Gold Mine. Sapawe West is ~13 km south of the Hammond Reef deposit.

Conclusion

Portofino Resources controls not two or three, but five options to acquire 100% interests in promising gold properties in and around the Red Lake district and the Atikokan area of northwestern Ontario. Two of the five, Gold Creek and South of Otter, are flagship projects near very prominent projects. Both will see drilling this year.

Ongoing, exciting drill results and exploration/development activities advanced by Great Bear Resources and Agnico Eagle will provide positive investment catalysts for Portofino.

In addition, management wisely held on to a 2,932 hectare lithium brine project in Catamarca province, Argentina that (could become, after drilling) fairly significant relative to Portofino Resources' (TSX-V: POR) / (OTCQB: PFFOF) tiny C$8M market cap. The Yergo lithium brine project is a long-dated call-option on continued strength in battery metals.

The company's projects are all early-stage, but in a bull market for gold, (and potentially for lithium), early-stage offers the most upside potential, albeit with commensurate risk. Having five gold properties spreads the risk and increases the odds that drilling will lead to one or more noteworthy discoveries. I continue to like the compelling risk/reward proposition here.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research[ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources was an advertiser on [ER] and Peter Epstein owned shares and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.