With a lot of attention being paid to the cloud, data analytics and AI, it seems like almost every day you are hearing about a new application or suite of solutions for this market. There is a company that is hovering just above the cloud and eyeing the next level of efficiency, cost reduction and security to cement a stake in the future of cloud infrastructure—Leonovus Inc. (LTV:TSX.V; LVNSF:OTC). With everyone moving data and large swaths of information to the cloud it's only inevitable that there is clutter, muck and eventually a data swamp that is difficult to navigate or salvage advantageous actionable information.

Leonovus has positioned itself with an impressive IP portfolio, several meaningful customer relationships, and a product that offers instant scalability and deployment across several verticals at enviable margins typical of software and SaaS solutions. In the most basic sense, Leonovus is looking to serve customers who are utilizing multiple cloud servers and to rapidly reduce their costs, improve functionality while, most importantly, providing an ironclad level of cybersecurity all in a product that's IP protected.

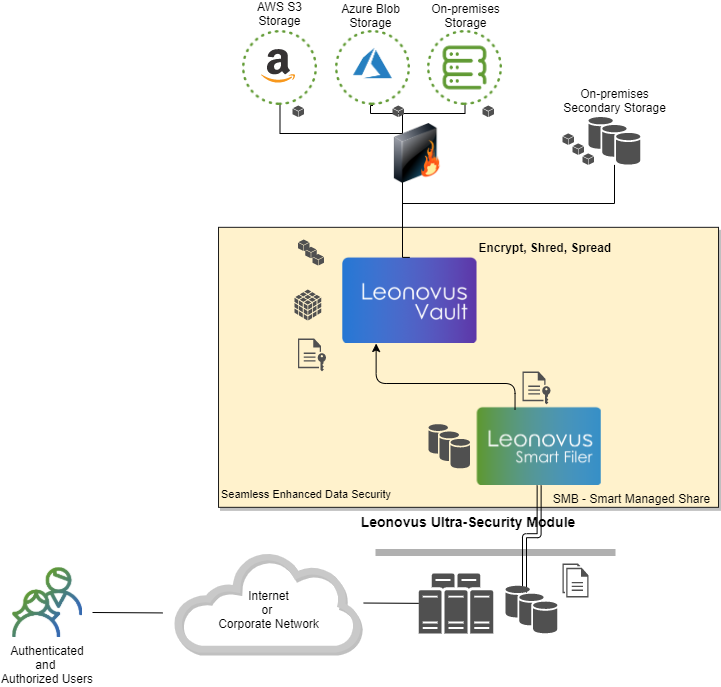

Leonovus' product Smart Filer offers cloud customers with structured or unstructured data cost reduction of up to 70% at a time when many companies are handing out blank checks for data storage. A critical aspect is that their products remain host-agnostic, meaning that they can work across Azure, Rackspace (RXT), Palantir (PLTR), SnowFlake (SNOW) or AWS (AMZN). This is their economic proposition, and it is a strong incentive for companies who want to shop cloud storage while also demanding low prices without sacrificing data migration costs. They also offer a proprietary cybersecurity solution that is enviable by any standard—taking data and dissecting them into discrete, encrypted objects distributed across hybrid multi-cloud storage.

To put this into terms even I can understand, imagine your critical data is a strawberry. Leonvovus' Vault product puts that strawberry in a blender and distributes the smoothie throughout the multi-cloud infrastructure. If you need to recall or construct this data, it can be done with a select combination of pieces in several cloud(s), but does not require all servers. Also, in the scenario of a bad actor or cybersecurity threat seeking the "strawberry" even if they were able to penetrate the cloud, they would only see a small piece of the smoothie, but never the entire strawberry, keeping your data secure. Following the recent SolarWinds hack, the ultra-secure and failure presumptive nature of Leonovus' product is a deciding factor for many customers when comparing the cybersecurity features of their competition. Unlike many legacy systems, their algorithm assumes that bad actors will succeed and ensures their progress is limited to the smallest extent possible. Many cloud customers want to have complete data sovereignty, and Leonovus offers them exactly that.

I view an investment in Leonovus as a turnaround story in a company offering a unique advantage in the future of multi-cloud infrastructure, AI data migration and cybersecurity. At its core is a mission to offer significant cost reductions for cloud data storage while remaining agnostic allowing it to work with clouds including Snowflake, Rackspace or Azure. Leonovus is brilliantly anticipating an issue that can arise from accelerated and unfettered cloud creation. It recently secured an oversubscribed private placement to assist in financial stability, and due to the demand for its hyper-secure zero-trust product, the company is accelerating the testing of its system to aim for completion by March of 2021.

Currently, Leonovus shares are trading on both the US (OTC:LVNSF) and the more dominant Canadian Venture Exchange (TSX.V: LTV); with approximately 14.7 million shares it stands at a total market cap of about US$18.2 million. As a value investor, I have to say I think Mr. Market is undervaluing this business. Relative to multiples that competitors are current trading at, I believe it can be worth approximately $500–$1 billion if its Smart Filer and Vault solutions can achieve large-scale customers. In addition Leonovus has consolidated shares, leaving a small float, which can always lead to some excitement.

Given this, I'm ready to say goodbye to the Data Swamps, and hello to Leonovus!

Follow Jack Hurley on Twitter @_JaxCapital.

John "Jack" C. Hurley is a value investor. His investment philosophy is centered on sustainability, emerging technologies and finding fundamentally undervalued business entities positioned to benefit from long-term secular trends. Hurley has a B.S. in chemistry and is currently a part-time graduate student at Rutgers University pursuing an MBS in sustainability with a concentration in energy technologies.

[NLINSERT]Disclosure:

1) Jack Hurley: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Leonovus. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Leonovus. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Leonovus, a company mentioned in this article.