Walker River Resources Corp. (WRR:TSX.V; WRRZF:OTCQB) is a high-grade gold junior with a compelling and sizable project in Nevada. There are >60 companies with all or substantially all of their precious metal properties in the state, but I believe Walker River stands out.

To say that this company is unknown would be an understatement. This story has gone largely untold because Walker River had been cash-starved for years. Now, management is cashed up, and fully funded for at least 60, but up to 90–100 holes—finishing around July. This is BIG NEWS, because all prior holes drilled in the Shear zone of Lapon Canyon (40 in total, reported over five annual programs) hit gold mineralization.

CEO/founder Michel David had been aware of this promising claims group since 1994, but they were scattered across private owners. It was not until nearly 20 years later that he was able to consolidate a meaningful number of claims.

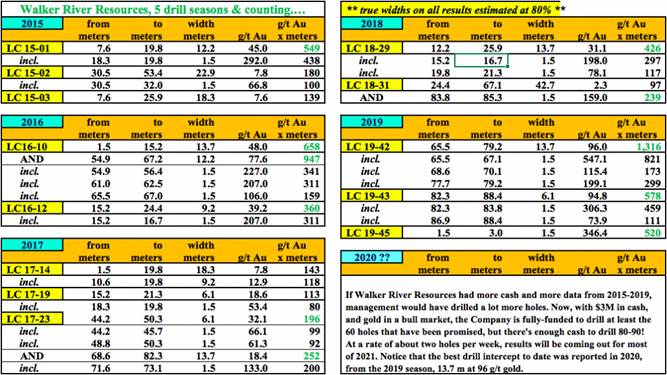

On very tight budgets in 2015–2019, five successful drill programs were completed, with the 2019 season hitting the best results to date (10 holes have been drilled so far in the 2020 campaign, starting at the end of November). Initial results are expected within 30 days. This current campaign will be larger than all five prior drill programs (57 RC holes/48 at Lapon Canyon) combined!

More holes in current drill program than drilled from 2015-2019!

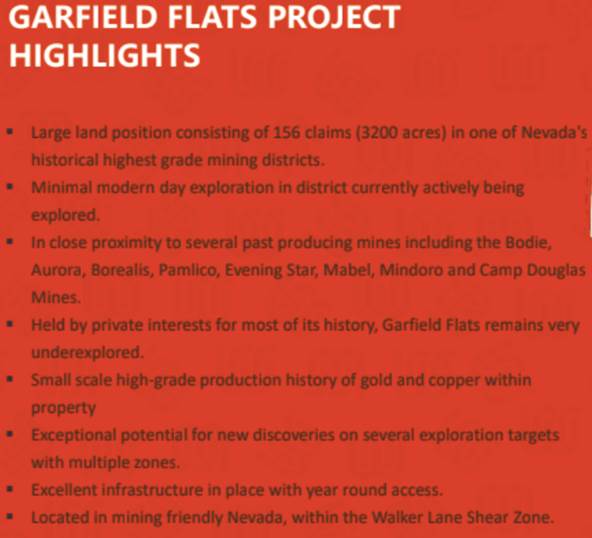

These campaigns were not large, but each delivered high-to-very-high-grade gold intervals. In looking at these very impressive intercepts, one wonders why a lot more drilling hasn't been done. Readers should note that Walker River also has a second project, Garfield Flats (3,120 acres), that could see limited, first-ever drilling later this year.

Simply put, the gold market wasn't nearly as inviting for most of the last ten years as it is today. In the five-year period from 2015–2019, the gold price averaged $1,267/oz, (lows in each year ranged from $1,050 to $1,270/oz). Compare that to today's price of ~$1,850/oz (down ~11% from its all-time high of ~$2,070/oz. last summer).

On top of a relatively weak gold price for years up until 2020, Walker's management team was hindered by a lack of historical exploration—virtually no maps, no drilling, no data. Claims were held by a slew of families, mined by old-timers more than a century ago. As one might imagine, only the easiest to find, safest (logistically) and highest-grade ore was exploited.

