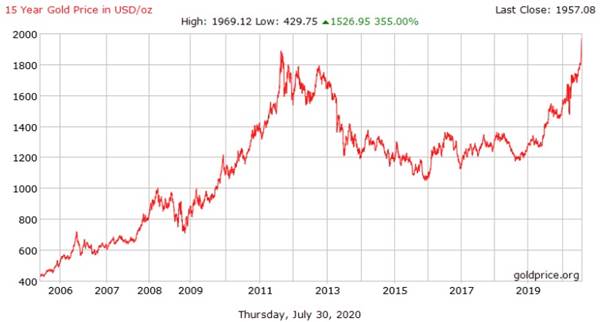

Treasury Metals Inc. (TML:TSX: TSRMF:OTCBB) recently surprised the markets with the raising of C$11.5 million in an oversubscribed financing, after announcing the pretty interesting all-equity acquisition, worth C$44 million in shares at the time of the news release, of the neighboring Goldlund open pit project from First Mining Gold, adding 1.6 Moz Au of resources to the 1.46 Moz AuEq of Treasury's flagship Goliath Gold open pit/underground project. By creating a 3 Moz gold developer in Ontario, one of the hottest gold mining districts in North America, Treasury attempts to come onto the radar of larger industry players. The beefed up treasury will allow the company to advance both assets at increased speed, hereby ideally utilizing the rising spot gold price, which reached all time highs on July 31 at US$1994/oz:

The sentiment drivers for gold couldn't have been better, as the amount of central bank stimulus is unprecedented, the U.S. dollar weakens further, interest rates are close to zero and real interest rates are negative for the foreseeable future, and to top it all off the second wave of COVID-19 combined with intensifying U.S.-China tensions increase uncertainty. Analysts expect to see gold surpassing the important US$2,000/oz level very soon.

Although Goliath Gold is more advanced and will be earlier into production if all goes as planned, management is now aiming at following the Atlantic Gold model, which consisted of a series of neighboring gold projects being permitted and constructed in a staged way, involving one central mill and processing plant. Synergies are obvious here, and therefore I am very much looking forward to the first combined economic study of both Goliath and Goldlund, which can be expected in about six months according to Treasury management. Notwithstanding this, I'll try to estimate combined economic potential myself in this article, and discuss other aspects of this deal.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

After years of advancing at a modest pace, Treasury Metals finally seems to have found the gearbox, coming up with one interesting news release after the other, varying from buying a significant gold asset like Goldlund to raising much larger amounts of cash than usual the last few years. Recently, the company closed a C$11.52 million bought deal private placement of 32 million common shares at a price of $0.36, plus a half warrant at a price of C$0.60 for a period of 24 months. There is an acceleration clause as well, if the closing price is equal to or greater than C$1.00 for a period of 20 consecutive trading days, the company may elect to accelerate the expiry date of the warrants at least 30 calendar days after notification of warrant holders. The placement was led by Haywood, and included PI Financial, Sprott Capital Partners and Canaccord.

Haywood, PI and Canaccord are the usual suspects in financings, but seeing Sprott Capital Partners subscribing as well could be seen as a welcome indication of quality, in my view, as they have some of the best analysts working for them and have buy side standards on risk/rewards. It is also good to see Treasury being less dependent on their loyal European investors, but also able to tap substantially into the Canadian capital market.

According to CEO Greg Ferron, the proceeds from this financing will fund the completion of a combined Goliath-Goldlund economic study expected within 2020, advance key engineering and environmental baseline data on Goldlund, and complete 25,000 meters of infill and expansion drilling program on the combined projects.

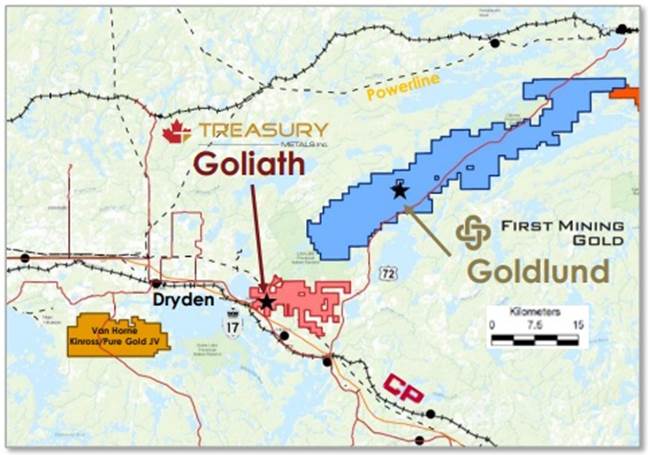

It will be clear that the second half of 2020 will be as remarkable and active as the first half for Treasury, after going through COVID-19 and acquiring a transformational gold asset. Although we have already seen our fair share of gold focused deals this year, like Shandong acquiring TMAC, SSR Mining merging with Alacer Gold, Silvercorp Metals bidding successfully for Guyana Goldfields, Shandong bidding for Cardinal Resources, and numerous smaller deals, Treasury did their own interesting gold asset deal by buying the nearby Goldlund project from First Mining Gold. This project hosts a large near-surface gold resource, and sports a NI43-101 resource, estimated to contain 809,200 ounces of gold in the Indicated category, plus 876,954 ounces of gold in the Inferred category within a vast 280 km2 property package located directly to the northeast of Goliath.

