A Solar Tutorial: Strong Growth in the USA Over the Past Decade

According to the Solar Energy Industry Association, Wood Mackenzie Power & Renewables and the Solar Foundation, solar energy in the USA has experienced an average annual growth rate of 49% per year over the past decade. What aided this growth were U.S. federal policies such as the solar investment tax credit, rapidly declining costs (installation costs have dropped >70% over the last decade) and increasing demand across the private and public sector for clean electricity.

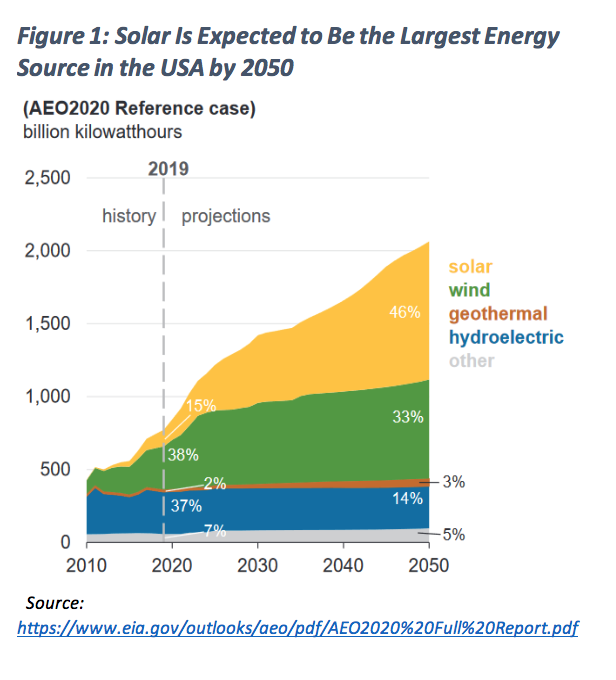

Despite falling hardware costs, additional room for cost improvements exists in the residential and small commercial segments. Specifically, labor, permitting, inspection, interconnection, supply chain and customer acquisition costs could further decline according to industry observers. The U.S. Energy Information Administration's (EIA, a U.S. federal agency that deals with energy-related information to support policy making), forecasts solar to be the dominant USA renewable energy source by 2050.

Solar now makes up a large share of new U.S. power capacity installations. According to the SEIA, the national trade association for the U.S. solar industry, solar has ranked first or second in new electric capacity additions in each of the last seven years through 2019. For example, during 2019, 40% of all new electric capacity added to the U.S. grid came from solar (a historical high point). Solar now contributes over 2.5% of total U.S. electrical generation versus 0.1% in 2010.