Gold recoveries were very low and it was back-breaking work. Yet at great cost and considerable effort, miners built a 2.5 mile road up the mountain. Why would they spend so much time and money on a road? Because the prize at the top of the mountain was well worth it!

Old-timers probably needed a troy ounce per (short) ton of gold (34.28 grams/metric tonne) to make it work. Except for Walker River's recent drill campaigns, surface sampling and other activities, no modern exploration or development work has been done. Old-timers drilled for production only, not for exploration or development.

Huge potential on underexplored property hosting past-producing mines

Therefore, the potential of finding new zones of high-grade mineralization is believed to be very good. And, areas of past production likely have excellent grade material by today's standards. Needless to say, access to the claims has greatly improved since mules hauled miners and equipment up the mountain.

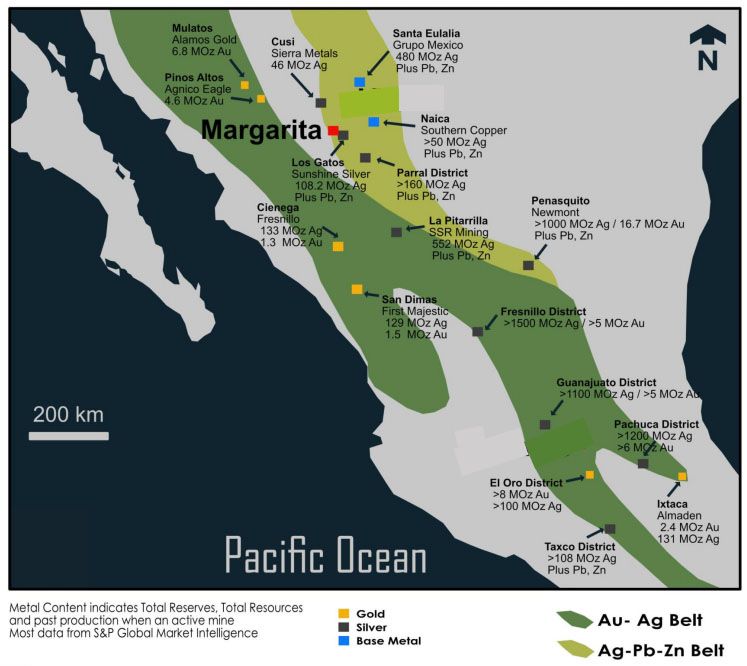

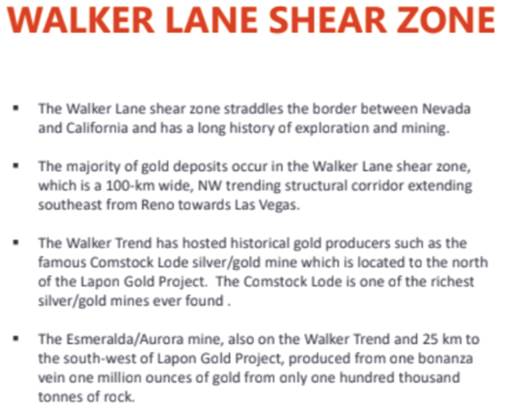

The project lies within the Walker Lane Trend, structural terrain that hosted the historical Bullfrog Mine where Barrick Gold produced ~2.3 million ounces gold, plus ~3.0 million ounces silver from 1989 through 1999.

Other companies with a substantial presence in the Walker Lane Trend include Kinross, AngloGold, Hecla Mining, Coeur Mining, Corvus Gold, West Vault Mining, Augusta Gold and Eclipse Gold (recently merged with Northern Vertex).