As can be seen, both claim packages of Goliath and Goldlund are almost connected. In the conference call regarding the transaction, CEO Greg Ferron of Treasury responded to a question involving this, that he very recently acquired the connecting claim package, before the Goldlund deal was announced. It is not very important in this case to have a continuous claim package, as both deposits are distanced about 23 km from each other as the crow flies, so not right on strike, but for the future it could come in handy not to have different owners sitting in between the two claim sets in the hypothetical case there might be exploration success near both borders of both sets.

The deal terms are as follows, per the news release:

- 130 million common shares of Treasury Metals

- 35 million warrants of Treasury with each warrant entitling the holder thereof to purchase one common share at an exercise price of $0.50 for a period of 36 months following the closing of the transaction

- a 1.5% net smelter returns royalty covering all of the Goldlund claims with the option for Treasury to buy back 0.5% of the Goldlund Royalty for $5.0 million

- a milestone cash payment of $5.0 million, with 50% payable upon receipt of a final and binding mining lease under the Mining Act (Ontario) to extract ore from an open pit mine at Goldlund, and the remaining 50% payable upon the extraction of 300,000 tonnes of ore from a mine at Goldlund.

What to make of these deal terms? At a current number of outstanding shares of 169.73 million, the addition of 130 million new shares and 35M million warrants would effectively almost double the share count when all new warrants would have been exercised. Under other circumstances when existing shareholders get diluted almost 50% in a company it is not considered a positive, but in this case it could very well be a transformative deal, in my view, justifying the dilution. Not only 1.6 Moz Au is added to the resource base of Treasury, resulting in 3 Moz Au, which makes things much more interesting for mid-tier producers, or with the assumed exploration potential at Goldlund even 5 Moz Au targets come in sight, alerting major producers in that case.

In my view, the big benefit of adding Goldlund is its open pit potential to Goliath, a combined open pit/underground project that has already received an environmental permit, which is hard to get in Ontario. An existing environmentally permitted, and later on eventually a fully permitted, Goliath project, could have a strong positive influence on the nearby Goldlund permitting process. We must keep in mind that Goldlund will have a larger footprint as an entirely open pit project and as such it could take a while before an environmental permit is granted, but since Goliath also has an open pit component, it sure doesn't seem unrealistic. I asked management what they think of the differences on permitting Goldlund compared to Goliath, and a realistic timeline for it, and this is what they said:

"A key commitment we will continue to make will be working closely with all regulatory agencies and local partners to educate them on the potential impact and the positive economic aspects of a larger and more robust operation. The Goldlund project permitting process will be unique compared with Goliath, which will host the mill and tailings facility. Ideally, we would propose to have the Goldlund open pit in production with 2-3 years following production at Goliath."

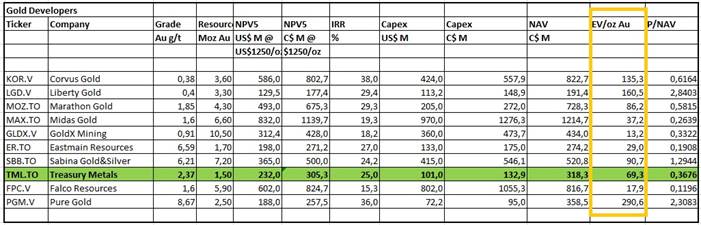

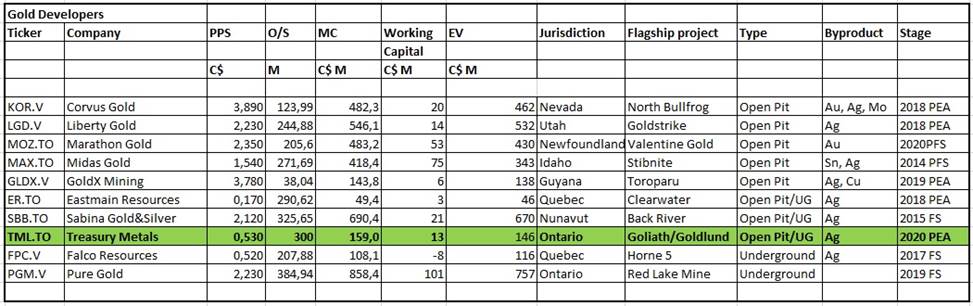

Back to the deal terms then. 130 million new shares are worth C$44 million at the time of announcing the deal, the warrants according to Black Scholes calculations had a valuation of about 6c each, adding about C$2.1 million, bringing equity to C$46.1 million. The milestone payment has to be done 2-4 years from now, being able to achieving those milestones, and the royalty is valued at C$15 million but its current value isn't close yet as economics of Goldlund have to be determined yet. All in all the transaction seems to hover around C$50 million in value for Goldlund, generating an EV/oz of C$31/oz Au. Assuming a decent profitable deposit (at least an after tax IRR of 20% at a gold price of US$1250/oz), with no economic study, this is a fair price in my view, considering peers who all have studies completed:

As can be seen in the IRR column, companies like GoldX and Falco have projects with low profitability, but are also combined with high capex or non-favorable jurisdictions, generating their relatively low EV/oz value. This doesn't mean that these peers should be avoided at all costs, as both have strong financial backings, meaning game changing M&A could be around the corner at any time. But this isn't something I consider a solid investment fundamental, and the market seems to agree for now. However, always keep in mind that every company has its own very specific set of circumstances, resulting in various metrics, I just picked out a few well-known ones in my view.

