Cassiar Gold project; British Columbia

1. Introduction

After exploring and evaluating their Kootenay Arc-based zinc and gold projects in 2017 and 2018, results were disappointing for Cassiar Gold Corp.'s (GLDC:TSX.V; CGLCF:OTCQB) predecessor Margaux Resources, and didn't justify the spending of much more precious cash in a lackluster market. As zinc prices dropped off, Margaux seemed to have missed out on the zinc spike every zinc junior was chasing, and management decided to focus on gold, although the yellow metal dropped off as well at the time. This lasted until the summer of 2019.

With gold recovering, it looked like management placed their gold bets correctly. After raising CA$1.1M in cash in December 2018, the company went after gold assets that were more de-risked compared to, for example, the fully owned early-stage exploration Sheep Creek and Bayonne projects, and dropped the base metal projects.

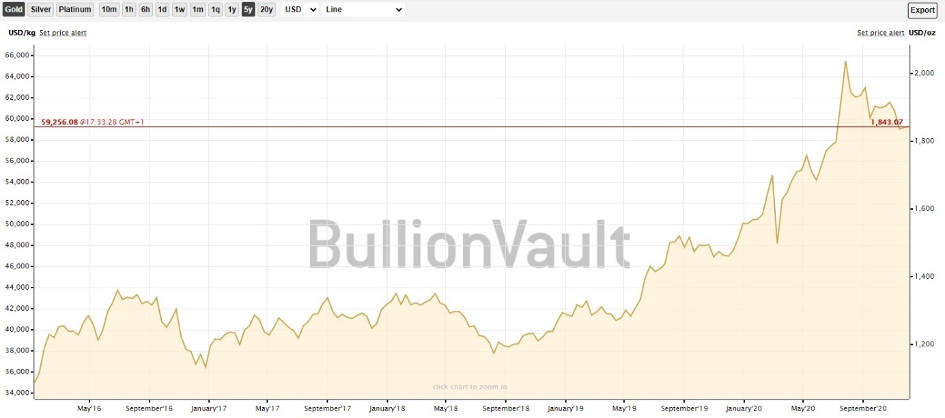

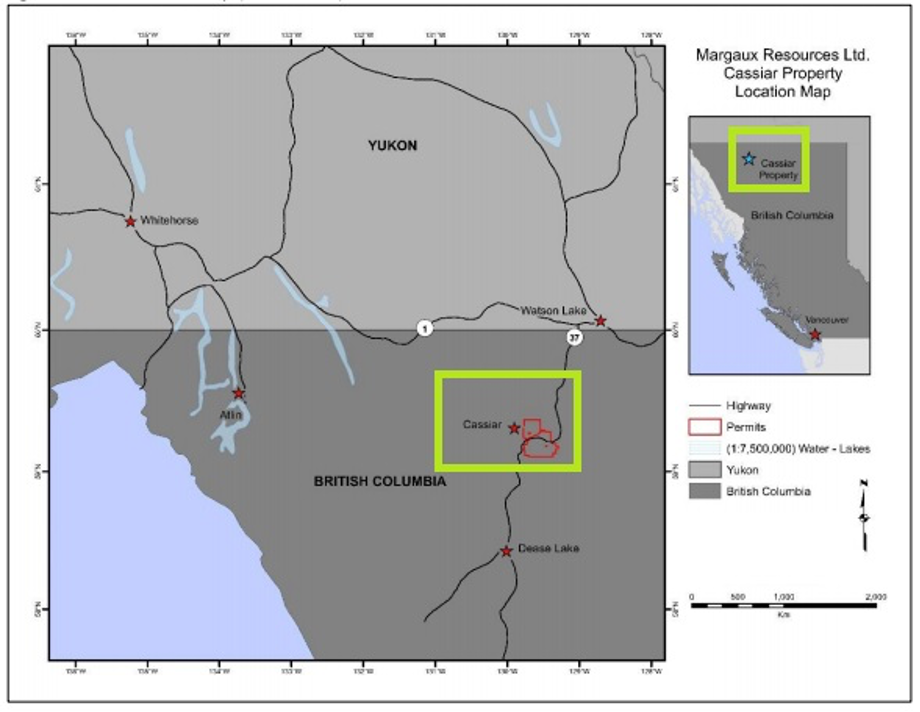

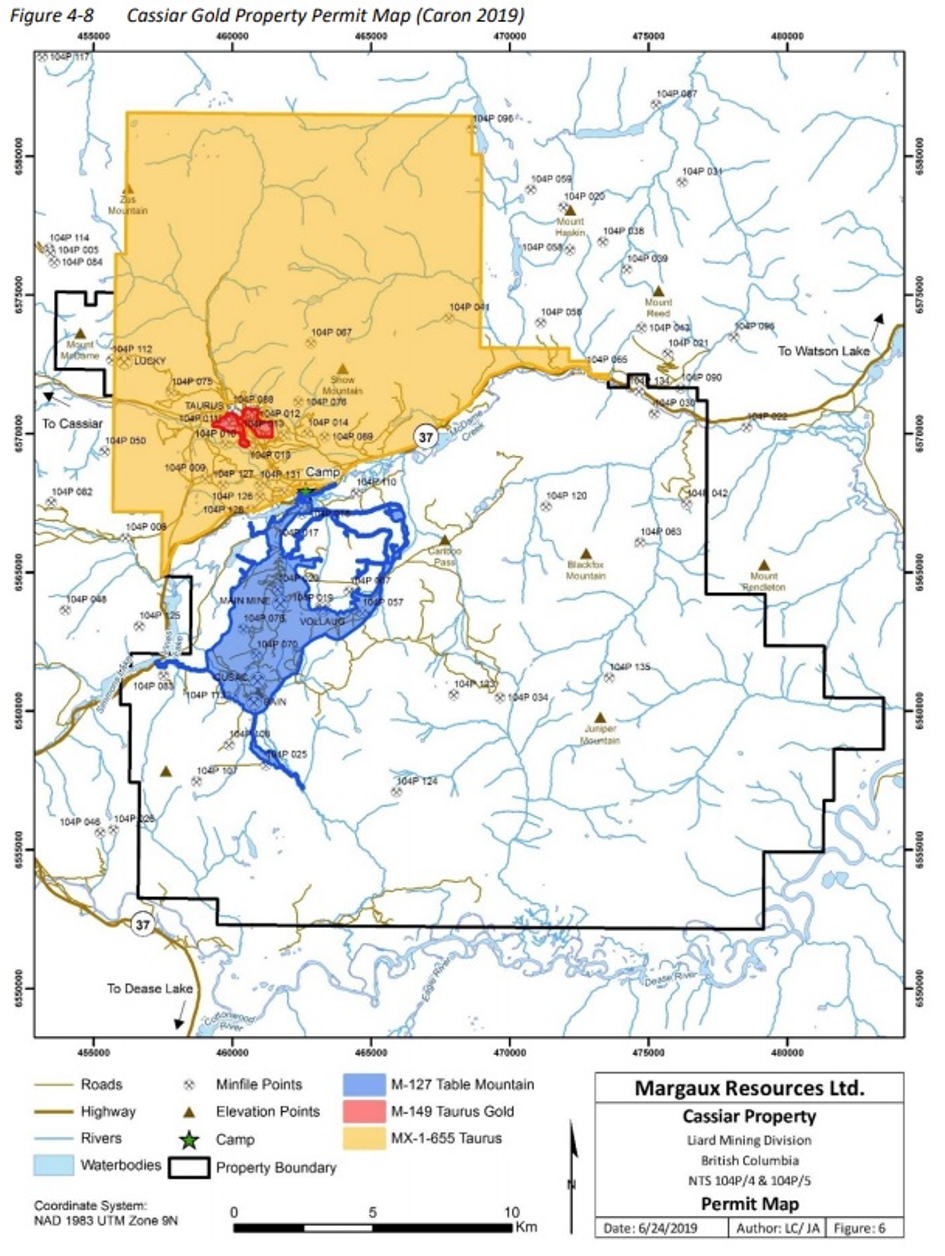

Steve Letwin & Co. managed to capture the Cassiar gold project in British Columbia, Canada, on June 24, 2019, when acquiring it from the private company Wildsky Resources for (at the time) CA$4.65M, in shares in staged payments. As this property sports a one million ounce (1Moz) gold (Au) historic resource estimate and has lots of potential to grow, this seems, despite the additional dilution, a very, very well-timed acquisition, as the price of gold jumped shortly after this and broke the all-time high this summer, and is still hovering around US$1,850/ounce (oz), on the back of 10-year bond interest rates set close to zero again. Read on to find out more about the potential of Cassiar Gold.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The Company

Cassiar Gold Corp. is a Canadian gold exploration company focused on projects in British Columbia. The company's key asset, the Cassiar Gold Project, is a large, advanced-stage, road-accessible gold property with a NI-43-101-compliant resource estimate of 1Moz at 1.43 g/t Au at the Taurus bulk-tonnage gold deposit. The property hosts numerous gold showings, historical workings and exploration prospects over a 15-kilometer (15 km) long and up to 10 km wide trend that extends from high-grade past-producing mines at Cassiar South to the Taurus deposit at Cassiar North.