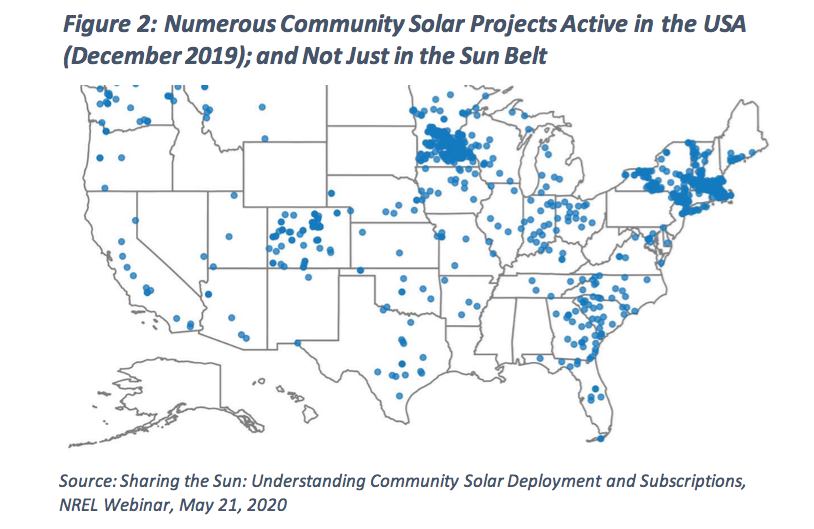

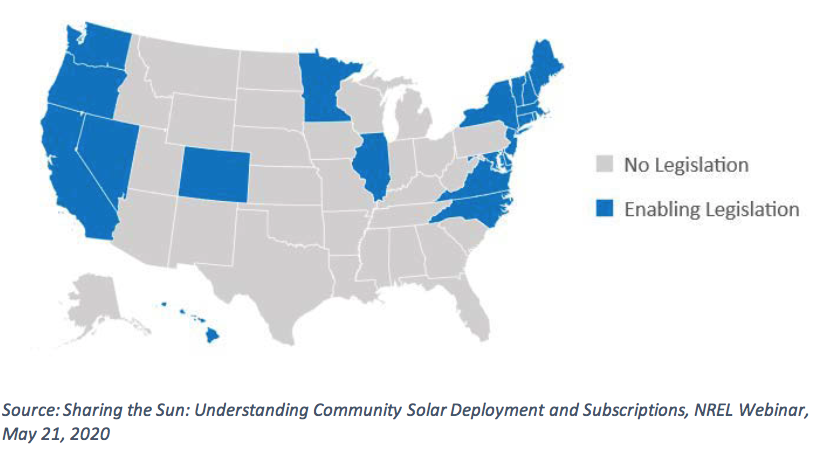

U.S. solar is no longer confined to a few key U.S. states, even though state legislation can help with adoption. While historically California dominated the U.S. solar market, other states, such as Florida and Texas have witnessed rapid growth in the past decade. That said, state level politics do impact solar policies. For example, California, New York, Minnesota, New Jersey, Colorado, Vermont, Oregon and Massachusetts are leading the way. In leading states, "community solar," or "shared solar," or "solar gardens" have been driving growth, as this model eliminates upfront capital investments by property owners and removes the planning and installation burden. As of 2019, the U.S. community solar installations of over 40 states were generating more than 2,000 megawatts (MW) of cumulative power.

Sophic Capital believes that over the next few decades, solar energy adoption is going to accelerate in the U.S. What gives us confidence is significant institutional and corporate investments and policy changes, which we believe will continue to accelerate.

Growing Institutional Stakeholder Focus on Renewables

Environmental, social and governance (ESG)-focused investing leads to better investing outcomes for both companies and investors. According to McKinsey & Company, companies with an ESG focus outperform peers on the top line, have lower costs, productivity enhancements, minimal regulatory interventions and increased asset optimization on capex investments. This could be why global sustainable investment topped US$30 trillion in 2019, a 68% increase since 2014 and tenfold since 2004.

Influential investors are also demanding action on climate change to help mitigate systemic financial risk. Recently, 40 investors (representing about US$1 trillion in assets under management), sent letters to the heads of the U.S. Federal Reserve, Securities and Exchange Commission, and other major financial agencies calling for regulatory action on climate change. These letters to regulators stated that climate risks were not only currently manifesting and presenting significant risks to the financial system, but could also compound with other crises in catastrophic ways. [These offices include the Office of the Comptroller of the Currency, Federal Deposit Insurance Corp., Commodity Futures Trading Commission, Federal Insurance Office, Federal Housing Finance Agency, Financial Stability Oversight Council and various state insurance regulators.]

Influential investors aren't waiting for regulators to address the risks that climate change and social and governance matters present to the financial system. The CEO of Blackrock (NYSE:BLK), the world's largest asset manager, announced a shift to investing in companies that require less fossil fuels. Vanguard, one of the world's largest investment companies, launched funds that include ESG factors as part of their decision process. Fidelity too has a family of ESG funds tied to areas of sustainability.

Why Investors Should Care About Solar in 2020

Corporate Investment is Accelerating

U.S. corporations are not only following the lead of influential investors but have also been aggressively achieving clean energy goals in recent years. Recognizing the importance of ESG to their stakeholders, the number of Fortune 500 companies with explicit carbon targets grew four times from December 2015 through September 2019, per Natural Capital Partners, a carbon offset retailer. Apple (NASDAQ:AAPL) recently indicated goals to reduce and offset emissions along its entire supply chain and in the production of its iPhones and other devices in under ten years. With this move, Apple aims to be completely carbon neutral by 2030. Recall, the company's global corporate operations are already carbon neutral; this move extends that goal to Apple's manufacturing supply chain and product life cycle. Amazon (NASDAQ:AMZN) announced its US$2 billion Climate Pledge Fund to support the development of sustainable and decarbonizing technologies and services. Recall, Microsoft (NASDAQ:MSFT) announced its $1 billion Climate Innovation Fund and has said it will be carbon negative by 2030. IBM (NYSE:IBM) has tracked its energy use since 1973 and its greenhouse gas emissions since the late 1990s.