The goal for Treasury is of course to integrate Goldlund to the same level as Goliath for economics, and by doing so increase the value of the Goldlund ounces accordingly. I'll get back to valuation later on in this article, first let's have a look into further transaction details.

- Treasury board of directors (the "Board of Directors") shall be reconstituted to consist of seven individuals, with First Mining entitled to nominate three directors, two of which shall be "independent" within the meaning of National Instrument 52-110 Audit Committees. Treasury will be entitled to appoint the chair of the Board of Directors. Additionally, (i) for so long as First Mining holds greater than 10% of the issued and outstanding Common Shares, First Mining shall have the right to nominate two nominees for election as directors of Treasury; and (ii) for so long as First Mining holds greater than 5% but less than 10% of the issued and outstanding Common Shares, First Mining shall have the right to nominate one nominee for election as a director of Treasury.

This is in line with the equity payments for Goldlund vs the outstanding number of shares of Treasury before closing the transaction.

- Pursuant to the Investor Rights Agreement, First Mining shall use commercially reasonable efforts to distribute a portion of the Share Consideration and all of the Warrant Consideration to First Mining shareholders on a pro-rata basis following the closing of the Transaction (the "Distribution"). The Distribution shall occur no earlier than six months but no later than one year after completion of the Transaction, with First Mining retaining ownership of Common Shares equal to no greater than 19.9% of the then issued and outstanding Common Shares on a partially diluted basis, subject to regulatory and tax advice. Following the Distribution of the Warrant Consideration, Treasury will use commercially reasonable efforts to list the Warrants for trading on the Toronto Stock Exchange (the "TSX") and the OTCQX in the US. First Mining has also agreed to certain standstill and resale provisions with respect to the Common Shares it controls. The Investor Rights Agreement shall terminate in the event that First Mining holds less than 5% of the issued and outstanding Common Shares.

As the amount of shares received by First Mining is very substantial (43% excluding warrants, 49% including warrants), this distribution is an important term of the deal. When listening to the press conference on June 9, 2020, First Mining CEO Dan Wilton indicated that the warrants will all be distributed to First Mining shareholders, and about 70 million of the common shares will be distributed as well. This will proceed at least 6 months and not later than 12 months after closing the deal. There is no plan of arrangement. First Mining will choose a record date for the distribution at some point in the next 12 months and dividend these shares and warrants to their shareholders. Potentially, they will distribute all but likely maintain up to 19.99%. By doing it this way, Treasury is hypothetically at risk of First Mining shareholders selling out on the Treasury shares, but I view these as better options on the gold price compared to the First Mining shares, so my take is they will hold on as long as gold continues to trade strong and Treasury keeps performing well.

- Upon closing of the Transaction, it is anticipated that Treasury will consolidate its Common Shares on a 3 for 1 basis, subject to the receipt of all necessary approvals.

Standing at 300 million shares already and still at PEA/PFS stage and a lot of work to do before capex funding could be arranged, this is probably the best thing to do. Usually I am not an advocate of roll-backs as it often dilutes existing shareholders and causes sell-offs by those disappointed shareholders, but in a positive environment like the gold bull market we seem to have on our hands now, it could certainly work out positively as potential new shareholders like lower share counts, and the optics of new raises in the future look better. It is even possible with a higher share price to increase the possibility to be included in the Van Eck GDXJ ETF for junior gold miners. This in turn usually increases liquidity in the relevant stock significantly, and makes relevant stocks eligible for inclusion in other funds. CEO Ferron told me when suggested, that they will indeed also consider a U.S. listing, and could qualify for GDXJ at some stage, which he agrees would enhance liquidity and better access to institutional investors globally. They will target marketing to North America investors upon completion of the transaction.

As several countries across the globe are already increasing COVID-19 restrictions again, fearing a second wave, I asked CEO Ferron what the status for Ontario and their work programs is. Ferron stated that they can't do anything else but follow guidance, they are ready to scale up/down activities as soon as the situation allows/demands it. The company will announce a large exploration program with three drilling rigs in the next few weeks and the teams are in place to manage the exploration program at both Goliath and Goldlund. At this point, the company has sufficient funds, and currently has about C$13 million in the treasury, and a convertible debt of C$4.5 million, carrying an 8% interest. As a reminder, the debenture is held by two of the largest equity holders in the company, Extract Capital and DSC, which are supportive.

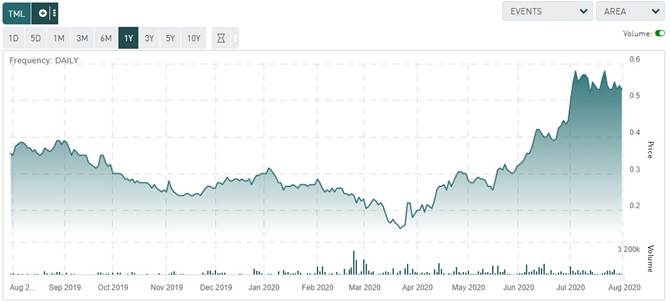

The share price of Treasury Metals looks like this:

Share price; 1 year time frame

The big COVID-19 sell-off around March 20, 2020, left scars on the chart for Treasury Metals as it did for almost any actively traded company worldwide. However it completely recovered at impressive volumes, as did almost all other companies, on the back of massive, unprecedented global central bank stimulus programs to the tune of trillions, in turn triggering gold reaching US$1,945/oz recently. The underlying deterioration of economic fundamentals seems to be completely neutralized by all stimulus, which is remarkable, as if COVID-19 was an isolated incident, and a well-forecasted recession wasn't in the cards whatsoever. It seems the markets feel invincible, having the unlimited support of the central banks now. Job reports being not as bad as forecasted cause further legs up, tech giants like Amazon, Microsoft and even Tesla break all time records time after time, even oil recovers. Strange times, even the Q2 financials can't derail the optimism. Notwithstanding this, with no strong economic fundamentals to back everything up, some caution is necessary, in my view.

For now the recovery and especially the large volumes accompanying this for Treasury show strong support, indicating Treasury as a serious gold developer in a gold bull market.

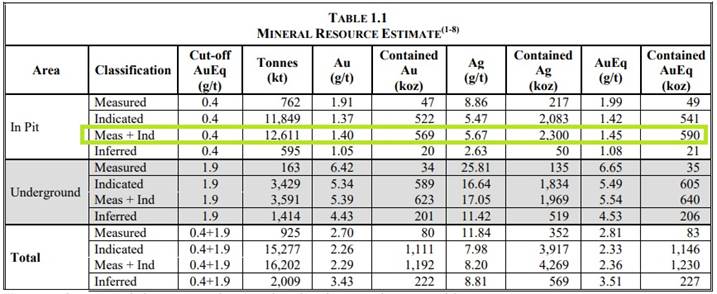

Let's have a look at the additional value of the Goldlund asset. As it is located nearby Goliath (25km distance), the synergies are obvious, as the planned processing facility of Goliath can be expanded for the future and much larger open pit ore from Goldlund. When looking at the basic numbers, the current Goliath resource stands at 1.46 Moz AuEq, consisting of 80 koz Au Measured, 1.2 Moz Au Indicated, 222 koz Au Inferred, and a bit of silver with an average grade of 1.40 g/t Au M&I for the open pit component, and 5.39 g/t Au for the underground component. Here is the resource table of Goliath:

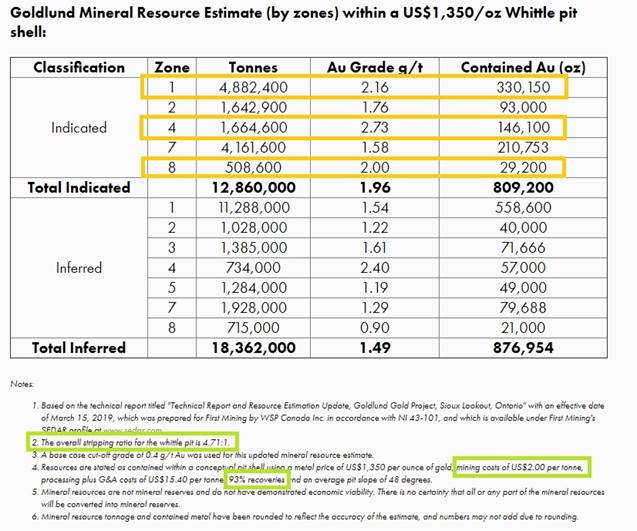

As can be seen in the resource statement, the open pit (= in pit area) component contains 569 koz Au @ 1.40g/t, which can be combined with Goldlund. The newly acquired Goldlund resource stands at 1.69 Moz Au, consisting of 810 koz Au Indicated @ 1.96 g/t, and 880 koz Au Inferred @ 1.49 g/t, all of which is open pittable. Here is the comparison between the Goldlund resource estimate from 2017 and 2019, as per the NI43-101 report:

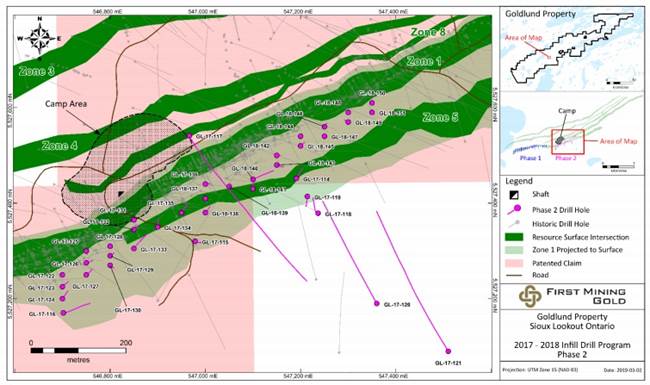

It is interesting to see the ounces being brought down by a solid drill program by First Mining Gold. However, when they bought the asset they had high hopes of increasing resources. Let's hope under Treasury's ownership and guidance more gold will be found. Let's have a quick look at Goldlund in order to get an impression. It is a very long deposit, consisting of several lenses:

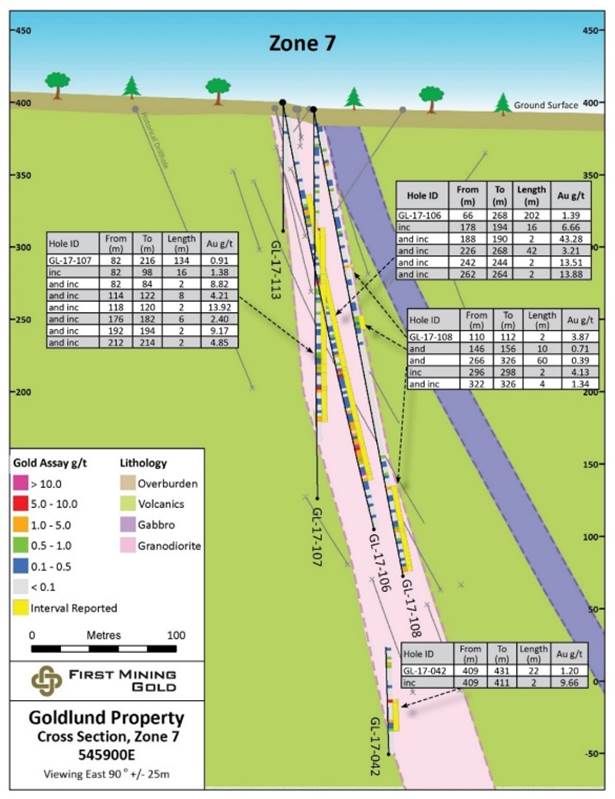

Please take notice of zone 1, 4 and 8 being located closely to one another. A typical section looks like this:

As can be seen, the lenses are relatively narrow, but start at surface, which justifies the open pit concept. Also the sections show that the mineralization runs quite deep, 400 meters or deeper, and the intercepts aren't that bad, like the 2m @9,66 g/t in the section. These are easily economic intercepts for an underground operation, of course continuity over long strike lengths is necessary in that case, and might be a possibility as the entire deposit is open at depth, but this will take much more drilling for starters. But who knows, with a gold price hovering above US$1900, mineralization like this becomes economic very quickly, especially if an open pit mine on top of it is already operational.

The combined open pittable resource goes to 2.26 Moz Au, the total resource more than doubles, going from 1.4 Moz to 3.1 Moz Au.

As not all Goldlund resource ounces can be included in a combined PEA mine plan, as reserves usually leave out 10–30% of resources, Indicated ounces provide a lot more certainty, and the Inferred ounces are standing at a much lower average grade, I would like to limit the number of included Inferred ounces to 190 koz Au, generating a nice round 1 Moz Au. It is usually common practice to pay back as much capex as possible in the first years of an operation, so in order to do so companies often optimize mine plans for this purpose by high grading the production schedule, providing the most ounces this way. I am no mining engineer, but I can imagine that in this case Zone 1, 4 and 8 (505 koz Au) could be mined first, as we have already seen their location close to each other, and for their higher grade ounces:

I noticed that the strip ratio at 4.7:1 is very decent, mining costs are estimated pretty low, and recoveries are very decent as well. This will show in the upcoming peer comparison.

As the company shares in their presentation, Goliath and Goldlund have similar metallurgical properties, which is a big plus when designing and engineering the Goldlund expansion considering expansion capex. Treasury also mentions a greater focus on open pit mining, resulting in operating cost reductions and further optimizations. The increased open pit component is kind of a double edged sword in my view. It is beneficial for costs, but it also complicates permitting as an open pit operation generates much more disturbance at surface, and therefore likely will create the need for staged development, assuming Goliath can be funded and constructed into production before Goldlund gets permitted. On the other hand it is a clear advantage that Goliath already received the environmental permit. All in all, as Goliath took 5 years to get this permit, I see Goldlund taking another 4–5 years from now to being fully permitted. For now, let's have a look at some peer projects in order to see what very globally can be expected for hypothetical combined economics.