British Columbia is a very familiar mining jurisdiction, and has a medium ranking on the Policy Perception Index according to the last Fraser Survey of Mining Companies, coming in at #36 out of 76 jurisdictions worldwide.

The infrastructure is excellent, as the area is a mining hotspot, with power dams nearby.

The company is basically controlled by a family of miners, to be more specific the Letwins. Steve Letwin, until recently President and CEO of IAMGOLD Corp. (IMG:TSX; IAG:NYSE), owns over 5% of Cassiar Gold. He is a director and is involved in buying assets, marketing and buying new assets. His brother, James Letwin, is chairman. Recently, they ramped up the C-suite, and brought in CEO Marco Roque, a banker with founding experience of mining juniors, and director Chris Stewart, former president and COO of McEwen Mining Inc. (MUX:TSX; MUX:NYSE). Last but not least Doug Kirwin, of Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX) fame, was brought on board by Roque as a chief technical advisor, and this last individual was the most impressive one to me, as Doug isn't a guy to waste his time on non-interesting, small potential projects. And keep in mind, with Doug, characters like Robert Friedland are one phone call away when things might become really interesting.

3. Basic Structure

Some basic information on share structure and financials: Cassiar Gold has a very decent 40.1 million (40.1M) shares outstanding, as a direct consequence of a 5:1 rollback in September 2020. Usually I don't fancy rollbacks, as these dilute existing shareholders and often disguise inefficient capital deployment from the past, but in this case I don't believe that to be true, and the turnaround with a new, reinforced management and new project deserves a fresh new start anyway, with a good structure. I, as a longstanding shareholder, can fully understand Letwin is done with a toiling junior with a bad structure in this gold bull market, and wants action.

The fully diluted share count stands at 54,346,435 shares, as there are 1,393,657 options (on average CA$0.82 exercise price) and 24,307,307 (with 710,000 expiring Dec. 4) warrants (at exercise prices ranging from CA$0.60 to $0.90, exercisable up to two years from now). The current cash position is estimated at CA$6.8M, the company has no debt and just raised an oversubscribed and non-brokered amount of CA$6.65M at CA$0.60 (non-flow-through), CA$0.70 (flow-through) and CA$0.82 (CEE [charity] flow-through); all units include two-year half warrants at CA$0.90. The current share price is CA$0.55, resulting in a current limited market cap of CA$29.89M.

Share price, 5-year time frame; Source tmxmoney.com

The stock has been recovering on the back of the Cassiar acquisition and the rising gold price, on a still relatively low average volume of 65,027 traded daily. Lately the share price has dropped off somewhat as gold is in the midst of a correction, dragging almost all gold stocks lower. The stock is still being held tightly by board, management, advisors and insiders who own around 36.58%.

4. Projects

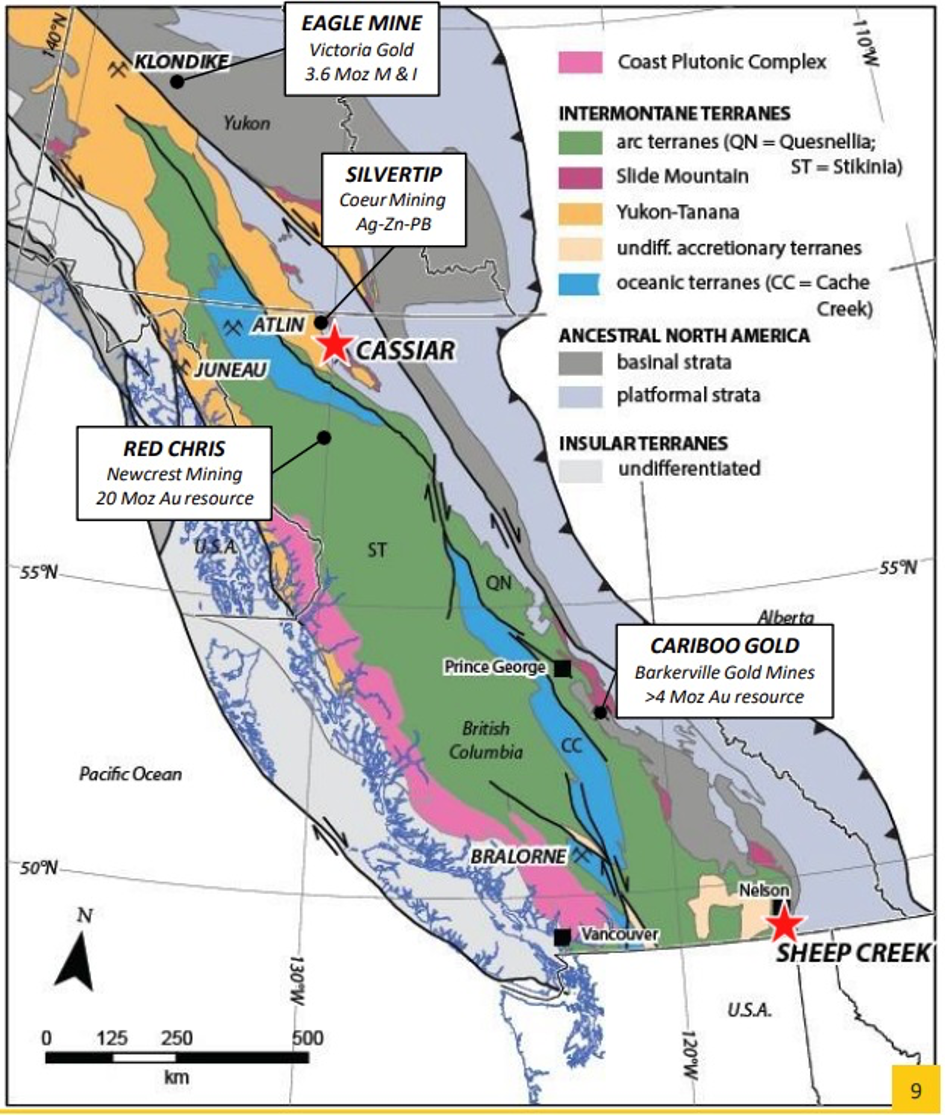

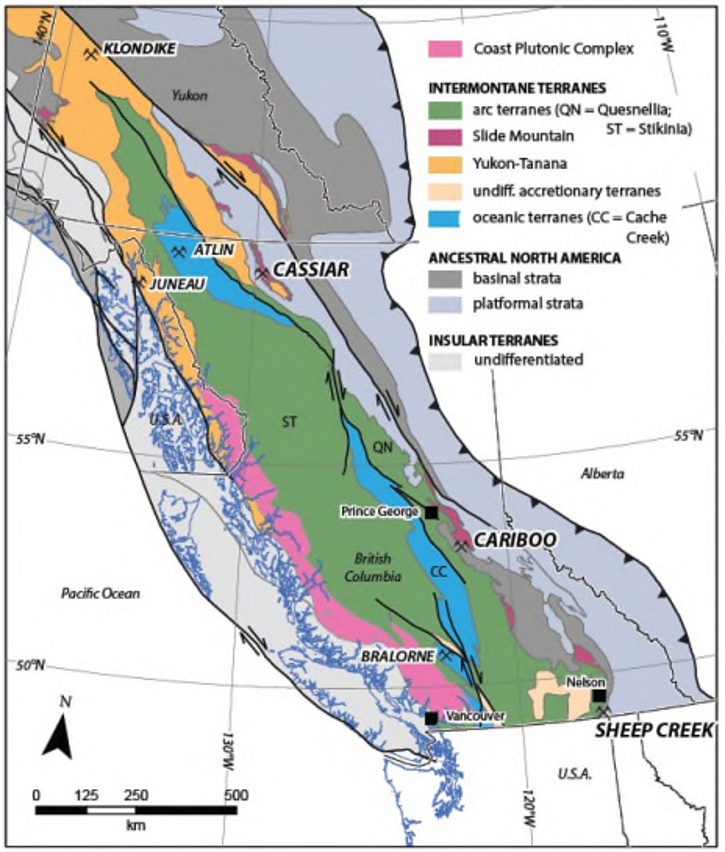

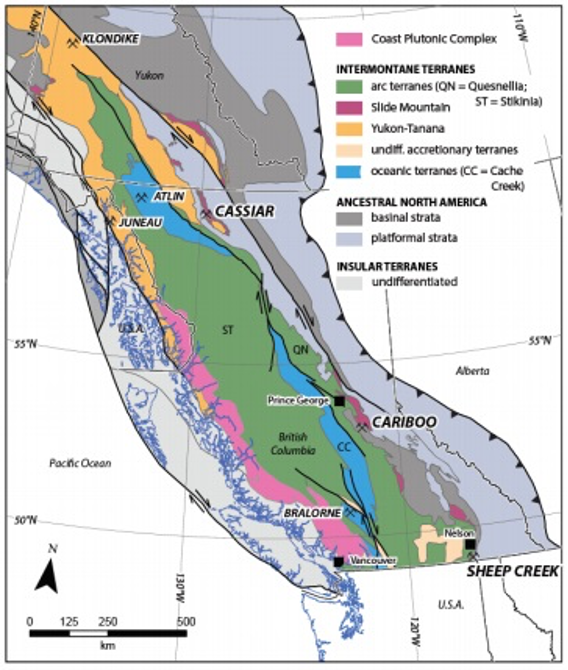

Cassiar Gold Corp. has two gold projects in their portfolio, both in British Columbia, Canada. These are the flagship Cassiar project in the north, which was acquired from Wildsky through a earn-in agreement, and the Sheep Creek project in the south, fully owned and drilled for several years by Cassiar's predecessor. Both are described as orogenic gold projects.

Eastern Cordilleran Gold Belt, British Columbia

Let's discuss a little bit of background first about orogenic gold deposits. Globally, they account for about 2,700 million ounces, or 30%, of known gold. Orogenic gold dominates gold production in Canada, Australia, Africa, Russia and China. In Canada, over 80% of gold comes from this style of deposit, with the Abitibi region alone contributing over 180 million ounces of gold. Orogenic gold deposits can consist of high grade veins as well as low grade bulk tonnage ore. Orogenic gold deposits are usually attractive for their high grades and large size. Recovery for both (high and low grade) generally comes in at 90+% rates, by gravity and flotation concentrate methods. Well-known projects/mines of orogenic origins to be found in Canada are Campbell-Red Lake, Kirkland Lake, Hemlo, Dome, Malartic, Cariboo, Klondike and Bralorne. Outside Canada there are equally famous names like Rosebel and, last but not least, Muruntau, the largest (estimated 2Moz Au per annum) open pit operation in the world, located in Uzbekistan.

The geologists of Cassiar's predecessor were already focused on their fully owned Sheep Creek project, which is part of the Eastern Cordilleran Gold Belt in British Columbia, but a Geoscience BC report from 2017, also handling Sheep Creek, triggered their interest in another discussed but, at the time, very much under-the radar-orogenic gold deposit called Cassiar. On a side note, the third and last discussed gold project in the report was Cariboo, explored a long time ago by Barkerville Gold Mines Ltd. and eventually acquired by Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE), sporting an economic 4.4 Moz Au underground resource.

When the zinc market didn't perform well, and the exploration programs on Bayonne and Sheep Creek didn't return the kind of results that would generate lots of investor enthusiasm, management fully impaired their zinc and tungsten projects by terminating the option agreements for both (Jersey-Emerald and Jackpot projects), maintained and amended the option agreements for Sheep Creek and Bayonne, and decided to go after Cassiar as the new flagship project during 2018.

The flagship Cassiar project

The first LOI (letter of intent) on Cassiar was signed on Jan. 21, 2019, the definitive agreement on it was executed on March 26, 2019, and the final approval from the vendor Wildsky Resources was received at June 24, 2019, involving the acquisition of Cassiar Gold, fully owning the Cassiar gold project in British Columbia. As it was an all-share deal, no further cash was required at the time, which would involve significant dilution as the share price was (and still is) quite low, and not suitable for multimillion dollar acquisitions. With the staged share payments, the company made the acquisition of a strong gold asset possible in the first place, but also bought itself time as it would spread out the inevitable dilution over a longer period.

Benefits were that Cassiar Gold could start exploring right away, and profited directly from the increasing gold price (at US$1,321.90/oz at the time of the execution of the definitive agreement with the vendor, now hovering around US$1,900/oz). In my view, and looking in hindsight, of course, this is a good and superbly timed acquisition, involving a decent portion of luck, of course, as gold started rising after the LOI was signed. Let's have a look at the transaction.

Under the terms of the agreement, Cassiar had to issue a total of 58.2M (pre-consolidation) common shares, at a deemed price of $0.08 per share, to Wildsky to acquire all the common shares in the capital of Wildsky's wholly-owned subsidiary, Cassiar Gold Corp. Shares were issued in four tranches over an 18-month period. A 10% initial share payment was due upon signing the Definitive Agreement. Thereafter, subsequent 20, 30 and 40% share payments were due at six month intervals.

In order to exercise the agreement, the 58.2M shares were issued for aggregate consideration of $4.656 million. Cassiar must also undertake certain exploration expenditures on the Cassiar property and satisfy certain other conditions as follows:

· Already paid: 5,820,000 shares issued to Wildsky on execution of the Definitive Agreement, as fully paid and non-assessable securities;

· Already paid: 11,640,000 shares issued to Wildsky no later than six (6) months after execution of the Definitive Agreement, as fully paid and non-assessable securities;

· Already paid: 17,460,000 shares issued to Wildsky no later than twelve (12) months after execution of the Definitive Agreement, as fully paid and non-assessable securities; and

· Already paid: 23,280,000 shares issued to Wildsky no later than eighteen (18) months after execution of the Definitive Agreement, as fully paid and non-assessable securities.

All shares issued to Wildsky in accordance with the Definitive Agreement were subject to a statutory hold period of four months and a contractual hold period of a further eight months (for a total of 12 months from the date of issuance).

The last payment to Wildsky was recently done at Oct. 19, 2020, and according to their news release they received a total value for 11.64M post-consolidation shares of CA$9.3M, which means a clean double from the time of the agreement, so if Wildsky has been holding onto their shares since the closing of the agreement, they are already looking at a nice profit. According to Cassiar management, they still hold all shares, which means 22% of outstanding shares, and have absolutely no plans to sell, as they understand the undervalued nature of their position. They intend to keep one director seat into the foreseeable future.

In addition, Cassiar must also undertake exploration on the property and must satisfy certain other conditions as follows:

· Already paid: Cassiar will expend at least $400,000 on the planning, development and execution of the Cassiar 2019 work program, based on a mutually approved budget;

· Exercised: Six (6) months after execution of the Definitive Agreement, Wildsky will have the right to appoint one member to the board of directors of Cassiar; this is Wenhong Jin, CEO of Wildsky Resources.

· Not exercised: Twelve (12) months after execution of the Definitive Agreement, Wildsky will have the right to appoint an additional person (for a total of two board members) to the board of directors of Cassiar; and

· Not exercised: Twelve (12) months after execution of the Definitive Agreement, Wildsky will have the right to appoint one person to the senior management team of Cassiar, on terms and conditions to be agreed upon by Cassiar and Wildsky, acting reasonably.