Solar is becoming an important aspect of the renewable portion of corporate ESG goals, and is forecasted to be the largest U.S. renewable energy source by 2050 (Figure 1). In its annual Solar Means Business report, the SEA stated that major U.S. corporations, including Apple, Amazon, Target (NYSE:TGT), and Walmart (NYSE:WMT), are aggressively investing in solar and renewable energy. Through 2018, top American corporate solar users installed over 7,000 MW of capacity across more than 35,000 different facilities across the U.S. And this trend continues in 2020:

- Sol Systems and Microsoft recently announced they will work together on a portfolio of 500 MW of U.S. solar-related initiatives. As part of this announcement, Sol Systems will finance, develop and operate new solar projects of varying capacities in locations spanning several states. This announcement represents the largest single renewables investment from Microsoft, which plans to reach "carbon negative" by 2030, and by 2050 remove more carbon than it has historically emitted.

Microsoft also announced it was joining eight other companies, including Mercedes-Benz and Starbucks (NASDAQ:SBUX), to help guide companies transitioning to net-zero emissions by mid-century.

Additional soft (non-hardware) cost savings could help further accelerate solar adoption in the U.S. Despite impressive progress, residential solar in the U.S. costs ~$US3.30/watt (W), U.S. commercial costs ~US$2.00/W versus ~$US1.10/W in Australia and US$1.25/W in Germany. Higher U.S. costs are driven by solar panel import tariffs, which nearly double U.S. solar panel costs to ~US$0.35/W versus US$0.19/W in the Philippines; similar tariff-driven cost inflation is experienced with other components, such as racking and invertors.

Additionally, soft costs, which include permitting, inspection, and interconnection (PII); overhead; and customer acquisition are higher in the U.S. These soft costs contribute ~65% to overall residential solar costs in the U.S., versus ~25% in Australia and Germany. Similarly, residential customer acquisition costs of ~US$0.35/W in the United States are significantly higher than ~US$0.05/W in Australia and Germany.

Addressing soft costs could be a meaningful catalyst to drive additional solar growth in the U.S., according to industry observers. For example, in 2016, National Renewable Energy Laboratory (NREL, a U.S. federal laboratory dedicated to research, development, commercialization and deployment of renewable energy and energy efficiency technologies) estimated that small U.S. buildings (less than 5,000 square feet) have sufficient rooftops for solar to generate 25% of total U.S. electrical consumption, versus residential solar accounting for 0.5% of U.S. electricity supply in 2019 and total solar supplying 2.5%. Residential solar penetration in the U.S. is roughly 10% of Australia's. The U.S. getting solar penetration inline with Australia's penetration could generate >US$450 billion of economic activity and 3.5 million jobs.

Plenty of Room for Community Solar Model Adoption

Community solar refers to solar-power-producing assets (whether installed on rooftops or ground mounted) that provide renewable energy access to users within a community who consume the power by way of a credit on their electricity bills. As of October 2019, there were community solar projects in 42 U.S. states, while 20 states had statewide regulatory frameworks, which has enabled community solar to start to achieve scale.

That said, a key challenge in regards to community solar pertains to the communication of risks to investors and subscribers, which can be mitigated by clearly articulating financial benefits to end users of solar energy and addressing subscriber churn risk for investors.

Community solar is estimated to be about 2 to 3% of the total U.S. solar market. Community solar, along with corporate deployments, are expected to drive meaningful growth in the non-residential segment, notwithstanding a temporary but significant (about 30% per year) dip in 2020 owing to COVID-19. On average, community solar project level NPV (net present value) became positive in 2016. As a result, in the USA, community solar capacity has increased due to a greater number of projects coming online and also projects getting larger. Regulatory support in states such as New York, Maine, New Jersey and Connecticut in the past few years has supported this positive community solar trend. For example, initial community projects were less than 1MW, while now project sizes are generally in the 1–5MW range in multiple states, including Minnesota, Maine and New York.

Varying U.S. state level legislations have an impact on community solar; most states still do not have enabling legislation. Community solar deployments tend to surge in certain states, owing to legislation: e.g., Colorado was a leader some years ago; Minnesota deployments took a bit longer and the state became a leader in 2016-2019; Massachusetts surged in 2016. New York and Maine are becoming increasingly relevant now.