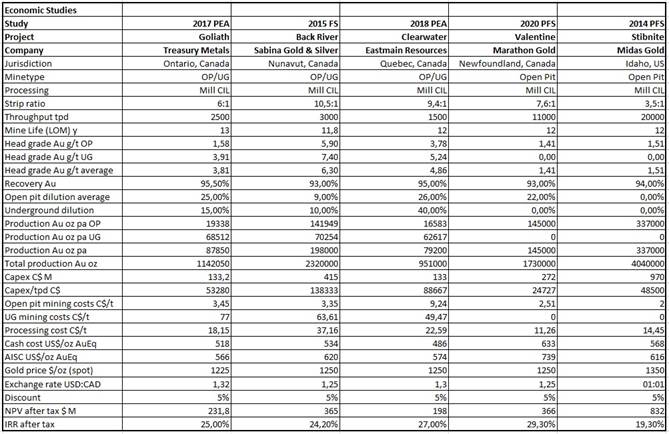

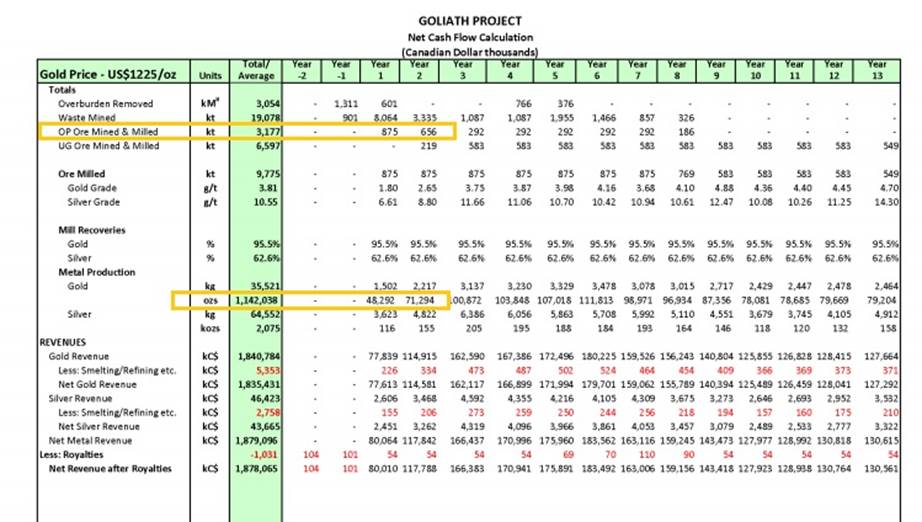

I lined up a few projects that are based on open pit/underground combinations, and a few solely open pit based projects:

Sabina with Back River is a bit of an outlier in this comparison, as the location (Nunavut) is much more Nordic, and as such the capex/tpd ratio is much higher, meaning the mining operation and infrastructure needs relatively more capital when constructed. Notwithstanding this, it still could be useful to determine average mine life, gold recoveries and mining costs for example. I will try to estimate Goldlund economics first, and then blend these with the existing Goliath economics:

- an important metric is the used head grade. Some deposits have a lower head grade compared to their resource, others have higher grades, as they were eligible for being high graded for production. Others have a higher head grade for the open pit component, and a lower head grade for the underground component (Treasury itself for example). Of course the geological makeup of the deposit must allow this, so the higher grade ounces can be mined efficiently. As indicated above, I do believe Zone 1, 4 and 8 can be mined first, although I have no clue about potential high grading. In order to err on the safe side, I will use the same head grade for the Goldlund ounces, on average 1.85g/t Au.

- I was surprised to often see open pit dilutions of over 20%, only Back River and Stibnite had 9% and 0% respectively. One could think that in an open pit everything being classified reserves gets mined anyway, but apparently not. Therefore I would like to use 25% dilution.

- For recovery the average is 94%, nearby Goliath uses 95.5% and according to management metallurgical properties of Goldlund are comparable, so I assume 94% here.

- As mid-tiers like to see average production figures of at least over 100koz Au per annum, I would like to spread additional Goldlund production as much as possible over the entire life of mine of Goliath, which is 13 years. Dilution and recovery generate 705 koz Au of Goldlund ounces, adding on average 54 koz per annum (pa), lifting the average production of just Goliath from 88 koz pa to a combined 142 koz pa.

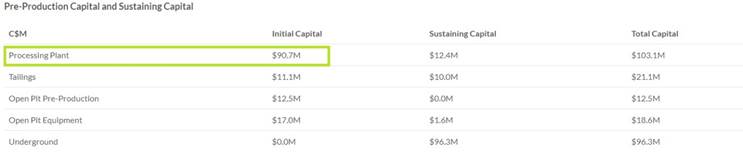

- Most of the expansion capital (sustaining capex) for Goldlund will be funded out of Goliath cash flow. Most of the synergy will be about the use of the processing facility at Goliath, as mine construction and infrastructure of Goldlund has to be done anyway. Most of the peers with underground/open pit production seem to have more expensive capex/tpd ratios compared to Treasury, and most of them have lower processing facility costs relative to total initial capex, as Treasury has low infrastructure costs:

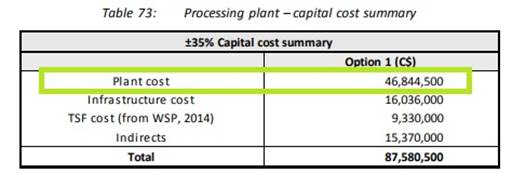

And a breakdown of the Processing Plant, as things like Infra and Indirects were included:

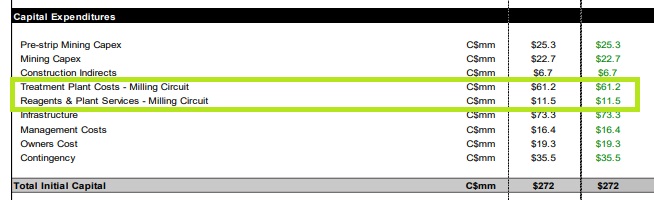

Contingency is part of the Indirects. I found the different tables and breakdowns in the Treasury PEA confusing, usually a single table is used to summarize a capex breakdown, comparing to, for example, the capex numbers of Valentine (Marathon Gold, PFS p. 356):

In order to combine Goldlund, the processing plant and the tailings facility can be used, but will have to be expanded. As Goldlund will be a larger open pit operation compared to Goliath, I expect things like pre-strip, mining capex and construction indirects, maybe some infrastructure, to be more expensive. As gold production will increase by an estimated 60%, and the average estimated diluted head grade of Goldlund is about 17% higher, I would like to increase the throughput with a bit of margin by 60%, going from 2,500 tpd to 4,000 tpd. Such expansions can be done in a second stage after Goliath commences commercial production.