· Wildsky being granted a 30% net profit interest (NPI) on all minerals processed from Cassiar's TM-TSF #1 tailings pond) located on the Cassiar property, after capital payout of up to $500,000. The Definitive Agreement includes a schedule detailing the calculation of NPI.

The Project

The Cassiar Gold property is one of the typical orogenic gold systems, which are identified in the Northeastern Cordillera, alongside Cariboo and Sheep Creek.

The significance of orogenic gold deposits is well known as mentioned earlier. In British Columbia, 45% of historic lode gold production (to 2002) and almost all the province's historic placer gold production can be attributed to orogenic gold mineralization. The most economically significant veins for gold mineralization are shear veins. These average 1 to 2 meters (m) in width, but locally can blow out to over 10m or shrink to several centimeters. Shear veins are steeply dipping to near-vertical. The veins are generally west-northwest trending. Other veins can be extensional, thrust filling, or vein arrays and/or breccia zones.

On the Cassiar property, gold mineralization occurs along a 15 km corridor of veining (2). Within this structural corridor, gold occurs both as discrete high-grade veins and as near-surface low-grade bulk tonnage style mineralization.

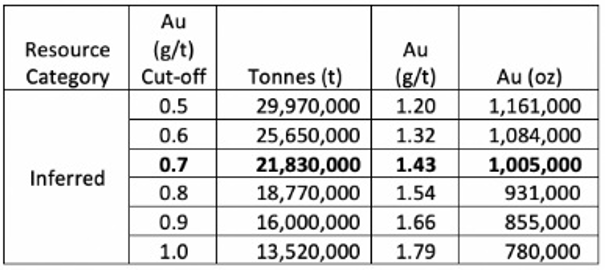

The Taurus bulk tonnage target, in the northern part of the property, hosts an Inferred resource of 1.0Moz Au (21.8 million tonnes at an average grade of 1.43 g/t Au using a cutoff grade of 0.7 g/t gold). The resource is supported by a technical report entitled "NI 43-101 Technical Report on the Cassiar Gold Property (Amended)", dated Nov. 12, 2019.

The mineral resource estimate is based on the results from 423 drill holes completed to date on the Cassiar property. Wireframes were prepared using the drill hole information combined with geological interpretations of the deposit and validated through a thorough literature review, historical observations and internal modeling by several recent project stakeholders. Further details related to the current mineral resource estimate are detailed below. The next table outlines the total base-case mineral resources:

Notes: The effective date for this mineral resource estimate for Taurus Deposit is Sept. 11, 2019. Mineral resources are calculated assuming a cutoff grade of 0.7 g/t Au, consistent with open pit mining methods. Density of 2.65 t/m3 was chosen based on a conservative value for similar deposits. The high grade cutoff was set at 27 g/t Au in the high-grade domains, and at 7 g/t Au in the low-grade domain.

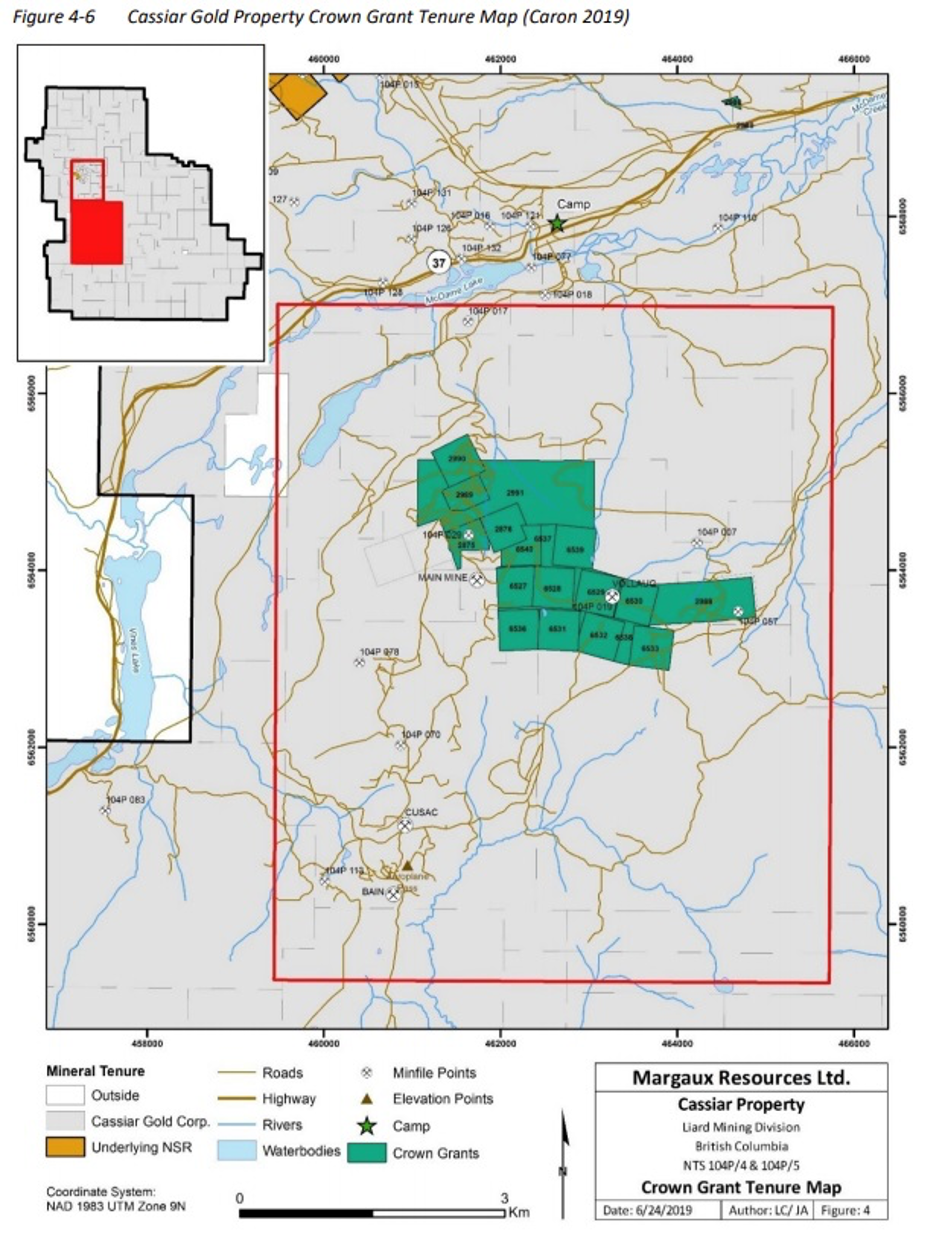

On the Cassiar Property, gold mineralization occurs along a 15 km corridor. Within this structural corridor, gold occurs both as discrete high-grade veins and as near-surface low-grade style mineralization. Past production from the Cassiar Property (primarily 1979–1997) is approximately 920,000 tonnes at an average grade of 11.9 grams per tonne (g/t) gold, or a total of 350,000 ounces of hard rock gold. During this period, portions of the Cassiar property were held by different operators, and production was from different mine operations (predominantly underground) utilizing different mill facilities.

There has been a colossal amount of historic sampling and drilling in the past, to be more specific 2475 drill holes, incorporating 275,000m between 1937 and 2012. Most of it was targeting Table Mountain, and more specific the mining areas. Most drill core is stored on the property, and core from the late nineties onward is in very good condition, including tagged samples.

The historic Table Mountain mines also generated tailings, and former owner Wildsky performed drilling and metallurgical work on those, resulting in an average grade of 1.25g/t Au. Unfortunately, gold recovery from a bulk sample of these tailings achieve a recovery of only 33%, despite initial bench-scale testing that yielded recoveries up to 72%, indicating that this needs more work before it could become economic.

The Cassiar Property has subsequently been amalgamated and now covers 56,000 hectares. It is bisected by Highway 37, with significant existing road access infrastructure and a 30-person camp with grid power. The property has seen lots of exploration, development and mining in the past, included 25 km of underground workings, a 300 tonnes per day (tpd) fully permitted milling facility not used since 2007, and now under care and maintenance, and numerous former housing and mine buildings, as well as mine permits for substantial parts of the property.

Management does see value in these assets, besides the fully utilized, aforementioned exploration camp and a core logging facility. The underground (UG) workings are not safely accessible nowadays, so they can't be used for underground drilling. According to Roque, reclamation and environmental work is being done in order to be fully compliant with regulatory standards and community expectations. They are advancing it simultaneously with exploration work. By advancing this important work in concert with exploration work, Cassiar is demonstrating its commitment to project development to both regulators and to the local community.

Therefore, the NI-43-101 report mentions the following conclusion: "The Property has multiple issues relating to historic mining and exploration that require ongoing attention and/or remediation." It made me wonder to what extent these are issues, and asked Roque to elaborate on this, including eventual in-house, back-of-the-envelope budgets if available. He had this to say: "Reclamation work is largely completed at Taurus. Continued maintenance of the road network is is an asset to continued exploration and development of the property. We are advancing environmental data collection and monitoring, while taking advantage of the existing roads and buildings to reduce our program costs as we advance the Cassiar project."

As can be seen on the map above, the location of Cassiar is pretty nordic, implying that drilling is only possible outside the winter break period (November-April). Roque continued: "Technically we can work on the bottom of the valley (Taurus) during winter if we choose to. At South Cassiar (Table Mountain) we can only work outside the winter break."

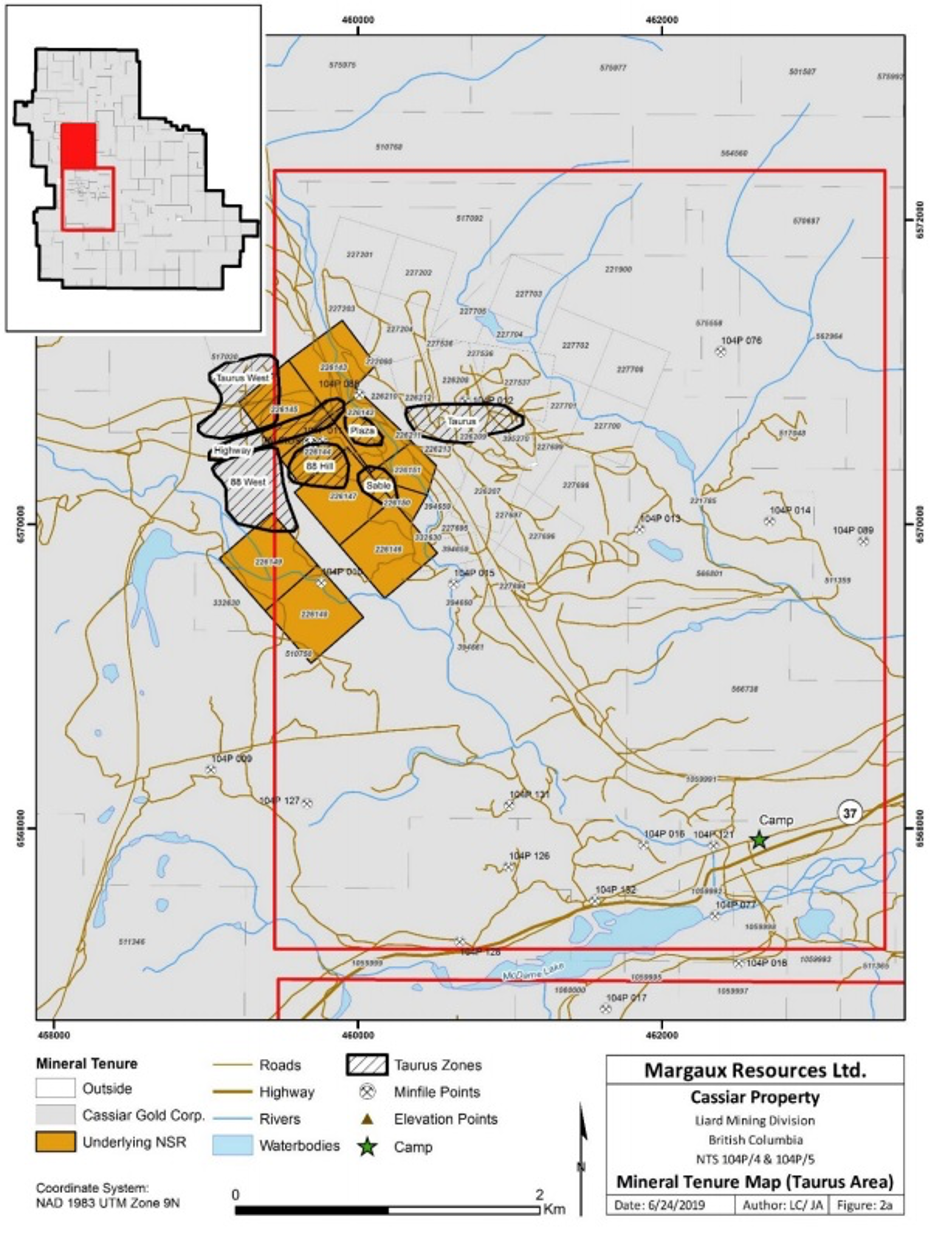

Cassiar believes there is good potential for not only expansion at Taurus but also new discoveries of low-grade bulk tonnage gold mineralization on its Cassiar property. Numerous known high-grade gold showings on the Cassiar property have been tested by only limited drilling, and the property-wide potential for low-grade bulk tonnage deposits has only been investigated at Taurus, to date. In addition, the company has set its target on the high-grade potential at South Cassiar (Table Mountain), where it sees the potential to turn its high-grade historic resource into a multimillion ounce high-grade resource that would overshadow its bulk tonnage resource. The property has a limited 2.5% NSR (net smelter return) on just a few claims, but these are pretty strategic, as part of them are located right at the Taurus deposit (NSR in yellow, Taurus Zones grey marked):

Both the Taurus and Table Mountain properties host historic mines, and both have tailings storage facilities, which need to be checked annually in order to maintain permits. Both properties actually host mine permits, and the most part of the Taurus property has an exploration permit. I don't think the existing Taurus mine permit is of much use, as this is has been granted a long time ago for a very small underground mine, whereas Taurus contains an open pit resource that will undoubtedly require a much larger throughput and creates much more surface disturbance.

I asked CEO Roque if this permit was very useful, and if he had a view on permitting open pit operations in British Columbia (BC), including dealing with First Nations. He stated, "The Taurus mine permit includes all areas previously disturbed for mining and exploration activities, and not just the original Taurus underground mine, which was restricted to the eastern portion of the permit area. A mine permit is granted for an area and its conditions can be modified with regulator approval to suit the proposed work; for example, from active mining to care and maintenance, or vice versa. An existing mine permit is an important step in developing a mining project. We enjoy a respectful, constructive, and productive relationship with the local First Nation, and we are confident that we can work together to move the Cassiar project forward."

A separate, small, historic 2010 resource estimate for high-grade veins in the Table Mountain area in the southern part of the project includes 13,650 oz at 18.02 g/t Au (Indicated) and 56,360 oz at 24.30 g/t gold (Inferred), using a cutoff grade of 3 g/t gold. Most of the Table Mountain resource was accessed by underground ramp development (now decommissioned), which is linked by road to the permitted mill facility.

According to the NI-43-101 report, over 140 individual assessment reports have been filed on this asset, representing approximately $26M in exploration expenditures. CEO Marko Roque didn't know why former owners Hawthorne Gold Corp. and China Minerals didn't really advance Taurus during the raging gold bull market that ended in 2012.

Numerous other veins are known on the Cassiar property, which have been tested by only limited drilling. In addition, Cassiar believes there to be good potential to discover new veins and new areas of bulk tonnage style gold mineralization.

The Sheep Creek project

The Sheep Creek property consists of mineral and crown grants, covering 1,589 hectares, and is prospective for gold and silver. The property has a historic resource of more than 68,000 tonnes grading more than 15 g/t gold. Historic production from the Sheep Creek camp is 736,000 oz Au (plus lead [Pb], zinc [Zn], silver [Ag]) at an average grade of 14.7 g/t Au. The majority of the gold production was during the periods 1899–1916 and 1928–1951, with historic mining from 34 separate high-grade, gold-bearing quartz veins.

Veins in the Sheep Creek camp are orogenic gold veins, which are considered analogous to the Barkerville District in age and style. The gold potential for this property is considered significant by management, and a soil anomaly program and drilling was completed on the Bayonne target and veins of Sheep Creek. Drilling returned some interesting results, enough not to drop the claims.

These results were generated at Bayonne, which is considered a near-surface, low-grade, bulk tonnage gold target. In order to be economic, the intercepts need to be in the range of at least 30–50m of 1–1.5 g/t Au without too much overburden (strip ratio up to 4-5:1), so I view these results not exactly as interesting so far. But who knows what further exploration could bring to the table here.

Others

Cassiar Gold has a few other, more early-stage exploration prospects at the Cassiar property, like Lucky, Wings Canyon (currently being drilled) and Newcoast, which are proximal to their flagship Taurus and Table Mountain deposits; however, these other projects will not be discussed here in further detail.

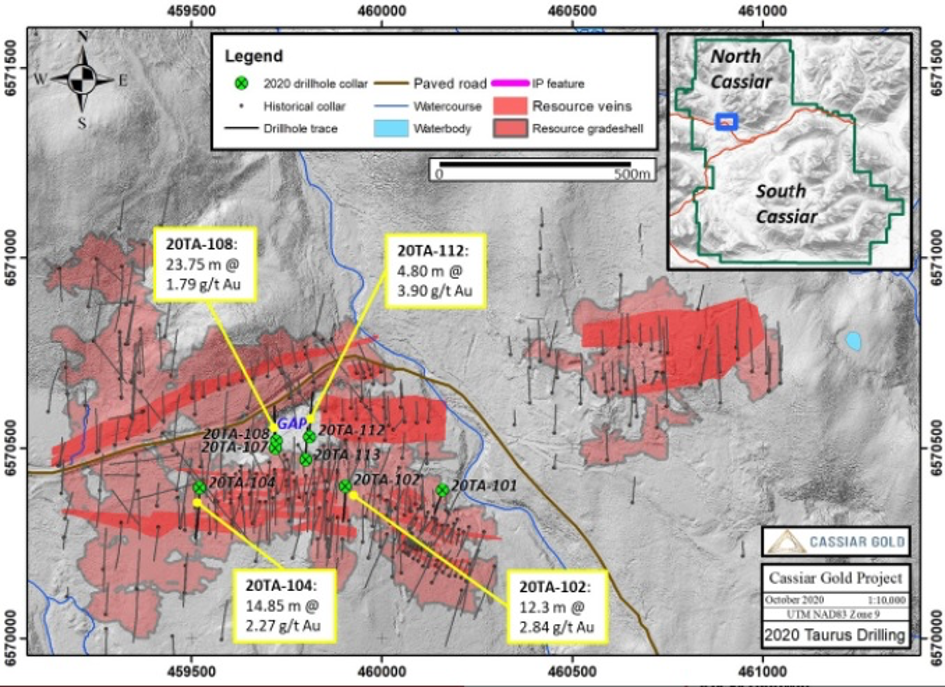

5. The 2020–2021 exploration program

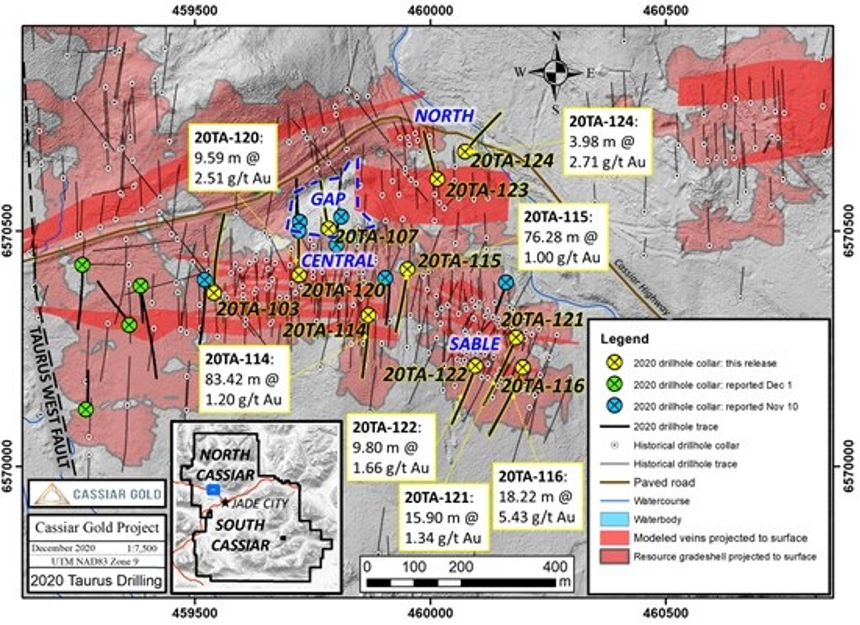

For now, they have finished a 4,700m infill and extension drill program at Taurus, with two batches of assays reported already and the rest expected in December. The Nov. 11 news release presented results like 23.75m at 1.79 g/t Au and 4.80m at 3.90 g/t Au returned from an undrilled near-surface gap in bulk-tonnage resource:

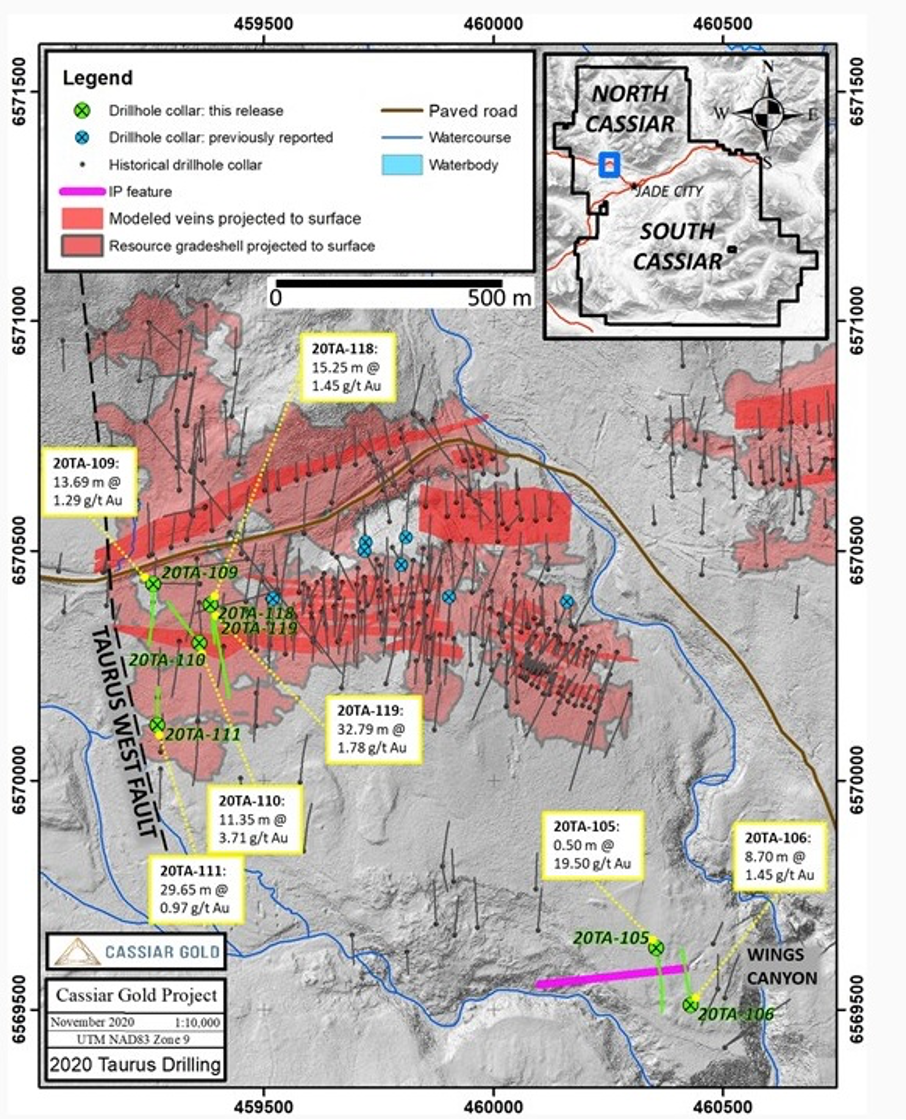

A good thing is that all intercepts except 20TA-112 started above –100m, so all results are clearly inline with open pit potential. The news release from Dec. 1 showed more confirmation, with very solid results like 29.65m at 0.97 g/t Au from 37.8m, 15.25m at 1.45 g/t Au from 41.8m and 11.35m at 3.71 g/t Au from 28.6m. All holes from the second batch were mineralized. The news release of Dec. 8 contained the last batch of results, and these were even better, showing intercepts like 18.22m at 5.43 g/t Au from 141m, 76m at 1 g/t Au from 27m, 13,55m at 2.77 g/t Au, 5.55m at 3.73 g/t Au from 14m, 7.3m at 2.58 g/t Au from 4.5m, 83.4m at 1.2 g/t Au from 7m, 9.6m at 2.52 g/t Au from 33m, and 4m at 2.7 g/t Au from 80m. together with the results bode well for an increase in the resource, as the targeted south western part of Taurus had seen only very little drilling.

The following map gives an impression of location and intercepts involving the Dec. 1 news release:

Management even encountered some visible gold in drill hole 20TA-110, at 30.5m depth. They continued drilling southwest among other targets; this is the map from the Dec. 8 news release:

The southeast zone, now called Sable, generated the best results so far. Please note that most results don't represent true width. I expect the intercepts to be 70–80% of the reported lengths, which is still good. For example, if the southwestern part would add a mineralized envelope with a conservative size of 300x400mx10m, a gravity of 2.75t/m3 and a grade of 1 g/t Au, this would already add 100,000 oz Au. As most intercepts are much longer than 10m corrected for angles, and the grade in most cases also is significantly higher than 1 g/t, it isn't unrealistic in my view to guesstimate at least 200,000 if not 300,000 oz Au to the resource based on the southwest alone. As the (infill) results of Sable were beating expectations, this could add another hypothetical 100,000 oz Au. Because of this, I wouldn't be surprised if the new resource came in at 1.3–1.4Moz Au at a slightly higher grade.

The plan at the moment is to drill 15,000m starting in April 2021 at the South Cassiar (Table Mountain) location, with the aim to grow resources as fast as they can at both targets. On a side note, their drilling costs are CA$175/m, which is very low. In northern BC, average all-in costs usually range between CA$300-500/m. According to CEO Roque, this is attributable to a network of established access roads leading from paved highways, and subdued topography that allows simple moves and servicing.

Advisor Doug Kirwin was drawn to Table Mountain, as he believes there are a lot of similarities to the wildly successful Fosterville Mine, owned by Kirkland Lake Gold Inc. (KL:TSX; KL:NYSE). This operation is mining high-grade gold from an orogenic deposit with certain characteristics, as seems to be the case at Cassiar. Kirwin is also involved in a junior, which is exploring targets next door to the Fosterville Mine in Victoria, Australia, so he is very familiar with the typical geology.

A quick description, which you can skip if you are not into geology: Mineralization at Fosterville is controlled by late brittle faulting. These late brittle faults are generally steeply west-dipping reverse faults with a series of moderately west-dipping reverse splay faults formed in the footwall of the main fault. There are also moderately east dipping faults that have become more significant footwall to the anticlinal offsets along the west-dipping faults. Primary gold mineralization occurs as disseminated arsenopyrite and pyrite, forming as a selvage to veins in a quartz–carbonate veinlet stockwork. The mineralization is structurally controlled with high-grade zones localized by the geometric relationship between bedding and faulting. Mineralized shoots are typically 4m to 15m thick, 50m to 150m up/down dip and 300m to 1,500m+ down plunge, and have average grades of 5–10 g/t Au, with individual assays up to 60 g/t Au.

The NI-43-101 report of Taurus/Table Mountain elaborates only very little about the Table Mountain mineralization, so it was hard for me to find analogies with Fosterville. Unfortunately I couldn't get the analogy from Doug Kirwin yet, so hopefully this will be disclosed at a later time.

If this all plays out as envisioned, Cassiar might end up with a multimillion ounce resource base, potentially open pit and underground. It doesn't take a genius to figure out the hypothetical consequences for the market cap and share price, but as I always like to calibrate current valuations of competitors against the discussed company, I made a peer comparison to get a bit more context.

Peer comparison

As I often mention with peer comparisons, one has to be careful and avoid blind acceptation of the companies which are compared. There are many ways with peer comparisons to cherry pick companies with relatively high metrics, which generate high averages, which almost always make analyzed companies look better. Another hot item with peer comparisons is finding the most equal companies regarding quality and size of projects, jurisdictions, financial situation, backing, permitting—in short, everything that makes every project and company so unique in this space. The better the resemblance, the more useful the company for a comparison.

Finally, there are always very unique circumstances surrounding each company and/or project, which can have a pretty strong influence on valuations. One of the most important factors in this regard is management. If a real rainmaker and/or very strong, serially successful team is at the helm, investors tend to follow these persons almost religiously, and as a consequence prop up share prices of the involved companies sometimes far beyond anything their fundamentals could justify.

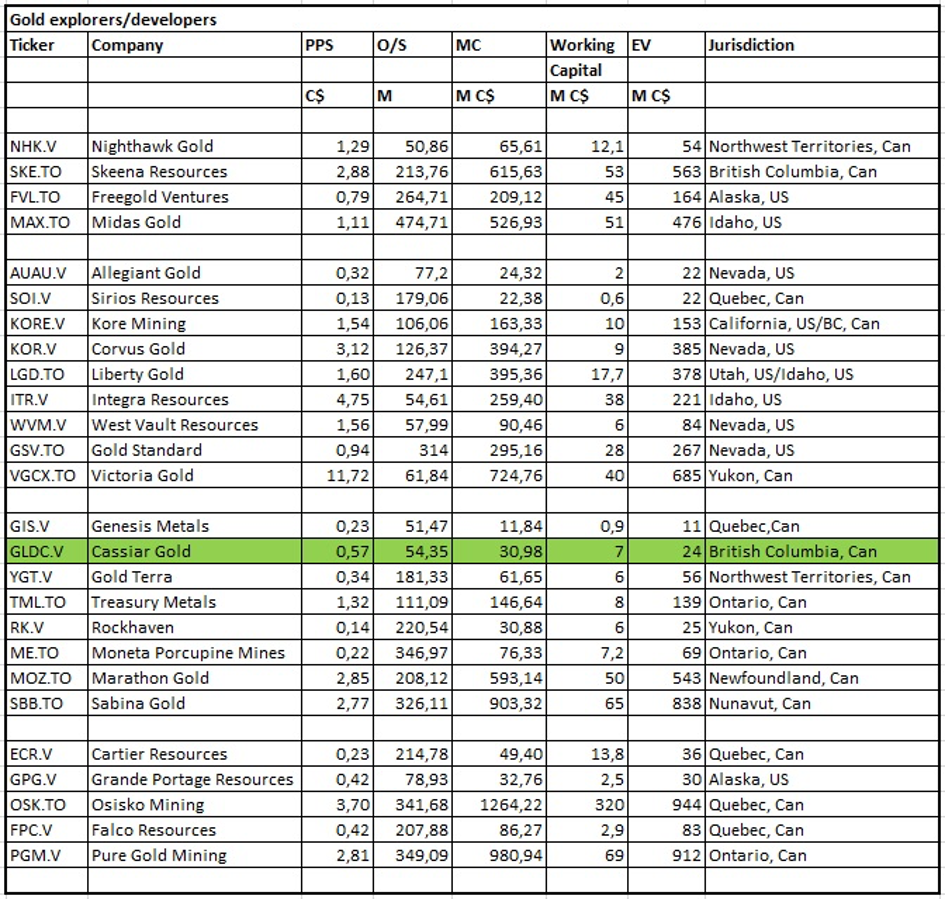

So, as a reader, armed with all these complicating factors, one might feel somewhat uncomfortable now. However, I tried to gather more companies than usual, also with projects of different operation types to provide more understanding. Plus, I felt it couldn't hurt to get a bit more broader understanding of advanced gold explorers and developers and their valuations. On a side note, the working capital isn't always up to date, as I didn't communicate with the companies, so I made assumptions based on financials, presentations and news involving financings. Here we go, the first table shows the basics:

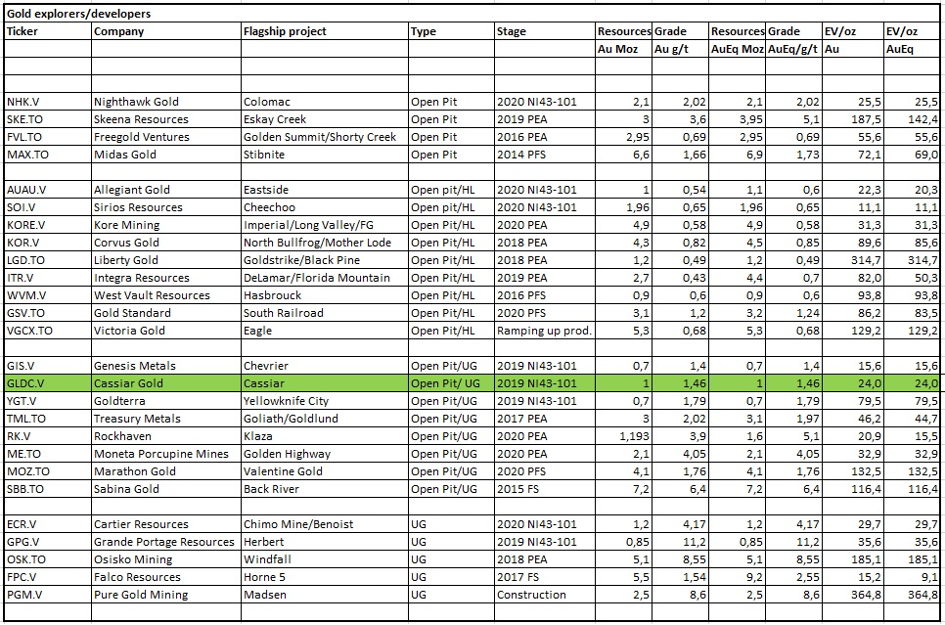

The second table is the most important one, as it generates the enterprise value (EV)/oz metric, the most important metric for advanced explorers and developers:

As can be seen, Cassiar sports a pretty low EV/oz number of 18.8, although exploration of Table Mountain by Cassiar is still in its infancy. Notwithstanding this, Kirwin has high hopes as he explained earlier, so if Cassiar really can create a 2–3Moz developer with profitable deposits, an EV/oz figure of $40-50/oz wouldn't be unrealistic at all in my view, when looking at peers. Peers with comparable metrics like Genesis Metals Corp. (GIS:TSX.V; GGISF:OTC) and Moneta Porcupine Mines Inc. (ME:TSX) sometimes have more complicated geology, also with more underground mineralization than Cassiar, at grades that aren't very economic. I honestly haven't look too deep into Rockhaven Resources Ltd. (RK:TSX.V) as I am not familiar with them, so I don't know exactly why their valuation is so low, but I will take a closer look soon as low valuations with no apparent cause could be interesting.

So in my view these three companies need a lot of successful exploration first. As a consequence, their projects probably will be less economic. Cassiar, on the other hand, could, if desired and if everything else goes wrong at Table Mountain exploration, just develop Taurus only, as a 1Moz deposit without too much dilution and an average grade above 1g/t Au could have a LOM (life of mine) of 8 years with 100,000 oz Au annual production, generating an after-tax net present value (NPV)5 of anywhere between US$200–300M at US$1,500/oz Au.

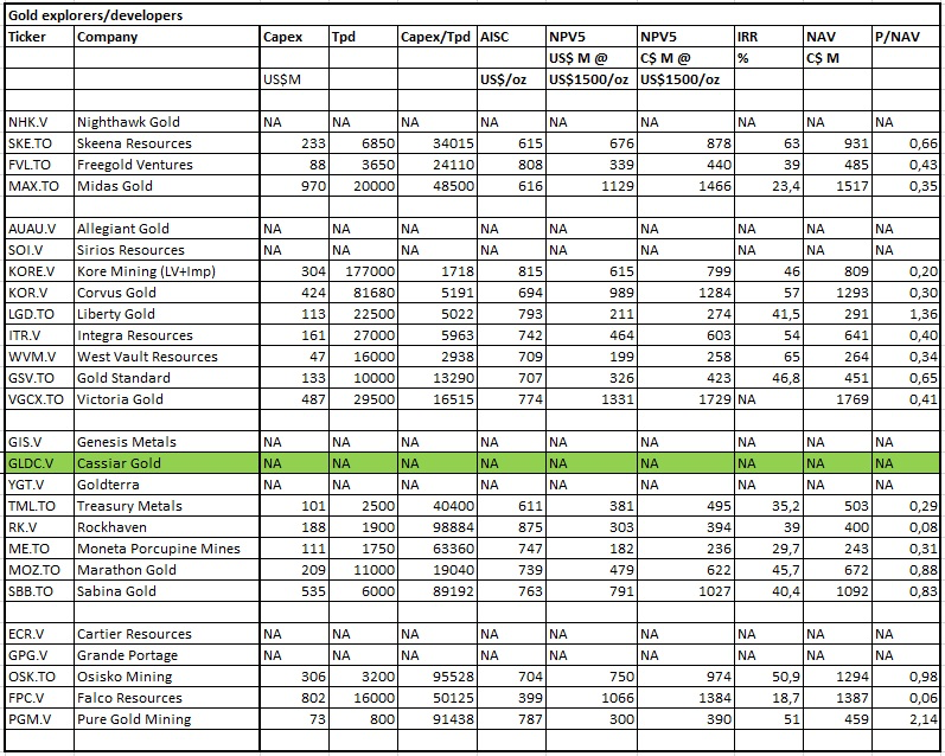

To get an impression about NPVs and internal rates of return (IRRs) and the resulting P/NAV, my favorite valuation method, by the way, as it is much more accurate compared to EV/oz, have a look at the following table:

If we would use an after-tax NPV5 of CA$250M, the P/NAV would be 0.10 for now, which is extremely low for a profitable gold project these days. Again Rockhaven sports an even lower metric. Falco Resources Ltd. (FPC:TSX.V) does as well, but their high capex, low grade and moderate economics are clear fundamental causes in my view. Notwithstanding this, Sean Roosen is probably powerful enough, with Osisko behind him, to build the Horne 5 Mine anyway, as long as gold stays above US1,600/oz.

But Cassiar's projects are different, fortunately, of a smaller scale, but likely with a more profitable grade. With a 2–3Moz resource at a good grade, I can see Cassiar trading in the EV/oz range of $30–$40 soon. Management is planning on drilling out Taurus/Table Mountain during 2021, coming out with a resource update and most likely will do a PEA in 2022.

Cassiar Gold project; British Columbia

6. Conclusion

In my view, this could be one of the more convincing mining junior turnarounds of the last few years in the making. Former management, to their credit, already acquired the 1Moz Cassiar Gold project, which brought them on my radar again, but since management was reshuffled, and especially with Doug Kirwin demanding a first-row seat, this was something else. On top of this, the company raised a substantial CA$6.65M after a rollback, an amount they have never been even close raising in the past. It shows that new CEO Marco Roque has the right connections, bringing in that kind of cash and intriguing Kirwin enough to join this new venture.

When the much-acclaimed Kirwin, who is working on a project next to the Fosterville Mine in Australia, calls Cassiar, and more specifically Table Mountain, a "potential second Fosterville," things might be worth your attention. For now, I like the cheap EV/oz valuation, and an eventual resource update will most likely add to an even cheaper metric.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Read what other experts are saying about:

Critical Investor Disclaimer: The author is not a registered investment advisor, and has a long position in this stock. All facts are to be checked by the reader. For more information go to www.cassiargold.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Cassiar Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cassiar Gold, a company mentioned in this article.

Charts and graphics provided by the author.