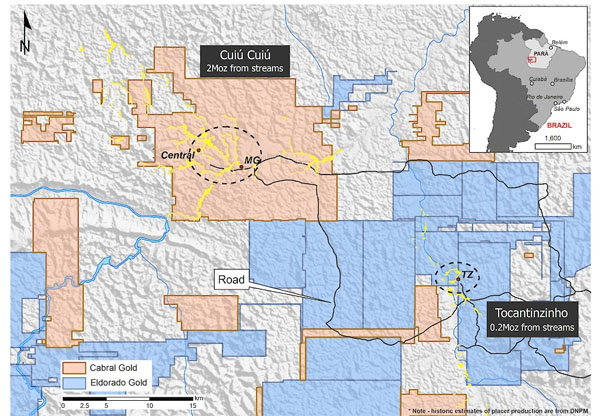

Cabral Gold Inc.'s (CBR:TSX.V; CBGZF:OTC.MKTS) Cuiú Cuiú project in northern Brazil sits in the middle of the region that hosted the world's largest gold rush, the 1978–1995 Tapajós Gold Rush, and on the company's property some 2 million ounces of placer gold were produced. But the hard-rock source of all that gold has never been found.

Which is where Cabral Gold comes in. "During the gold rush," Cabral CEO Alan Carter told Streetwise Reports, "people were probably washing gold from about 100 different places in the region and Cuiú Cuiú was the biggest and the richest one, and so we've been looking for the source of all that gold."

Cabral's 100%-controlled Cuiú Cuiú is a large property, around 36,000 hectares or around 360 square kilometers. To date, the company has identified two deposits, MG and Central, five kilometers apart, that together have a 1 million ounce gold resource, and both are open at depth.

"Cabral has major drill programs scheduled for the next six months so expect a lot of news." - Bob Moriarty, 321gold

"So far, we think we found the source of maybe about 10% of all the placer gold," Carter explained. "We are very optimistic that there are a number of other deposits within our project area still to be found, because most of the placer gold that was mined during the Gold Rush days is unexplained. Our objective is to grow this significantly; we think there's potential for 5 to 10 million ounces of gold at least here in multiple deposits."

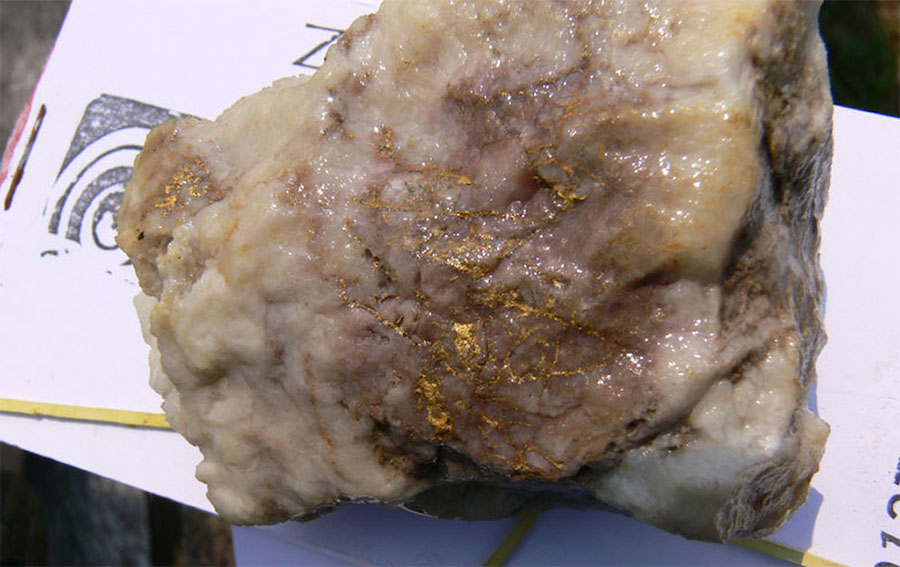

The MC and Central deposits both are characterized by narrow zones of high-grade mineralization surrounded by low-grade mineralization. "What happens is over hundreds of thousands of years, hot water flushes through the cracks and starts depositing a little gold with quartz so we have these halos of low-grade mineralization, which extend out from the main high-grade veins up to 50 meters," Carter said.

The company has found high-grade drill intercepts in eight other target areas within a five kilometer radius of the two known deposits. "We believe that several of those eight areas will ultimately prove to be additional deposits with more drilling," Carter said.

"Beyond those eight areas, there are probably about 15 or 20 other targets that have had no drilling but there is gold coming out of the streams, and we can see that there are geological structures that probably contain gold," Carter said. "A number of those targets that have had no drilling are quite compelling, and some of those untested targets we will test first in our new, 25,000-meter drill program, notably the Alonso target where the boulders on surface are averaging 91 grams per tonne gold."

Another target the drill program will home in on is Medusa, which has never been drilled, but boulders at surface have returned gold values of 1.1 to 82.1 g/t.

"A third target that has never been tested is Cilmar, where there's a lot of coarse nuggets on the surface. We think we know where all these coarse gold nuggets are coming from," Carter stated.

"Cuiú Cuiú is a district-scale opportunity, which is quite unusual, as most gold projects have one deposit," Carter said. "We're very much focused on the high-grade potential of this project; the strategy is to define an economically viable gold deposit."

Cabral bought its own reverse-circulation drill rig in February. "It should allow us to drill very quickly and very cheaply; diamond drilling, which produces these beautiful sticks of core, is quite expensive, about CA$247 a meter, while reverse circulation drilling is going to cost us about 10% of that. We were able to buy a secondhand rig for only $75,000 and it only had 200 hours on the clock. That is a game-changer for us."

Cabral is not the only one in the neighborhood exploring. Eldorado Gold is advancing the Tocantinzinho deposit located 25 kilometers to the southeast. Carter was involved in the discovery of that project and until recently owned a 3.5% NSR on that project. "We've got this on our doorstep, and having a major gold company with the project next door is always a good sign and one of the things I look for as an investor," he noted.

The company has about 99 million shares outstanding, 128 million fully diluted. Insiders own 19%, institutions 27% and retail the remaining 44%. Institutional shareholders include Phoenix Gold Fund, Dundee Goodman, RBC Precious Metals Fund and O3 Investments. CEO Carter is one of the largest shareholders, having personally invested CA$1.7 million to date and has taken positions in the last three private placement financings. "I'm aligned with my shareholders," Carter emphasized.

Two things are going to happen within the next 6 to 12 months, Carter stressed. "The first is we're going to get more drill holes into the high-grade zones in the two existing deposits. And we're going to get wireframe models of the higher-grade zones themselves so that we can ultimately establish high-grade resources. To do that we need more drill hole hits into the high-grade centers of the existing deposits."

"The second thing that we're doing as part of this drill program, which I think is more exciting, is we're looking for another 1, 2, 3 or more gold deposits," Carter said. "Some of that drilling is going to test targets that have fantastic bonanza grade numbers on surface that never have been drilled. And a lot of the planned drilling will be on other targets outside the two known deposits where we've got a little bit of drilling and some high-grade results that we want to follow up on."

Cabral has mobilized its drill rig to the site and first results from the drilling should be released within a few weeks from the commencement of drilling. "So within the next month, we should start to see results and then there will be a constant flow of drill results over the next to the next 9 to 12 months," Carter said.

Industry observer Bob Moriarty of 321gold echoes Carter's assessment. Moriarty wrote on July 3, "I highly suggest potential investors download the corporate presentation and go to page 11. I totally disagree with how Micon calculated the resource. When you are dealing with this form of gold, it has large nuggety gold in the saprolite layer at the surface decreasing to a tiny size in the laterite lower down: you get a really wide variation in size. Most investors, indeed most geologists don't understand this but gold is highly mobile. In a very wet area such as Brazil half the year, the gold actually grows at surface in chemical remobilization. So using a top cut where you just ignore the very high grade simply is not accurate. So I don't buy the current 1 million ounce 43-101. It's really 1.5 million ounces using the existing numbers."

". . .owning a real resource run by real management where their interests are aligned with that of shareholders is probably a very good idea. Cabral has major drill programs scheduled for the next six months so expect a lot of news," Moriarty concluded.

Readers can watch a Crescat Capital video with geologist Quinton Hennigh discussing Cabral Gold:

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Cabral Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cabral Gold, a company mentioned in this article.

Additional disclosures:

Disclosures from Bob Moriarty, 321gold, July 3, 2020

Cabral is an advertiser. I missed the pp but I have bought shares in the open market. Do your own due diligence.