The world famous Walker Lane is a shear zone, a 100-km-wide structural corridor extending in a southeast direction from Reno, Nevada. The Lapon gold project includes Lapon Canyon, Pikes Peak (4 km to the north), and Rattlesnake (3 km to the west, and >600 meters below current drilling activities at Lapon Canyon). Combined, the three properties total 3,960 acres, with Lapon Canyon alone accounting for 2,940 acres.

Nevada's better known Cortez and Carlin trends are dominated by Barrick and Newmont Corp. The Walker Lane Trend has been nearly as prolific, but less exploited. Majors like Kinross and AngoGold that already have footprints in Walker Lane are likely looking to expand, as operations in Nevada are increasingly preferable to places like West Africa and Russia (where Kinross derived a combined 44% of 2019 production from).

Mid-tier and major players care about the Walker Lane Trend

Mid-tier and major precious metal companies that do not yet have a Nevada footprint would greatly benefit from diversifying their global operations with assets like those the safe, high-grade deposits owned by Walker River Resources.

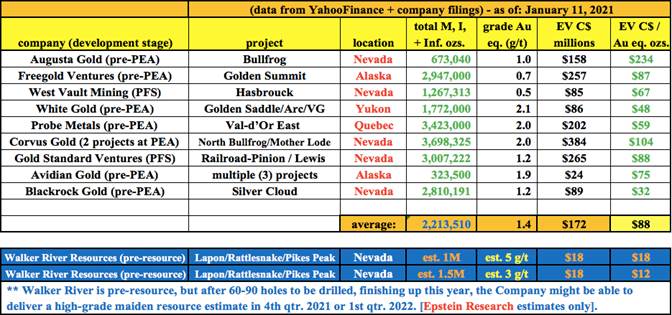

In the junior company peers chart above, notice that well regarded gold/silver juniors in Canada and the U.S. trade at an average enterprise value (EV) to gold ounce equivalent (Au Eq.) of C$88 EV/Au Eq.. Notice also that Walker River could have a grade that's 2–3x higher than the peers' average of 1.4 g/t.

Make no mistake, Walker River is pre-resource estimate, but if management can deliver 1.0–1.5 million ounces in a maiden mineral resource estimate (or in the first update to the maiden resource), then it's trading at a cheap valuation.

To recap, fractured ownership, a severe lack of exploration, no near-site infrastructure, a remote location—there were plenty of easier claim blocks to pursue. But, Mr. David persevered. By 2010, he had accumulated a fairly large contiguous block, now totaling 198 claims (3,960 acres).

On November 30th, Walker River commenced a substantial, fully funded, RC drill campaign at its Lapon gold project. At least 60, and as many as 90, holes are possible across three distinct targets from December 2020 into summer of 2021. About 10 holes have been completed to date. The ongoing program consists of systematic drilling for geological modeling purposes and for new discoveries.

The Rattlesnake and Pikers Peak claims cover more than 8 km of possible extensions of mineralization to the west, north and south of Lapon Canyon. They contain numerous historical mining and milling areas consisting of adits, shafts and underground workings. Very little exploration work was done on these claims prior to Walker River taking over.

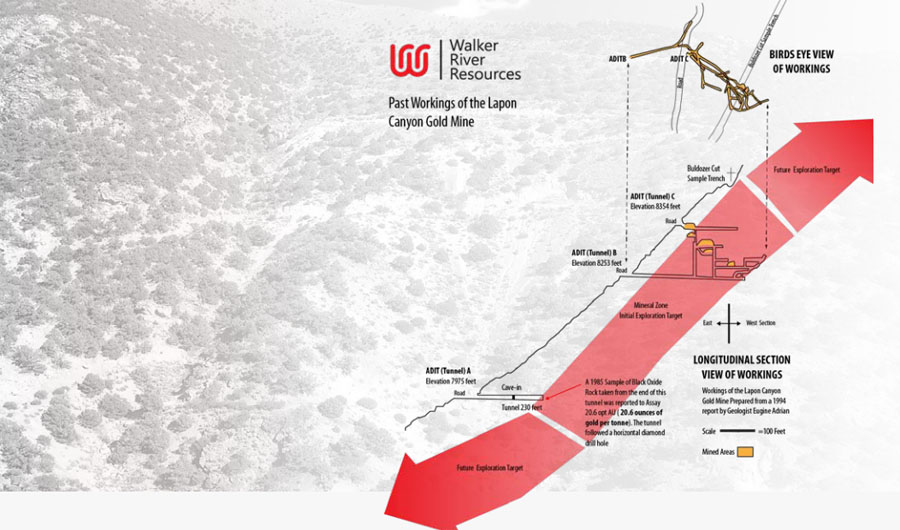

Lapon Canyon hosts historical zones of high-to-very-high-grade gold, with >2,000 ft. of underground workings and three adits. Underground work returned numerous assays in the ounce per ton ("opt") range, including one sample at the end of the A adit of 20.6 opt / [~705 grams/tonne].

Investors love the words "high-grade" and "past-producing"

Gold mineralization at Lapon Canyon is contained in a 300 meter wide zone, with >4 km of strike length. Gold is present throughout the property as an envelope of lower-grade mineralization (~0.5 to 2.0 g/t Au) surrounding distinct high-grade structures that have been drilled over a strike length of 750 meters and a vertical extent of 400 meters.

Examples of shallow high-grade drill hole intercepts [all <100 meters depth] across several holes include; 48 g/t over 13.7m; 39 g/t over 12.0m; 31 g/t over 13.7m; 96 g/t over 13.7m (incl. 547 g/t over 1.5m, 115.4 g/t over 1.5m and 199 g/t over 1.5m) and 95 g/t over 6.1m (including 305 g/t Au over 1.5m) and 346 g/t Au over 1.5m at a depth of 3m.

In the Pikes Peak section, Walker completed access for future exploration. Mapping and sampling are under way with initial results returning values of up to 9 g/t gold, plus up to 2.22% copper from outcrops. Significant historical milling and mining workings are present. At least 10 holes are planned there.

The Rattlesnake zone hosts historical adits and extensive historical gold placer mining was done within the altered sheared zone encountered at Lapon Canyon. At least 10 holes are planned there.

Conclusion

At a time when >100 Canadian and U.S.-listed gold juniors are up 500% (or more) from 52-week lows, Walker River Resources (TSX-V: WRR) / (OTCQB: WRRZF) trading at $0.10, is up just 67% from its $0.06 low.

The last time the company announced meaningful drill results, in January 2020, the stock briefly hit $0.19. However, this time drill results will be arriving all the way into the fourth quarter [10 holes completed so far, first results expected within 30 days].

When shares hit that $0.19 level, the gold price was about US$1,490/oz. At today's US$1,850/oz., gold is up 24%, yet the share price is down 47%. In 1Q 2019, the share price hit $0.265 on the back of the best results to date.

At that time, gold was around US$1,340/oz. Clearly, the lack of consistent news flow and excitement has caused investors to lose interest. However, 2021 should be entirely different with drill results extending through most of the year, and no capital raises anytime soon (unless in response to success-based blockbuster results).

Now's the time for readers to dig deeper into the Walker River story. If the next batch of drill results are strong, the share price should move higher. And, since the valuation has underperformed, the share price could rise more than some are expecting.

Please remember, every single hole drilled in the Shear zone of Lapon Canyon (40 in total, reported over five annual programs) reported gold mineralization. Thirteen, one-third, of those 40 holes returned high-to-very-high gold values. {see intercepts at top of page}. Walker River's market cap is under $20 million; it might not remain there much longer.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures / disclaimers: The content of the above article is for information only. Readers fully understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Walker River Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Walker River Resources are highly speculative, not suitable for all investors. Readers understand & agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed & agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Walker River Resources was an advertiser on [ER] & Peter Epstein owned shares in the Company.

Readers understand & agree that they must conduct their own due diligence above & beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.