Five weeks ago, gold hit an all-time high of US$2,073/oz. Since then, it's down 6.2% to US$1,944/oz. (still above 2011's record level). Yet, based on the share price declines in some well-known juniors, one would think gold was down 2–3 times as much.

Apollo Gold is down 52% from its recent high, Evergold Corp. is down 51%, Freegold Ventures down 45%, Vizsla Resources down 41%, Spanish Mountain down 38% …. dozens of juniors are off >35%.

Is now the time to give up on gold? Never in the past 15+ years that I've been following this sector have I been more bullish on gold fundamentals. However, my optimism is not predicated on the price soaring, it's already quite high. I believe it will remain strong well into 2021.

In a world gone mad, gold junior stocks make sense as a safe haven

Elevated uncertainty in my home country, the U.S., due to economic, COVID-19, race relations, climate change and protracted political concerns, will not end soon. We have a presidential election in seven weeks, but the next president is not sworn in until January 20, 2021.

If the election is contested, which seems increasingly likely, it could be months before things calm down. Or, the situation could spiral out of control, making 2021 worse than 2020. The chances of smooth sailing? Close to zero.

If a second wave of COVID-19, in concert with the typical flu season, hits this fall/winter, the money printing exercise will likely be much larger and longer lasting. All roads lead to bullish backdrops for gold juniors.

If gold was ever a safe haven asset, now might be a wise time to own gold stocks. Adding to the growing fear and uncertainty, on multiple fronts, is unprecedented money printing, deficit spending and debt issuance around the world.

In the U.S., 2020's fiscal deficit will be nearly $4 trillion, ~18% of GDP. In 2009, the worst year of the Great Recession, the deficit was 9.8%. The last time it approached or surpassed 20% was during WWII. Globally, deficits will be huge this year, and probably quite large again in 2021.

FenixOro could deliver evidence of a major deposit within 2 months

A company I continue to be excited about, despite it being very speculative, is FenixOro Gold Corp. (FENX:CSE). Despite the ongoing correction in the junior space, FENX shares have been surprisingly resilient. If I'm mostly right on gold fundamentals, and if the drill bit delivers some high-grade intercepts, there could be a re-rating in FenixOro's valuation before year-end.

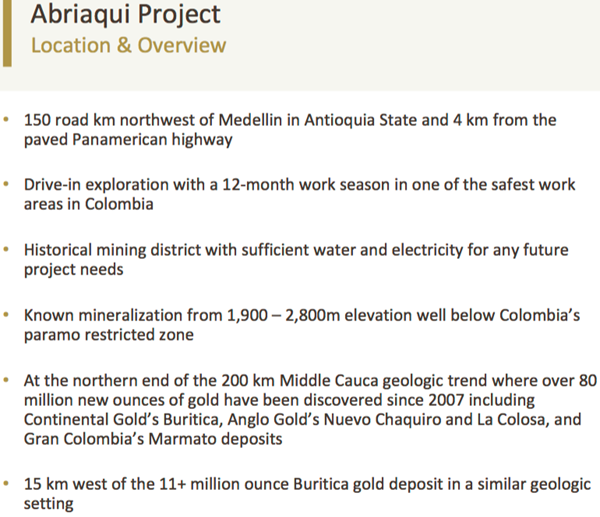

Make no mistake, FenixOro is a speculative low-cap play, but given the state of the world, investors might benefit from owning gold juniors. The big news this month is that the company's drill permits have been issued. This means we are a few weeks from starting a critically important drill program on the 100%-owned Abriaqui project in northwestern Colombia.

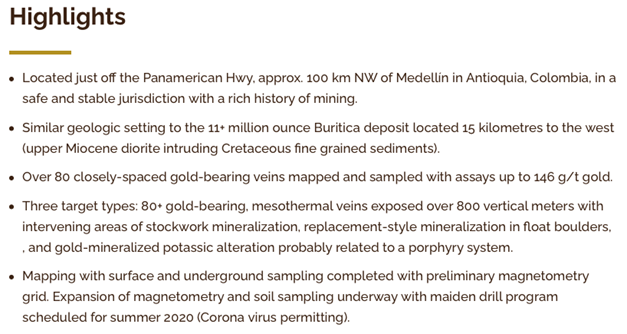

Readers may recall that earlier this year, evidence of porphyry-style gold mineralization was discovered in a mineralized surface outcrop. The alteration type and grade identified is typical of gold-bearing portions of mineralized porphyry systems around the world.

Ground magnetics defined a strong near-surface anomaly measuring about one sq. km. Analysis indicates that it continues on, at roughly the same diameter, to a depth of >700 meters. Already, 1 km length x 1 km width x 700+ m depth = a potentially attractive deposit. Large-tonnage porphyry deposits of >1 g/t gold have the potential to be long-lived, low-cost, cash-generating machines.

Is FenixOro's 100%-owned Abriaqui project the next C$2B Buriticá?

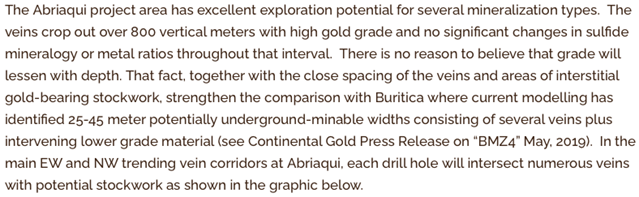

The primary target at Abriaqui is a sequence of >80 closely spaced, high-grade veins developed in 500 meter wide corridors, of which >20 have assayed 20 g/t+ gold, and up to 146 g/t gold. They outcrop over 800+ vertical meters with areas of intervening lower grade mineralization.

Near-term catalysts like drilling, new discoveries and strong results are often well rewarded in bull markets. Management is optimistic about this particular drill program due in large part to the nearby, world-class C$2B Buriticá project's geology, but also a recent ground magnetometry survey, promising soil sampling results and geo-chem studies.

Ten angled drill holes (4,500 meters) have been carefully planned, one searching for a large-tonnage gold porphyry target. Four drill pads and a core shack facility are being built right now. A vertical depth of 300–350 meters is considered to be ideal for these first passes. If successful, management would likely do an additional 1,500–2,000 meters in this phase.

CEO John Carlesso commented,

"The preliminary exploration program has had a lot of success and we've generated multiple new target areas for the drilling that's about to begin. We're seeing potential for much more of the high-grade "Buriticá–style" vein mineralization throughout the full extent of the project, and we've identified a potential large-tonnage, gold porphyry target. With drills now being mobilized, our entire team is eager to uncover the full potential of the Abriaqui project."

In speaking at length with FenixOro's VP of Exploration Stuart Moller, who led the discovery team at Buriticá for Continental Gold (acquired by Zijin Mining) from 2007–2011, he explained that the COVID-19 situation in and around the project area is well contained. There have only been a few cases, and no new ones in the past month. Work is progressing without any restrictions.

Very serious 10-hole drill program (4,500m) testing new zones….

Next, we discussed the imminent drill program. He assured me it's not going to be about twinning high-grade holes to generate a feel-good press release. No, the technical team has had months to develop optimal drill targets and they think they have nailed it.

The program will drill test, for the first time, six or more families of stacked, high-grade vein systems. Each target is distinct, drilling will go after showings at different depths, angles and orientations, across multiple types of mineralization.

Many new veins will likely be identified. Management expects to gain valuable insights on grades, depths, continuity, vein spacing and widths.

In addition, a better understanding of indicative grades/thicknesses between, above and below newly discovered and existing higher-grade zones should be forthcoming.

If enough higher-grade vein material exists, interspersed with wider zones of 2+ g/t material, there could be one or more compelling deposit(s). In fact, management believes results from the recently completed soil sampling program point to this distinct possibility. Evidence of a potentially meaningful project will be shared within a few months.

Most juniors require multiple drill programs (and capital raises)over multiple seasons to get a decent glimpse of what their properties might hold. However, since FenixOro's project is so near to the giant Buriticá project, and given that the two projects share geological characteristics, and the considerable amount of exploration work done—drill results should give investors good visibility into the company's prospects.

That's why I believe FenixOro has the potential to experience a re-rating in valuation upon the release of assays, expected to begin being received by November, that would tie Abriaqui ever closer to the nearby 12M+ ounce Buriticá project.

Readers please note, I don't use the term "re-rating" lightly. Buriticá is not just an attractive analog deposit, it's one of the world's premiere advanced-stage, high-grade gold development projects. Commercial production is expected there within six months.

I asked Carlesso and Moller about the share price, which has enjoyed a nice move. Have investors missed the boat? While no one can predict the future, they indicated that some institutional investors are waiting for drill results before potentially initiating a position. This is common for small-cap exploration plays; passing on potential earlier-stage, higher-risk returns, trying to capture smaller, but less risky gains.

This suggests FenixOro Gold Corp. (CSE: FENX) is not a go-go stock about to run out of steam. The best comparable project, which happens to be just 15 km away—is soon to be a world-class, high-grade mine—valued at roughly 60 times FenixOro's C$33 million valuation.

Near-term, very impactful investment catalysts are right around the corner. I strongly believe there's room for this valuation gap to shrink upon further de-risking of the Abriaqui project.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of the above article is for information only. Readers fully understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand & agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed & agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was an advertiser on [ER] & Peter Epstein owned shares in the Company.

Readers understand & agree that they must conduct their own due diligence above & beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.