Summary: With nuclear power back on the agenda of some big energy markets, demand for uranium now exceeds pre-Fukushima levels and has outstripped primary supply over the past few years. Until now, stockpiles made up the difference, but even those are being depleted. Accordingly, the uranium industry is setting up for a classic commodity supply-demand imbalance, which should benefit mining companies in this space.

The Global Nuclear Fleet Is Expanding

Nearly a decade after the Fukushima disaster prompted the panic closure of dozens of nuclear reactors worldwide, the global fleet is expanding once again.

There are 440 reactors operating in the world today, with 54 more currently under construction and scheduled to become operational by 2026. An additional 110 reactors are on order or planned. Many countries with existing nuclear programs plan to add capacity, but most of the growth is occurring in Asia, where large populations, rising incomes and surging demand for electricity are driving activity.

In the past decade, new plants coming online have been largely balanced by old plants being retired. Going forward, new units are expected to exceed retirements. Projections from the Nuclear Fuel Report show 154 reactors closing by 2040 versus 289 coming online, resulting in a net gain of 135 reactors.

Mine Production is Falling

Those new reactors will require the world to produce more uranium. But while demand for the commodity is building up, supply is falling. Consider that there just 62 companies exploring for uranium today, down from 420 companies pre-Fukushima. Moreover, primary production has lagged global demand ever since below-breakeven uranium prices forced several mines to be shut down a couple of years ago.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on September 21.

Mines in 2019 produced some 63,273 tonnes of uranium oxide concentrate (aka "U3O8") containing 53,656 tonnes of uranium (tU). That fulfilled just 79% of the 67,800 tU required by utilities last year. The balance had to come from secondary sources including stockpiles of uranium held by utilities.

The 441 reactors currently in operation have a combined capacity of about 400 GWe and require some 67,500 tU (or 79,500 tonnes of U308). Mine production for 2020 was expected to be around 63,600 tU. But that was before the coronavirus pandemic forced the world's largest producers to suspend operations until it was safe for workers to get back to work. Because of the COVID-related disruption, uranium production in 2020 could fall as low as 45,000 tU, leaving a shortfall of 33% which again has to be filled from inventories and secondary supplies.

At this point, most analysts are projecting the uranium deficit will last until 2022, at the very least.

U.S. Strategic Uranium Reserve?

The deficit could be compounded by another wildcard: Possible stockpiling by the United States.

As the largest consumer of global uranium production, the U.S. accounts for nearly 30% of worldwide demand. Very little of that uranium is sourced internally, as domestic producers simply don't have that kind of capacity. Last year, U.S. nuclear power plants got 90% of their uranium from foreign suppliers and only 10% from U.S. mines. While Canada remained the top supplier, the combined purchases of uranium from Russia/Kazakhstan/Uzbekistan ("non-allies") exceeded those from Canada/Australia/US for the first time ever, and this may be exceeded further in 2020 given shutdowns at Canada's Cameco operations.

Not surprisingly, there's been talk in Congress about the need to reduce U.S. reliance on outside suppliers. For 2021, the Trump administration has asked Congress for $1.5 billion over the next 10 years to establish a uranium stockpile. While approval seems improbable at the moment, that could change in the future. After all, nuclear power plants generate 20% of U.S. electricity and are increasingly vulnerable to geopolitical risk.

In late 1973, an OPEC oil embargo nearly brought the U.S. economy to its knees as U.S. access to oil dried up quickly. To ensure that foreign suppliers could never again hold the economy hostage, U.S. Congress passed the Energy Policy and Conservation Act in 1975, establishing a strategic petroleum reserve. If Congress determines in the future that a strategic uranium reserve is needed, the ensuing stockpiling would provide a boost to the commodity's price.

Prices Could Move Quickly

Whether or not the U.S. goes ahead with a strategic reserve does not change the fact that the uranium industry is setting up for a classic commodity supply-demand imbalance, with global demand outstripping annual primary supply from currently operating mines. Once the market absorbs this reality, prices will head north, and it is worth noting here that commodity prices can move fairly quickly.

In a six-week stretch from mid-March to early May, the price of uranium soared 42% from $24.00 to $34.05/lb before trending back down to $30.10/lb. While the March–May spike was merely a bounce off of oversold levels, there are fundamental reasons for uranium's price to move up again in the months ahead.

First, many U.S. and European utilities have largely run down their stockpiles. Unless global production ramps up again, a supply crunch seems inevitable. Given that the cost to produce a pound of uranium averages around $50–$60/lb, the current market price is well below the incentive price needed to bring meaningful new production back online.

Second, with output down this year, even Cameco and Kazatomprom—the world's largest producers—have resorted to buying uranium in the spot market to help meet their contractual requirements with utilities. The more they buy, and the longer they're active in the market, the more likely we will see a spike in the price.