Due to the disparity in legislation and regulations, about 90% of cumulative U.S. community solar capacity is concentrated in only 10 states, excluding well established residential solar markets (e.g., California and Hawaii). Supportive legislation is widely recognized as enabling Minnesota to be a leader in U.S. community solar—favorable incentives for community solar is credited for the state having 10x community solar projects in the queue (in the pipeline, but not approved) than has been built so far in all of the U.S.

COVID-19 Impacts and Potential Responses

COVID-19 has undoubtedly dealt the sector setbacks, unfortunately including job losses. Thus far, we have detailed the catalysts that could drive U.S. solar energy adoption. We'd be remiss to not discuss the impediments due to COVID-19.

The residential and commercial solar segments are expected to witness an approximate 30% year-over-year decline in 2020 due to COVID-19, according to energy research firms. In response, cities across the United States are moving permitting services online to try to remove setbacks from social distancing. The International Code Council (ICC), a nonprofit association that provides a wide range of building safety solutions, found that 65% of its members in a recent survey migrated to remote work in response to COVID-19. The recently launched SolarAPP (Solar Automated Permit Processing), by NREL aims to standardize an instant permitting process in the U.S., and streamline the process by aligning with leading countries' best practices. Rooftop solar companies are using drones to inspect roofs, in addition to online permitting, and are putting together more attractive financing options for residential solar buyers.

However, despite these measures, in the United States—the third biggest rooftop solar market after China and Japan—the sector has unfortunately witnessed job losses. Residential solar accounted for over 90,000 of the 160,000 solar installation and project development jobs in 2019 in the U.S., which has about 250,000 (approximately 270% growth since 2010) total solar jobs. SEIA estimates that about 65,000 solar jobs have been lost due to COVID-19, eliminating about five years of job growth in the sector.

However, recent U.S. political pronouncements recognize sector challenges and could favor clean energy and solar, with potentially positive sector catalysts on the horizon. U.S. political stakeholders are, to some extent, beginning to lay out a plan to respond to the COVID-19 challenge. To this effect, some solar-related targets referenced by presumptive Democratic U.S. presidential nominee, Joe Biden, include 500 million solar panels installed over five years, which could equate to two times the current U.S. solar market size, according to equity analysts at Cowen (an independent U.S.-based investment bank), which also notes the 500 million solar panel plan was a Hillary Clinton proposal in 2016. The plan also calls for eight million panels specifically for rooftop and community solar, which could represent about 30 to 50% incremental U.S. home rooftop penetration.

Our buyside and sellside contacts indicate investor interest in ESG remains elevated, due to Biden's Clean Energy Plan, the Green Deal in Europe and upcoming U.S. elections, among other reasons. Echoing this investor interest, a few weeks ago, the Bank of Nova Scotia [Scotiabank] published its Green Bond Report, which outlines the estimated impact of the use of proceeds from its inaugural Green Bond. In July 2019, the bank issued its inaugural US$500 million, 3.5-year Green Bond. Net proceeds from this Green Bond were used to refinance and allocated to eligible green assets.

How Investors Can Participate in the Commercial Solar Energy Industry

We dig a little deeper into community solar, as it pertains to Sophic client UGE International Ltd. (UGE:TSX.V; UGEIF:OTCQB). Founded in 2010, UGE International is a solar and renewable energy solutions company, which provides investors a way to participate in this ESG theme. We will follow up shortly with additional insight into investing in UGE International. Until then, we recommend investors download Sophic Capital's recent interview with UGE's CEO, Nick Blitterswyk, here.

[NLINSERT]Streetwise Reports Disclosure:

1) Sophic Capital's disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: UGE International. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of UGE International, a company mentioned in this article.

Sophic Capital Disclosures / Disclaimers

UGE International has contracted Sophic Capital for capital markets advisory and investor relations services. The information and recommendations made available here through our emails, newsletters, website, press releases, collectively considered as ("Material") by Sophic Capital Inc. ("Sophic" or "Company") is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. You hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company's Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Company's Material. By accessing Sophic's website and signing up to receive the Company's monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company's website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser under the securities legislation of any jurisdiction of Canada and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company's website or Material. The information is directed only at persons resident in Canada. The Company's Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic's website and/or have signed up to receive the Company's monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisory, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company's Material is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company's Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor.