Silver Viper Minerals Corp.'s (VIPR:TSX.V; VIPRF:OTCQB) La Virginia gold-silver project is situated in Sonora, northern Mexico, Mexico's top gold producing state.

Prior to Silver Viper Minerals' ownership, the property was drilled by Minefinders and Pan American Silver: 188 drill holes totaling 52,000 meters. One highlight hole intercepted 23.5 meters of 7.63 grams per tonne (g/t) gold and 363 g/t silver.

"What really excited us was not only the historical work, but that the same structures run on surface for tens of kilometers, and most of the project hasn't been mapped or sampled," Silver Viper President and CEO Steve Cope tells Streetwise Reports.

Silver Viper acquired the La Virginia project in 2018. In exchange for a 2% net smelter returns (NSR) royalty, Pan American Silver granted Silver Viper Minerals 100% ownership of its claims, data and physical core, which is stored in Hermosillo, Mexico. At this time, Silver Viper also struck a backloaded option agreement on the internal claims with the prospect generator group.

"We have an excellent track record of making discoveries, and we knew we could make new discoveries on this project while having the historical area to fall back on," Cope says.

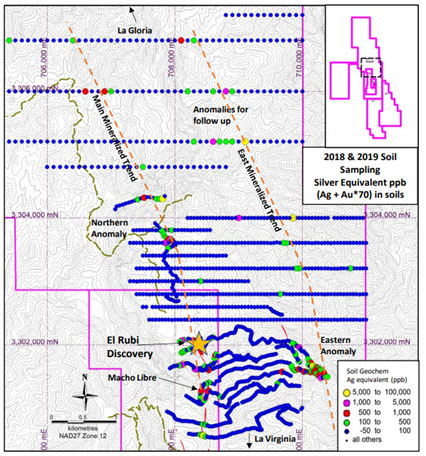

Silver Viper did not waste time getting to the discoveries. Phase 1 drilling in late 2018 focused on both filling the gaps in the historical data at the Con Virginia and Las Huatas areas, as well as sinking five reconnaissance holes. That drilling led to the discovery of El Rubi, a mineralized zone composed of quartz veining, stockwork and breccia, located halfway between La Gloria and the historical drill areas of Campo Santos and El Oriental.

The company spent most of 2019 following up on that discovery and conducting a mapping, geochem and rock chip sampling program focused on the El Rubi area.

At the end of 2019, the company began phase 2 drilling. Phase 2 has been ongoing since, except for a brief hiatus due to Covid-19 restrictions. To date, the drill program has totaled 15,000 meters.

Hole LV20-245, 100 meters west of the main El Rubi zone, was the second discovery at El Rubi. "That hole is a game changer; it shows the open-pit potential of the El Rubi area. It looks like we can start with open-pit, heap-leach mining, then go underground in the high-grade structures," Cope explains.

"El Rubi has become the main event, our focus is on El Rubi and the surrounding area," Cope adds.

The company is also working to define a maiden resource, as there has not yet been one in the area.

"We hope to release a maiden resource by either the end of the year or early January. We want to show value and develop an ounce number for the historical area. We also want to define the resource at El Rubi in tandem," Cope says.

Silver Viper is also testing other anomalies around the El Rubi area, as well as some drilling in the western zone.

The company is part of the Belcarra Group, an organization made up of technical and capital markets professionals in the mining industry.

"The Belcarra Group’s model is to get involved with an exploration stage project, anywhere along the exploration spectrum, and take it as far as the feasibility study," Cope explains. "Our group has extensive exploration expertise, but we are not mining engineers. Our goal, and where our shareholders benefit, is when a major comes in and buys our project. We get involved with projects we know are big enough to interest the major mining companies."

Silver Viper has approximately 81 million shares outstanding, 93.5 million fully diluted. Institutional investors, including U.S. Global Investors and Sprott Asset Management, hold 57% of the shares, and management holds 23%. In June, Silver Viper closed an oversubscribed brokered private placement, raising gross proceeds of CA$5.1 million.

On October 29, Red Cloud Securities added Silver Viper to its Top Picks list, with analyst Derek Macpherson noting, "Based on the significant work-to-date, La Virginia appears to have the potential to yield a major, low-sulphidation epithermal silver-gold system. With a maiden resource based on historic work expected shortly, and step-out drilling to demonstrate scope underway, we expect the stock to re-rate towards our target of C$1.00/sh as drilling success begins to demonstrate the scale potential of La Virginia. . . With funding locked in, the company is primed to materially grow La Virginia in 2020."

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Silver Viper. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Red Cloud Securities, Precious Metals Continue to Run: Updating Top Picks & Metal Prices, Initiating Coverage, October 29, 2020

Red Cloud Securities Inc. is registered as an Investment Dealer in Ontario, Quebec, Alberta and British Columbia and is a member of the Investment Industry Organization of Canada (IIROC). Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Company Specific Disclosure Details

3. In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services and has been retained under a service or advisory agreement by the issuer.

4. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or the analyst involved in the preparation of the research report has received compensation for investment banking services from the issuer.

5. The analyst who prepared this research report has a long position, in the issuer’s securities.

Analyst Certification

Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst's personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.