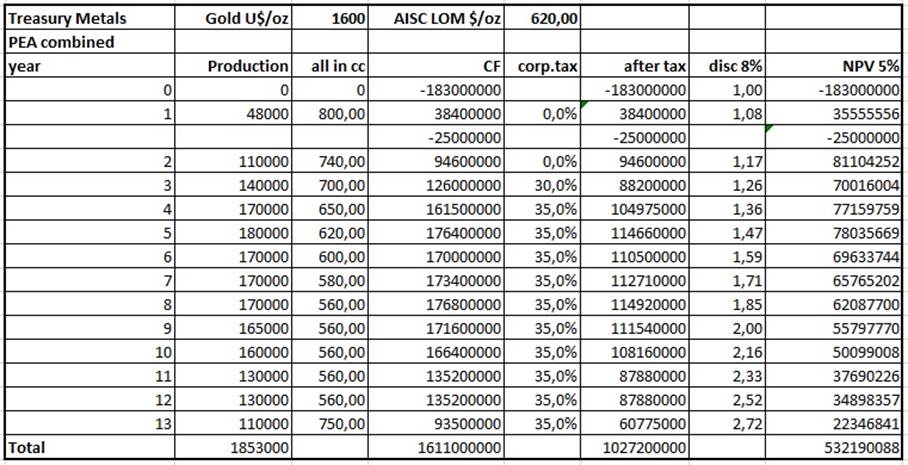

I estimate such a processing expansion cost to come in at C$50 million, although I expect Goliath to be designed, engineered and constructed with lots of future Goldlund expansions in mind, as such probably saving on this number. Mine development, some additional mine fleet, expanded tailings facilities, etc., could be roughly the same figure compared to Goliath (C$40 million), resulting in C$90 million, as I see Goldlund production coming in close to that of the Goliath open pit figures of the first years of production (see PEA p. 276):

Adding contingency, some infrastructure, EPCM and other extras I would like to estimate the expansion capex for Goldlund at C$115 million. Timing of Goldlund commencing production isn't easy. Management expects Goldlund to be in operation 2–3 years after Goliath commences commercial production, but they also hope at a faster start of Goliath. Key ingredient for me is an anticipated 4–5 year permitting timeline for Goldlund. Besides this, I would like to rely on the most conservative scenario regarding funding capex, which is funding most capex by third parties instead of internal cash flow. That way Treasury maybe doesn't have the highest IRR that it would have with staged development, but reaches maximum production and cash flow as soon as possible, which in my view creates the most leverage for the share price, especially when gold continues to trade strongly. So it is a time versus return dilemma for management in my opinion, and likely the banks and other lenders will show their preferences in due time. Some capex can be funded internally of course. For now, the resulting EBIT in the 2017 PEA is C$28 million for year 1, so I estimate Treasury to fund an estimated C$25 million of the Goldlund capex internally, resulting in initial capex of C$153M + C$90M is C$243M (=US$183M).

- The open pit mining costs vary from C$2/t to C$3.45/t (I discard Clearwater as their C$9.24 figure is a clear outlier), I assume C$3.50/t.

- Processing costs are on average C$16/t (I discard Back River as the C$37.16/t will probably be caused by the extreme conditions up north), I assume C$18/t.

- AISC ranges between US$566/oz (Treasury) and US$739/oz (Marathon Gold), although Marathon is clearly the highest, as the second highest is Back River, which has US$620/oz despite their very high grade open pit grades, but as mentioned it's their Nordic location that makes things relatively expensive to operate. I assume US$620/oz.

- As far as I know there is no reclamation trust connected to Goldlund, like the C$20 million obligation at Goliath.

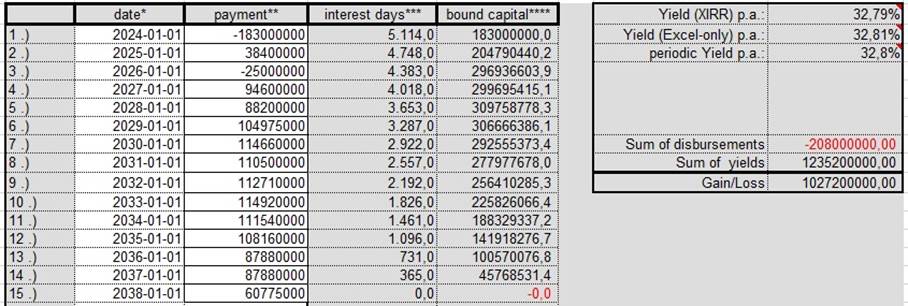

- The discount rate for the discounted cash flow model is 8%

This all results in the following metrics:

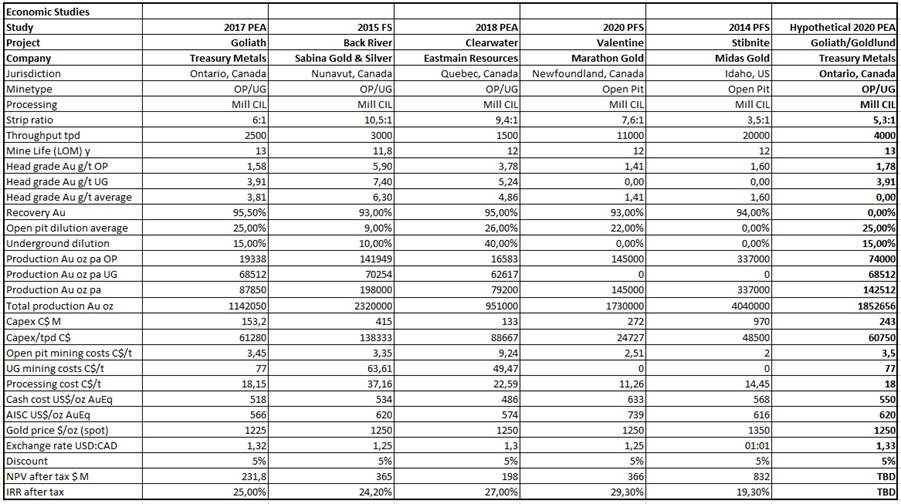

And this in turn results in the following hypothetical, simplified DCF model, using a US$1600/oz gold price:

Please note the resulting NPVs are in U.S. Dollars. The corresponding after-tax IRR looks like this:

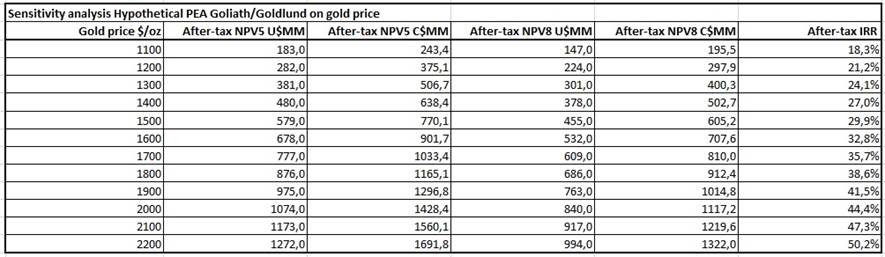

For best comparisons, a sensitivity analysis regarding the gold price is necessary:

As can be seen at for example the 2017 PEA base case gold price of US$1250/oz, the combined after-tax NPV5 increases a lot and almost doubles. The after-tax IRR goes down from 25% to 24.1% at this gold price, so the project is slightly less robust but much larger, and as such and certainly at current gold prices should be much more interesting to mid-tier producers, who are scrambling to buy sizeable assets worldwide, let alone in prime jurisdictions like Ontario. At current gold prices of around US$1960/oz, the NPV5 stands at C$1354 million. For comparison, the current market cap of Treasury stands at C$90 million, and after the deal has closed (and trading at the same share price) at C$159 million, which is barely 12% of the after-tax NPV5. As a rule of thumb, single project companies trade at or close to NPV value when production commences, so any billion-plus valuation isn't in the cards anytime soon, but it sure indicates the potential of Treasury Metals.

Another benefit for Treasury or any suitor is the exploration upside of both Goliath and Goldlund. Both are open at depth, and although the mineralization at depth doesn't seem as spectacular as Red Lake or Madsen for example, at these gold prices there is a lot of margin for error.

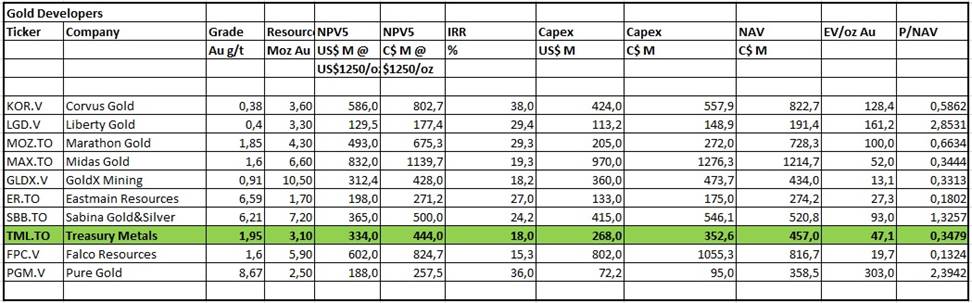

In order to get a better feeling of where Treasury stands now compared to its peers, I updated the peer comparison, and used the hypothetical numbers of my 2020 PEA estimates:

And:

At first sight, Treasury doesn't seem particularly undervalued, although some market commentators think that solid, advanced gold projects should at least be valued at C$100/oz on an EV/oz metric basis these days. When hair-splitting over it, one could argue that once the Goliath PFS comes out within months, that part of the company should have a higher EV/oz valuation, and as such blending the Goliath metric with the Goldlund metric probably ending up higher. After the combined PEA comes out, economic potential of Goldlund is indicated as well, and if robust a further re-rating of ounces and thus value seems justified. However, it is also important to realize that Goliath/Goldlund is located in a prime jurisdiction, Goliath has an environmental permit secured, and the total capex is relatively limited so it has a very decent chance of funding capex by itself and reach full potential, and combined with the exploration potential as such also at least in my view a prime target for a mid-tier producer.

5. Conclusion

After a perfect storm seems to be aligning for gold, Treasury Metals seems to have done the Goldlund deal right on time. A combined PEA of both Goliath and Goldlund clearly has synergies, and almost doubles the hypothetical NPV5. The estimated IRR is just marginally lower, but at these gold prices the combined operation has a significant margin for error. Keep in mind that Treasury has options with funding Goldlund capex with internal cash flow, resulting in a much higher IRR, but a longer timeline to full production and full NPV. With the recently raised C$11.5 million, all the exploration potential as a wild card, and both the combined PEA and the Goliath PFS coming up this year with gold rising to all-time highs, the story for Treasury Metals looks better and better by the week.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Critical Investor Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Treasury Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.treasurymetals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.