Restaurant, catering and food delivery logistics platform company DoorDash Inc. (DASH:NYSE) went public today and the action was well received with much fanfare.

The company initiated its listing on the New York Stock Exchange (NYSE) by offering 33 million shares priced at $102.00 per share under the ticker symbol DASH.

The firm's shares were priced at $102.00 per share, but then proceeded to open at $182.00 (+$80.00, +78.43%). The stock traded over 25 million shares today between $163.80 to $195.50 per share and closed at $189.51 per share (+85.79%), nearly double the IPO price.

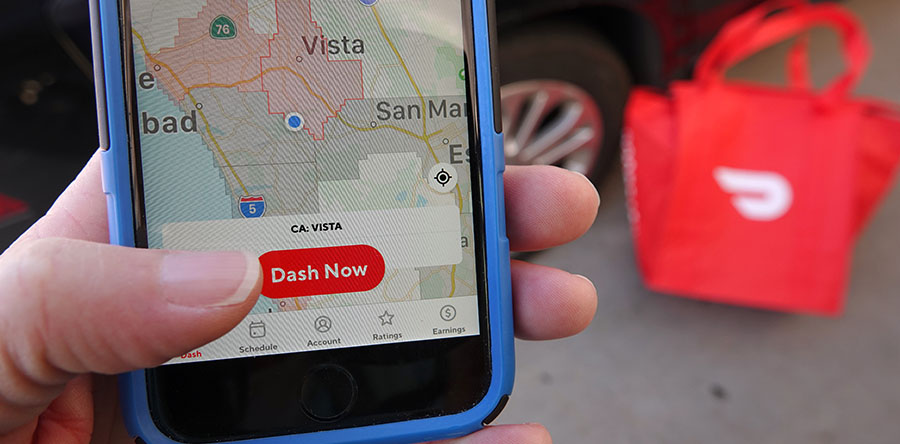

DoorDash is headquartered in San Francisco and operates a logistics platform that smartly connects merchants with customers via its independent delivery staff, which it calls "Dashers." The company allows consumers to place and pick up advance orders or request delivery.

The company states on its website that it offers consumers choices of all styles and types of cuisine from more than 300,000 local and national restaurant providers across Canada and the U.S. Available options range from fast food choice like burger and fries to ethnic foods from just about every country imaginable. Meal selections can be as simple as fast food items all the way up to gourmet choices and catering for group events.

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.