Irving Resources Inc. (IRV:CSE; IRVRF:OTCMKTS)

54,990,799 shares

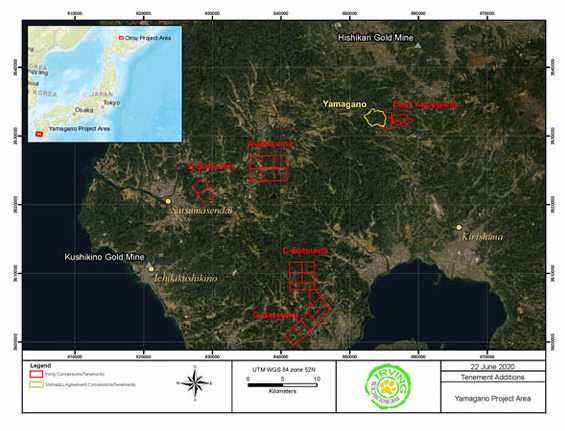

On June 23 Irving's shares popped upward by ~14% on news of Irving's plans to acquire the Yamagano gold mining license from Shimadzu Ltd. Irving Resources Inc. has signed a non-binding term sheet with Shimadzu Ltd. to acquire the 5.25-square-kilometer Yamagano mining license, site of extensive historic high-grade gold vein mining in southern Kyushu, approximately 11 kilometers (11 km) southwest of the large, high-grade Hishikari gold mine.

Irving and Shimadzu have begun work on a definitive mineral property option agreement; the terms of the option agreement will be announced once signed. In addition, the Kyushu Bureau of Economy, Trade and Industry has accepted the filing of 23 new mineral prospecting licenses totaling 65.19 square kilometers. A multistep review now begins for the approval of these licenses. An engineering division of Mitsui & Co. Ltd. (MITSY:NASDAQ) is assisting Irving through the license approval process.

Already Irving is one of my personal favorites, but this potential acquisition ramps up my excitement for this story into the future. Following are some of the highlights of the Yamagano high-grade vein mining district that say why.

The Yamagano mining district is situated approximately 11 km southwest of the large, high-grade Hishikari gold mine, which is host to innumerable historic gold mine workings, some dating back to 1640 AD, during the early Edo Period in Japan. Mining focused on a multitude of high-grade epithermal gold veins hosted by volcanic rocks blanketing this region.

Yamagano gold production is reported to be approximately 80 tonnes, or 2.57 million ounces. Amazingly, this mining right tenement has seen no modern exploration, including drilling. Yamagano is the major nearest past producer neighbor to the exceptionally high-grade Hishikari Mine.

Gold veins are easily identified by geophysics, so this should be a rather high probability success story. Gold-bearing veins here are associated with an area of anomalously high gravity, thought to represent a buried uplift, or dome, in underlying denser basement sedimentary rocks. This geologic feature is believed to have focused gold-depositing hydro- thermal fluids to ascend into overlying faults and fissures where they formed extensive high-grade vein networks.

A gravity high was recognized very early as an important ore control at the Kushikino gold mine (56 tonnes or 1.80 million ounces [Moz] Au [gold] produced) situated approximately 39 km southwest of Yamagano. In fact, based upon this geologic model, initial targeting of the famous Hishikari deposits (248.2 tonnes, or 7.98 Moz Au produced) was driven largely by recognition of an anomalous gravity high underlying that area. Irving believes the gravity high at Yamagano reflects a buried dome of basement rock and that, given the large footprint of this feature, there is considerable prospectivity for veins elsewhere across the property.

Irving now holds four important new mineral prospecting licenses immediately east of the Yamagano mining, right where the extension of gravity feature discussed above is situated. This area is covered by post mineral volcanic rocks and has not been explored for blind high-grade Au veins. Irving believes this area is highly prospective for natural continuations of the Yamagano vein network. In fact, the majority of the local gravity anomaly lies within these new mineral prospecting licenses.

But that's not all! As noted in the area map above, Irving already holds four new blocks of mineral prospecting licenses, the Satsuma A, Satsuma B, Satsuma C and Satsuma D projects, each covering a discrete gravity anomaly similar to that recognized at Yamagano. Each of these gravity highs lie within areas covered by young, post-mineral volcanic rocks. Similar to Yamagano, Irving considers these highly prospective when considering the "gravity high" model discussed above.

Importantly, Satsuma A and Satsuma B lie between the Yamagano gold district and the Kushikino mine in a trend Irving considers highly prospective for new discovery. Satsuma C and Satsuma D also lie within areas covered by young, post- mineral volcanic rocks with no known history of exploration.

A Reminder: Also keep in mind that Irving and Newmont Corp. (NEM:NYSE) have an exploration alliance in Japan. All landholdings discussed above are subject to the Irving-Newmont exploration alliance, and both companies are currently discussing the best path to advance exploration at each project.

Most Important: Don't forget that although the veins in these deposits are narrow, they are hosted in silica material that is highly valuable and sought after by smelters throughout Japan. So, the business model for Irving requires no mill construction. The high-grade silica-hosted gold is simply mined, put on a ship and sent to one of the smelters that not only gives Irving 100% of the gold but actually pays a bit for the silica material. It's an amazing business model that even has Brent Cook raving about it.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor's interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career—including publication of his weekly J. Taylor's Gold, Energy & Tech Stocks newsletter. He also has a radio program, "Turning Hard Times Into Good Times."

Read what other experts are saying about:

Disclosure:

1) Jay Taylor's disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Irving Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources and Newmont Corp., companies mentioned in this article.

Charts and graphics provided by the author.

Disclosures: J Taylor's Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGETS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $250 to $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.

To Subscribe to J Taylor's Gold, Energy & Tech Stocks Visit: https://www.miningstocks.com/select/gold. Copyright @ 2020Taylor Hard Money Advisors, Inc. All Rights Reserved.

Note: Article originally published on June 26, 2020.