Third, utilities themselves have become more aggressive buyers in the spot market. The reason for this is simple. Uranium is typically supplied to nuclear power plants through long-term contracts. Several contracts up for renewal pre-date the Fukushima disaster, when the prevailing price was $73/lb. But producers are unwilling to lock themselves into new long-term contracts at current levels, forcing utilities to rely on the spot market for supplies. An acceleration of this trend should put upward pressure on the uranium price.

Jordan Trimble, CEO of Skyharbour Resources, notes that, since 2003 we have experienced eight periods in which the spot price of uranium spiked over a short period of time. Each time, the average price increase was +58% over an average of 6.6 months.

How to Gain Exposure

A fresh bull run would greatly benefit uranium miners and boost their share prices.

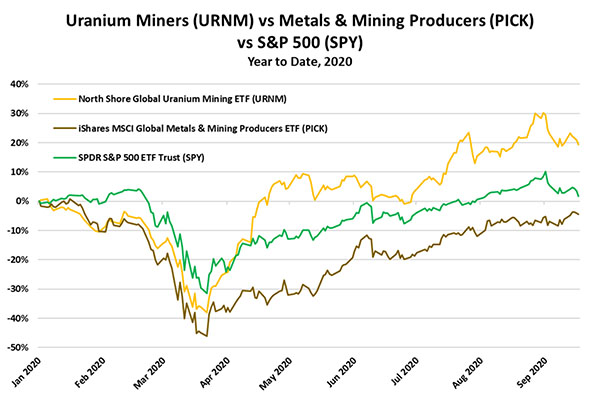

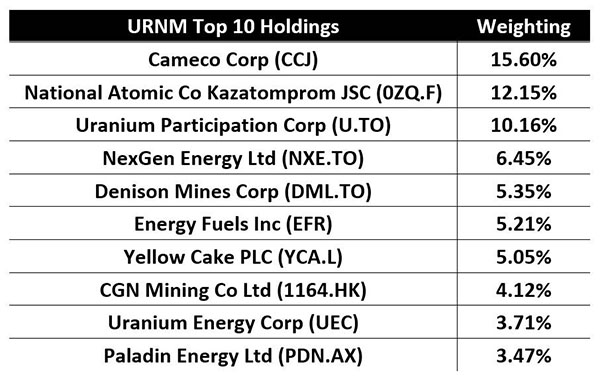

Investors seeking to capitalize on that opportunity have several ETFs to choose from. One of these is the North Shore Global Uranium Mining ETF (URNM), which invests in a basket of global companies involved in the mining, exploration, development and production of uranium, as well as companies that hold physical uranium.

URNM launched in December 2019, so it is a relatively new ETF with just 14.4M in AUM. It is a pureplay on uranium miners, unlike the older and larger Global X Uranium ETF (URA) which combines uranium miners with nuclear component producers.

In our April 16 report on uranium, MRP wrote: "An ongoing supply shock is moving the uranium market's demand/supply balance in favor of miners." Since the publication of that report, the North Shore Global Uranium Mining ETF (URNM) has returned +25%, outperforming the SPY's +19% gain.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

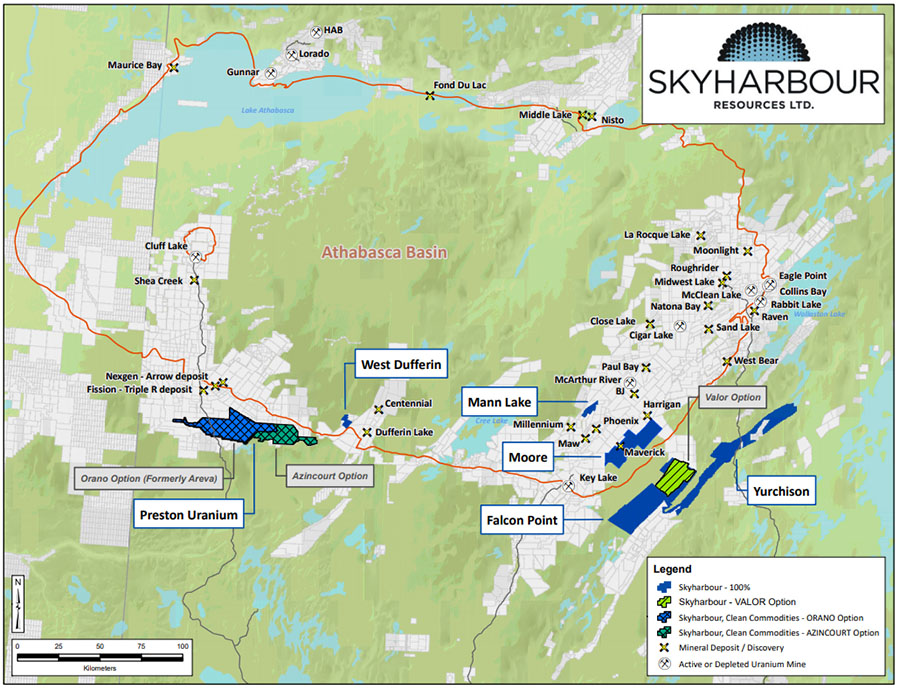

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.