MAG Silver Corp. (MAG:TSX; MAG:NYSE A), known for its high-grade Juanicipio silver project in Mexico that it is developing with Fresnillo Plc, is branching out with an earn-in agreement to acquire 100% of the Deer Trail Project in Utah.

The company has consolidated lots of different claimsóthe property totals about 5,600 hectares and includes 111 patented and 682 unpatented claimsóto form the project. The project combines the Deer Trail Mine with the surrounding Alunite Ridge area.

Dr. Peter Megaw, MAG Silver's chief exploration officer, has had his eyes on the property since the early 1980s, when he was working for Kennecott in the central Utah area. "Kennecott sent me out to look at some regional prospects, Deer Trail being one of them, which was being explored at the time. And I really liked what I saw and filed it away," Dr. Megaw told Streetwise Reports.

"This is classic replacement style mineralization; the more I learned about Deer Trail and the more I learned about other carbonate replacement systems (CRD), the more it says there's something important here," Dr. Megaw explained. Deer Trail is on the same fault as the major porphyry and CRD deposits Bingham Canyon and Tintic.

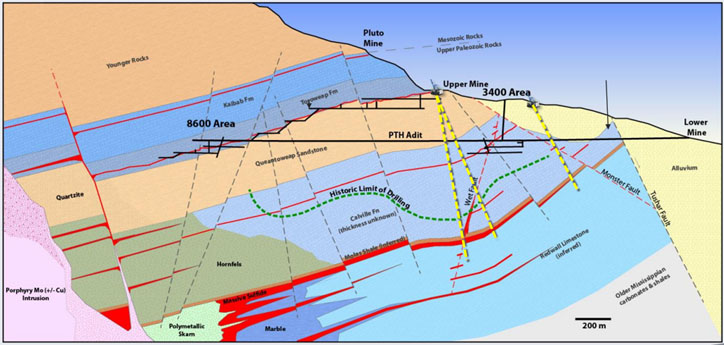

Consolidating the area allows MAG Silver to apply an "integrated district-scale exploration approach based on the continuum of mineralization styles from CRD through skarn to porphyry copper-molybdenum shown by many related systems worldwide. This model suggests that the high-grade silver, gold, lead, zinc and copper CRD sulfides of the Deer Trail mine are linked by kilometers of continuous mineralization to a porphyry copper-molybdenum center lying to the west near Alunite Ridge," the company stated.

Geologists believe that the Deer Trail deposit is a hub and spoke system, with the porphyry being the hub. The company's initial focus has been on one spoke. "Because of work that's been done historically, including the 20,000 meters of historical drilling, we understand what we call the distal end of the spoke pretty well. We think that when they found the Deer Trail in outcrop in 1878, they found basically the tip of the one spoke. That tip has a very characteristic gold bearing quartz style of mineralization associated with it; they followed that down dip, ultimately for two and a half kilometers. It went from that style of gold quartz mineralization to the massive sulphide mineralization that is typical of the Deer Trail manto." Dr. Megaw said.

As for the porphyry, Dr. Megaw explained that about a half dozen holes were drilled into it from various places, but by companies holding only small pieces of the property package. "One of those drill holes actually got something that has to be very close to the porphyry because they've got hundreds of meters of pervasive sericite alteration, a high temperature acid alteration that's typical of when you're near or actually in the porphyry. They also cut, but didn't sample, high-grade quartz-molybdenite veins," he stated.

One of the features MAG is searching for is Redwall Limestone, which is more than 300 meters thick, and should underlie the relatively unfavorable section that hosts mineralization in the historical Deer Trail mine. "The Redwall is the most favorable unit in the Western United States for carbonate replacement mineralization. We want to figure out how deep we have to go to get to it. And we want to focus our exploration there because you want to focus in what you think is the highest potential host rock. So the identification of the Redwall Limestone host rock is what our first round of drilling is targeted on," Dr. Megaw said.

MAG Silver has already conducted a small seismic survey, employing technology used by oil explorers. "We used what's called a Thumper, which is like a hydraulic pounder on the back of a mine cart, Dr. Megaw explained. "We could only see about 150 meters below the adit, but we could see the bedding very nicely. And we could see the structures in that, the same ones that we see and can recognize are feeders in the workings. So we got really good ground truth from that."

Next up is a 1.8-kilometer-long seismic survey. "We're using small explosive charges because explosives give you a sharper signal, penetrate better and give you higher resolution. That could see 600Ė700 meters in depth, well past where we think the Redwall is," Dr. Megaw explained. "We're expecting to be able to see a lot with that. We also know based on surface use of the same approach in similar types of replacement systems that sulfides have a very distinctive signature, so we are hoping to pick them up too."

MAG Silver is partnering with a local university to run the seismic survey. The seismic work will be used to refine 3D models and guide drilling.

MAG Silver is fully permitted for its initial, 6,500-meter surface drill program, with holes targeting depths of 800 to 1,000 meters.

"We're going to start to understand our first spoke, then we're going to try to find where the porphyry center is. A porphyry deposit is not a target for a junior company. For a porphyry to make sense, you need a billion tons of 0.5% copper; there's no way we want to do that. But if we can demonstrate that there's one there and it's a viable target, then perhaps a major would be interested in partnering with us on that part of the system, leaving us to continue to explore all around the system, looking for the high-grade silver, lead, zinc, copper, gold mineralization that we see at the Deer Trail and have every reason to think there's more of."

The Deer Trail agreement is structured so that the property and claims holders contributed their properties into DT Mining LLC in exchange for 99% ownership. MAG Silver holds the remaining 1% and has the right to earn a 100% interest by spending $30 million in expenditures and $2 million in royalty payments over 10 years. The parties retain a 2% net smelter recovery (NSR) royalty. MAG Silver has no obligation to make any payments beyond the $2.5 million first year commitment of royalty and expenditure payments, which has already been satisfied.

"MAG is not interested in small mines, MAG is interested in big, high-grade mines with a long mine life, because it's just as much trouble to put a small mine into production as it is to put a big one into production. But a small mine runs out faster, and you don't really make any big money. A large mine is also big enough to last a couple of market cycles, at least," Dr. Megaw concluded.

A report by Stifel GMP Analyst Stephen Soock on September 11 focused on MAG's new property. "The acquisition comes with an extensive amount of data that has been compiled on a regional scale for the first time. This includes surface and UG geological maps, geochem sampling, logs, core and chip samples from 20,000m of drilling, extensive geophysics surveys and 2.5m of accessible underground drift. MAG's primary focus will be on the deeper limestone unit prime for hosting CRD mineralization between the Deer Trail mine and source porphyry intrusion 3-5km away. The company's technical advisor, Dr. Peter Megaw, is the world's leading expert on CRDs." The firm increased its target price to CA$27.75 and maintained its Buy rating. MAG shares are currently trading at around CA$22.35.

MAG Silver has around 94 million shares outstanding, 96.6 million fully diluted. The company's market cap is approximately CA$2.10 billion.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: MAG Silver. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Stifel GMP, MAG Silver Corp., September 11, 2020

Important Disclosures and Certifications

Each research analyst and associate research analyst who authored this document and whose name appears herein certifies that: (1) the recommendations and opinions expressed in the research report accurately reflect their personal views about any and all of the securities or issuers discussed herein that are within their coverage universe; and (2) no part of their compensation was, is or will be, directly or indirectly, related to the provision of specific recommendations or views expressed herein.

Stifel Canada Analysts are compensated competitively based on several criteria. The Analyst compensation pool is comprised of several revenue sources, including secondary trading commissions, new issue commissions, investment banking fees, and directed payments from institutional clients.

Company-Specific Disclosures: None