With a mere nineteen days (19) to go until the U.S. election, I think it is important to turn down the volume on the business news networks and ignore the commentators, the vast majority of whom have simply no clue as to political or economic outcomes moving into the year's end.

I must confess that having lived in the U.S. Midwest for four years in the Stagflation Seventies, and having fallen totally in love with the conservative values of the average Midwesterner, it at once saddens and frightens me that the current socioeconomic divide is so glaringly and painfully agape. Say what you wish about the Americans, they are a truly extraordinary breed and what saddens me is the way the media has massaged the narrative to conform to their elitist-controlled preference. The current rift is allegedly all about "liberalism versus conservativism," "socialism versus capitalism," and "order versus chaos," while in reality it is simply about "social and economic inequality."

Just as the baby-boomers of the Sixties changed not only attitudes but also laws surrounding race, foreign policy and social justice, the youth of today are struggling to forge a future for themselves in the debt-clogged world bequeathed upon them by those very baby boomers who jettisoned bell-bottomed bluejeans for pinstripe suits and love beads for diamond-studded tie tacks. Fueled by the constant barrage of tainted news flows, the protesters have swallowed the bait and are now waging wars as card-carrying members of anarchy, carefully molded into anti-white, anti-law-and-order vigilante mobs bent on total disruption of the status quo.

By doing this, they have been cleverly maneuvered into what appears to be an anti-right-wing, factionist mob, but if you clear away the Facebook posts and the Twitter feeds for more than a mouse-click, what surfaces is a generation steeped in desperation and need. That generation is not political, it is socioeconomic. As always, it is simply about the money, and not how much but rather how little.

In the Sixties, the protests were triggered by events that struck nerves close to home. The picture of a girl kneeling over a dead student, gunned down at the Kent State campus still reverberates to this day, and that was long before the internet. Classmates and neighbors across all ethnic and racial spectrums were being brought home from the Far East in body bags, while the media spewed story after story of propagandist bunk on the "progress" being made in liberating their South Vietnamese allies from the "horrors of Communism." A generation of young people of all colors and creeds marched in protest on Washington demanding change and nothing done by either the politicians or their media minions could dissuade them.

So, as I sit in a vacuum of audio inputs, purposely avoiding the nausea of media-driven thought-control messaging made many times more impactful by the social media delivery systems of 2020, I am confident in my current investment posture, which puts precious metal ownership at the peak of the pyramid, with all else residing many levels of amplitude beneath them. This brings me to a topic that is the title of this week's missive: Skin in the Game.

In my prior career as a financier of junior mining companies, I cannot even begin to count the number of "pitches" I have had to sit through, listening to some chap in a sharkskin suit wearing bull-and-bear cuff links expounding on the investment potential of his deal. Whether it was "gold in Mexico" or "kimberlites in Angola" or "oil in Saskatchewan," these entrepreneurial carnival barkers would put on performances that would rival Freddie Mercury. It would be truly relentless, their confidence growing minute by minute, until the final moment where they have to execute "the close"—where they actually ask for the order or commitment from me to help them raise money for their endeavor.

It was later in my career, after many errors in judgment, the myriad skeletons of shipwrecked deals lying on the cluttered coastlines of shattered dreams, that I learned to ask the singular most important question:

"How much of your personal wealth have you committed to this deal?"

Once I learned to pre-empt their "close" with that question, the blank stares and dropped jaws were always accompanied by brief silences, that critical point where the presenter knows that he is now squarely in the crosshairs of "truth versus fiction." The responses would vary from "Management owns around x% of the issued capital," or "I have 2,000,000 options at x$ per share," or "I have x million shares in my retirement account." The looks of anticipatory anxiety would disintegrate in tiny little shards of broken hope when my response returned like an Iron Mike Tyson lead right hand:

"No. I didn't ask you that. How much SKIN do you have in the GAME?"

While management's dollar exposure was not always a deal killer, it certainly weighed heavily on my final decision. While there have been occasions where the major shareholders hold the bulk of the issued capital and work closely with management in major decisions (such as Getchell Gold Corp. [GTCH:CSE]), most of the component companies held in the 2020 GGMA portfolio have either management or the major shareholder group with serious "skin" in the game.

Now, of all of the deals in which I have invested, there is one company and one chief executive officer that wins the "Skin in the Game" sweepstakes, hands down. That company is Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB) and the CEO is George Sanders. From the company website: "George is a mineral exploration and development entrepreneur with over 35 years of exploration, development and mining finance experience. He spent over 15 years as a Registered Representative and Precious Metals Specialist with the investment firm Canaccord Capital Corp. He has held executive positions with several junior exploration and mining companies including Consolidated Cinola Mines Ltd., Richmont Mines Ltd., and Shore Gold Inc. He is currently also a Director of Bitterroot Resources Ltd. and SilverCrest Mines Inc."

In my October Special Situations report, I walked you through how I found the 823,000 ounces of gold present at Aurora West, which, at US$80/ounce, capitalizes GCN/GCFFF at US$65.8 million (US$1.09 per share). With a US$6 million market cap as of Oct. 15, that implies a ten-bagger lift over time as those in-ground gold ounces are properly valued. So, while the numbers are compelling, there are non-financial reasons for ownership as well.

Further, from the 2020 Intro to the recent Aurora West transaction:

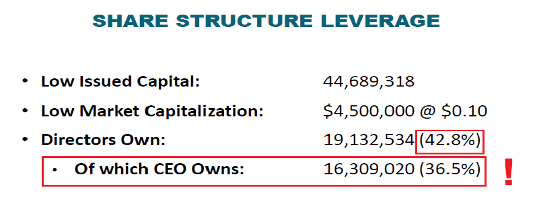

This is a significant table of information for the following reasons:

- At 44.6 million shares issued, total issued capital is still relatively low, which is good;

- Directors own 42.8% of the company. That figure alone aligns the interests of minority shareholders in perfect tandem with the individuals running the business;

- CEO George Sanders owns and controls 36.5% of the issued capital. His only exit will be to sell the company, lock, stock and barrel.

In light of the recent Aurora West acquisition, you can see the outlines of a larger strategy whose objective is to amass a resource large enough to attract the covetous affections of a major mining company desperate to augment valuation parameters through adding non-organic ounces. I believe that Goldcliff management sees a window of opportunity through which they can secure leverage to the rising gold price at a reasonable cost in both dollars and prospective dilution. In this manner, minority shareholders can occupy well-positioned seats at the table, at which they can also partake of the impending feast.

It is unusual for shareholders to have such an advantage, in this day and age, as management groups have typically viewed minority shareholders as "necessary evils" to be managed, coddled and coerced while they peel off millions of shares into the hype. Knowing George Sanders as I do, this would never be an issue, but in the case of Goldcliff, regulatory guidelines prohibit him from selling unless approved by IIROC and TSXV Regulation Services, so minority shareholders have zero chance of being blindsided by wayward insider selling.

In this regard, Goldcliff comes across as one the premier issues in which one can participate. We are still going to need the blessings of the Two Goddesses of the Junior Mining World (Lady Luck and Mother Nature), but these two deities have tended to show affections for companies that give heed to proper corporate governance. I believe that Goldcliff is one such company.

In 2002, Metallic Ventures Gold Inc. (MVG:TSX) filed a technical report on SEDAR (that anyone can access) that confirmed the presence of 823,000 ounces at Aurora West. With 44.6 million shares issued trading at US$0.1077/share, and a market cap at US$4.19 million, Goldcliff trades at US$5.09/ounce of in-ground gold, so whether I use the US$40 benchmark or the US$80 benchmark, I see a hefty lift from current levels as the underlying value to Aurora West is unlocked.

In sum, you have a CEO with serious skin in the game, a well-situated property in a favorable jurisdiction with a justified resource and a market cap at a fraction of "fair value."

Just as Steve Jobs had serious reputational capital in Apple long after the bankers almost ruined his company, it was his reputational "skin" that motivated him to come back from deal purgatory and rescue the company. There is nothing that drives value more rapidly than a motivated CEO with a great deal of pride and money at risk.

Goldcliff is a buy.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold and Goldcliff Resources. My company has a financial relationship with the following companies referred to in this article: Getchell Gold and Goldcliff Resources. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldcliff Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold and Goldcliff Resources, companies mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.